Complaint Review: World Financial Group - Nationwide

- World Financial Group Nationwide U.S.A.

- Phone:

- Web:

- Category: Multi Level Marketing

World Financial Group Demystifying World Financial Group (WFG) Nationwide Nationwide

*UPDATE Employee: WFG Not a Job, Ripoff, Scam or MLM and Offers Great Products and Services.

*Consumer Comment: They don't offer just life insurance.

*Author of original report: Straight-forward way to tell if it's a scam

*Author of original report: Straight-forward way to tell if it's a scam

*Author of original report: Straight-forward way to tell if it's a scam

*Author of original report: Straight-forward way to tell if it's a scam

*Consumer Comment: Where is the consumer?

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

World Financial Group claim that they are financial planners and their goal is helping families have a better financial future. Is it the truth? What are they really doing? I joined the group and paid $100 background check fee (the actual cost is less than $50). Believe it or not, please keep reading to the end.

WFG is a Multilevel Marketing (MLM) company, and their essential goal is to sell their overpriced products, most importantly, their life insurance policy. You may ask: why? They are holding financial classes, and they are teaching people financial concepts, aren't they? Yes, they are, but these are the covers of their essential goal.

Ask the members (except the "new employees") in WFG: how many of you did NOT buy any product from WFG? They will tell you that most employees in other companies buy their own products as well. That's true. Now ask them the second question: How many products are sold to non-members? If the products themselves are good and the prices are reasonable, most of the products should be sold to non-members easily, then why bother to make someone a member, and then sell him/her the products? They will tell you: we are teaching them financial concepts, and we are helping them as group members. Keep reading.

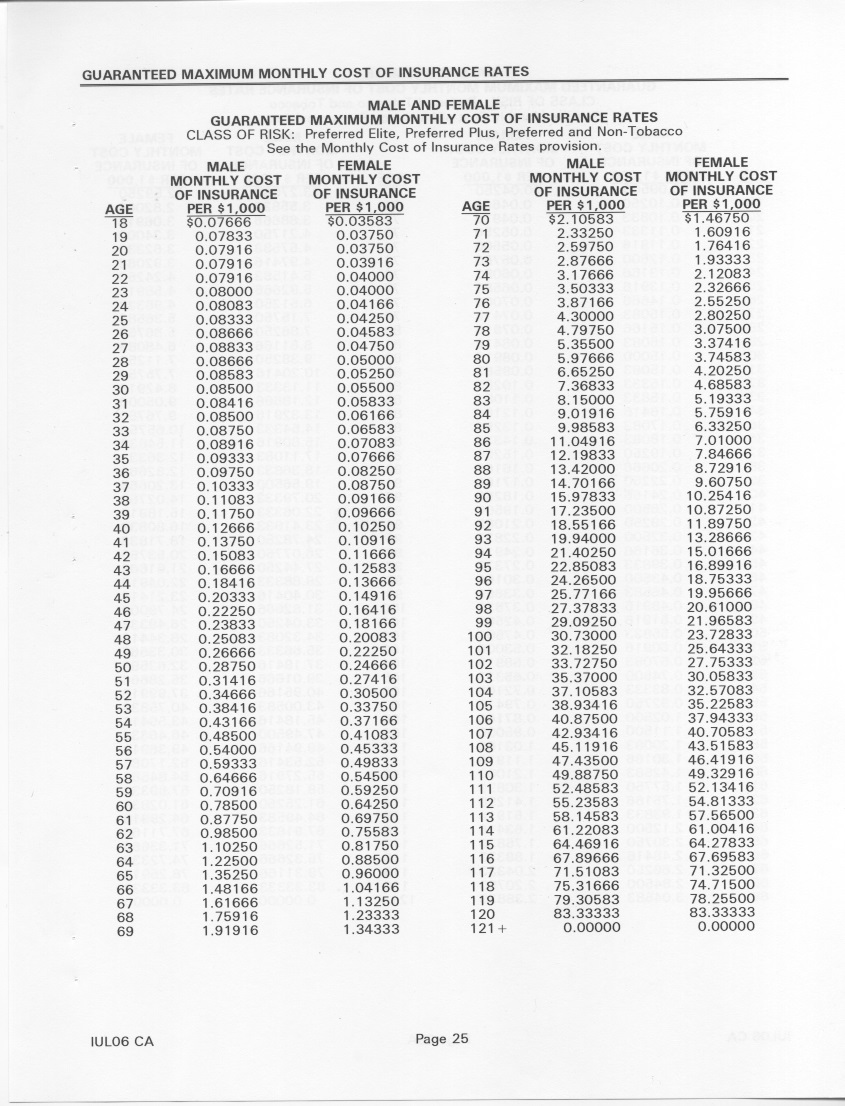

Now let's talk about "overpriced". Hey, what are NOT overpriced these days? A TV may cost the manufacture only $200, and then you buy it for $1000 from a retail store. Is it overpriced? Well, you need to look around: check the price in other retail stores. If they are selling it for the similar price, then it should not be considered overpriced.

