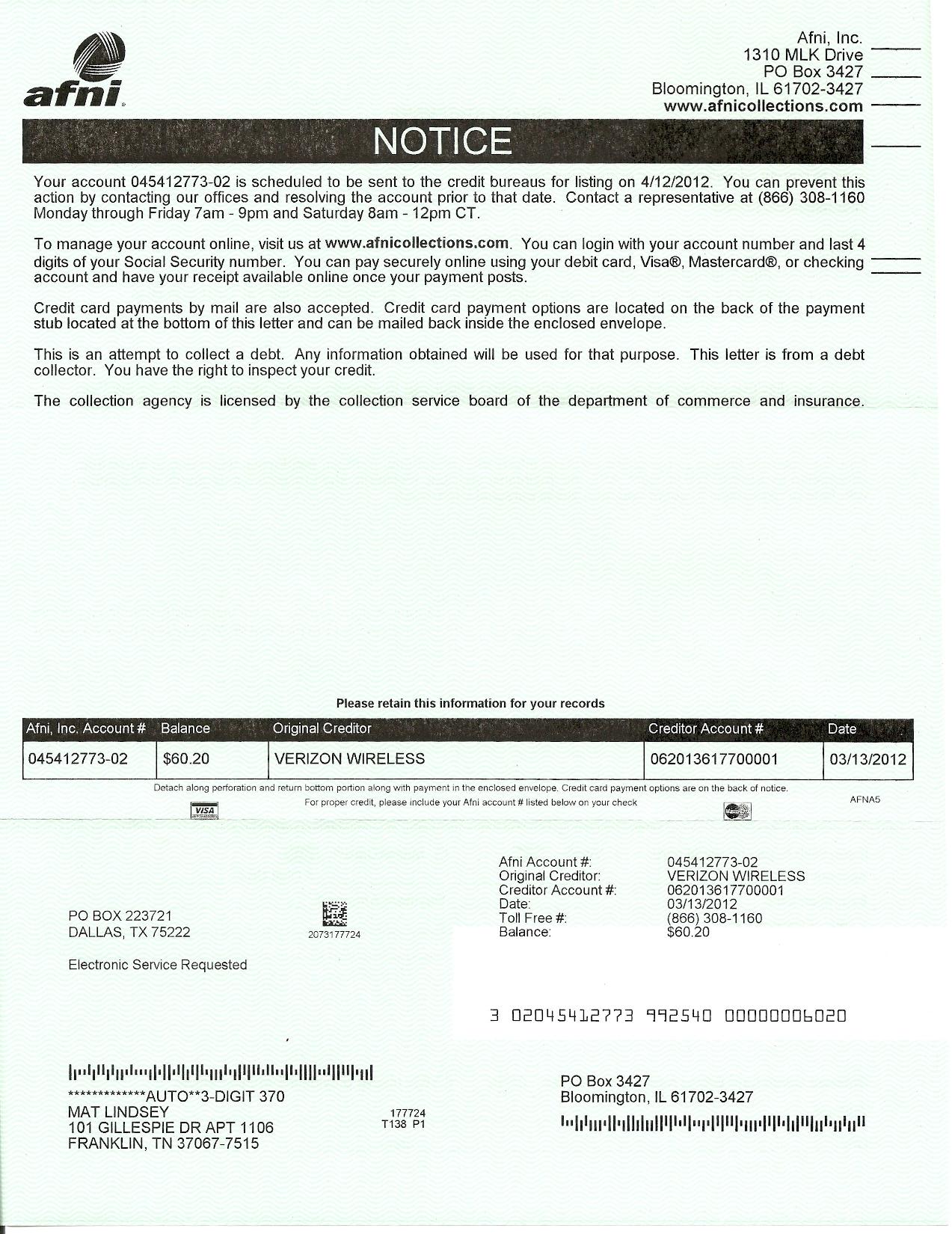

Complaint Review: Afni Collections - Bloomington Illinois

- Afni Collections PO Box 3427 Bloomington, Illinois U.S.A.

- Phone: 866-308-1160

- Web:

- Category: Collection Agencies

Afni Collections sent a collection notice for almost 500 dollars saying it was a debt owed from 1993- 1996 Bloomington Illinois

*Consumer Suggestion: File a complaint with FTC

*Consumer Suggestion: THE FOLLOWING IS OFF SEVERAL SITES REGARDING COLLECTION AGENCYS

*Consumer Suggestion: Tell them to go punt

*Consumer Suggestion: Tell them to go punt

*Consumer Suggestion: Tell them to go punt

*Consumer Suggestion: Tell them to go punt

Afni Collections sent me a collection notice stating I owed almost 500 dollars to them for a telephone bill from 1993-1996

they have my husbands social security number and the address we lived in at that time. this is NOT our account. PLEASE HELP

Elena

Western Slope, Colorado

U.S.A.

