Complaint Review: Lexington Law Firm - Salt Lake City Utah

- Lexington Law Firm 360 North Cutler Drive Salt Lake City, Utah United States of America

- Phone: 1-800-341-8441

- Web: www.lexingtoncreditrevolution.com

- Category: Credit Services

Lexington Law Firm John Heath and Andrea Warren They are definitely a SCAM!! Do not give your personal INFO!! They will TAKE your MONEY, and provide NOTHING!!! Salt Lake City, Utah

*UPDATE EX-employee responds: Lexington Law Firm

*General Comment: Let cool heads prevail

*Consumer Comment: Troll

*General Comment: Dear Sir or Madam

*Consumer Comment: Response to those who are wary of my positive post about Lexington Law Firm due to length of post...I'm trying to get consumers informed about their credit!

*Consumer Comment: I Agree with Positive Reports

*General Comment: Hhhhmmm?

*Consumer Comment: Thanks for the info

*Consumer Suggestion: Lexington Law Firm is not a scam, however it does require time & effort. I used their services for a year and my score improved almost 200 points!

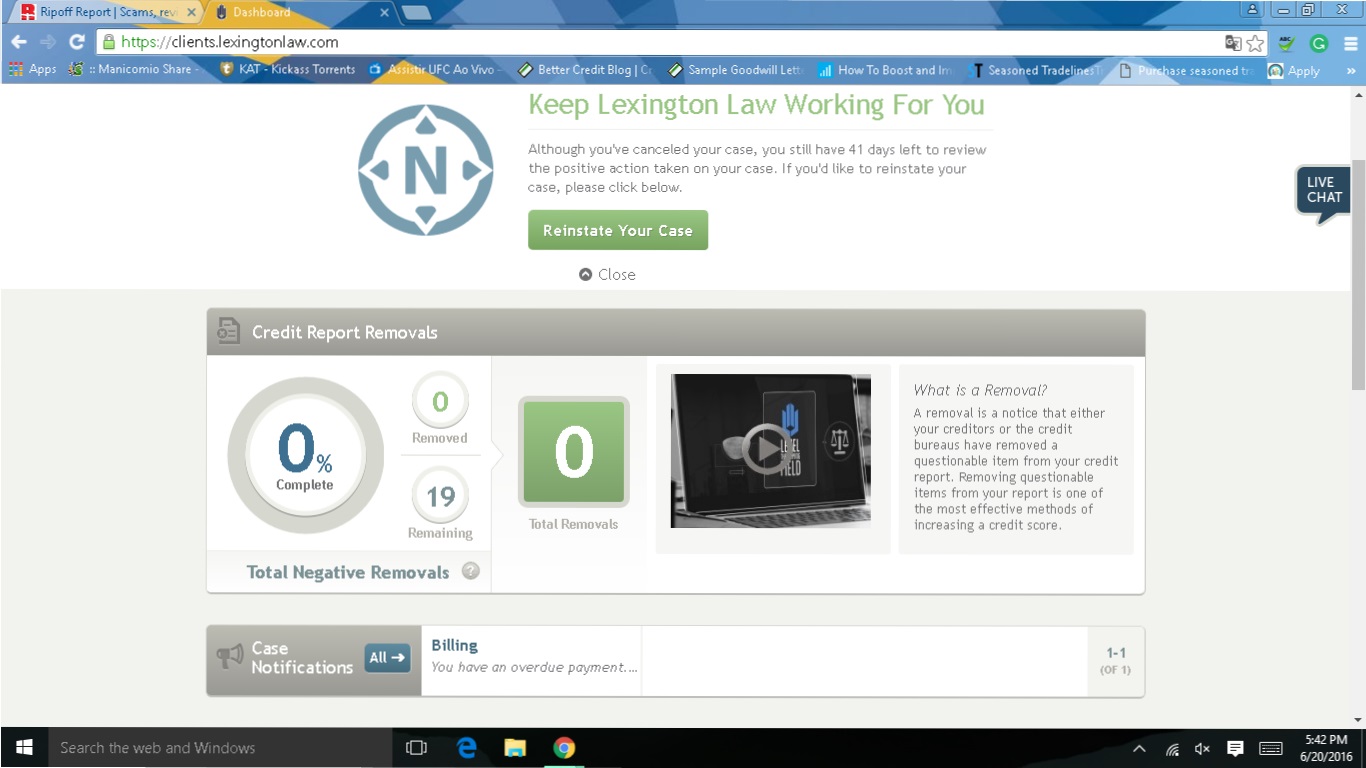

They are a scam..do not provide servces...but keep charging you week after week. Will use your personal information just to get your money!!!

