Complaint Review: First Convenience Bank - Nationwide

- First Convenience Bank Nationwide USA

- Phone:

- Web: https://www.1stcb.com/

- Category: Banks

First Convenience Bank First National Bank Absolutely the WORST BANK EVER!!!!!!!!! STAY AWAY!!!!!! Nationwide

*Consumer Comment: And There's The Reason!

*Author of original report: Are you lonely?

*Consumer Comment: Ding..Ding..Ding..

*Author of original report: I've use layman's terms for you

*Consumer Comment: Giving Yourself Away

*Author of original report: Lmao

*Consumer Comment: Oh brother...

*Consumer Comment: Simple resolution

*Author of original report: Try again. I worked for a major bank for yearsss.

*Consumer Comment: What You're Saying Is...

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

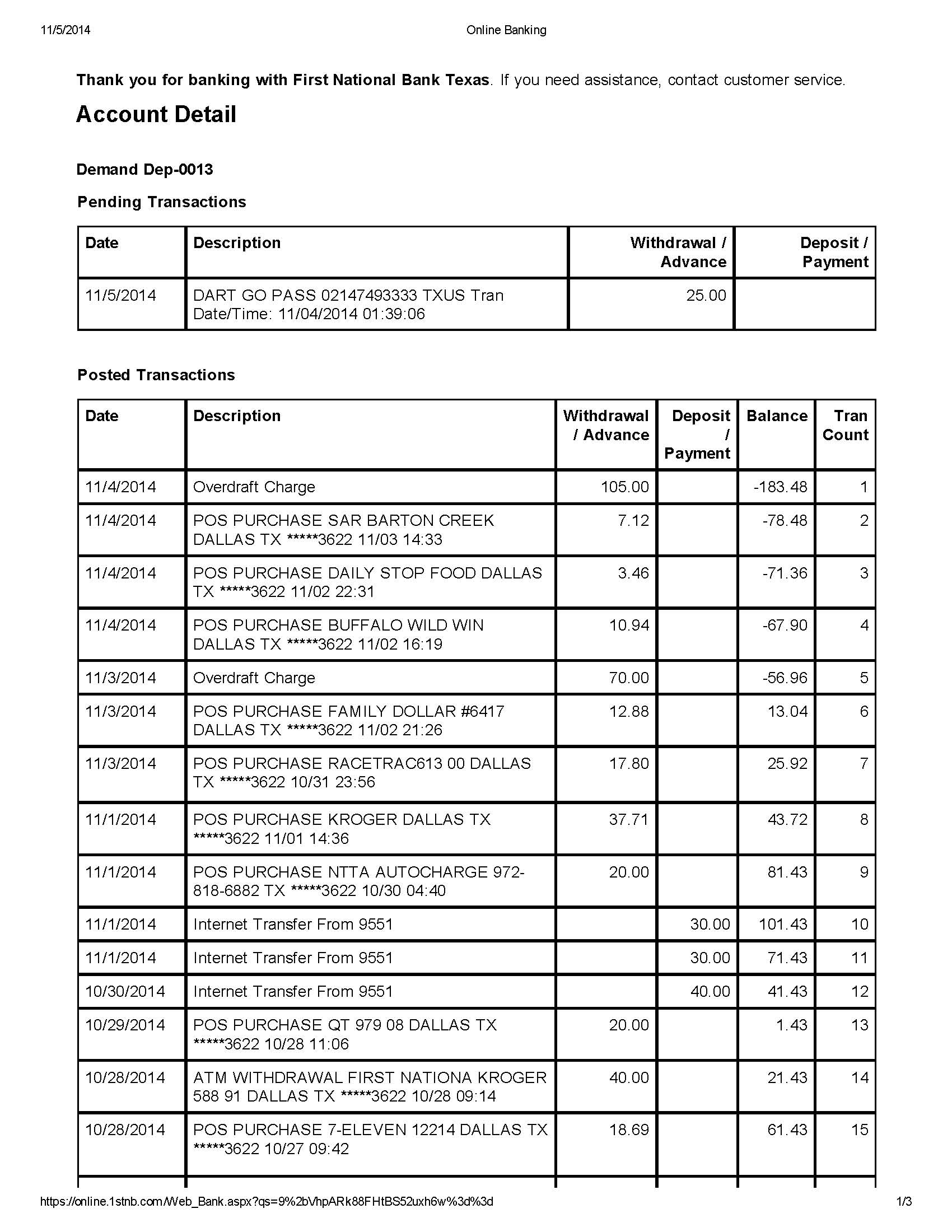

By far the worst bank ever. They post charges out of order to rack up the fees. They don't believe in reversing any fees as a courtesy. There are very few branches in the state of AZ and they are all inside Walmart so it is very inconvenient. You are not able to make a deposit into your account without actually going into the branch to speak to an actual banker. If an error occurs on your account they deny your claim and basically say there is no proof of the error. Horrible customer service. The list just goes on and on. STAY AWAY FROM THIS BANK.

