Complaint Review: Barclays Bank - Wilmington Delaware

- Barclays Bank 125 S West St Wilmington, Delaware United States of America

- Phone: 302-622-8990

- Web: https://www.barclaycardus.com/

- Category: Credit Card Processing (ACH) Companies

Barclays Bank Juniper Bank, American Express Credit card rate reduction, telemarketing Wilmington, Delaware

*Consumer Comment: MadInDelaware, I believe that Barclays was one of the banks mentioned.......

*Consumer Comment: Very Suspicious

*Consumer Comment: Team Rebutt Seal of Approval

*Consumer Comment: question

*Consumer Comment: My Experience With Barclay's

*Consumer Comment: rate reduction and up to date never

*Author of original report: Reply

*Consumer Comment: Interesting

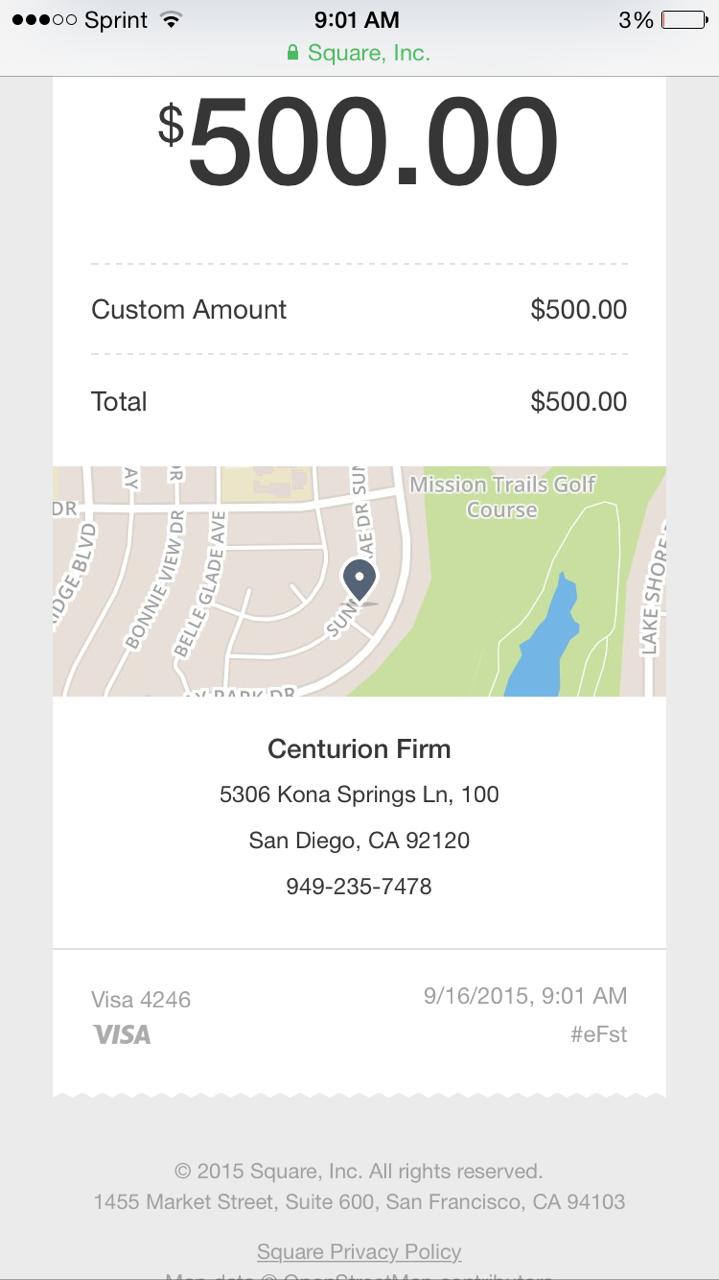

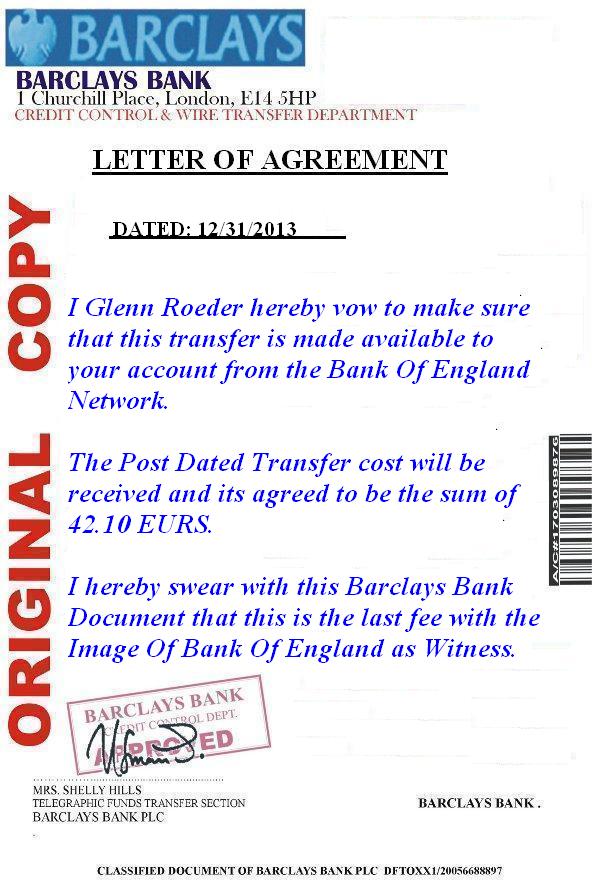

Received a call from Barclays offering me a rate reduction from 35.9% to 11.9% back in July, 2011. They would reduce my rate provided I remitted a $200 payment which I did immediately via mail. They requested I make payment over the which I refused. I do not provide bank account numbers to anyone over the phone. The check has cleared. They said I will be receiving a revised statement reflecting the new rate. To date (2/12), no receipt and nothing but harassing phone calls every week. I keep telling them this is not a matter of repayment ability, but rather them keeping their end of the deal. I refuse to send them a nickel until I receive their promise evidenced by mail.