This report was posted on Ripoff Report on 04/27/2011 02:49 PM and is a permanent record located here: https://www.ripoffreport.com/reports/lexington-law-firm/salt-lake-city-utah-84151/lexington-law-firm-john-heath-and-andrea-warren-they-are-definitely-a-scam-do-not-give-y-722815. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#9 UPDATE EX-employee responds

Lexington Law Firm

AUTHOR: Erika L - (USA)

SUBMITTED: Monday, December 03, 2012

The positive rebuttal was most definitely affiliated with the company in some way. I know this because half of their verbiage is directly from the Lexington training manual. I will say this. I used to work there myself and the process can and does work, so long as credit reports are being sent to the firm on a regular basis. The positive rebuttal was correct in stating that you must stay involved in the process. However, they do take money on a monthly basis, even if they have nothing to work with and no, they will not give you a refund for lack of credit reports or results. You must understand that nothing in law is guaranteed.

An attorney, whether representing criminals, families, etc., cannot make any guarantees on the outcome of a case, and this is the same deal. As an ex-employee I will admit I have some hang ups about this company, but I cannot deny the process can work, I've seen it. You can also do this yourself, so if you have the time, go about it that way and save yourself the money. There is plenty of information online about how you can do this and Lexington does nothing different. Do I ethically agree with the billing processes? No. But it's a business and it's hard to find businesses these days that are 100% ethical and well, ethics seem to be subjective in business.

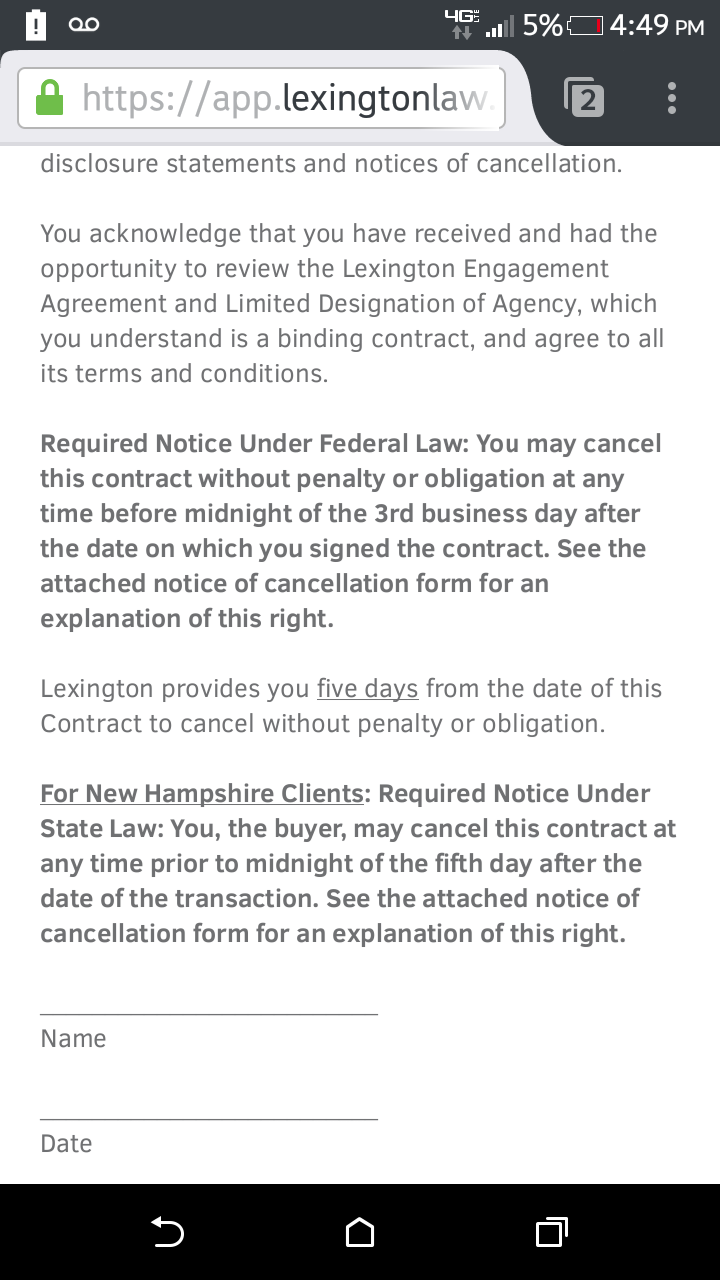

Gray area is taken advantage of by a great deal of companies and Lexington operates on that gray area, both in positive and negative ways. The bottom line, do research and read the fine print before you sign up for anything. Any time you are told to read or agree to anything before personal information is taken, READ IT-ALL OF IT and be wary. There is always a reason why they are having you do this and it should raise a red flag. By proving that they provided you with a full disclosure that you agreed to, the accountability does fall on you, whether their processes are considered ethical or not.

