Complaint Review: BB&T - Calhoun Georgia

- BB&T 215 N. Wall St. Calhoun, Georgia U.S.A.

- Phone: 706-629-4531

- Web:

- Category: Banks

BB&T Invalid Returned Checks Calhoun Georgia

*Author of original report: Invalid Returned Checks

*Consumer Comment: Check Holds

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

I was also a victim of invalid returned check fees. BB&T will cash your check and give you the money immediately but hold your check until it clears when you deposit it. There is only one reason I can see for doing this and thats to accumulate returned check fees. I have read rebuttals on complaints concerning BB&T telling people to better manage their money. I keep track of every penny of my money. Sometimes it is very close but I make sure I have enough money to cover any debits to my account. There are people like me who because of good reason are living week to week. Believe me, it's not pleasant.

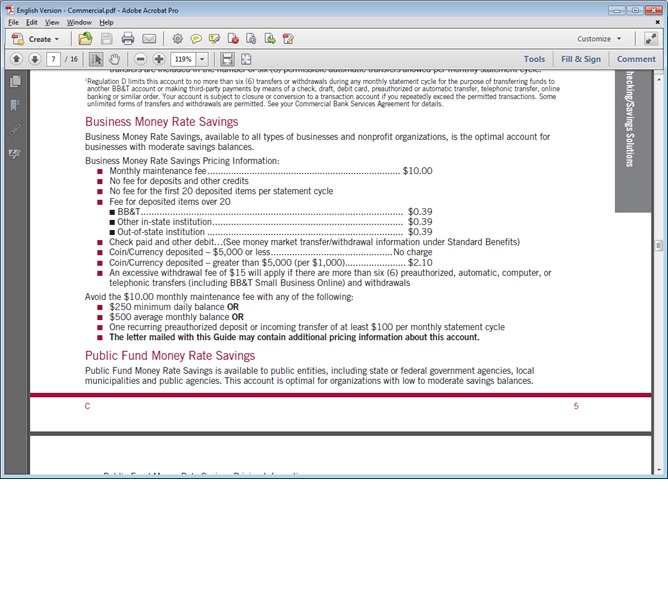

To all of you who have had BB&T charge you invalid returned check fees, get out your Bank Services Agreement booklet. If you don't have one get them to send you one. Turn to page 23. This is what it says: "If we are not going to make all the funds from a BB&T check deposit available on the same day of your deposit, or, if we are not going to make all of the funds from a non-BB&T check available on the next business day after your deposit, we will notify you at the time of your deposit. We will also tell you when the funds will be available. If your deposit is not made directly to one of our employees, or if we decide to take this action after you have left the premises, we will mail you the notice no later than the next day after you make the deposit." I wasn't told anything about funds being held nor when the funds would be available and I bet none of you were either.

I called BB&T after finding this in their booklet explaining that I had not been notified. The person I talked to still would not remove the fees denying their own rules but is having someone else call me. My deposit was posted the same day as the checks that were returned but they posted the checks before the deposit. Don't allow them to get away with this. Call them up and show them their own service agreement mentioned above. If they still will not remove the fees, take them to small claims court. They don't have a leg to stand on concerning hold your deposited check if they did not notify you at the time you made the deposit. Good Luck!

Fee'd Up

Calhoun, Georgia

U.S.A.

This report was posted on Ripoff Report on 02/04/2009 12:12 PM and is a permanent record located here: https://www.ripoffreport.com/reports/bbt/calhoun-georgia-30701/bbt-invalid-returned-checks-calhoun-georgia-420112. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#2 Author of original report

Invalid Returned Checks

AUTHOR: Teresa - (U.S.A.)

SUBMITTED: Saturday, February 07, 2009

I have been banking with BB&T for several years. This "new policy" of holding every deposited check just started. When I opened the account they didn't do this. I learned of it when I got notice of the returned checks. The Bank Services Agreement states that they must tell you at the time of deposit that they will hold your deposited check until it clears. This is not for exceptional holds. I have talked to BB&T since my last post and it seems like the more I talk to them the more they change the rules. Now they are trying to tell me that if you make a deposit after cut off date on Friday the deposit will not be available until the next business day which they call Tuesday. The BB&T Bank Service Agreement says that if a deposit is made after the cut off on Friday the funds will be available on the next day they are OPEN. They continue to tell me things are one way when their printed services agreement booklet that they give customers says something else. When I point out how the Bank Services Agreement is different from what they are telling me, they make excuses and still refuse to remove the fees. I am prepared to take them to small claims court not just for the fees but to prove the point that they can't just make rules up as they go along. Their business ethics are ridiculous and shameful. The least they could do if they insist on holding every deposited check to clear, is to hold any overdraft fees until the check has a chance to clear. If it doesn't then apply the fees. Now they will not return my calls. I see no other choice but to take them to court. I refuse to let them steal from me which is exactly what they are doing

#1 Consumer Comment

Check Holds

AUTHOR: Ken - (U.S.A.)

SUBMITTED: Thursday, February 05, 2009

Every bank has to have a Funds Availability Policy. They are required to give you a copy when you open the account, and also anytime you request one. It also has to be posted in every branch. The policy dictates how checks will be held, and for how long.

The policy you refer to in your post is for Exceptional Holds, i.e. when they are holding the check for longer than the standard hold. That is the only time they need to notify you, and they have to do it within a business day, but it can be by mail.

From your posting, it doesn't sound like a problem because they held check deposits, it sounds like checks cleared on the same day you made a check deposit.

Many banks are reasonable in as much as if you tell them at time of deposit that you have checks clearing that day, they can flag the account so the checks get paid. If allowed to just run through the system, they will probably be returned as 'uncollected funds' and you get charged.

Advertisers above have met our

strict standards for business conduct.