Then how can I say that the products sold by WFG are overpriced? Did I compare with other companies products? Yes, I did, but most importantly, look at the commissions in WFG. If you buy a life insurance policy from WFG, how much commission can you earn (yes, you earn a little money for the policy you buy)? And how much can your upline earn for just this sale? And your uplines upline, etc? Where do these commissions come from? Your pocket! Now you understand, dont you? Hmm, wait a minute. My boss also earns some money for the work I do, doesnt him? Keep reading, you will find the answer soon enough.

Now WFG has some overpriced products, and they want to sell them. How? If someone wants to sell you a $1500 TV which you found out that the other guy sell for only $1000, will you buy it? NO WAY! So here is the wonderful part of Multilevel Marketing companies: they sell you a HOPE! See, here is the structure of the company (Pyramid Scheme), and how much and how easily can you earn money by selling the products! Then you believe: hmm, at least give it a try. At least you dont need to buy the products that will be sold to your customers, right? Then you joined them, then they asked you to attend the classes, and then they came to your home to give you a personal financial strategy presentation, and then, YOU BOUGHT THE LIFE INSURANCE!!! (its required: how can you persuade your customers if you dont buy it for yourself.)

You say: hey, I actually need life insurance, and the product they sold me is not bad at all! Ask yourself this: did I compare the same or similar products by other companies before I buy it? Did I ask a professional (not the professional in WFG) before I buy it? Now you understand, right? You bought the HOPE they sold to you! They distracted your attention, from the product and the price, to the potential money you may earn in the future.

You may say: well, perhaps I paid a little too much for the life insurance, but I will earn more in the future, which will compensate it. Really? Ask the leader in your group: how many years did you work for this company? Or find someone who worked for many years, for example, 5. Then do a math by yourself: if he/she recruited 3 persons in the first month (which is the most basic requirement), and then their downlines do the same thing. After 5 years, how many people are in his/her group? Dont do the calculation by yourself, do it by a scientific calculator: its huge. And compare the actual people in the group now. That is how likely you can succeed. Or do another math: WFG was founded in 2001. If the first person recruited 3 persons in the first month, etc., how many people should be in the company now? How many times is the number as many as the total population on the Earth?

Hmm, it sounds not good. But you only bought a life insurance, right? You only overpaid probably $20 a month, not a big deal. Hey, EVERY month! How many months do you have in your rest of your life? How much totally did you overpaid? This is another wonderful part of WFG: they dont let you pay thousands of dollars at a time, which may make you skeptical. They overcharge you just a little every month, but in the rest of your life! A few years later, things will be changed, so do life insurance policies by other companies, then you will never have a chance to compare and find out you were overpaid. Wow, such a great strategy!

Another attractive merit they might tell you is that you dont have to work in the future and you still have income if you build your downline. This is the point: the commissions come from sales, and the sales are one-time deal. If no new people buy the products, the whole team will be starving. Well, if everyone believes the HOPE they are selling, they should have new sales forever, right? Not true. First, the population on the Earth is limited, and can be consumed in very short time. Second, look at your team leader. If he/she has been doing this for so many years, his/her downline should be able to feed him/her. Its time to retire! Why is he/she talking to you?! Now you know why many Multilevel Marketing companies are illegal: if no one joins, then no income. And you understand why your boss earns money from your work but its still a healthy business: your company doesnt have to hire new people in order to have revenue.

Let me tell you one more thing: you didnt only overpay for the products if you are working for them, you will also lose many intangible valuable things, such as friendships. Suppose you talk to 50 people you know, and half of them join the group. Consider the success rate is so low, only about 1 out of them will earn enough money which they think is worth their time, effort and again, their friendships. Then your 24 friends joining the group will hate you, and the 25 friends not joining the group will think you are annoying. Not to mention the time and effort you waste on thinking all day how to approach people, and the effort to come back to normal life if you want to quit some day.

As a conclusion, let me summarize the common features of Multilevel Marketing companies:

1. They emphasize on the money you can earn in the future, not the products they try to sell you.

2. Most of the buyers are group members.

3. They push you to buy their products. They dont give you enough time or freedom to compare their products with other companies products.