#8 General Comment

Let cool heads prevail

AUTHOR: Steve in San Diego - (USA)

SUBMITTED: Friday, August 17, 2012

I see no reason to directly challenge another writer. If you doubt the authenticity of a contributor, and you feel you must speak out for the benefit of those of us who are less astute, you should simply state the reasons for your skepticism and leave it at that. I'm sure most subscribers to this site would prefer just the facts. Thank you.

#7 Consumer Comment

Troll

AUTHOR: Dick - (USA)

SUBMITTED: Friday, July 20, 2012

I don't know if Lexington Law is a ripoff or not. And frankly, I don't care as my credit is golden. However, it is patented obvious that Bella09 is a troll for them. A troll that can't read! NO ONE asked you to post your personal information. If you could read and understand, you were asked for information to "Present a copy of your credit report marring out your particulars......" . Yup, definitely a sign of a troll who immediately gets defensive instead of having an intellectual discussion. So, what is YOUR position at Lexington Law and how much are they paying you for the glowing writeup? Go troll somewhere else!

#6 General Comment

Dear Sir or Madam

AUTHOR: Lexington Law Firm - (United States of America)

SUBMITTED: Friday, July 20, 2012

It's important to us that clients begin any credit repair program (or any legal process, for that matter) with a fundamental understanding that not every case will end with a particular positive result. On the other hand, as you may have seen from those who've shared positive testimonials, so many cases do.

#5 Consumer Comment

Response to those who are wary of my positive post about Lexington Law Firm due to length of post...I'm trying to get consumers informed about their credit!

AUTHOR: bella09 - (United States of America)

SUBMITTED: Sunday, June 10, 2012

To S. Jones-

I am not a paid spokesperson for anyone whatsoever, especially Lexington Law Firm. You apparently read my post which clearly states that I was extremely pleased with Lexington Law Firm's services because it allowed for me to drastically improve my credit. How could you possibly be so dense as to even ask for me to post a copy of my ID and credit report online? Hey, why not throw a copy of my social security card in there too, huh? Yea, that sounds like a fantastic idea. All to please you, so you will believe my review of a business. I'm not sure how old you are, but if you're saying you've had bad credit for the last 12 years you must be at least 30. I'm just curious how anyone, especially an adult without any cognitive disabilities, could possibly be as oblivious to even ask a question of that nature. You know, there may be some of those less fortunate whom may live with mental disabilities and they may actually do that, but only because idiots like you ask them to in order to prove themselves. Crazy. I do understand that your credit isn't that great so you must not understand how important it is to those of us with excellent credit to keep it excellent. Which includes safe-guarding our private information (i.e. photo ID and credit reports that blatantly list our social security numbers) so that imbeciles like you don't have the opportunity to attempt to steal our identity for the purpose of obtaining credit simply because your own credit is wrecked. Maybe you should think about that in the future before posting such asinine and daft comments on any forum.

Those doubting the authenticity of my previous post-

I posted that lengthy comment in attempt to inform consumers. Surprisingly enough, not a lot of people fully comprehend what is required to improve their credit. Many with bad credit think that simply

because they pay their bills on time every month, their credit will improve. Many people do not understand that simply missing or being late on only one revolving credit payment can drop your score by 50 points. Many people believe that the more open credit accounts they have, the better their credit score will be when that very likely could hurt their credit based on their income to debt ratio.

I want for consumers to understand what their services entail, what is required of them, everything is not done for them and ultimately there is no quick fix when repairing your credit. Those who actually care to improve their credit will put in the time and effort it requires because having good credit is having peace of mind, like I said. This isn't a topic to be taken lightly; I wasn't rebutting someone who didn't enjoy the restaurant they dined in. This is about credit. Those of us who care about our credit and have worked hard to maintain good credit know how important it is to have. To many it's our livelihood. We are able to purchase our homes that our families live in, buy our cars that get us to our places of employment, get a loan for some home remodeling if we don't have enough in savings. Those of us who do have these things understand just how important it is to keep it good because life happens.

