Complaint Review: Lightstream - Atlanta Georgia

- Lightstream Atlanta , Georgia United States

- Phone:

- Web: www.lightstream.com

- Category: Money Lender, Home loans

Lightstream Loan Rejection For Reasons That Don't Add Up: Damage to Credit Report Atlanta Georgia

*Consumer Comment: Interesting

*Author of original report: You're Full Of It

*Consumer Comment: You can't afford a house

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

Where I live homes are cheap. Remodeled homes, that are beautiful go for as little as $40,000. Houses like mine that need a little TLC can go as low as $10,000. Since I'm related to the current owner, I was able to get it for $7000. I asked Lightstream for a $12,000 loan for the home, and the additional $5,000 to the $7000 cost was for repairs. They rejected this loan, while hurting my credit with a hard pull for the following reasons.

1. You Don't Make Enough/Don't Have Enough Equity

A. Equity: The current tax value of the home is $17,500 in Greenwood County Kansas. $5,500 more than I'm asking. If for the HIGHLY UNLIKELY reason I could not make payments occured. It would be exceptionally easy to sell the home, pay the loan, and PROFIT from it. I also have a 2015 Corolla I could sell for more than I owe. I also have a 2001 Corolla that could account for at least 1/3 of the loan.

B. Income: I make approximately $29,500 a year. The rent in the house I want to buy is $150. I asked (again) for $12,000, in a 5 year period. The payment on this amounts to around $150 more than I spend on rent. The cost of living here is exceptionally low. My total living expense (including rent which would be replaced by the payment of the loan) is $1200. My monthly income AFTER taxes is between $1800-$2100 at my current pay rate. My expenses WITH the loan would be $1400 MAXIMUM. Leaving me $400-600 to put in savings a month. My TAX RETURNS would pay nearly half of the loan in the 5 year period by themselves. This is Bogus.

C. The amount of my newer car was the same price. I did put 10% down, however; I made significantly less money at that time. My credit history was 2 1/4 years shorter. My credit score was lower (but still excellent)

2. Too Much Debt As Stands.

This is only somewhat understandable. I owe $6000 yet on my car, and another couple thousand on my credit cards, which I am right in line to wipe the owed balance on my cards out. My payment history will also show I have a habit of making LARGE payments on these cards. IE: Letting the balance get to $1200, and paying it off all at once. My car payment is a measely $190 monthly, and I am mostly paying on principle at this point.