This report was posted on Ripoff Report on 02/08/2016 11:48 AM and is a permanent record located here: https://www.ripoffreport.com/reports/first-convenience-bank/nationwide/first-convenience-bank-first-national-bank-absolutely-the-worst-bank-ever-stay-a-1286003. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#10 Consumer Comment

And There's The Reason!

AUTHOR: Jim - (USA)

SUBMITTED: Sunday, February 14, 2016

Oh yes, you are "better" than Robert or any of the rest of us! Not only that, you know everything there is to know about banking. The FACTS are there are numerous holes in your "story". Not only that, there are numerous cases in your various postings here which use terms, phraseology and "reasoning" which are not indicative of your self declared "knowledge". Then you persist on this stupid crap about order of debits. Anybody who knows anything about basic math knows order DOES NOT MATTER. Order DOES MATTER when someone fails to manage their checking account and is playing the check kiting game.

#9 Author of original report

Are you lonely?

AUTHOR: - ()

SUBMITTED: Wednesday, February 10, 2016

First of all. I never once said I didnt create the overdraft. You assumed that. I am only talking about the way they post their transactions. You clearly know nothng about Wells Fargo because they do not post their transactions that way. They post as they come in. So if there are 3 transactions from 2/5 and 1 from 2/8 the ones on 2/5 are posted first. Chase is the same as Wells Fargo and so is BOA. I really feel like I'm talking to a person who should be riding the short bus. I have always taken responsibilty for my part of the overdraft.

I am only talking about their bad business practices. I really don't know why you are trying so hard to defend a bank that you probably don't know anything about. I also don't know why you feel the need to try and criticize me for my actions and my thoughts. If you don't want to live in a country where you can speak freely then I suggest you move somewhere else. I have a right to voice my opinion. You have a right to voice yours. But you are being chilidish.

I bet you don't even bank with this company. Your just lonely and miserable so you have nothihg better to do than to get on here and try to stir the pot. Well sorry sweetie. I am better than you. I will always be better than you. So stop wasting your time. Now I really hope that you concentrate on growing up. Find yourself a hobby. This will be my last response as I have much better things to do with my time then go back and forth with a child who clearly has no life. Have a nice day. Thank you. P.S. There are many sites like facebook, match.com, pof, etc where you can find someone to talk to if you are that lonely. Hope everything works out for you.

#8 Consumer Comment

Ding..Ding..Ding..

AUTHOR: Robert - (USA)

SUBMITTED: Tuesday, February 09, 2016

It took you a while to finally admit it, but I was 100% right on.

You in fact INTENTIONALLY overdrafted your account and are now upset that you don't like how you were held accountable. All of your spinning and twisting and diverting from that does not change this fact.

How they post transacations is listed in the Terms and Condtions. Since you were in bank management for 7 years, if anyone should know this it should be you. So you have absolutly zero excuse in not knowing this.

As for your claims that "most" bank's don't process their transactions that way...again you are wrong. In fact it is quite the opposite...most banks do in fact still post transactions highest to lowest and this same thing would have happened with them as well.

#7 Author of original report

I've use layman's terms for you

AUTHOR: - ()

SUBMITTED: Tuesday, February 09, 2016

Clearly I will need to write this in layman’s terms for you. I didn’t realize just how ignorant some people can be. A charge on the account would be considered a debit in the eyes of a banking professional. However, this is not an actual debit. This is an ATM withdrawal. I requested a withdrawal for $160.00. I only received $100.00. The other $60.00 is missing. I filed a dispute and was told that since they couldn’t find an error they could not assist. That is my 1st major problem with this bank. Now I’m out $60.00 because they don’t know how to do their job nor do they care about their customers. Secondly, I know exactly when, how, and why an overdraft occurs. I never said that I had a problem with being charged an overdraft fee. I had a problem with the way they go about it. For example. If I make 4 transactions using my debit card for small amounts such as $3.35, $5.50, $4.95, and $8.10 and after I am done I have an available balance of $3.20 left in my account. Now if I choose to go and pay for an emergency 3days later that costs $50.00, I then have a negative balance of -$46.80. I made that choice and am completely fine with paying the $34.00 overdraft fee that comes with it and also the next $34.00 overdraft fee for keeping my account in a negative standing. What I had a problem with is that even though I made the other transactions 3 days before, the bank decided to post the $50.00 transaction first. This makes me negative from the very beginning and then every single small transaction that they posted after gets hit with its very own $34.00 overdraft fee. So instead of paying 2 overdraft fees, I am now paying 6 overdraft fees. Most banks do not process their transactions that way. I can tell you first hand that Wells Fargo does not post transactions that way and they go in order as they come in. But this bank is not a major Financial Institution like Wells Fargo is. This bank wants to collect the fees so therefore their business practices are shady. I also don’t like the fact that this bank doesn’t give any courtesy fee reversals even if you have had your account for years and have never gone negative once. Everyone has an emergency once in awhile. I don’t have a problem paying for the overdrafts I deserved but the others I should not have been charged for. Hopefully now that I have spelled it out for you maybe you will understand what I am saying. Thirdly, I do know where to go to file reports against Financial Institutions and I have done that but I can also file a report here for the World to see as that is my right as an American. I don’t care to get even with this bank. That is very childish and something a 3yr old would do. It sounds to me like you are a very childish person to even think that this report was for that purpose. I suggest you grow up. The purpose of this report was to share with the public my experience so they will be aware if they decide to bank with this generic bank out of Texas. For the record, the only reason I use this bank is because this is the bank my employer uses for their payroll and I get my check 2 days quicker if I use their bank. I also have an account at Wells Fargo and I have never had a bad experience with them. I have paid the overdraft fees. My account is at a zero balance. I am now closing this account with a major loss due to their bad business practices and have learned not to trust a Financial Institution that is not widely known in the banking world. Do you have anything else you would like to add?

