Complaint Review: Sterling Commercial Capital - Upper Marlboro Maryland

- Sterling Commercial Capital 9008 McFarland Way Keller Texas 76248 Upper Marlboro, Maryland U.S.A.

- Phone: 504--250-7115

- Web:

- Category: Loans

Sterling Commercial Capital I as a commercial brought a loan to Sterling Commercial Capital / Brian Opert for funding. Sterling advertises as a direct lender, this is not true Sterling in turn with all agreements in place brokered the loan and conspiried with the unethical client to pay them and not me. Liars and Thievs Upper Marlboro Maryland

*REBUTTAL Owner of company: Broker Filed False Claim

*REBUTTAL Owner of company: Sadly Broker Filed a False Allegation

*REBUTTAL Owner of company: Broker misplaces blame

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

Sterling Commercial Capital advertises to be a dorect lender thus encouraging Broker to bring them loans for funding. They are not direct lenders they are Brokers who will take another Brokers effort and clients and steal them. I dealt directly with the CEO Brian Opert, master rat. Opert worked this loan with me for over 4 months, he had my client wait when he promised to close, he lied to me and the client about rate and terms. He then goes to my client and cuts a deal while under contract to get paid therefore cutting me out.

He runs around saying I missed my dead line, this is untrue I have docs to prove it. He encouraged the client to use his lawyer as the title attorney and to not pay me. I brought the deal to Opert, he was late because he was the funding agent. He walked away with his money and my money. The client had no loyalty after calling me 5 times a day for over 6 months. I put this deal together and did it right but Opert the thief stole it all. I suggest that you have no dealings with this piece of ...... If you hear the name Khaled Taye or Dennis Mille run run run they are in the thief club with opert.

Kholmes

Upper Marlboro, Maryland

U.S.A.

This report was posted on Ripoff Report on 12/16/2008 12:52 AM and is a permanent record located here: https://www.ripoffreport.com/reports/sterling-commercial-capital/upper-marlboro-maryland-20772/sterling-commercial-capital-i-as-a-commercial-brought-a-loan-to-sterling-commercial-capita-401785. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

