Complaint Review: Westlake Financial - Nationwide

- Westlake Financial Nationwide USA

- Phone: 888-739-9192

- Web: Westlakefinancial.com

- Category: Car Financing

Westlake Financial services Repossession on my credit report and I am in possession of the vehicle still making payments! Westlake said oh well it's gonna stay on there for 7 years! Los Angelas California

*Consumer Comment: Grow Up Ronald!

*UPDATE Employee: “We apologize for the negative experience”

*Author of original report: Still dealing with a lying, cheating, non customer service company!

*Consumer Comment: Typical Sub-Prime attitude

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

Westlake Financial repossess my vehicle after being 31 days late on a payment and told me if you pay your payment and late fees and a fee for it being repossessed you can get your vehicle back and everything will be fine! Well everything was fine after paying everything they had asked us to pay! We got our vehicle back been making payments now for another year. At least we thought until we had our credit pulled due to wanting to buy a house and we find out westlake financial put the repossess on our credit! How is this even possible if we are making current payments and still in possession of the vehicle.

When we called them saying there has been a mistake that we are in possession of our vehicle and are still making payment to look at our account and they told us if we paid the fees a year ago it wouldn't even go on our credit and its on there they said were sorry but it was repo and will stay there for the next 7 years! They totally lied to us then screwed us just to get our money! If we knew it was gonna be a repossession do they think We would have continued to pay them!

I would of took that money and put it on a down payment with a company that isn't a bunch of harassing liars! They should know we are making currents payments they call us every month 2 to 3 days before the car payment is even due! My questions is this legal? How do I get the repossession off our credit? This isn't right when I have the vehicle, make payments on it and drive it everyday! Don't sound like a repossession to me! Also future car buyers beware of this company WESTLAKE FINANCIAL yourself' don't get caught up in there lying, cheating scams!

This report was posted on Ripoff Report on 10/22/2014 08:51 PM and is a permanent record located here: https://www.ripoffreport.com/reports/westlake-financial/nationwide/westlake-financial-services-repossession-on-my-credit-report-and-i-am-in-possession-of-th-1184418. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#4 Consumer Comment

Grow Up Ronald!

AUTHOR: Jim - ()

SUBMITTED: Thursday, November 20, 2014

First of all, unless Robert has made a major purchase, this SUB-PRIME lender is NOT his company. You were repo'ed PLAIN AND SIMPLE. If you don't like that, then YOU should have realized the end result prior to YOU deciding to not pay YOUR bills on time. If the repo is correct then it has a 100% right to be on your bureau reports.

However, I see where we are going with this. Robert made excellent points as he usually does. He hit the nail squarely on the head over and over. You have no intelligent rebuttal to his response...none at all! So what do you do? Its the typical deadbeat immature response of "you must work for them". YOU screwed up. YOU failed to pay YOUR bills on time. YOU turned on the collections and repo efforts. END OF STORY!

Oh yes, I don't work for them either!

#3 UPDATE Employee

“We apologize for the negative experience”

AUTHOR: Westlake Financial Services - ()