3. Lack Of Credit History

A. I have over six years of credit history.

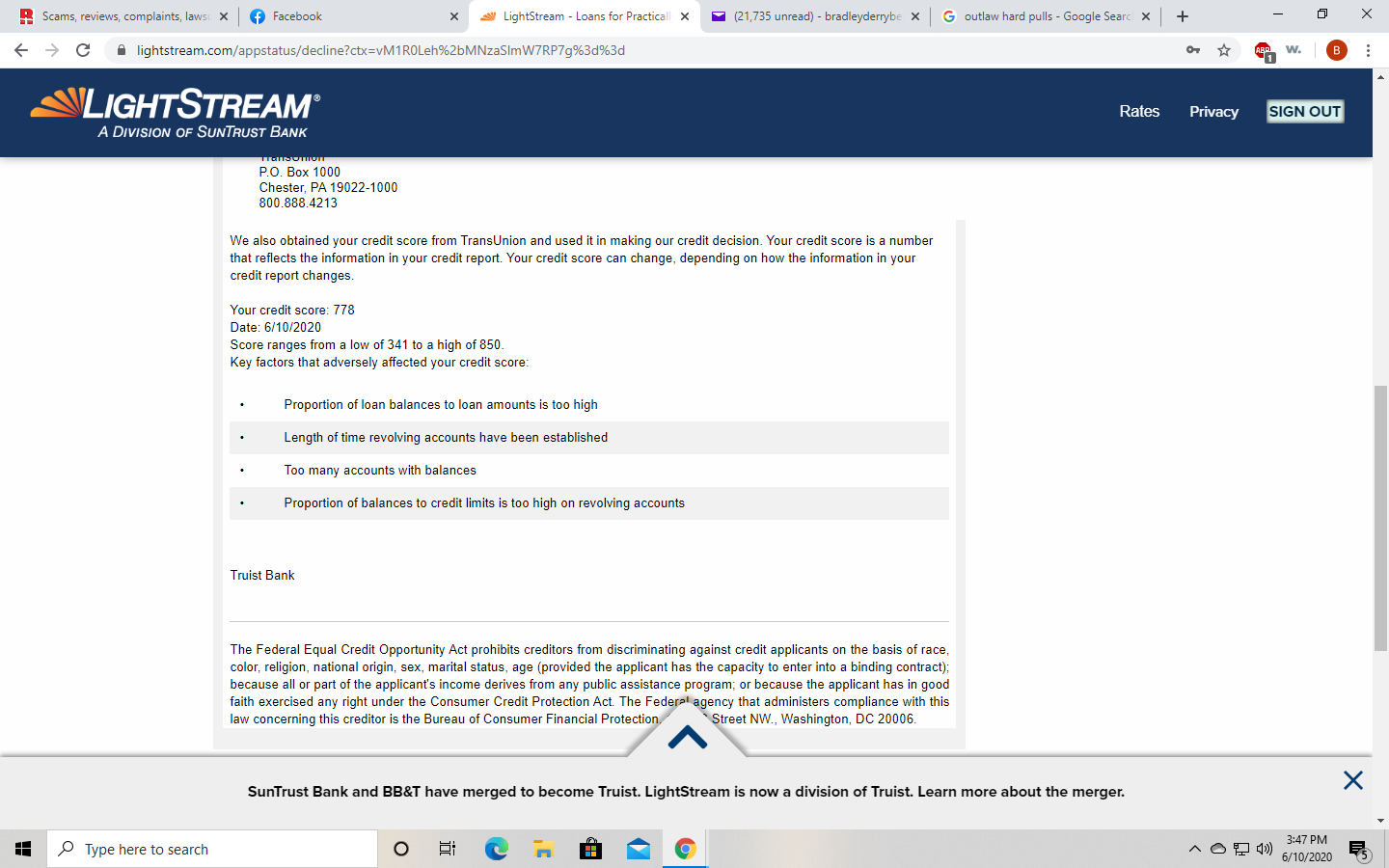

B. My credit history will show minimal inquiries, minimal new accounts, 100% on time payments, a vehcile loan that was paid off years ago, and a credit score of 778 that has been excellent for years.

In conclusion, 2 of the 3 reasons for rejecting me were completely bogus. By not disclosing they had ridiculous standards for a VERY SMALL LOAN, I feel I have been misled, and the ease of getting the loan was falsely advertised. With the additional inquiry (hard pull) on my report it will be more difficult to negotiate reasonable APR rates with other lenders which strongly effects the quality of my life.

This report was posted on Ripoff Report on 06/10/2020 01:26 PM and is a permanent record located here: https://www.ripoffreport.com/report/lightstream/atlanta-georgia-loan-reasons-1496216. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#3 Consumer Comment

Interesting

AUTHOR: Robert - (United States)

SUBMITTED: Friday, June 12, 2020

Your update didn't touch the things that really matter. The reasons in your denial letters proved everything I stated.

Loan to Value is one of the biggest keys to approval. As stated your LTV is likely over 100%. These type of loans went away during the mortgage crisis about 10 years ago for all but people with top tier credit, that is people with FICO's well over 800 and income many times yours. In effect you are asking for a no money down loan and an extra couple of thousand dollars on top of that.

Did you even ever get an official appraisal on this house?

You are basically suffering from the problem of over estimating what you can do, and this is what banks try to work through.