This report was posted on Ripoff Report on 02/09/2012 08:12 AM and is a permanent record located here: https://www.ripoffreport.com/reports/barclays-bank/wilmington-delaware-19801/barclays-bank-juniper-bank-american-express-credit-card-rate-reduction-telemarketing-wil-836382. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#8 Consumer Comment

MadInDelaware, I believe that Barclays was one of the banks mentioned.......

AUTHOR: Karl - (USA)

SUBMITTED: Sunday, April 08, 2012

in the 60 Minutes segment from 2009 for 'speculating' oil in 2008, which caused gasoline prices to go over $4 a gallon in the USA in the summer of 2008.

Feel free to 'Google' this- DID SPECULATION FUEL OIL PRICE SWINGS, and watch that 60 Minutes segment on the web. I believe that Barclays was one of the banks named, along with Goldman Sachs, JPMorgan, and Morgan Stanley.

Have a nice day.

***NATIONWIDE BANK ALERT: Make sure to stay at this site and type in- BANK, and read the Ripoff Reports from people all over America for important information if you have a bank account or a mortgage in the USA.

#7 Consumer Comment

Very Suspicious

AUTHOR: voiceofreason - (United States of America)

SUBMITTED: Saturday, April 07, 2012

To the OP, are you totally sure you dealt with your actual card issuer, and not some clever scammer to whom you ended up sending a $200 gift?

Sounds weird that the actual card issuing bank would cold call you like that instead of mailing you card change materials.

And you keep stating you never got any confirmation.

Have you spoken to them via any call you initiated to their bona fide call number listed on your card, or their website? Do they acknowledge getting that payment?