If you chose not to believe me and my experience, well that's your right. I can only be honest in sharing my own experiences hoping it will help others and that has been my only intention for writing about this. I know that there are intelligent consumers out there that will read my comment and it will help explain a few things and that was my only goal. It doesn't make one difference to me whether or not others use that company's services. There are many other businesses that provide the same service, however I cannot comment on any others because I only needed this service once and it worked. I was simply commenting on the prior post of someone who apparently expected to pay the law firm to do everything for them and they felt as though they were being robbed. They did not go into detail about anything. Considering I used the service and I know how much time I put into doing random tasks like scanning and emailing updated credit reports and new orrespondence from creditors; I wanted to let anyone who read this to know that you cannot just expect to pay a monthly fee and your credit will automatically be "fixed". I am aware of a few scams that allow you to "piggy-back" off of another individual with good credit, however I personally would not recommend it and it's not ethically moral. You as the consumer need to take responsibility for yourself and realize that your credit didn't just turn on you overnight; credit becomes bad when consumers are irresponsible. However, I will say that those who have or have had bad credit due to medical bills only, due to an illness, I do not feel that is due to being irresponsible. Those consumers are simply doing what they need to do to stay alive and unfortunately that affects their credit while doing so. I do not believe that is morally sound at all.

I want consumers to know they need to put the necessary time in to communicate, forward any and all correspondence regarding your credit, with whatever business you choose, to get the ball rolling on removing negative items from your credit report. I was dedicated to repairing my credit and luckily I was young enough to where it wasn't incredibly bad. I made some irresponsible decisions after high school and while in college, but I grew up and took responsibility. I did what I had to do so I would have good credit. It was a time in my life that I realized I needed good credit for everything, I couldn't ask my parents to co-sign on a mortgage or a new car. I couldn't expect them to keep bailing me out, that is not their responsibility. Honestly, if they had bailed me out I would never have learned from my mistakes. They did their part and co-signed for a new car right after high school to make sure I had reliable transportation, but it was my responsibility to maintain the car payments and insurance. I didn't want to need to rely on help from anyone else anymore. If I needed something like a new car, I wanted the ability to be able and go out and get one on my own credit without asking anyone else for their permission and understandably so. I was able to repair my credit drastically using this service and because it worked so well for me I honestly wanted to share with others exactly how it works. Imagine my surprise when I requested an updated credit score only a few months after using this service and it was literally 100 points higher. Mind you I had several old accounts completely deleted from my credit report so that made a significant difference. You can decide for yourself if you have the time to do all that's required and only you can decide how important it is to you. I hope this helps all of you who are looking for an affordable service to help repair their credit. Best of luck!

-NOTE to anyone who isn't fully satisfied with any service that you are paying for on a recurring basis:

Call or write a letter to cancel service. If the business is not receptive to your demands, immediately call your bank (the bank associated with your method of payment) and have them put an immediate stop payment in for that business. You can also dispute charges if they continued to charge after you requested they cancel your service, unless the bill was for prior service already received. You will have to look into the billing cycles to see how you are being charged; although you canceled service, it may be a legitimate charge from a prior billing cycle or they may be a deceitful company and still charging you for services you requested to be canceled. Please remember that you do not have to continue to pay for something that you do not want, just err on the side of caution when asked to sign a contract for a certain time period before trying any services. Good luck!

#4 Consumer Comment

I Agree with Positive Reports

AUTHOR: kevlkg - (United States of America)

SUBMITTED: Thursday, May 24, 2012

As stated by other Consumers here I do agree that with the Bombardment of Negative Reports regarding Lexington Law it is Refreshing to see some letters of Encouragement. I am a New Customer of Lexington Law (1 week New) so obviously I do not have an opinion about them at this time. However, I do want to point out to all the "Ney-Sayers" is that every individual sitution is different. As with any other consumer driven service out there that there will Always be Good Consumer Experiences and there will be Bad ones. As for me, I am slightly uneasy with dealing with Lexington Law, but only after reading al the Horror Stories about them on this site. But there are also consumers here that have Wonderful things to say. I will let time be the answer. If I don't see Positive Results after 6 months than at that time I will decide if it is even worth the $99.00 a month I spend with them. I Will check back here at Ri[p Off to Report eithr the Good or the Bad about Lexington Law....To Be Continued-

#3 General Comment

Hhhhmmm?

