Complaint Review: OCWEN - Orlando Florida

- OCWEN 12650 Ingenuity Dr Orlando Florida 32826 Orlando, Florida U.S.A.

- Phone: 877-569-8580

- Web:

- Category: Corrupt Companies

OCWEN ocwen rip off conartist OrlandoOrlando Florida

*Author of original report: Ocwen States Of America

*Consumer Suggestion: Do Not Waste Time

*Consumer Suggestion: Do Not Waste Time

*Consumer Suggestion: Do Not Waste Time

*Consumer Suggestion: Do Not Waste Time

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

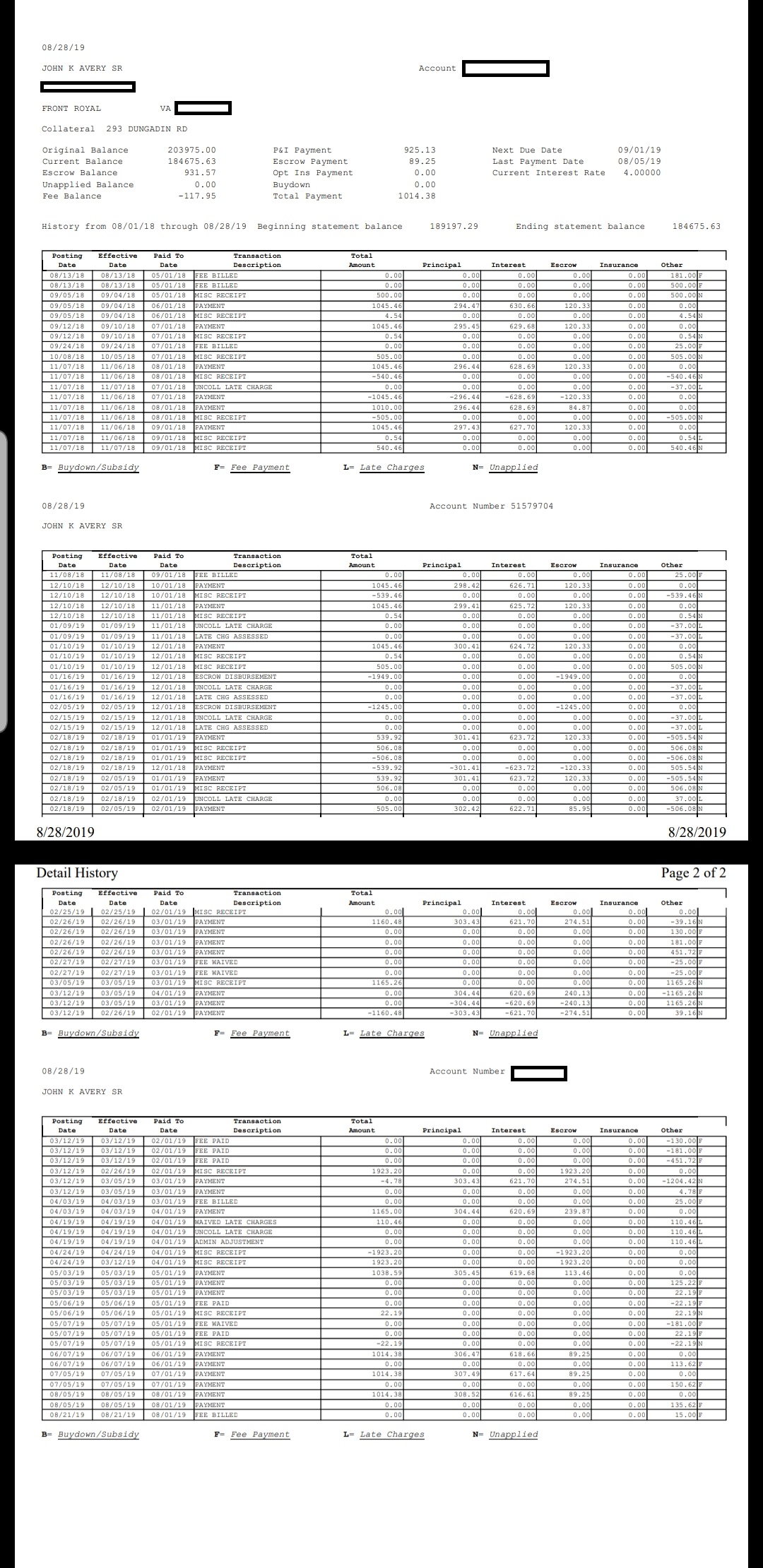

I am a victim of OCWEN fraud this company has wrongly charged me figures that are not right and is promising foreclosure of my home, many stories of lawsuits against OCWEN is on the internet just by searching "OCWEN" can you help me with this litigation? I have made my payment to them each month, I have already went through one forbearance plan because of other allegations made by OCWEN just to try to get on their track, they are a rip off con artist and there is no making anything right with them Thank you,

late fees 706.00

interest 2,691.00

past due 4,088.00

property inspection 736

property valuation 575.00 & 115.00

maintenance expense 31.50

legal collection 1,100.00

Jeff

Pennington Gap, Virginia

U.S.A.

This report was posted on Ripoff Report on 04/18/2008 05:57 PM and is a permanent record located here: https://www.ripoffreport.com/reports/ocwen/orlando-florida-32826/ocwen-ocwen-rip-off-conartist-orlandoorlando-florida-327151. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#5 Author of original report

Ocwen States Of America

AUTHOR: - ()

SUBMITTED: Thursday, July 09, 2015

Update: Ocwen foreclosed on my home that was my parents home, the home I grew up in believing in the American Dream, believing that hard work paid off so very not true. Scammers in the Mortgage business are part of what the U.S.A. has become, you can read all day for several days about "Ocwen Ripoff" even use other names of Mortgage Companies and add the name ripoff or scam along with them and see what ruins America has become.

With all the problems that the Mortgage Scam Industry has become it's a wonder their protectors allow these stories to remain on the internet..... If You are not a part of the solution, You are part of the Problem.

#4 Consumer Suggestion

Do Not Waste Time

AUTHOR: Lesa - (U.S.A.)

SUBMITTED: Saturday, April 19, 2008

