Complaint Review: Allied Interstate - Amherst New York

- Allied Interstate 15 Hazelwood Drive #102 Amherst, New York U.S.A.

- Phone: 716-691-1320

- Web:

- Category: Adult Career & Continuing Education

Allied Interstate Harrassed for no reason by Allied Interstate student loan Amherst New York

*Consumer Comment: unsecured student loans...???

*Consumer Comment: Some facts on student loans

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

In 1987 I applied for a student loan. The lending institution was private and the loan was not guaranteed. The business school grossly overstated the value of the education and charged accordingly, only I did not learn that until later. All I learned was how to use a computer and other general office skills.

The school charged $4,000 for this low end education that was not worth more than $400. The claim was that my earning potential would increase to at least $10.00 per hour immediately upon graduation and could potentially go as high as $18.00 per hour after a few years of experience. This sounded quite good to me since until that time I was only able to earn minimum wage. In reality, after 20 years I am still unable to earn more than $12.00 per hour.

I feel I was badly ripped off by that school but was ripped off worse by the lending institution, Nebraska Higher Education. This company used outside loan servicing agencies to service their loans. These agencies were applying 80-90% of each payment made to their fees and interest charges. I made payments until 1995 when I moved out of state.

After the move, I tried to contact the lender and Department of Education to find out where I should send my payments since I was in another part of the country now. My requests were ignored, but in 1998 I started getting calls at work, by collection agencies about this loan. This was a number that the agency could not have obtained except by running my SSN and looking up the phone number.