#6 Consumer Comment

Giving Yourself Away

AUTHOR: Jim - (USA)

SUBMITTED: Tuesday, February 09, 2016

First off, an expert in banking knows how and why people overdraft and would know order has nothing to do with it. Secondly, your wording about being "charged" $160 is NOT what a banking expert says! Thirdly, as a banking expert you would know who the regulatory agency is in regards to banking problems and as an expert, you'd go to them before you came here. Looks like you've run up a ton of overdraft fees and in order to get even for what YOU did, you came here to write a bogus report.

#5 Author of original report

Lmao

AUTHOR: - ()

SUBMITTED: Tuesday, February 09, 2016

You can believe whatever you choose. I was in management for the fraud dept of wells fargo bank for 7yrs in chandler, az. Regardless, if you read what i said you would understand that fees were not my only complaint. how about the fact that i ask an atm for $160 and it only gives me $100 but im still charged $160. When I file a dispute for the missing cash i am told an investigation will be done and then I receive a letter telling me they cannot assist because they cant find a bank error. Now how is that fair? You people are so quick to try and jump down someones throat without reading the facts. The facts are, this bank does not care about their customer. They charge fees for everything, not just overdrafts. They even charge you to talk to a banker. The point of my report was to get the truth out there. So how about you go get an account there and when they mess you over you can come to me so I can say I told you so. Otherwise, grow up please.

#4 Consumer Comment

Oh brother...

AUTHOR: Robert - (USA)

SUBMITTED: Monday, February 08, 2016

Okay for the sake of this report, let's take this piece of fiction that you worked for the fraud department of a bank and know how to keep a running balance, as a fact.

So please answer this little math question:

You have a balance of $386, and you make 5 checks/debits transactions in the following order: $12, $20, $190, $160, $3.50.

Please arrange those transactions in any way you want where you go negative.

Oh, you can't do it, well what a surprise. So now we can get to the REAL issue. Since again we take that you know how to keep a running balance, and you talk about posting order we can only figure that you intentionally overdrafted your account and figured you would only get 1 or perhaps 2 fees. But even with your years of banking experience you failed to read the terms of your account that said they can post the transactions in what ever order they desire. So you ended up with a (wink) "bank error" (wink) and a lot more fees.

Ding..Ding..Ding..we have a winner.

By the way, go back to your banking days and tell us how you would treat people who intentionally overdrafted their account?

#3 Consumer Comment

Simple resolution

AUTHOR: coast - (USA)

SUBMITTED: Monday, February 08, 2016

“They post charges out of order to rack up the fees.”

Stop authorizing checks, debits and withdrawals against unavailable funds and then you won’t have any concern for what order they process transactions.

What are the bank errors?

#2 Author of original report

Try again. I worked for a major bank for yearsss.

AUTHOR: - ()

SUBMITTED: Monday, February 08, 2016

That was actually quite funny considering the fact that I worked in the fraud department for a major banking institution for many many years. Clearly I know how to keep a running balance on my account and clearly I know everything there is to know in the banking world. This is a horrible bank with bad business practices and they try to rip you off anyway they can. I suggest you go back and read my original report because I mentioned numerous things not just fees. Thank you.

#1 Consumer Comment

What You're Saying Is...

AUTHOR: Jim - (USA)

SUBMITTED: Monday, February 08, 2016

You don't keep written records of account usage. You don't keep an on going running balance. You have numerous overdraft charges as a direct result of YOU not managing YOUR account properly. You keep using the account when you haven't the slightest idea of what your account balance is. Of course, this is all their fault! NO RIPOFF HERE -- Complainer does not keep written records and has no clue of their balance but keeps using the account and blames bank.

Advertisers above have met our

strict standards for business conduct.