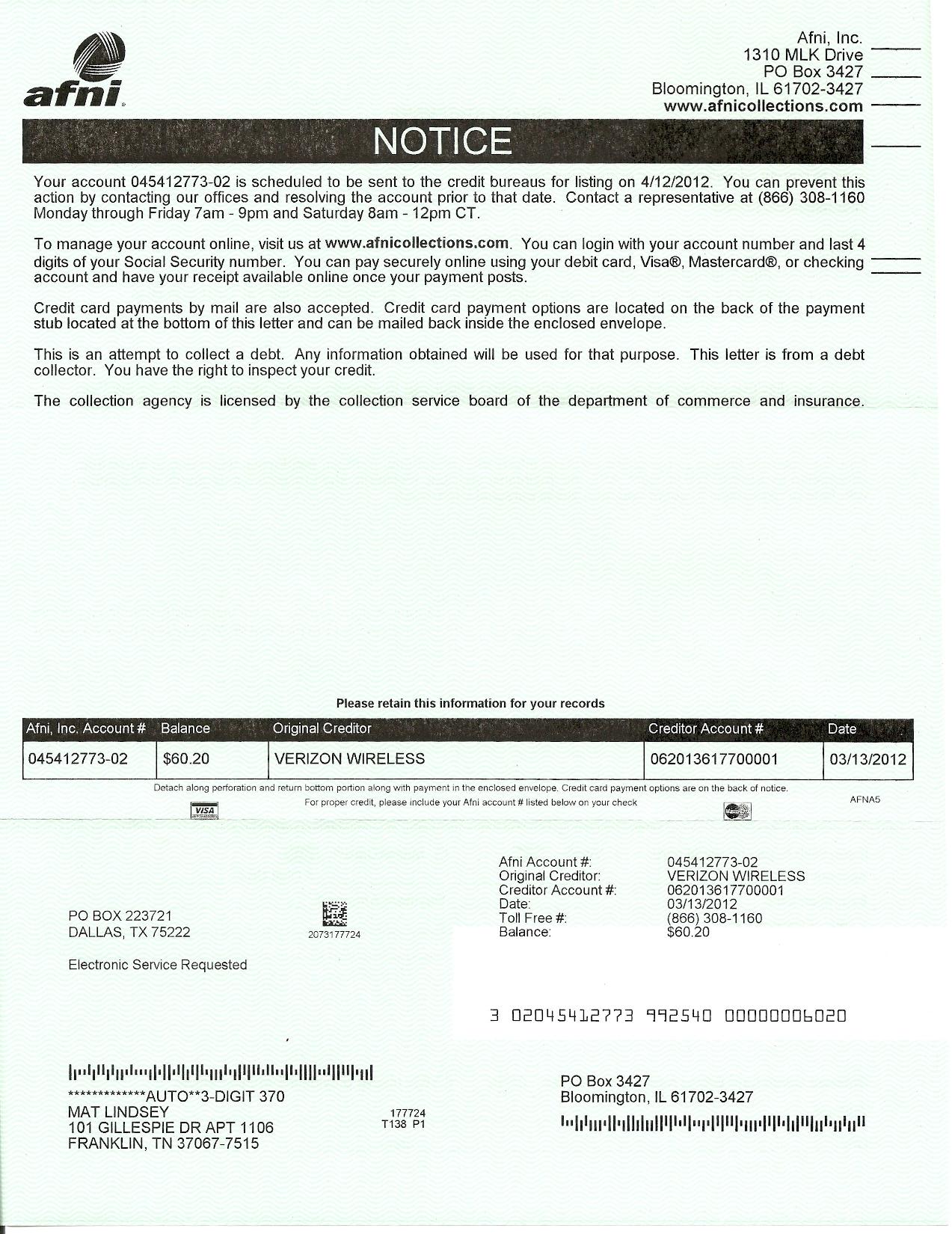

Complaint Review: AFNI COLLECTIONS - Bloomington Illinois

- AFNI COLLECTIONS PO BOX 3427 Bloomington, Illinois U.S.A.

- Phone: 888-257-1585

- Web:

- Category: Collection Agency's

AFNI COLLECTIONS Sent a collection notice from Verizon for a phone bill that is not mine from 1994 I live 400 miles from NYC where the phone was. My brother had that phone # but not me. Said I must pay 357.51 after 13 years ripoff Bloomington Illinois

*Consumer Suggestion: More debt collector employee tripe!