This report was posted on Ripoff Report on 01/16/2007 03:12 PM and is a permanent record located here: https://www.ripoffreport.com/reports/afni-collections/bloomington-illinois-61702-3427/afni-collections-sent-a-collection-notice-for-almost-500-dollars-saying-it-was-a-debt-owed-230866. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#6 Consumer Suggestion

File a complaint with FTC

AUTHOR: Jennifer - (U.S.A.)

SUBMITTED: Tuesday, January 16, 2007

Please go to the FTC website and file a complaint. FTC.gov

#5 Consumer Suggestion

THE FOLLOWING IS OFF SEVERAL SITES REGARDING COLLECTION AGENCYS

AUTHOR: P - (U.S.A.)

SUBMITTED: Tuesday, January 16, 2007

First the SOL has run out and in a letter you should tell them that ......

Tell them to validate by

. What the money you say I owe is for;

Explain and show me how you calculated what you say I owe;

Provide me with copies of any papers that show I agreed to pay what you say I owe;

Provide a verification or copy of any judgment if applicable;

Identify the original creditor;

Prove the Statute of Limitations has not expired on this account

Show me that you are licensed to collect in my state

Provide me with your license numbers and Registered Agent

1. NEVER talk to a collection agency on the phone. Period.

2. Keep good records. This can be the difference between a good and bad settlement. Don't expect them to remember you or what you agreed upon.

3. Send all correspondence via registered mail, receipt requested and put the registered mail number ON THE LETTER.

4. Keep a copy of every letter you send.

5. Penalties and extra interest are typically fictious amounts of money added on by the collection agency to pad their profits. Sometimes as much as to 50% of the debt or more claimed to be owed by a collection agency consisting of interest and fees. This is illegal, every state has usery laws (which dictate the maximum interests allowed to be charged. That is except North Dakota. There are no such laws which is why most credit card companies incorporate there.) Junk debt buyer pay anywhere from 1 cent to 7 cents on the dollar, there is no way there is this much interest.

6. Time is on your side. As time passes, the creditors will likely stop calling and the debt will be filed away for future attention or until the SOL runs out ..

#4 Consumer Suggestion

Tell them to go punt

AUTHOR: Steve - (U.S.A.)

SUBMITTED: Tuesday, January 16, 2007

Let's see....

The Statute of Limitations on collections for this type of debt in Colorado is 3 years, so they can't sue you.

The Statute of Limitations for putting this on your credit report is 7 years, so they can't do that either.

Whether it's your account or not is irrelevant - they can't enforce collection against you.

If you play your cards right, they will be sending you $1000.... Do a Google Search for "Flyingifr Method".... it will tell you a lot.

#3 Consumer Suggestion

Tell them to go punt

AUTHOR: Steve - (U.S.A.)

SUBMITTED: Tuesday, January 16, 2007

Let's see....

The Statute of Limitations on collections for this type of debt in Colorado is 3 years, so they can't sue you.

The Statute of Limitations for putting this on your credit report is 7 years, so they can't do that either.

Whether it's your account or not is irrelevant - they can't enforce collection against you.

If you play your cards right, they will be sending you $1000.... Do a Google Search for "Flyingifr Method".... it will tell you a lot.

#2 Consumer Suggestion

Tell them to go punt

AUTHOR: Steve - (U.S.A.)

SUBMITTED: Tuesday, January 16, 2007

Let's see....

The Statute of Limitations on collections for this type of debt in Colorado is 3 years, so they can't sue you.

The Statute of Limitations for putting this on your credit report is 7 years, so they can't do that either.

Whether it's your account or not is irrelevant - they can't enforce collection against you.

If you play your cards right, they will be sending you $1000.... Do a Google Search for "Flyingifr Method".... it will tell you a lot.

#1 Consumer Suggestion

Tell them to go punt

AUTHOR: Steve - (U.S.A.)

SUBMITTED: Tuesday, January 16, 2007

Let's see....

The Statute of Limitations on collections for this type of debt in Colorado is 3 years, so they can't sue you.

The Statute of Limitations for putting this on your credit report is 7 years, so they can't do that either.

Whether it's your account or not is irrelevant - they can't enforce collection against you.

If you play your cards right, they will be sending you $1000.... Do a Google Search for "Flyingifr Method".... it will tell you a lot.

Advertisers above have met our

strict standards for business conduct.