Complaint Review: Infinity Capital Finance of Maryland - Bethesda Maryland

- Infinity Capital Finance of Maryland Bethesda, Maryland United States

- Phone: 4435289699

- Web: infinitycapitalfinance.com

- Category: Financial Fraud, Financial Services, Real Estate Financing, Financial

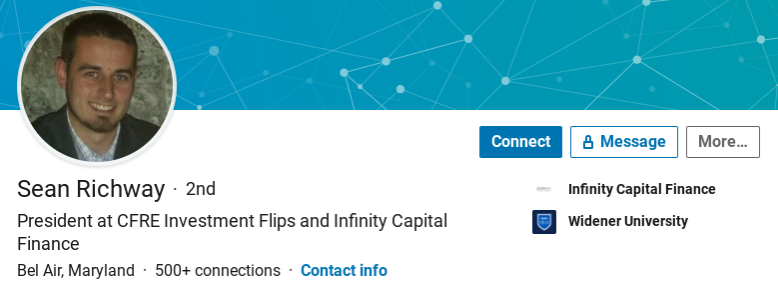

Infinity Capital Finance of Maryland CFRE Investment Flips I, Sean Richway INVESTORS BEWARE OF THIS COMPANY Bethesda Maryland

*Author of original report: Limited Response Because of Litigation

*REBUTTAL Owner of company: Anyone who wants to know the truth about Kevin's deals as well see below:

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

INVESTORS BEWARE!!! The first and last 60/40 JV deal I closed with this company (see below) settled on 10/28, Monday morning. It's now Saturday afternoon, 11/2, and I still haven't received my money (over $25K). An amount sent via email in a spreadsheet, 2 days after the date we agreed I would receive payment, was equal to 12% of the net profits...

Vastly different from the 60% split I was anticipating after rehabbing, managing and selling the property...This calculation included doubled the closing costs, recouping revenue and expenses that were already subtracted from the HUD/CD.

Prior to closing, I had a feeling Sean Richway, the president of this company, would do this. So, I asked to be paid at closing. That was denied with all types of excuses. My wire instructions were sent without the company's request, which was questionable.

Responses from Sean prior to receiving the settlement money were within the hour. Now, that Sean is in receipt of the closing funds, responses take 24 hours...Before experiencing this very unprofessional way of handling business - I knew there wouldn't be a second time at bat with Sean and this company given the persuasion of becoming the buyer instead of the lender, and the 3% monthly management fee outlined in the JV agreement.

This clause is a very sneaky way to turn his 40% split to upwards of 50%. Sean, when discussing this transaction at least, did not manage the subject property in any aspect. Yet, he stands to generate $37K in management fees. Roughly, 1/3 of the net proceeds...That's a straight rip off!

The money I've earned should have been wired at this point, period. Any amounts in question north of this payment, could be hashed out and negotiated at a later date. If I do not receive payment Monday, a full week after closing - I will be contacting the authorities and taken appropriate action to receive payment.

Hopefully, I've saved a few people from dealing with Sean, Infinity Capital Finance, its affiliates and this drama...Real estate is too fun and profitable to deal with such an individual that makes partnering dreadful and holds someone else's profit illegally. Fellow investors, BEWARE!!!

Sean Richway, President Infinity Capital Finance Cell: 443-528-9699 srichway@cfrejvflips.com srichway@infinitycapitalfinance.com www.infinitycapitalfinance.com

This report was posted on Ripoff Report on 11/02/2019 10:47 AM and is a permanent record located here: https://www.ripoffreport.com/report/infinity-capital-finance/bethesda-cfre-investment-i-1487191. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#2 Author of original report

Limited Response Because of Litigation

AUTHOR: Kevin - (United States)

SUBMITTED: Thursday, April 09, 2020

The first sentence in your post is a lie, so everything that follows is not creditable. You didn't lend me money... The funds came from a company, I will not name, who pools funds/crowd funds and distributes - not you... What you did and continue to do is fabricate reality. In the end, you owe me joint venture profits.

You not only stole money from me, but others who are in the process of a class action lawsuit. I will not say more, because I'm in the middle of suing you for stolen profits... However, I will share this post with my lawyer as additional evidence of your perpetual lies and fraud... Lastly, that counterclaim is ridiculous.For reasons that are beyond obvious to everyone but you and your lawyer - monies are owed. I'll be sure to post the trial transcript that will prove, without doubt, your theft, deceit and fraud.

#1 REBUTTAL Owner of company

Anyone who wants to know the truth about Kevin's deals as well see below:

AUTHOR: Sean - (United States)

SUBMITTED: Thursday, April 09, 2020

Kevin and I did 2 projects in NJ together that were fix and flips projects. I agreed to lend Kevin and secure a 1st, 2nd, and profit-sharing interest on the houses as the lender. Kevin did not have to put any money himself into the deals. The 1st deal is still ongoing, and I had to exercise my pledge agreement I had on Kevin’s entity as he still hadn’t sold or repaid me.

This was originated in August of 2018 and was a 12-month term note. It has been 19 months past maturity and the deficiency amount he owes me is $190K and growing. The 2nd deal was sold in October of 2019 and his net profit per our arrangement was $15K. That $15K was kept as right of offset on the 1st deal since Kevin still owed me over $190K, which is per the laws in NJ. In NJ if a joint venture deal is entered into and one of the projects goes south the party who takes that loss can hold proceeds from another deal as right of offset for that loss.

Kevin didn't like the fact he thought I was the bad guy for keeping $15K of his profit when he owes me $190K still. He therefore tried to file fraudulent suits himself instead of hiring an attorney. I had to spend $18K to prepare my defense and file a counterclaim against Kevin. Once that was filed Kevin did hire an attorney that advised him to withdraw the suits. I had to take over the Burlington property when Kevin listed it for rent without my knowledge and placed tenants in the property without authorization from me.

Once I sold the collateral at auction to take it over he continued to threaten and intimidate the tenants to pay him rent. He collected $4K from these tenants and never made a single payment on the mortgage for over 15 months. He sent a relative to the house to try to make contact with the tenants after a cease and desist letter was sent to him from my attorney. He never applied for a CO and occupied the property so the city actually went after him as well. I had to redo about $12K worth of work that he botched or wasn't to code. Below is the counterclaim that was filed in his lawsuit he filed against me:

https://www.dropbox.com/s/b7s9...

Oh forgot about the article he linked to his post. Basically my ex contractor forged deeds to homes I owned in NJ and applied for the SOTO program with NY to place tenants in those properties. Without my knowledge he applied for the program and created forged deeds, leases, and property management agreement all between himself and his entity. The State of NY never bothered to verify the online records for who the owner was and sent him $50K upfront for the years worth of rents.

I then got fined when the living conditions were up to code when I didn't know anyone was living there. They had been contacting my contractor directly and he wasn't fixing anything. I ended up paying $3K in fines and now I am having him prosecuted by the NY Attorney General's Office of Financial Fraud. They already have assigned someone to head the arrest and trial against him.

Advertisers above have met our

strict standards for business conduct.