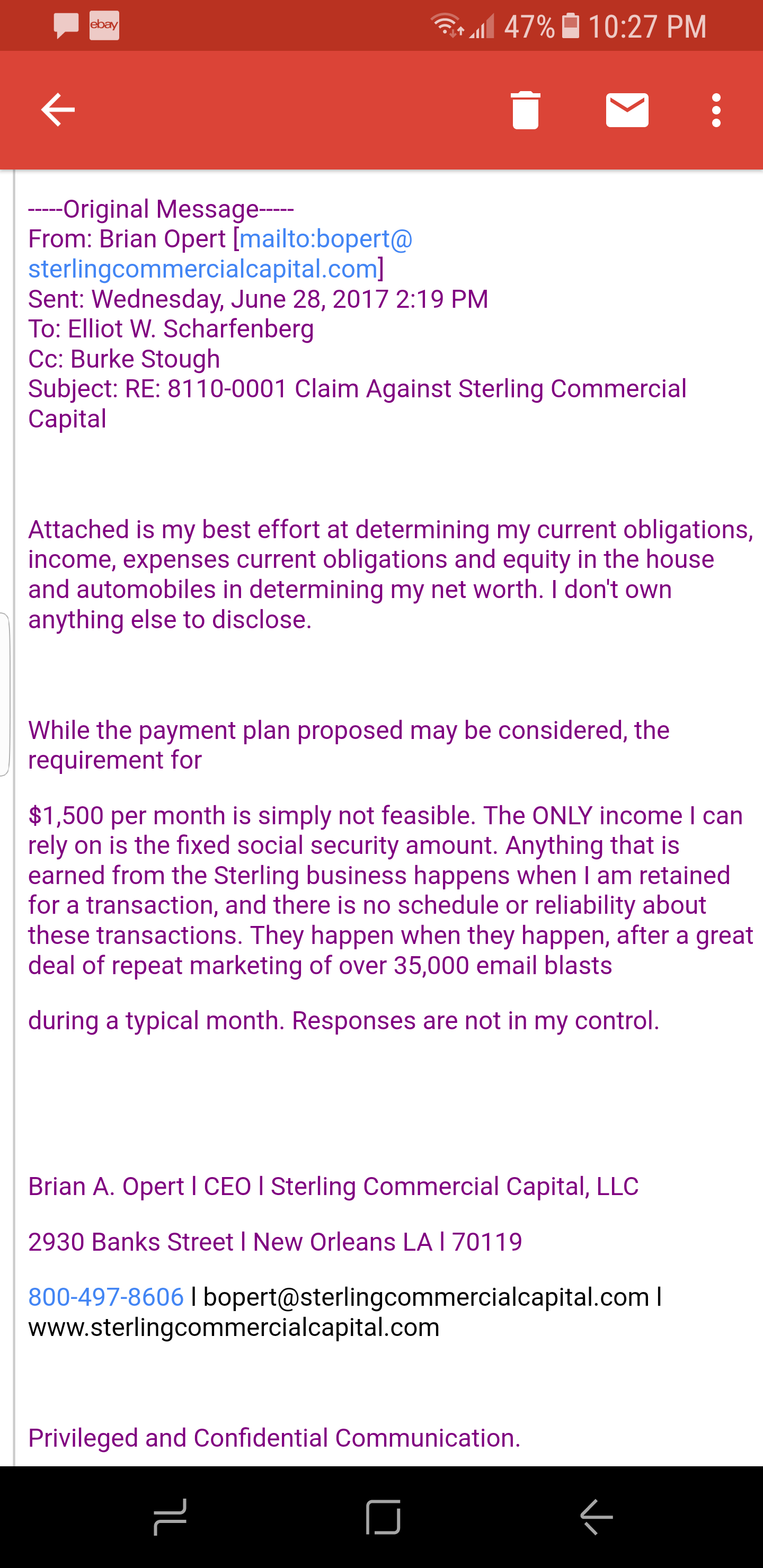

#3 REBUTTAL Owner of company

Broker Filed False Claim

AUTHOR: Brian opert - (U.S.A.)

SUBMITTED: Monday, November 09, 2015

TO SIMPLIFY: This complaint was filed in 2008 - many years ago. The complaint was filed by an unhappy mortgage broker, who lost his fee payable ONLY by his client. For this closed loan, Sterling Commercial Capital was the lender, not the client. Sterling was not under contract or other agreement with the broker, and never was under any obligation to pay this broker's fee. Filing this false report was a last ditch effort by this unhappy broker, who found a legitimate company to hang his hat on, accomplishing no financial benefitl for the broker. It is our understanding that he could have accepted the fee he was offered by this client. Instead, he refused and got nothing. This is through no fault of Sterling. This was and continues to be a false allegation.

#2 REBUTTAL Owner of company

Sadly Broker Filed a False Allegation

AUTHOR: Brian opert - (U.S.A.)

SUBMITTED: Monday, November 09, 2015

TO SIMPLIFY: This complaint was filed in 2008 - many years ago. The complaint was filed by an unhappy mortgage broker, who lost his fee payable ONLY by his client. Sterling Commercial Capital was the lender, not the client. Sterling was not under contract or other agreement with the broket, and never was under any obligation to pay this broker's fee. Filing this false report was a last ditch effort by this unhappy broker, who found a legitimate company to hang his hat on, accomplishing no financial beneficiual for the broker. It is out understanbding that he could have accepted the fee he was offered by this client. Instead, he refused and got nothing. This is through no fault of Sterling. This was and continues to be a false allegation.

#1 REBUTTAL Owner of company

Broker misplaces blame

AUTHOR: Brian Opert - (U.S.A.)

SUBMITTED: Tuesday, January 06, 2009

Unfortunately, this mortgage broker is blaming Sterling Commercial Capital regarding the treatment he received from his own client. As a broker, Kenneth Holmes did little other than make a referral. The project involved 3 separate C-store operations located in the Detroit area late in 2007. As is our standard procedure, we had pre-sold the loans and so packaging had to also meet our investor's standards. From the outset, Holmes did not document the loan. He did not provide financial information on each operation, never met the client, never visited the properties, did not provide adequate sources and uses information, never fully described the real estate nor provide photos of the properties, did not deal with environmental issues, among other items that were missed. We actually returned the package with detailed instructions and asked Holmes to start over. He refused, and requested that we work directly with the client. As a result, it took a long time for us to receive the information and create up to date and accurate financial information (requiring us to interface with the client and client's accountants numerous times). We were finally able to commit, retain 3rd party consultants and then close the 3 loans. The client/borrower was satisfied. However, he and his attorney advised us that Holmes' broker agreement was not valid. Apparently he had promised a single loan, with much larger loan amount than was possible, rates and terms that were not available, and a time table that could not be achieved. He never modified or extended his agreement. But with Sterling's assistance and insistence, we made certain that Holmes would be paid by the client 1 point from closing proceeds, as a gesture of good business and good faith (not the 2 points on a much larger loan that he expected.) As we understand it, Holmes refused that 1 point fee. Now he blames Sterling for his not being paid. There was no contract or other agreement between Sterling and Holmes. If his broker agreement was in fact still valid, it would have been grounds for a good law suit, or even a lis pendents. But this is not the case. By the way, this loan closed about a year ago - and his post went up 2 weeks ago? Sad story, but Kenneth Holmes' post does not truthfully report the circumstances. [PS: we don't know anything about the Upper Marlboro Maryland references]

Advertisers above have met our

strict standards for business conduct.