To Jeff--my experience with Ocwen is first try to resolve the complaint with them. After trying to reason with them and providing them with all of your information--request their immediate attention to resolving your questions and complaint. Get everything in writing from them and record any phone conversations if possible. If they refuse to correct their errors and you have exhausted all peaceful means of resolution, contact a lawyer regarding consumer law and mortgage fraud. Do this now as they are probably making their next move legally on you. They will continue to harrass you by telephone and by mail and will move to foreclose on you as soon as possible. They will also report any negative information they can to the credit bureaus and this will trap you from getting away from them by refinancing.

Make certain that all of your complaints against them are completely accurate and you have the proof of timely payments etc. Then your lawyer can easily sort out any violations. My experience is that they will not listen or reason with a customer if they intend to foreclose anyway. You have to hire a lawyer or they will not stop.

Ocwen also charges excessive fees and many fees that do not seem justified. They presume that most customers will not question them or just walk away and not fight. Exposing their questionable mortgage servicing in the legal system is important and necessary to stop them.

Filing complaints with your State Attorney General and the Federal Trade Commission is also helpful. Contacting your Congressmen of your state and even the news media--anything to expose their mortgage servicing tactics is important.

Fight back and do not let them intimidate you. They are used to bullying their customers and scaring them into fear. Don't let them do it. There are so many complaints against Ocwen that we all must try to stop them. They will not listen to us as customers so hiring an attorney seems to be the only way to deal with them. Hope this helps.

LF

New Mexico

#3 Consumer Suggestion

Do Not Waste Time

AUTHOR: Lesa - (U.S.A.)

SUBMITTED: Saturday, April 19, 2008

To Jeff--my experience with Ocwen is first try to resolve the complaint with them. After trying to reason with them and providing them with all of your information--request their immediate attention to resolving your questions and complaint. Get everything in writing from them and record any phone conversations if possible. If they refuse to correct their errors and you have exhausted all peaceful means of resolution, contact a lawyer regarding consumer law and mortgage fraud. Do this now as they are probably making their next move legally on you. They will continue to harrass you by telephone and by mail and will move to foreclose on you as soon as possible. They will also report any negative information they can to the credit bureaus and this will trap you from getting away from them by refinancing.

