Complaint Review: Ocwen - Orlando Florida

- Ocwen Orlando, Florida USA

- Phone: 8007462936

- Web: www.ocwencustomers.com

- Category: Mortgage Brokers

Ocwen Loan Servicing, LLC Pads Payoff Quotes With Unnecessary & Excessive Fees, Costing Client Thousands! Orlando Florida

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

So my husband and I fell behind on our mortgage towards the end of 2012. We applied for Ocwen's home loan modification program, and, after 4 months, were denied. During this "review process," we were told that all foreclosure proceedings were suspended, which they were. However, after we were denied, our CSR (all in India, apparently) recommended that we apply for an "exceptional modification." What he didn't tell us was that THAT process did NOT suspend foreclosure proceedings, so Ocwen began foreclosure proceedings on our property in mid-January 2013. In March, we were denied for the exceptional modification and informed that, by the way, our house was up for foreclosure "sale" on April 2, 2013! As we had already decided to sell the property, and were told that if we didn't agree to their forebearance plan, our home would be foreclosed on April 2nd, we borrowed money and paid them the $6500.00 to stop the foreclosure. We then agreed to pay them forebearance payments of nearly $1900 a month - thinking it would only be for a couple of months, because we were selling the property.

Finally, we got a buyer and a sales contract, so I requested a payoff quote on 4/10/13 and discovered Ocwen had added over $4400.00 in "foreclosure fees and expenses" to our payoff quote! Upon calling customer service, I was informed that these were attorney's fees charged to Ocwen by their attorney and passed on to our account. I was also told that, since we were now in a forebearance plan, there shouldn't be anymore foreclosure or attorney fees, because the foreclosure was in suspension. You can imagine my surprise when two more subsequent payoff quote (5/1 and 5/20) included an additional $3,000 in these so called "foreclosure fees and expenses!" Several phone calls and one letter to their "research department" later, no one can tell me exactly WHAT their "attorney" did to warrant these fees, when exactly they were assessed to my account, or even the NAME of the attorney that was assigned to our "foreclosure" (that never proceeded, mind you)!! All I get is, "I can send a request for that information. Call us back in 24-48 hours."

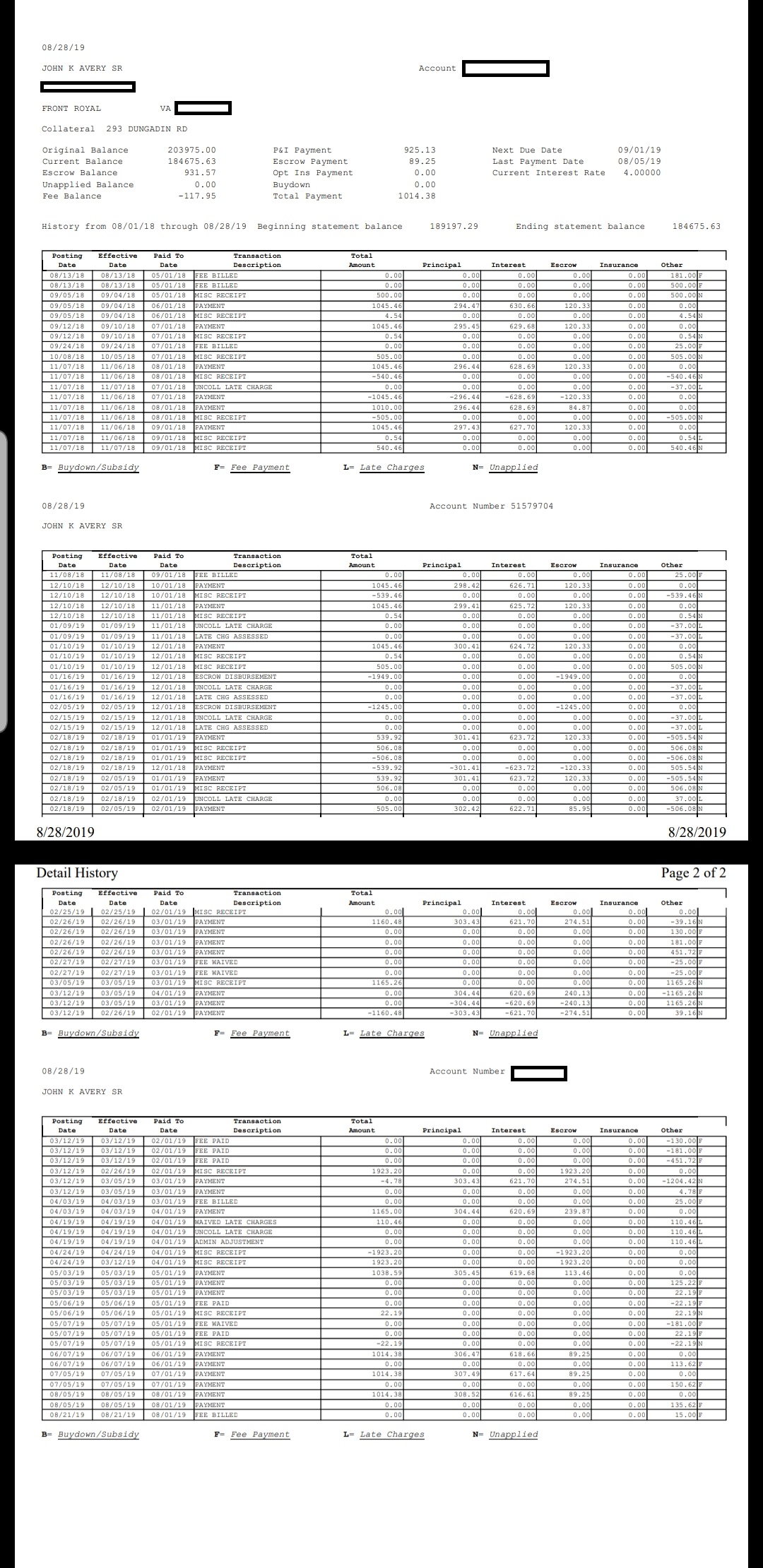

I have contacted their supervisors in the Research Dept several times. I have emailed their omsbudman and heard nothing back. I have requested three times now an itemized statement from this attorney detailing these fees. What I found interesting, though, was that Ocwen did send me a transacation detail statement on my account, dating from 07/2012 through 05/15/2013, which detailed every transaction on my account during that time, including all fees and expenses. Guess what is NOT included on these statements? Not one dime of these so called attorney's fees.

Appealing to Ocwen has done nothing. I have reported them to the BBB, the Consumer Protection Agency, and the Consumer Banking and Finance Agengy, but - as we're closing on this property on 5/31/13 - I doubt anyone will be able to do anything about the $7,000.00 that Ocwen just siphoned out of my back pocket for no verifiable reason. Even my local attorney said these fees are excessive, but there's little we can do since Ocwen is such a huge company. My best bet would be to go on and close, then try to sue them for the money that was stolen from me. But I had to sell my house because I couldn't affford it. How am I supposed to afford to sue a huge company like Ocwen? And once we close, they will have no reason to even take my phone call anymore, much less give me back my money.

We did not start out with Ocwen. Our loan was originally with Countrywide, then it was sold to BOA, then to Ocwen. If you're with Ocwen and ever have trouble making your payments, bend over and grab your ankles.

This report was posted on Ripoff Report on 05/23/2013 06:34 AM and is a permanent record located here: https://www.ripoffreport.com/reports/ocwen/orlando-florida/ocwen-loan-servicing-llc-pads-payoff-quotes-with-unnecessary-excessive-fees-costing-c-1053208. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

Advertisers above have met our

strict standards for business conduct.