*Consumer Suggestion: Well Rr if Afni is not a rip off agency...

*UPDATE Employee: I assure you Afni is not a "rip off" agency

*Consumer Suggestion: Read the other comments on this site regarding Afni

I received a collection notice from AFNI for a verizon bill for 357.51 & called the 800 # and after 20 minutes on hold was told that I had a bill from 1994 to 1995 . I never lived there come to find out it was my brothers old phone not mine. they said I must have co signed but I did not now. Why no notices from Verizon then You wait 13 years to collect?

What can I do? Its going to go on my credit report

Bonnie

Olean, New York

U.S.A.

This report was posted on Ripoff Report on 07/31/2007 08:04 AM and is a permanent record located here: https://www.ripoffreport.com/reports/afni-collections/bloomington-illinois-61702-3427/afni-collections-sent-a-collection-notice-from-verizon-for-a-phone-bill-that-is-not-mine-f-264322. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#4 Consumer Suggestion

More debt collector employee tripe!

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Friday, December 28, 2007

What debt collectors don't want you to know.

Since you have a mailing address for these folks, do not discuss this matter with them any further. All communications with them needs to be in writing to ensure your protections under the Fair Debt Collections Practices Act. You need to DISPUTE that the debt is not yours and demand they VALIDATE this alleged debt per the FDCPA.

It's no coincidence that the rebuttals from alleged employees don't bother to mention your rights and protections. They don't want you to know. What's amusing is that these debt collectors are required by law to tell you that you have the right to DISPUTE and request VALIDATION of the alleged debt. If they don't tell you how to dispute and demand validation (you have to do this in WRITING - so they have to tell you WHERE to send a letter) when they are talking to you, they are then required by the FDCPA to send you a written notice of this alleged debt that includes a statement that you have the right to DISPUTE IT and demand VALIDATION.

Have they done this? Did they tell you where to send a written letter to dispute and demand validation of this alleged debt? Probably not. If they didn't tell you this while talking to you (or in their notice to you), they are then required by law to send you a written notice of your right to dispute and demand validation of this alleged debt within 5 days from their initial contact! (The date that they first called you.) If this hasn't been done, that's a violation of the FDCPA right there, so that should give you an idea of how they conduct their 'legitimate' business.

Now, let's get to my advice to you.

FIRST - Read the Fair Debt Collection Practices Act at ftc.gov/os/statutes/fdcpa/fdcpact.htm.

If you're interested in obtaining free credit reports, read the Fair Credit Reporting Act at ftc.gov/os/statutes/fcradoc.pdf

SECOND - send a certified letter, return receipt requested, to the DEBT COLLECTOR to DISPUTE the alleged debt and request written VALIDATION of the debt or any copy of a judgment, or the name and address of the original creditor, and a copy of such validation or judgment, or name and address of the original creditor. Also, include a statement stating that you do not wish to be contacted again until you receive all the written debt validation information you have requested. You should specifically ask for the following documentation:

What the money you say I owe is for;

Name and address of the current Creditor who owns the debt;

Name and address of the original Creditor;

Explain and show me how you calculated what you say I owe;

Provide me with copies of any papers that show I agreed to pay what you say I owe;

Provide a verification or copy of any judgment if applicable;

Identify the original creditor;

Prove the Statute of Limitations has not expired on this account;

Show me that you are licensed to collect in my state;

Provide me with your license numbers and Registered Agent.

Once they receive the letter, they must cease all collection efforts until they provide the written information requested. This is in accordance with the Fair Debt Collection Practices Act.

THIRD - Once you received the written validation information requested, contact the CREDITOR (who owns the debt) via certified mail to resolve the matter. Many times, the creditor will come after you again using a different debt collector so you will want to notify (in writing) the CREDITOR that you DISPUTE this alleged debt.

That's why you demand validation, as well as dispute it with the debt collector. As part of the validation process, the debt collector is required to inform you (in writing) who the CREDITOR is with contact information for the creditor. If they fail to do this, that's another violation of the FDCPA.

Please note that simply sending the letter telling them to leave you alone does not absolve a valid debt. What the letter does do is force them to provide you with written validation of the debt and to stop all collection actions until you receive the information. Once you have the information, you should act on it accordingly by contacting the CREDITOR via certified mail.

Some other notes: Any statute of limitations does not absolve a valid debt; it merely prohibits the creditor from going to court and winning a money judgment against you. IF there is already a money judgment, the statute of limitations most likely is longer - in New York State it's 20 years.