4. Most of their income is from recruiting. If no more people join the group, the group will collapse.

Some links that might be helpful:

Multi-level Marketing on Wikipedia (((link redacted)))

World Financial Group on Wikipedia (((link redacted)))

MLM Watch (((link redacted)))

Checklist to Evaluate Multi-Level Marketing (MLM) Programs that may be Pyramid Schemes (((link redacted)))

What's Wrong With Multi-Level Marketing? (((link redacted)))

World Financial Group on Ripoff Report (http://www.ripoffreport.com/searchresults.asp?q1=ALL&q4=&q6=&q3=&q2=&q7=&searchtype=0&submit2=Search%21&q5=World+Financial+Group&Search=Search)

World Financial Group on Scam.com (((link redacted)))

More World Financial Group Scam Lies (((link redacted)))

Is There a World Financial Group Scam? (((link redacted)))

Anonymous

Anonymous

U.S.A.

This report was posted on Ripoff Report on 04/06/2008 07:17 PM and is a permanent record located here: https://www.ripoffreport.com/reports/world-financial-group/nationwide/world-financial-group-demystifying-world-financial-group-wfg-nationwide-nationwide-324138. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#7 UPDATE Employee

WFG Not a Job, Ripoff, Scam or MLM and Offers Great Products and Services.

AUTHOR: Thetruth - (U.S.A.)

SUBMITTED: Wednesday, April 09, 2008

First and foremost, WFG is not a job, it's a business, similar to a franchise.

$100 is nothing to complain about. WFG has hundreds of employees to pay. It is a very minimal investment to start a million dollar business.

WFG is not MLM, but the business uses the network-marketing concept. To clarify: all MLMs are network marketing businesses, but not all network marketing businesses are MLMs.

WFG associates do not make a dime off recruiting. In fact the leaders have to invest a lot of time into a new person to help that person start to make money, because only then do they make money. If you are not willing to learn the business, then don't waste your trainer's time. And don't complain about it because you never learned the business to know enough to make a legitimate complaint.

Money is made off of the recruited team by way of overrides. Picture a real estate agency making a cut off every real estate agent in the field selling houses. In WFG, each associate is their own agency, and their recruits are their agents out in the field. When an agent in the field makes a sale (opens an account for a client), the people above with a higher contract level makes the override. This is the basic idea. Not only in WFG, but this is the way any agency works in the financial services industry. Some agencies are independently run, and some are corporate. Picture WFG as both.

WFG offers the opportunity to the masses to get into the financial services industry with absolutely no prior experience, and this is why many people come into contact with WFG associates who may not be seasoned enough to deliver the right message in the right way. The company as a whole should not be judged by a handful of inexperienced people, especially people just learning the business. Just like anyone new to any field has to go thru a learning curve, WFG associates do too.

Of course most WFG associates own products from WFG providers. It would be irresponsible and hypocritical to try to sell someone something you don't believe in yourself. But the poster is very wrong to assume that non-WFG associates aren't buying. There are thousands of clients that are not WFG associates.

WFG is not a product provider. WFG is a broker representing an bunch of providers. Each provider has their own line of products. Some of the providers that WFG represent have really great products at competitive prices. I started working with WFG months after I was a client first. I was impressed that they could save me money and I learned a lot from the financial concepts that they taught me.

About life insurance... Go shop around first and then compare with the WFG providers. Chances are very good that you will find a better value and cheaper rate with at least one of WFG's providers. Your statement about overcharging is a flat-out lie.

In this industry, no matter who you work with, you will either sell or recruit or train recruits. If you don't want to work with WFG because you don't like to recruit, then you might as well go get a job with another financial company and be an employee and be a salesperson. Bad thing is you have no ownership and when you get fired or laid off because you didn't make quota, all your book of business will stay with the company and you would have spent all your time building a business for someone else.

You will find that in order for you to survive in the financial services industry you will have to be a super-salesperson. And all the while you'll be by your lonesome self, relying 100% on your own efforts. Eventually you will run out of steam. A smart person would open their own agency, recruit some people, train them, and make a cut off their production, and sell a little him/herself. That is what WFG offers. The difference is, with WFG your approach to sales is education. You don't have to be a salesperson to be successful in WFG.

So which would you rather do? Be super-salesperson, rely on just yourself, top out at $100K/yr.? Or would you rather use a proven system to build your own brokerage... A business that, if you build it according to the system, will grow bigger and bigger, and will give you longevity and prosperity in the most lucrative industry, because you're not just relying on yourself. That's why recruiting is important in this industry, and in any industry for that matter.

In response to your recruiting math... Everyone recruited does not and will not stay forever. Just like every business has turnover, some at higher rates than others. Out of all the people who have jobs or own businesses, how many people actually stay their whole lives? Your argument is pointless.

