Complaint Review: FIRST PREMIER - SIOUX FALLS Minnesota

- FIRST PREMIER 900 WEST DELEWARE AVENUE SIOUX FALLS, Minnesota U.S.A.

- Phone: 800-9875521

- Web:

- Category: Corrupt Companies

FIRST PREMIER Outlandish Fees Just to Activate a Credit Card!!! SIOUX FALLS SOUTH DAKOTA

*Consumer Comment: Rob from Ohio is right on the money

*Consumer Comment: Finally Saw The Light

*Consumer Comment: Robert in Huron....thanks.

*Consumer Suggestion: They make it very clear of the fees

*Consumer Suggestion: Kat Unfortunately I Don't Think You Will Get a Refund

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

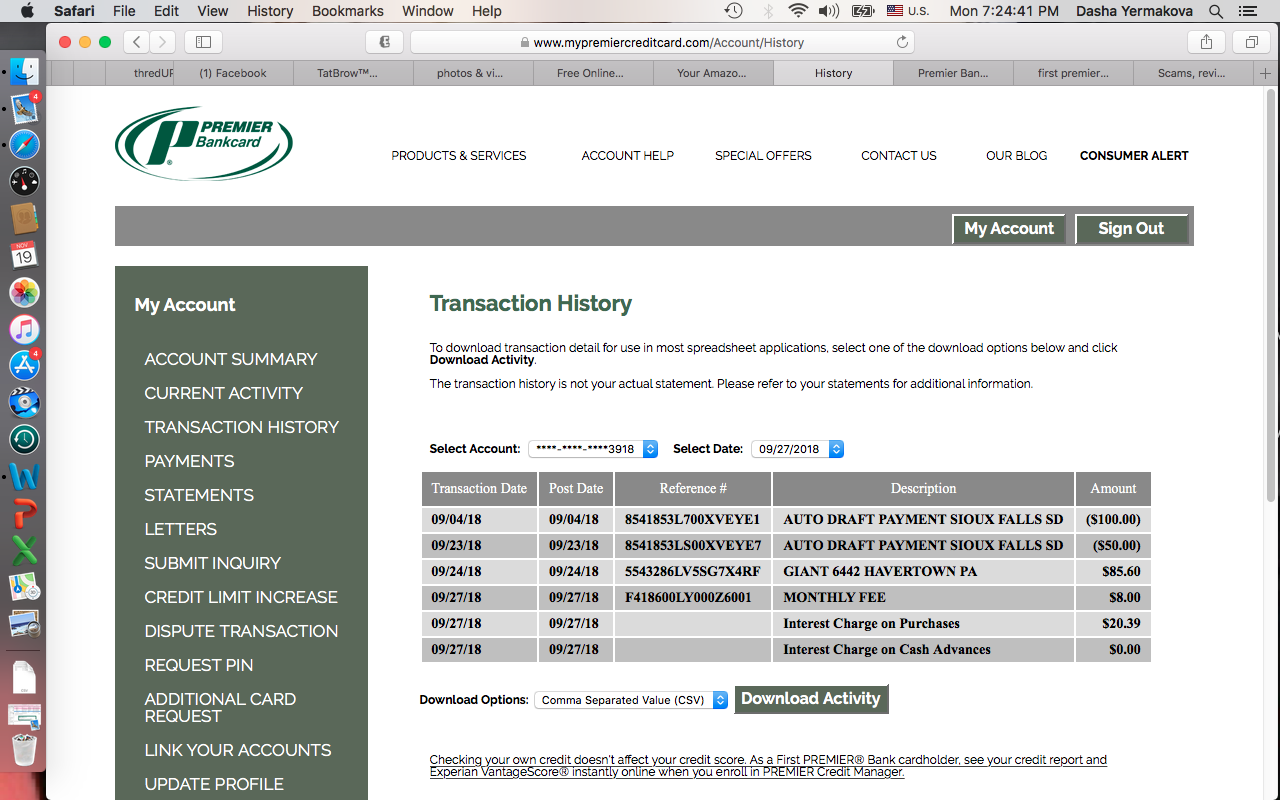

I just want to say that I feel that I am a victim of this credit card company. I just found out after surfing the internet, I accidentally came upon this information regarding the ridiculous fees just to get started. I feel that I should bee reimbursed for the fees that were charged just to activate the card. Those fees totaled $178.00 , which then left me with an available credit of $80.00.