AUTHOR: S. Jones - (United States of America)

SUBMITTED: Tuesday, June 07, 2011

While my curiosity is up, I err to the side of caution. With such a wordy rebuttal I must say this sounds like a paid advocate or company rep. giving out this information. Be very, VERY wary of such strong advocation. Here's what I ask of bella09. 1) Present a copy of your credit report marring out your particulars that would allow for potential identity theft before and after, along with scores. 2) Present a copy of your ID with the same particulars marred. 3) Present a utility bill that verifies the information from your ID and... 4) Present a copy of the information from Lexington Law showing how they helped you along with a cancelled check or credit card payment transaction. THEN I will be able to believe, but 12 years and 5 credit repair agencies later with a worse credit score than EVER tells me to be very wary of one more RIPOFF!

#2 Consumer Comment

Thanks for the info

AUTHOR: Lyista - (USA)

SUBMITTED: Thursday, May 19, 2011

For the person that posted the long comment above, thank you. It is frustrating when people go on here and say a company is bad, but don't explain why or they don't accept their part in the bad experience. I am starting to actually care about my credit and your comments will help me in doing so. And thank you for the well thought out review of LL.

#1 Consumer Suggestion

Lexington Law Firm is not a scam, however it does require time & effort. I used their services for a year and my score improved almost 200 points!

AUTHOR: bella09 - (United States of America)

SUBMITTED: Thursday, May 19, 2011

Lexington Law Firm was an absolute Godsend for me. I like many others had negative items listed on my credit report, however accounts had been sold, paid, transferred, closed, etc. So in that case many accounts were listed as multiples which in turn lowers my credit score and incorrectly. It makes it look like you have several accounts because each company documents the account of yours that they once had, even if they don't own the account anymore. There's also the issue of negative accounts that have been on my credit for their fair share of time and were overstaying their welcome. Accounts in negative standing on your credit report will often show the date they started reporting to credit bureaus as well as the date they plan to remove the account from your credit report. However, it's not their first priority to remove a delinquent account when they've received nothing of monetary value from you as the consumer.

Now what is required if you were to take care of this yourself without any outside assistance is to write a formal letter to each company, often citing different laws that fall under the Fair Credit Reporting Act. These laws state that if they no longer own the account, they must delete it from your credit report completely, if they have owned the account for a certain period of time (usually 5-7 years) and have reported this negative information for the legal amount of time allowed, they must now delete the account from your credit report. You as the consumer can file online disputes, write a letter or attempt to reach these companies by phone to resolve the issue, but it comes down to this- when they receive any type of correspondence from a law firm, they know they're dealing with someone who knows the laws surrounding credit reporting and they must act accordingly. Unfortunately for us as consumers, they don't always act like that when dealing with us directly as they should because they've gotten used to getting away with it. Don't get me wrong, many companies have been under tremendous scrutiny for their unethical business practices, downright harassing and threatening consumers and these consumers were smart enough to record these conversations. So as I've stated, they act on their best behavior and do as they should when contacted by any attorney or law firm in general. Also, the amount of time that goes into doing everything yourself is incredible. For me, it was well worth paying for their services every month as they were doing what I paid them to do.

Their program is setup online, but you may also call to speak to someone any day of the week and believe me I did and took full advantage of their services. You go online and request all three copies of credit reports from Trans Union, Experian an Equifax, these credit reports will then load into your profile. At that point you can select from several options for disputing negative information on your credit report, some of those options include- your identity was stolen and the account was opened without your knowledge, the account just does not belong to you and there is someone with the same name, the have reported an incorrect balance on your account, they have mistakenly reported that you've made late payments when in fact they were on time and you have documentation to prove that, they're still reporting negative account information and you've satisfied the balance in full, the account was paid in settlement but they are still reporting a balance owed or no payments made, the account was paid off with the agreement (in writing, always get it in writing) that they would delete the account from your credit report once paid in full or for whatever the agreed upon amount was. You select from those options and they send off the appropriate letter to the company disputing the negative information in your credit report. These companies can respond in several different ways, but you will receive whatever changes they made in the mail. It will be in the form of a partially updated credit report from a particular credit bureau. It could say that the information was confirmed and will stay the same, the account has been deleted from your report, the account has been updated with correct information, etc.

It is crucial that consumers looking into receiving this service understand that it is then your responsibility to take this updated account on your credit report and make a copy of it then mail it to Lexington Law, scan it to your computer and email it to Lexington Law or they may have a fax option now. Lexington Law will not receive any information from the credit bureaus about your credit, they are not the consumer or credit holder. They may be your attorney, but legally this information has to go directly to you. It is then your responsibility to send this information to them so they may update your profile to show which accounts have been taken care of and which ones you're still working on.