#6 Consumer Comment

Team Rebutt Seal of Approval

AUTHOR: The Outlaw Josey Wales - (United States of America)

SUBMITTED: Saturday, April 07, 2012

You fail to meet Team Rebutt seal of Approval :=(

#5 Consumer Comment

question

AUTHOR: coast - (USA)

SUBMITTED: Friday, April 06, 2012

"harassing phone calls every week"

What do they want? I'm curious to know why they are calling you every week concerning an account that is in good standing with a 35.9% rate.

#4 Consumer Comment

My Experience With Barclay's

AUTHOR: Cory - (U.S.A.)

SUBMITTED: Friday, April 06, 2012

Went on a cruise with carnival last August. Last full day of the cruise they offered a BARCLAY'S CARNIVAL VISA/MASTERCARD. IF you opened the card with $100 down towards your next cruise, they would match it with a $100 shipboard credit good for up to two years. Filled out the app and NEVER heard from them. After a couple of weeks, I call barclay's, who tell me I was turned down. As I understand it, a credit card company along with any other company that "turns you down" is required by law to send you a formal notice of such AND in that notice tell you WHY you were turned down and what criteria they used, what credit reporting agency. None of this was done. Some bimbo tells me "You didn't qualify". Fair enough. Have three V/MCards, two with $20,000 lines and one with a $5,000 line, all with $0 balances. Use them now and then and pay them off each month. Heck, the cruise was a grand and paid that off when the bill came in. Receive a half dozen or more credit card offers a week, that I shred. Screw barclay's and screw carnival.

#3 Consumer Comment

rate reduction and up to date never

AUTHOR: bubbles8308 - (United States of America)

SUBMITTED: Thursday, April 05, 2012

I agree with the comment above, there is no way your acct was current and had never been past due with an apr over 30%.. also i could guarantee you were offered a rate reduction because your acct was at penalty pricing which usually occurs at roughly 90 days past due.. Also like he said in the comment above mailing a check is not secure, if you would have done the payment over the phone you would have gotten a confirmation number and been enrolled into the rate reduction as agreed..Also when you make an agreement like you did there is break period when if the check was not rec by a certain date you would have defaulted which if i were to guess is what happened, the problem here is no one ever wants to take personal responsibility for themselves. good luck not paying them unfortunately they usually will win in the long run costing you even more in the end

#2 Author of original report

Reply

AUTHOR: MadInDelaware - (United States of America)

SUBMITTED: Friday, February 10, 2012

This is a "Travelocity" credit card administered by Barclays Bank; always in good standing. They had called and said the card will be changing from Visa to American Express. I opted to reject the offer since I already have an AmEx card. As such, they offered a rate reduction on the outstanding balance as a compromise. They wanted a good faith payment of $200 as a confirmation. There were no arrearages on the account. I agreed and remitted the payment immediately. I'm still waiting for a confirmation from them. Nothing.

#1 Consumer Comment

Interesting

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Thursday, February 09, 2012

It is always interesting how little details always seem to be left out of reports.

Received a call from Barclays offering me a rate reduction from 35.9% to 11.9% back in July, 2011. They would reduce my rate provided I remitted a $200 payment which I did immediately via mail. They requested I make payment over the which I refused

- Okay why did they want a $200 payment over the phone? I would bet that you were delinquent and they were offering you to go back to your standard rate from the default rate.

Then they wanted you to pay over the phone but you refused...so if that was part of the terms of this "agreement" why would you expect them to follow-through if you didn't meet your end by giving them the payment over the phone?

By the way it was actually more dangerous to send a check in the mail than it is to give it to someone over the phone. First both ways they still have your account information(and don't be naive to think that they didn't save the information from the check you sent). While not common it would actually be more likely that your paper check would be "intercepted" en-route to the payment center than it would be for the person taking the information to use it.

I keep telling them this is not a matter of repayment ability, but rather them keeping their end of the deal.

- Then why did they give you the original offer and why would they need to make a "deal"? You obviously are leaving things out about your history with them.

I refuse to send them a nickel until I receive their promise evidenced by mail.

- Let us know how that works out for you when they transfer you to a Collection Agency(if they haven't already), and possibly file a suit against you.

Advertisers above have met our

strict standards for business conduct.