I started out with a credit of $250.00 , but after all the fees were deducted, I only had $80.00 of available credit. I would like to know how to go about being refunded for this amount of $178.00. I have tried calling the Attorney Generals Helpline, but have had no success in getting through. I received this card shortly after the settlement agreement was issued in the state of NY , with Andrew Cuomo, the Attorney General of the State of New York. Now I am trying to get my refund for these outlandish fees.

Please if anyone can help me, I'd appreciate it.

Kat

JUPITER, Florida

U.S.A.

This report was posted on Ripoff Report on 11/13/2007 07:21 AM and is a permanent record located here: https://www.ripoffreport.com/reports/first-premier/sioux-falls-minnesota-57117/first-premier-outlandish-fees-just-to-activate-a-credit-card-sioux-falls-south-dakota-284521. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#5 Consumer Comment

Rob from Ohio is right on the money

AUTHOR: Al - (U.S.A.)

SUBMITTED: Monday, June 23, 2008

Rob's right on the money on both SD and First Premier. I've never had a card with these guys but I interviewed with them on a job a year ago. That's when I found out what they were doing. I can assure you that the vast majority of the people that work at this place are plain con-artists themselves. During my interview I openly heard associates lie and exaggerate on the phones constantly. $180 to set up an account that maybe has a $300 - 400 credit limit. $10 to pay by phone, $5 or something like that just to log in to their website, just plain BS fees that I would imagine even your worst bank wouldn't charge. I don't think you can even call First Premier a bank, they're more like a collections agency gone bad (we have plenty of those in SD).

Rob is also right on SD being a bankers haven. The usury laws here are very lax. I think that the credit card laws here are somewhat more lax than most other states, but the real kicker is the payday loan crap-outfits here. In Sioux Falls we probably have close to three or four dozen of these types of places, and 500%, 600%, even 700% and higher APRs are not uncommon. Place them right next to the casinos and bars (no shortage of them here either) and you get a real fun show. Finance is a big part of the SOuth Dakotan economy. It's also why the state barely scrapes by even in good times. These credit card and finance companies probably hire close to around 4000 - 11000 people in the SIoux Falls metropolitan area combined. That's out of a labor force of maybe 100,000. Also, T. Sanford (the owner of First Premier) gives a ton of $$$ to charity here (like that helps). He bought out one of the local hospitals here and changed it into his name. I swear to God he is going to take over the whole town.

Personally, I really hope that someone takes them down like Cuomo did in NY. South Dakota likely won't though since the whole state is corrupt like First Premier. Politically I'm not sold on any differences between the Red and Blue States, but I will agree that the Red states usually are more corrupt and self-serving as a whole.

#4 Consumer Comment

Finally Saw The Light

AUTHOR: Bartmanla - (U.S.A.)

SUBMITTED: Monday, November 19, 2007

Kat I agree with what has been said I find it surprising that you at some point did not read the information on the website or the mailed enclosures that pointed out every cost just to get an account with this predatory company.

I knew going in I was going to pay those fee's and choose to do so in a effort to try to repair my faltering and bad credit. Of course I had not found this site to find out what a truely bad deal I was getting. I discovered the nickel & diming that they do after you get an account, $6 a month "maintenence" fee, $7 just to pay the account ONLINE, up to 20 days for the payment to be posted to an account if you pay with a check or online. NEVER was given a credit increase for prompt payments, I would have to PAY them a fee to get one.

The interest rate that they charged while lower than some cards I have didn't justify the rest of the money they billed every month just to have the account. The final straw was a notice on my statement that my "annual" fee of $48 was going to be applied the following month, and to make sure there was enough "credit" available or they would charge me a overlimit fee and subject my account to the penalties with such activity and my interest rate would skyrocket. I paid the account via Western Union in full, made sure it posted and I had a $0 balance and then called and cancelled the card.