You can check the statute of limitations for debt in your state at http://www.fair-debt-collection.com/statue-limitations.html

In addition, a credit report listing does not in any way determine if a debt is valid or not, or collectible or not that is what courts are for. There are 3 ways a valid debt can be absolved; you pay it off, the creditor forgives it, or bankruptcy court orders it absolved.

Section 809 of the FDCPA covers debt validation nicely:

809. Validation of debts [15 USC 1692g]

(a) Within five days after the initial communication with a consumer in connection with the collection of any debt, a debt collector shall, unless the following information is contained in the initial communication or the consumer has paid the debt, send the consumer a written notice containing --

(1) the amount of the debt;

(2) the name of the creditor to whom the debt is owed;

(3) a statement that unless the consumer, within thirty days after receipt of the notice, disputes the validity of the debt, or any portion thereof, the debt will be assumed to be valid by the debt collector;

(4) a statement that if the consumer notifies the debt collector in writing within the thirty-day period that the debt, or any portion thereof, is disputed, the debt collector will obtain verification of the debt or a copy of a judgment against the consumer and a copy of such verification or judgment will be mailed to the consumer by the debt collector; and

(5) a statement that, upon the consumer's written request within the thirty-day period, the debt collector will provide the consumer with the name and address of the original creditor, if different from the current creditor.

(b) If the consumer notifies the debt collector in writing within the thirty-day period described in subsection (a) that the debt, or any portion thereof, is disputed, or that the consumer requests the name and address of the original creditor, the debt collector shall cease collection of the debt, or any disputed portion thereof, until the debt collector obtains verification of the debt or any copy of a judgment, or the name and address of the original creditor, and a copy of such verification or judgment, or name and address of the original creditor, is mailed to the consumer by the debt collector.

(c) The failure of a consumer to dispute the validity of a debt under this section may not be construed by any court as an admission of liability by the consumer.

Hope this helps.

#3 Consumer Suggestion

Well Rr if Afni is not a rip off agency...

AUTHOR: Sheri - (U.S.A.)

SUBMITTED: Friday, December 28, 2007

Hey Rr if Afni is not a rip off agency then they better watch their a** because they tried to scam me (with the Verizon scam) and tried to get personal information from me and I fully meant what I said when I told them if they or Verizon EVER poke into my credit in the future OR sell or give my information to anyone else they will be looking at possible legal action along with charges of ID theft. This was after they wanted to cut a deal on a bogus bill.

#2 UPDATE Employee

I assure you Afni is not a "rip off" agency

AUTHOR: Rr - (U.S.A.)

SUBMITTED: Tuesday, July 31, 2007

I understand that you are saying Afni is a "rip-off" agency and I can certainly understand how frustrating this must be for you; however I can assure you that Afni is a credible collection agency.

I believe that you stated that this acct. that you are mentioning is 13 yrs. old so I can also assure you that Afni will not report in to the credit bureau, because it is past the statute of limitations. The statute of limitations just refers to the ability to report to the credit bureaus after 7 yrs, not the legal ability to collect an acct. below is a link to the better business bureau regarding Afni.

http://search.bbb.org/Results.aspx?n=Afni&add=&c=&st=&z=

#1 Consumer Suggestion

Read the other comments on this site regarding Afni

AUTHOR: Billsburg Brooklyn - (U.S.A.)

SUBMITTED: Tuesday, July 31, 2007

Bonnie,

DO NOT TALK TO THE COLLECTION AGENCY AGAIN!!

I spent hours going through the previous posts on this topic yesterday (and writing my letter). Seems the NY Statute of Limitations is 6 yrs so you should be fine. However, you must take a few actions to try to make sure that they don't stick you and hurt your credit.

Send a certified letter as posted by Fightback - lead, South Dakota demanding all of the items as included in his example (and others further along down this thread).

It's not likely that you will hear anything back from them since this debt is past the SOL. But I'm not sure what happened when you spoke with Afni, if that might have given them some kind of leverage.

Please read all of the helpful information for how to deal with these bottomfeeders. Since I just got involved with my own battle for clearance from this mess, yesterday, I'm certainly no expert. My collection notice was for a phone# that I had for 12 yrs. I MOVED and disconnected that line 12 yrs AGO! They were asking for more than $200! I know I have paid all of my bills, I always do!

Good luck!

Advertisers above have met our

strict standards for business conduct.