It is also important to understand that once inquiries have been sent to these companies, it usually takes them about 30-45 days to even respond to it. Once they respond, they then have up to 45 days to correct or update this information on your credit report. Nothing happens overnight. If you dispute several accounts at once, it gets the ball rolling, but if you sit around and maybe dispute one a month or something like that then it will take a very long time to get anything done and you will be wasting your own money paying for Lexington Law's services every month. When I used their services, there was a limit as to how many accounts on my credit they would work on at any given time. When I used their services I believe it was 4 accounts at any given time, however it may be different now. So for this reason, it is crucial that you forward any information you get from the credit bureaus right away so they can take that account off the list and you can move on to the next account you would like to dispute.

When I started using their services, I opened an account for myself and my husband. It was $200 for the initial fee and $60 per month for each of us, so total of $120 total monthly for their services. You have to be proactive and it's so easy to utilize their services to your advantage to improve your credit drastically. You take a few hours on your weekend, log onto your profile and go through and find duplicate accounts for the same original account, dispute the oldest ones so that your credit report only reflects one open account. You look for any incorrect information, you contact the companies that have accurate balances and try to come to an agreement to get it paid off and removed from your credit. Any company that won't agree to remove their account from my credit once it's been paid, I've just not paid. There's no reason why they shouldn't remove it, it's a simple process for them to put in the request to remove from credit reporting. What you can't do is expect to pay Lexington Law every month and have them do absolutely everything for you, they don't know you personally, they don't know what's accurate and what's not. You have to put the time and effort in and let them know what you need done and they'll work on getting it done. Within the first 4 months of using their services I had about 6 accounts removed from my credit report and my credit score went up over 100 points and continued to rise. You can't expect them to just "fix" your credit. There is a process and if you were to have a local law firm on retainer to do this for you, you would wind up being billed hourly for their work, for each piece of correspondence that went out, for each phone call you had with them, etc. With this service, they're charging an affordable monthly rate for an invaluable service. When it comes to your credit, it's just so much easier for it to be good. I usually called their customer service department 3-4 times a week and would get the same 4 or 5 people and they were always friendly. They would confirm the documents that I sent were received, they would let me know what accounts they were currently working on, when correspondence was sent out and would answer any questions I had to the best of their ability. Maybe they were nice to me because they saw how hard I was working with them to improve my credit, maybe they thought hey, she's really trying to take care of everything here, even pay off the accurate ones and then let us work on getting it removed so they were more prone to assist with what they could. It was all around a great experience and when they had done everything that they could for me, which in my case was removing duplicate accounts, deleting old information and paid accounts, updating payment information, etc. then I was done using their service and canceled my plan with them. They never took out money when they weren't supposed to or more than they were supposed to, they always charged my bank account at the same time every month, they were all around a very professional company with excellent customer service.

This could be a great tool for anyone to use, but you must be involved. You should have a good understanding of the process and they are more than happy to explain it to you. I already knew how it worked, but knew it was too much for me to take care of while working full time. So to me it was definitely well worth paying $60 a month for almost a year to get my credit cleaned up. I would recommend them to anyone who was serious about improving their credit and planned on having the time to take care of responsibilities on their end and was ultimately motivated to get it all done knowing the end result was peace of mind.

I hope this helps any of you who are looking to improve your credit and are looking for a company to help with this. I also hope that it helps those of you who think you were ripped off by their services because you paid for services and they did nothing...well did you do what you were supposed to do which was direct them, tell them which accounts to work on and why you were disputing it? If you never did any of this, then yes you paid for nothing because you didn't understand what you were getting into and maybe didn't care to figure it out. There may be some companies out there that claim to "fix" your credit overnight, but please be aware that's probably a scam. This is the legitimate, legal process for improving your credit. There is no "easy" way, you will have to put time in and send documents and make phone calls. Sorry, but there is no way around that. Again, I hope this helps everyone make a more informed decision about using this service. I hope it helps those of you who claimed to be ripped off by this company to understand what went wrong and how you could change that in the future. Always understand what you are getting into before agreeing to it, understand the other end of the agreement (what services you will receive), and fully understand what you need to do to get the best service, especially before giving your consent for an ACH debit to your checking account every month when you're strapped as it is and that may risk being able to put food on the table for your children. Please own up to your mistakes and don't place blame on others for your lack of comprehension. I guess that seems to be the way this country is going these days...

Advertisers above have met our

strict standards for business conduct.