A final response about losing friends.... First of all, a true friend will not stop being your friend just because you have started a business and want their support. A true friend would listen to you and encourage you, and support you if possible. Worse case scenario they don't like the education or the products or the business, if they are a true friend, they would still be your friend. The WFG opportunity is so great that, in fact, you would not be a good friend if you didn't share it with your friend. If anything, you will find out who your true friends are. At the same token, a WFG associate should remain good friends with their good friends that do not join the business and not hold it against them.

It takes a special kind of person to have a business mind in our society. It takes an even more special kind of person to be able to see a business in financial services. And it takes an incredibly special kind of person to see the WFG opportunity.

The good thing is, WFG is not for everyone, only special people who can see a bigger picture. If WFG attracted everyone, then there wouldn't be people to fill all the other necessary positions out there.

#6 Consumer Comment

They don't offer just life insurance.

AUTHOR: Ken - (Canada)

SUBMITTED: Tuesday, April 08, 2008

From what I understand an associate will come see your family and figure out a way so that your not stuck paying bills/debts to the bank for a long period of time. I'm not sure how they do that but they work with other companies and they free up money and you can choose to do what you want with it....get the adequate insurance,investment, saving for kids education, retirement, travel. And it is a free service so really all they are doing is educating people. If someone has more information about how they do this it would be much appreciated.

#5 Author of original report

Straight-forward way to tell if it's a scam

AUTHOR: Anonymous - (U.S.A.)

SUBMITTED: Monday, April 07, 2008

Before you buy any product from them, tell them you want to do an independent research, and ask them for a complete copy of the terms and conditions of the product they try to sell you (most importantly, the life insurance).

Then ask someone outside of WFG for a second opinion, or do the research by yourself. It won't hurt, right? If the product is good indeed, and you need it, go ahead to buy it. Why not? But, if they hesitate to give you that, or try to find an excuse, then you need to be very careful.

#4 Author of original report

Straight-forward way to tell if it's a scam

AUTHOR: Anonymous - (U.S.A.)

SUBMITTED: Monday, April 07, 2008

Before you buy any product from them, tell them you want to do an independent research, and ask them for a complete copy of the terms and conditions of the product they try to sell you (most importantly, the life insurance).

Then ask someone outside of WFG for a second opinion, or do the research by yourself. It won't hurt, right? If the product is good indeed, and you need it, go ahead to buy it. Why not? But, if they hesitate to give you that, or try to find an excuse, then you need to be very careful.

#3 Author of original report

Straight-forward way to tell if it's a scam

AUTHOR: Anonymous - (U.S.A.)

SUBMITTED: Monday, April 07, 2008

Before you buy any product from them, tell them you want to do an independent research, and ask them for a complete copy of the terms and conditions of the product they try to sell you (most importantly, the life insurance).

Then ask someone outside of WFG for a second opinion, or do the research by yourself. It won't hurt, right? If the product is good indeed, and you need it, go ahead to buy it. Why not? But, if they hesitate to give you that, or try to find an excuse, then you need to be very careful.

#2 Author of original report

Straight-forward way to tell if it's a scam

AUTHOR: Anonymous - (U.S.A.)

SUBMITTED: Monday, April 07, 2008

Before you buy any product from them, tell them you want to do an independent research, and ask them for a complete copy of the terms and conditions of the product they try to sell you (most importantly, the life insurance).

Then ask someone outside of WFG for a second opinion, or do the research by yourself. It won't hurt, right? If the product is good indeed, and you need it, go ahead to buy it. Why not? But, if they hesitate to give you that, or try to find an excuse, then you need to be very careful.

#1 Consumer Comment

Where is the consumer?

AUTHOR: Ken - (Canada)

SUBMITTED: Sunday, April 06, 2008

First off I would like to say that I don't work for WFG or any other insurance company but I do know how it works but I will not be posting a long thread because it's a pointless argument. However if you search any company you will find someone bashing them because they don't understand or don't know all the information so it's just easier for them to point the finger. My point is if this is a scam as some people would say where is the consumer? I have read post after post but I haven't found 1 person who has bought this service or has gotten serious information from this company and has had a bad experience...I know if I had invested my money into something and a company f***** me over I would be on here burning/flaming/bashing them to hell. I am a person who has my own belief's and judgments and I certainly don't go off someone who is misinformed, I am here to find a person who has done business with this company and as I wish to do business as well, if all your gonna do is bash this company and not have any proof to state your claim than stop wasting mine and your time. Now if you wish to come after me for stating my comment go ahead but I hope your the person who has done business with this company so that I may ask how they screwed you over.

Advertisers above have met our

strict standards for business conduct.