Of course they tried their darnest to keep me from doing so, even offering to waive the credit limit increase fee if I kept the card. Their response when I asked how much my credit limit would be was "no more than 2/3 of your current credit line" I declined, and it took me another 4 statements of "cancel my account now" before I had to firmly tell them to cancel, and I would refuse to pay ANY further billing, and if they did charge me the annual fee I would report them to the California States Attorney office for deceptive business practices. At that point I got a "Your account is canceled" and the CSR hung up. I say GOOD RIDDANCE, I now have 4 other CC's that don't charge me these outrageous fees.

I hope you get your refunds, but I highly doubt it. Let this just be a unfortunately costly lesson into checking out EVERYTHING you get from these companies and read the fine print. And another suggestion, one which I did and am very happy I did. CALL that OPT OUT number that is required to be on all postal mail advertisements for such credit accounts and other financial institutions and GET YOURSELF OFF THEIR LISTS. It will remove the temptation and you can pick and choose where you go for credit accounts by yourself.

#3 Consumer Comment

Robert in Huron....thanks.

AUTHOR: John - (U.S.A.)

SUBMITTED: Saturday, November 17, 2007

It's great that someone else understands that there are larger issues involved here than a few rogue predatory companies who exploit people. There is a much larger issue of a corrupt political culture that allows such firms to operate. The political situation in this nation has greatly deteriorated. One might argue that we have become a crony-capitalist, pay-to-play corporate state. The government is largely run by and for the power elites and corporations. Usury laws have largely been abolished as a result.

Things will only changed with the over-worked, over-stressed, over-distracted and over-entertained citizens of this nation wake up and take back their government

#2 Consumer Suggestion

They make it very clear of the fees

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Friday, November 16, 2007

You need to read the disclosures when you sign up for a card. It is hard to beleive that you found out about this company, signed up for the card, got the card, and activated the card. However, you had no idea of any of the fees until you decided to surf the internet.

But with that said, have you even tried to call First Premier. If you just got the card you can call them up and tell then you decided to not keep the card. They should then refund the fees. Just know that if you do this you will close out the account and won't be able to use it.

#1 Consumer Suggestion

Kat Unfortunately I Don't Think You Will Get a Refund

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Friday, November 16, 2007

Kat, I think you getting a refund from First Premier Bank are non-existent. I don't say that with any glee as I do feel sorry for you. This may hurt but they do in a not so direct way or not so clear way tell you of the fees. Now please don't take that as an insult because this bank uses every tactic in the bag to not disclose the information to you. They basically stay just a bit above the law.

There are so many factors affecting this situation the most important one is First Premier Bank operates in South Dakota. That state is the most free in banking regulations of any state in the country. The only one that comes close to it is Delaware. You can see why. South Dakota does not have much to lure business to the state but they can allow shady outfits like First Premier to ripoff folks around the country. This bank employes some 3000 folks in that state and they are paid fairly good wages (alas from the scam fees they charge you) so South Dakota is not about to rock the boat and make it hard for First Premier to do business there.

Second reason is South Dakota is pretty Republican both houses are Repub and the Gov and all the state regulatory agencies and I bet you its a good prediction that all these elected folks are in bed so to say with First Premier. You know good campaign contribution from this scam outfit to these folks protects First Premier Bank and allows them to hussle folks around this country.

Now I had no dealings with this scam bank I had a credit card issued by them in my name. I have given them so much heat and I will continue to do it. They failed to do what they should have done validating the information and its a bad case of them "they got caught with their pants down." Oh, they don't like it but being in South Dakota not much is going to happen to them.

Best thing we can do is tell the story where ever you go about First Premier. Tell folks the scam bank they are. I have got many folks who receive their advertisements they have torn them up and when First Premier opens them up in South Dakota they have nothing but their junk torn up in the envelope. So please get the message out about the scam bank they are and also add that elected officials in South Dakota and mainly the Republicans who control that state are allowing it to happen. Maybe the good folks in South Dakota will clear some of these legislators who fail to control First Premier and force them out of office the we get some decent law bearing legislators who will take First Premier to the courts and stop this scam outfit.

Advertisers above have met our

strict standards for business conduct.