As I said by your own narrative you have several ways to bring down the amount you are asking for. Savings....Tax Refunds...Heck what about the stimulous check. You say you could even sell your 19 year old car for $4,000(1/3 of the $12,000 you are asking). Of cource we know you can't because even the most generous value of your car is around only $1500. Savings, again by your own narrative you should be putting away at least $500/month into savings. Where is that money? What about your tax refunds? If you've done this for even a year you would have had half the loan saved up. Over a couple of years you could have already bought the house outright..and still have a few thousand in savings. Obviosly you aren't doing that now. So why should they believe you will start doing that when you get your loan? A house has MANY more expenses that I think you realize. Especially one that seems to be in a "less than perfect" condition.

Of course if you think I don't know what I am talking about, why not search out other lenders? Perhaps you are right and it is just this company. If you are right then you should have line of loan companies banging on your door begging you to get a loan from them. So go answer the door.

#2 Author of original report

You're Full Of It

AUTHOR: Bradley - (United States)

SUBMITTED: Thursday, June 11, 2020

You doubt I have a FICO score of 778? Did you even look at the rejection letter in the photos? Maybe looking at the "big picture only" would be beneficial to you. They read my TRANSUNION for starters, and the letter shows quite clearly that is legitimately my score. My FICO score tends to be higher than my transunion score.

The idea that someone at my wage can't afford a $12,000 loan over 5 years is laughable. Very laughable. You asked about my savings, but due to the nature of the type of loans light stream offers that is frankly information that is barely relevant, certainly not relevant to you. Are you banker, or simply a banker's boot licker? I've seen lending institutions make much larger loans to much younger people, there would be no way they could have really believed these loans would work. With a 100% on time payment history over 6 years, my position as foreman, and the loans I've already paid I'm not much of a risk.

On the auto loan, I'm halfway through it. I have 2 1/2 years left. The payments are low cause the car was only $11,500 to begin with, and I put a little bit down. Also I got the lowest APR possible due to my *excellent* credit score you have the audacity to incinuate I am lying about. Seems like you're probably pretty good at kissing a**, you should stick that.

#1 Consumer Comment

You can't afford a house

AUTHOR: Robert - (United States)

SUBMITTED: Wednesday, June 10, 2020

Sorry but you are only looking at the whole picture. You keep saying what you CAN in the future, but bank's don't care about that. They care about getting their investment back. Based on your narrative you say you CAN put away about $400-$600/month into savings. Okay, so that means right now with the lower rent you should be able to put about $500/month into savings? So how much do you have saved up? What happened to the Tax returns?

While you haven't posted the whole picture, what you have posted does say a lot. First off a "Tax Value" has nothing to do with the actual appraised value of a house. You say that houses like yours go for about $10,000. So I would bet that appraised value of your house is a lot closer to the $10,000 than the $17,000. Which means your LTV is likely 100% or higher since you are asking for $12,000.

You say you owe a couple thousand on your credit cards, but you failed to tell us what your limits are. If your utilization on the cards(or any single card) is above 30% that is a negative, if you are approaching the credit limit you are considered "Maxed Out" which is a negative. It doesn't matter if you owe $9,000 with a $10,000 limit or $90 on a $100 limit the ratio is the same and in both cases show you being maxed out. It is all about living within your means.

Creditors want a minimum of 2 years of solid history. So if a lot of your credit has been added in the last 24 months, you are seen to have a "thin" credit file.

The fact that you still owe $6,000 on a 5 year old car with only a $190/month payment is also very concerning. Not the amount but the fact that you say you have a much older car that could pay for 1/3 of the loan($4,000). Why would you get another car loan with apparently a very solid car that is now just sitting there? Again I somehow doubt that 19 year old car is worth what you think. If that is truly the case then why not ask for $4,000 LESS and sell the car for the difference?

If you TRULY did have a deep history and a 778 FICO, which I doubt, a "Hard Pull" will affect your score by a few points. The affect is also very short term, at most a month or two.

Advertisers above have met our

strict standards for business conduct.