SUBMITTED: Tuesday, November 04, 2014

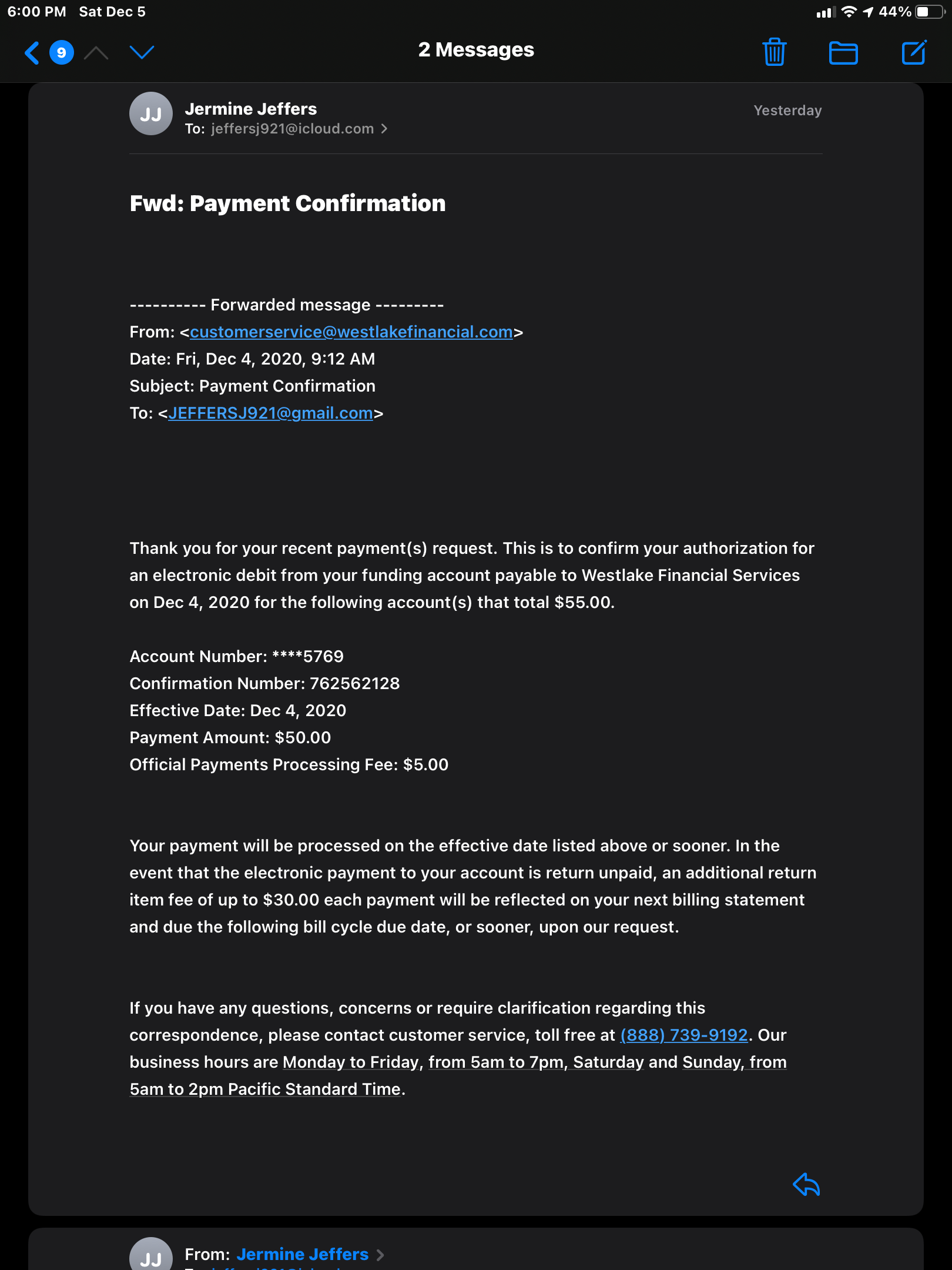

Thank you for sharing your feedback with Westlake Financial Services. We take all of our customers’ concerns seriously. We apologize for the negative experience you had with our company. We do not support this type of customer service, and we are working very hard to make sure that everyone is helped effectively and within a timely manner. If you have any questions about your account, please contact our customer service team at 888-739-9192.

#2 Author of original report

Still dealing with a lying, cheating, non customer service company!

AUTHOR: Ronald - ()

SUBMITTED: Thursday, October 23, 2014

So you say I am the liar here your company is whack! Do you not see how many negative comments are on this page? I guess we are all liars then...cracking up at this non sense! You think you know so much! Listen whoever you are I used your company because I never had built my credit I had pak everything cash so wanting to build my credit not having scores I made the simple mistake of using your company to do that! So before you sit here and say I have bad credit for different reasons know your facts! I tried calling and being nice but it's like dealing with a bunch of 2 year olds! Look at your response to my report! Horrible customer service is all you get! Just so you know it will not stay on my credit for seven years because I will fight it with the credit report agency as well as posting on every website out there what a horrible company you are!

#1 Consumer Comment

Typical Sub-Prime attitude

AUTHOR: Robert - ()

SUBMITTED: Thursday, October 23, 2014

First off you need to get out of your fantasy that you are actually going to get approved for a Mortgage right now...even if the Reposession wasn't there. You need to change your entire attitude. Harsh..yes but it is reality.

Here is the thing your credit report shows your HISTORY. Your car was REPOSESSED, it doesn't matter if you were able to later reclaim it, it does not take away that the reposession occured. So they are right it is going to remain on your credit for 7 years.

Now, even if the reposession wasn't there, you were still 31 days late and that would also legitimatly be on your credit HISTORY. Take that with the fact that people do not go to a Sub-Prime lender such as Westlake if they have good(or even decent credit) means you have had let's just say credit "issues" keeping you from going to a regular source. Well one thing Mortgage lenders basically require is to have at least 24 months of almost perfect credit(yes, people do this all of the time). Since you are with Westlake without even seeing your credit, I can imagine you have things such as Charge-Off's or collection accounts,. Those are a big no-no with lenders...even if they are beyond the 24 months. Most will require you to pay off these types of old debts before they will even consider approving you for a mortgage. Perhaps you have a Bankruptcy..again that is a big negative however that really just takes time to have less of an impact. You may say I am totally wrong..well sorry you are with Westlake for a reason and the reason isn't seen as a positive one.

Now, where do I say your attitude needs to be fixed....

They totally lied to us then screwed us just to get our money! If we knew it was gonna be a repossession do they think We would have continued to pay them!

Number 1 - YOUR money? They LIED? YOU made a legal agreement to pay them a certain amount on a certain date for a specific amount of time. YOU failed(lied) to meet YOUR obligation and they exercised their legal right to reposess the vehicle. So the only liar in this situation is YOU.

Number 2 - Had you failed to get the car back, it still would have been a reposession. But they would have then sold the car at auction. The auction price gives in general about 25-33% of the actual value of the car. YOU would have still been on the hook for the balance between what they sold it for and the remaining amount on the loan. If you failed to pay that they would then have the legal right to file a suit against you in civil court. You would have most likely lost and then not only now have a judgement on your credit report but subject to other things such as possible wage garnishment or having them attach your bank account.

So getting the car back was actually the smartest thing you could have done if you truly cared about your credit.

They should know we are making currents payments they call us every month 2 to 3 days before the car payment is even due! My questions is this legal?

- 100% Legal. Remember you had the car reposessed so even with them you have a negative history. They are a sub-prime lender and want to make sure they get THEIR money.

How do I get the repossession off our credit?

- Be real nice to them and see if they are willing to remove it. Otherwise....wait 7 years(well 6 years now).

Advertisers above have met our

strict standards for business conduct.