Make certain that all of your complaints against them are completely accurate and you have the proof of timely payments etc. Then your lawyer can easily sort out any violations. My experience is that they will not listen or reason with a customer if they intend to foreclose anyway. You have to hire a lawyer or they will not stop.

Ocwen also charges excessive fees and many fees that do not seem justified. They presume that most customers will not question them or just walk away and not fight. Exposing their questionable mortgage servicing in the legal system is important and necessary to stop them.

Filing complaints with your State Attorney General and the Federal Trade Commission is also helpful. Contacting your Congressmen of your state and even the news media--anything to expose their mortgage servicing tactics is important.

Fight back and do not let them intimidate you. They are used to bullying their customers and scaring them into fear. Don't let them do it. There are so many complaints against Ocwen that we all must try to stop them. They will not listen to us as customers so hiring an attorney seems to be the only way to deal with them. Hope this helps.

LF

New Mexico

#2 Consumer Suggestion

Do Not Waste Time

AUTHOR: Lesa - (U.S.A.)

SUBMITTED: Saturday, April 19, 2008

To Jeff--my experience with Ocwen is first try to resolve the complaint with them. After trying to reason with them and providing them with all of your information--request their immediate attention to resolving your questions and complaint. Get everything in writing from them and record any phone conversations if possible. If they refuse to correct their errors and you have exhausted all peaceful means of resolution, contact a lawyer regarding consumer law and mortgage fraud. Do this now as they are probably making their next move legally on you. They will continue to harrass you by telephone and by mail and will move to foreclose on you as soon as possible. They will also report any negative information they can to the credit bureaus and this will trap you from getting away from them by refinancing.

Make certain that all of your complaints against them are completely accurate and you have the proof of timely payments etc. Then your lawyer can easily sort out any violations. My experience is that they will not listen or reason with a customer if they intend to foreclose anyway. You have to hire a lawyer or they will not stop.

Ocwen also charges excessive fees and many fees that do not seem justified. They presume that most customers will not question them or just walk away and not fight. Exposing their questionable mortgage servicing in the legal system is important and necessary to stop them.

Filing complaints with your State Attorney General and the Federal Trade Commission is also helpful. Contacting your Congressmen of your state and even the news media--anything to expose their mortgage servicing tactics is important.

Fight back and do not let them intimidate you. They are used to bullying their customers and scaring them into fear. Don't let them do it. There are so many complaints against Ocwen that we all must try to stop them. They will not listen to us as customers so hiring an attorney seems to be the only way to deal with them. Hope this helps.

LF

New Mexico

#1 Consumer Suggestion

Do Not Waste Time

AUTHOR: Lesa - (U.S.A.)

SUBMITTED: Saturday, April 19, 2008

To Jeff--my experience with Ocwen is first try to resolve the complaint with them. After trying to reason with them and providing them with all of your information--request their immediate attention to resolving your questions and complaint. Get everything in writing from them and record any phone conversations if possible. If they refuse to correct their errors and you have exhausted all peaceful means of resolution, contact a lawyer regarding consumer law and mortgage fraud. Do this now as they are probably making their next move legally on you. They will continue to harrass you by telephone and by mail and will move to foreclose on you as soon as possible. They will also report any negative information they can to the credit bureaus and this will trap you from getting away from them by refinancing.

Make certain that all of your complaints against them are completely accurate and you have the proof of timely payments etc. Then your lawyer can easily sort out any violations. My experience is that they will not listen or reason with a customer if they intend to foreclose anyway. You have to hire a lawyer or they will not stop.

Ocwen also charges excessive fees and many fees that do not seem justified. They presume that most customers will not question them or just walk away and not fight. Exposing their questionable mortgage servicing in the legal system is important and necessary to stop them.

Filing complaints with your State Attorney General and the Federal Trade Commission is also helpful. Contacting your Congressmen of your state and even the news media--anything to expose their mortgage servicing tactics is important.

Fight back and do not let them intimidate you. They are used to bullying their customers and scaring them into fear. Don't let them do it. There are so many complaints against Ocwen that we all must try to stop them. They will not listen to us as customers so hiring an attorney seems to be the only way to deal with them. Hope this helps.

LF

New Mexico

Advertisers above have met our

strict standards for business conduct.