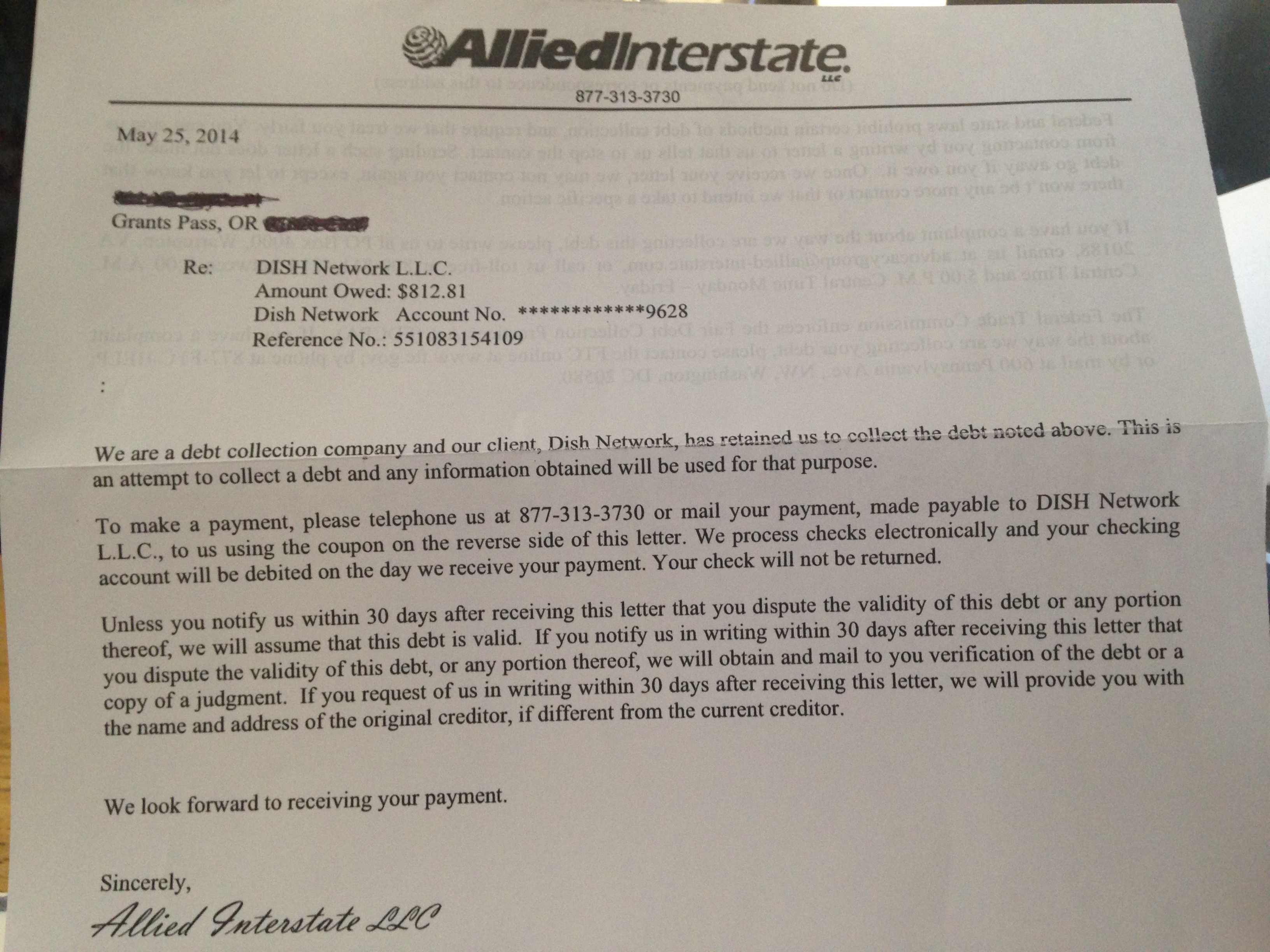

Some of the agencies that have called me were GC Services, Van Ru Credit Corporation, ConServe, Pioneer Credit Recovery, Inc. and now Allied Interstate Inc. I have been threatened with everything from garnishment of up to 90% of my wages to jail time for non-payment of a student loan, despite the fact that people cannot be jailed over student loans or any loans. I have been harrassed at home and work up to 40 times per day at each location.

The claim is I owe approximately $9,000 now on a loan that was originally for $4,000 and after paying for 8 years, only approximately $800 was applied to the principal balance. Furthermore, I was forced to take a Chapter 7 bankruptcy in 2002 due to circumstances beyond my control. The loan was discharged in that bankruptcy because it was unsecured, but I am still being harrassed.

I ran my credit report a couple of months ago and there is nothing on it that even remotely resembles a student loan, so what's the deal? It is high time government institutions like the Department of Education and their collection agencies were brought to account for their actions and are forced to stop their endless ripoffs against the American public.

Donna

Toms River, New Jersey

U.S.A.

This report was posted on Ripoff Report on 03/07/2007 04:19 AM and is a permanent record located here: https://www.ripoffreport.com/reports/allied-interstate/amherst-new-york-14228/allied-interstate-harrassed-for-no-reason-by-allied-interstate-student-loan-amherst-new-yo-238475. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#2 Consumer Comment

unsecured student loans...???

AUTHOR: Shaka - (U.S.A.)

SUBMITTED: Friday, July 25, 2008

What about unsecured student loans. NOT staffords, the ones your school sets up for you, but the ones advertised by wachovia, chase, etc, stating you can borrow up to 40k/year while in school? Do they fall under the same categories as government backed loans? I am in default on these,and am getting harrassed for garnishment, repo, home lien, etc. I am paying the original loans the school helped me with (stafford), but was injured, unable to finsish school, and cant afford these personal loans??? van ru is all over me... any help, info?

#1 Consumer Comment

Some facts on student loans

AUTHOR: Lynn - (U.S.A.)

SUBMITTED: Wednesday, March 07, 2007

As an ex student loan collector, there are a few things you should be aware of.

Nebraska Higher Ed or the Nebraska Student Loan program is a federal lender of guaranteed student loans. Your loan is guaranteed by the government and thus has no statutue of limitations. This means that the debt will never go away.

Student loans are NOT dischargable in bankruptcy. You might want to do some reading on the Department of Education website.

If Allied is calling you at work and you are refusing to pay, I can assure you they WILL quickly start a wage garnishment against you. Administrative wage garnishment is authorized by Congress and they can take 15% of your disposable pay. They can also seize your tax return and garnish goverment payments such as SSI and SSDI payments.

I would suggest that you do some careful reading on defaults on the department of education website. You do have rights but you have to understand that you took out a loan that must be repaid.

Advertisers above have met our

strict standards for business conduct.