Complaint Review: Loan Depot - Foothill Ranch California

- Loan Depot 26642 Towne Centre Drive Foothill Ranch, California United States of America

- Phone: 949-470-6259

- Web: www.loandepot.com

- Category: Mortgage Brokers

Loan Depot once they get your money then you get nothing in return Foothill Ranch, California

*Consumer Comment: The reason appraisals have to be ordered 1st thing.

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

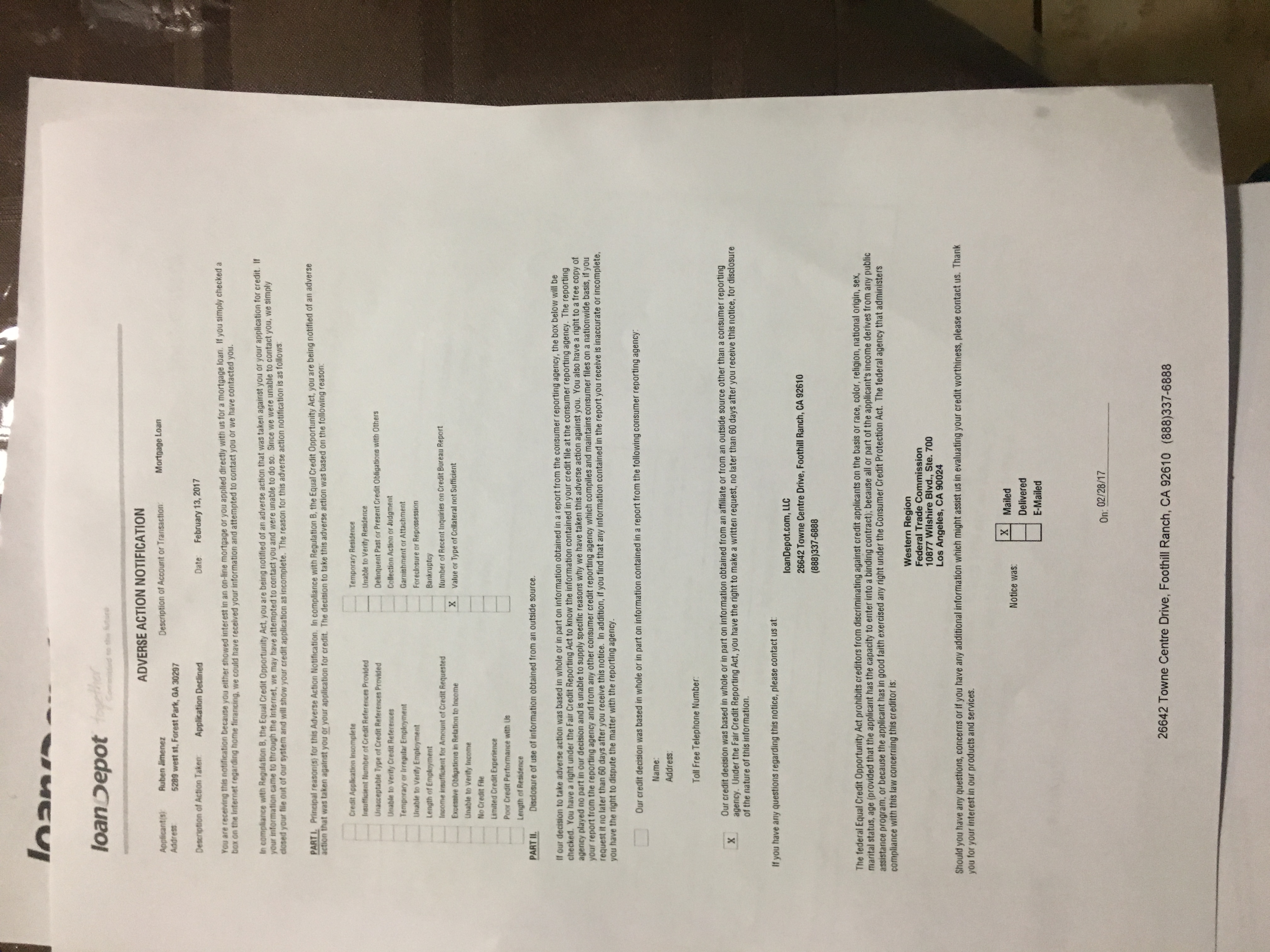

When interest rates dropped to 3.5% in June 2012. I went online to see about refinancing my mortgage. I was contacted by at least 3 different online companies wanting to give me a loan. I have excellent credit and have always paid my bills. I talked to a loan manager at Loan Depot and decided to lock in an interest rate of 3.5% and sent all requested information to them.

Almost immediately they had an appraisal company hired and coming to inspect my property. I have refinanced my property in the past, and had appraisals and felt there would not be any issue with coming in at least 80% or better. I was wrong and the appraised value of my property came in about 30K less than it should have. This should have been my first clue that I wasn't dealing with a reliable company.

For nearly 3 weeks I waited to hear something from this company, then I contacted them. I was told the case manager that was working my loan was sent packing and I had a new loan officer.

I then find out that they need some tax transcripts from the IRS. This is when I find out about an identity theft issue the IRS was supposed to have investigated last year had not actually been investigated.

I thought it was taken care of when I received my income tax return for 2011 in January of 2012. But NO the IRS had not done their job and flagged my SSN like they should have and the same thing has happened again this year.

I feel if loan depot was really an upstanding honorable company and not some sort of scam then they would have gotten all the paperwork in place then ordered an appraisal of the property.

So basically I am out $495 with absolutely NOTHING to show for it. I had a small lien on my property for the purchase of a new Air Conditioning Unit I had financed at a very low rate through the local utility that I paid off with a credit card to get the lien removed. This is at 3 times the interest rate I was paying.

All of this could have been avoided IF Loan Depot had done due diligence. I would love to sue them and the IRS. Both have been very negligent in the performance of what they are supposed to do.

Additionally, one month into the loan application process with Loan Depot I started feeling like it was a SCAM. I should have followed my gut and cut it off right there but I wanted to save $200/month on my mortgage.

I would warn anyone dealing with this company to beware and this is my opinon since it took more then 2 months for them to finally deny me a loan...did I say I have EXCELLENT Credit? And I do have all the emails that were exchanged with Loan Depot.

This report was posted on Ripoff Report on 08/08/2012 11:54 AM and is a permanent record located here: https://www.ripoffreport.com/reports/loan-depot/foothill-ranch-california-92610/loan-depot-once-they-get-your-money-then-you-get-nothing-in-return-foothill-ranch-califo-924270. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#1 Consumer Comment

The reason appraisals have to be ordered 1st thing.

AUTHOR: KW - (United States of America)

SUBMITTED: Sunday, October 28, 2012

I don't work for loan depot, but I have been in the business since 1991. The reason the companies have to order the appraisal prior to starting the rest of the process of paperwork on the loans is because of the loss of home values over the last 7 years. The appraisals are always done by an independent appraiser or appraisal company. This is a law. So if the value isn't there, then there isn't much else to do. The mtg. Companies cannot pay for appraisals as they did when the market was "hot".

It does not make good busieness sense whatsover to proceed into a loan ie,. Researching tax liens, credit ssues, title issues, before they know if a proprty has the value to qualify for a loan. That is wasting time, money and manpower for naught. It doesn't mean anything if you have perfect credit or not if the proprty value is not there.

I know it's a hard thing to hear, but it is the truth and it's not an easy thing to have to tell your borrowers when it happens.

I hope this helps in understanding a bit.

Advertisers above have met our

strict standards for business conduct.