Complaint Review: Insurance Stakes - Internet

- Insurance Stakes Internet United States

Insurance Stakes in Customer RipOff False Marketing/Endorsing Internet

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

Beware White Mountain/“Bamboo Insurance” that will prove itself to be a stereotypical “Made in China” Quality, ”Delay, Deny, Disappear” bogus, Bait and Switch scam. Insurance disappear, policy benefits prove useless as soon as you file a claim, they lack intentions to extend benefits to customers. Once you file a claim expect a Status letter ‘there’s no coverage for this claim’ and claim data will be forwarded to the claims database so you will face a hard time switching carrier.

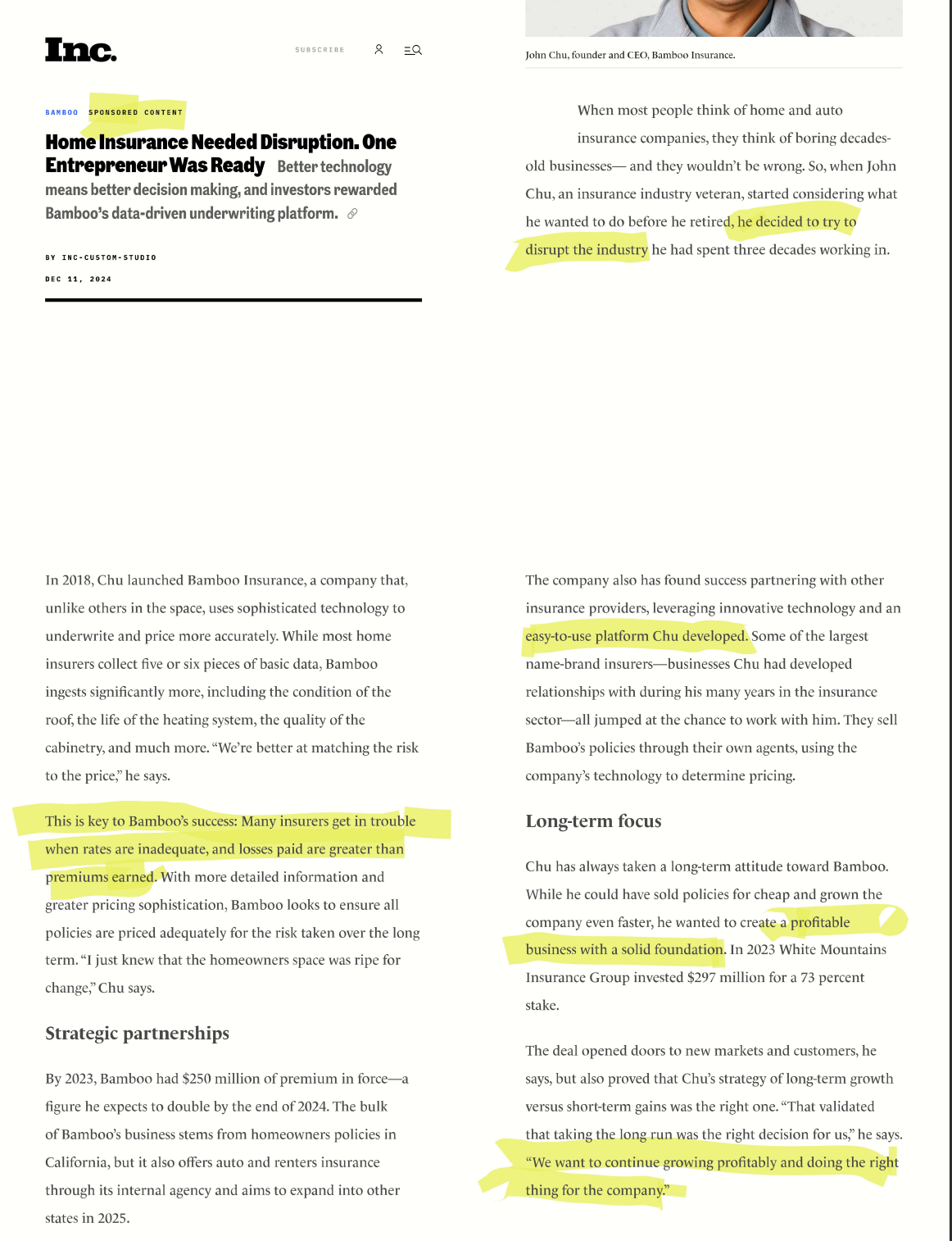

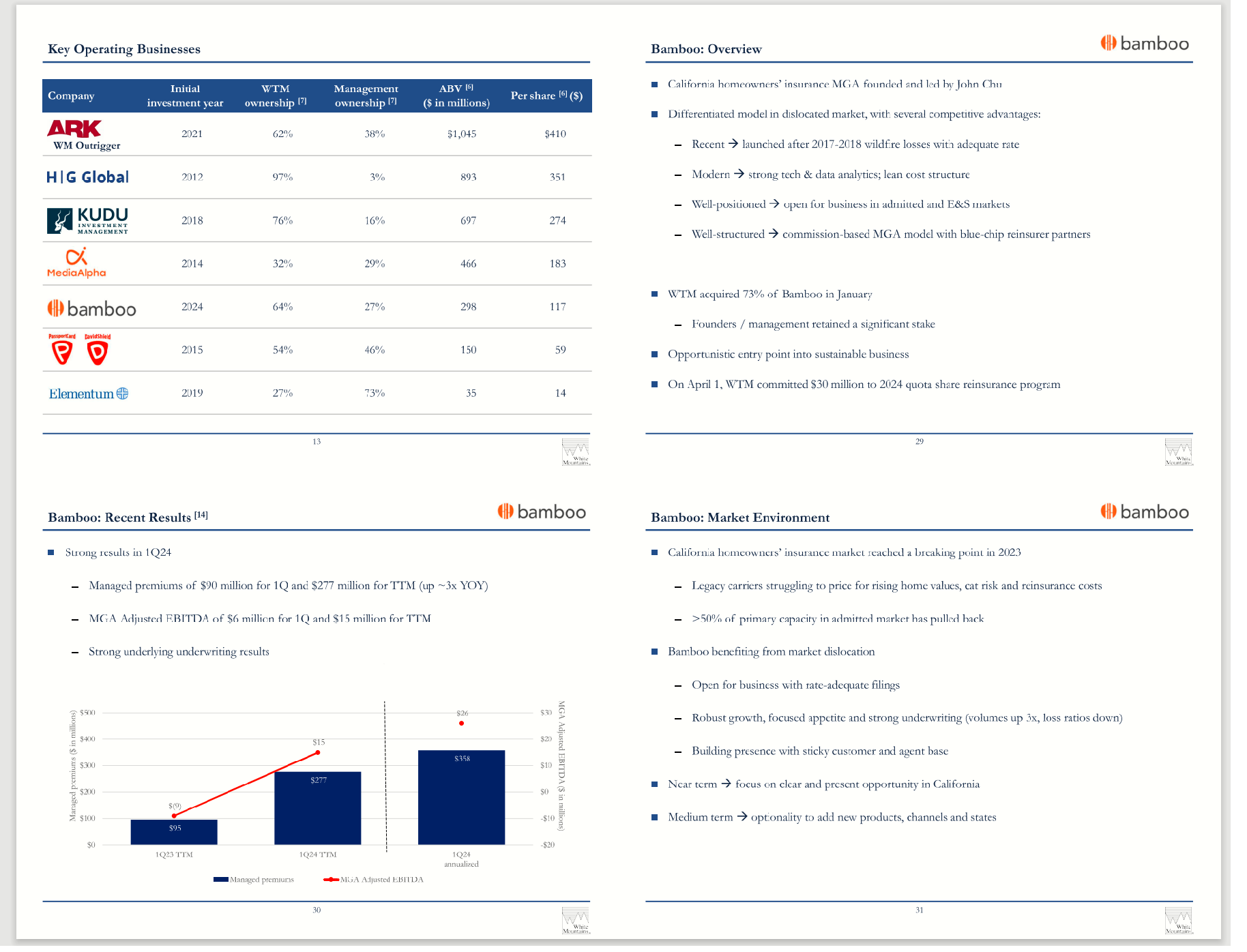

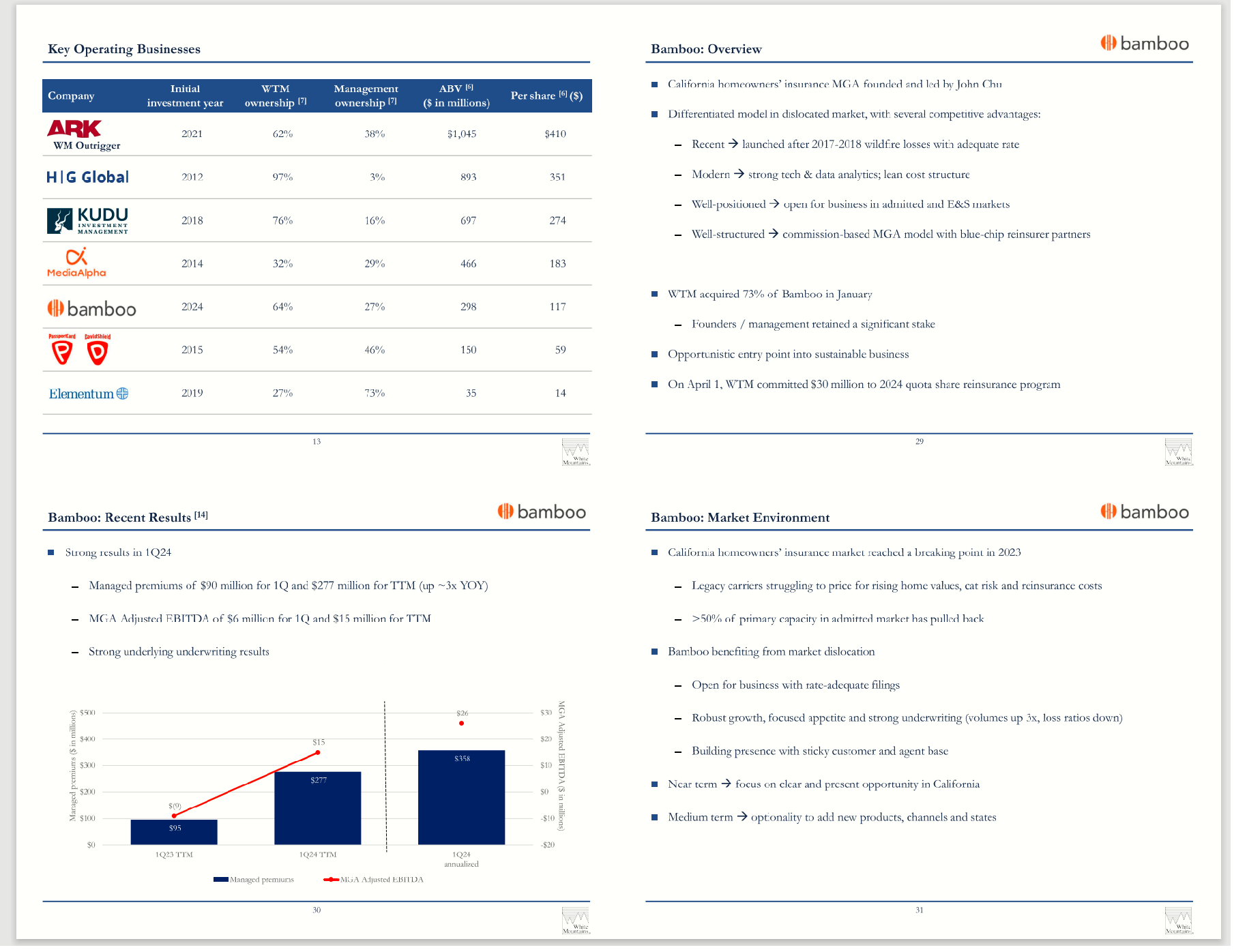

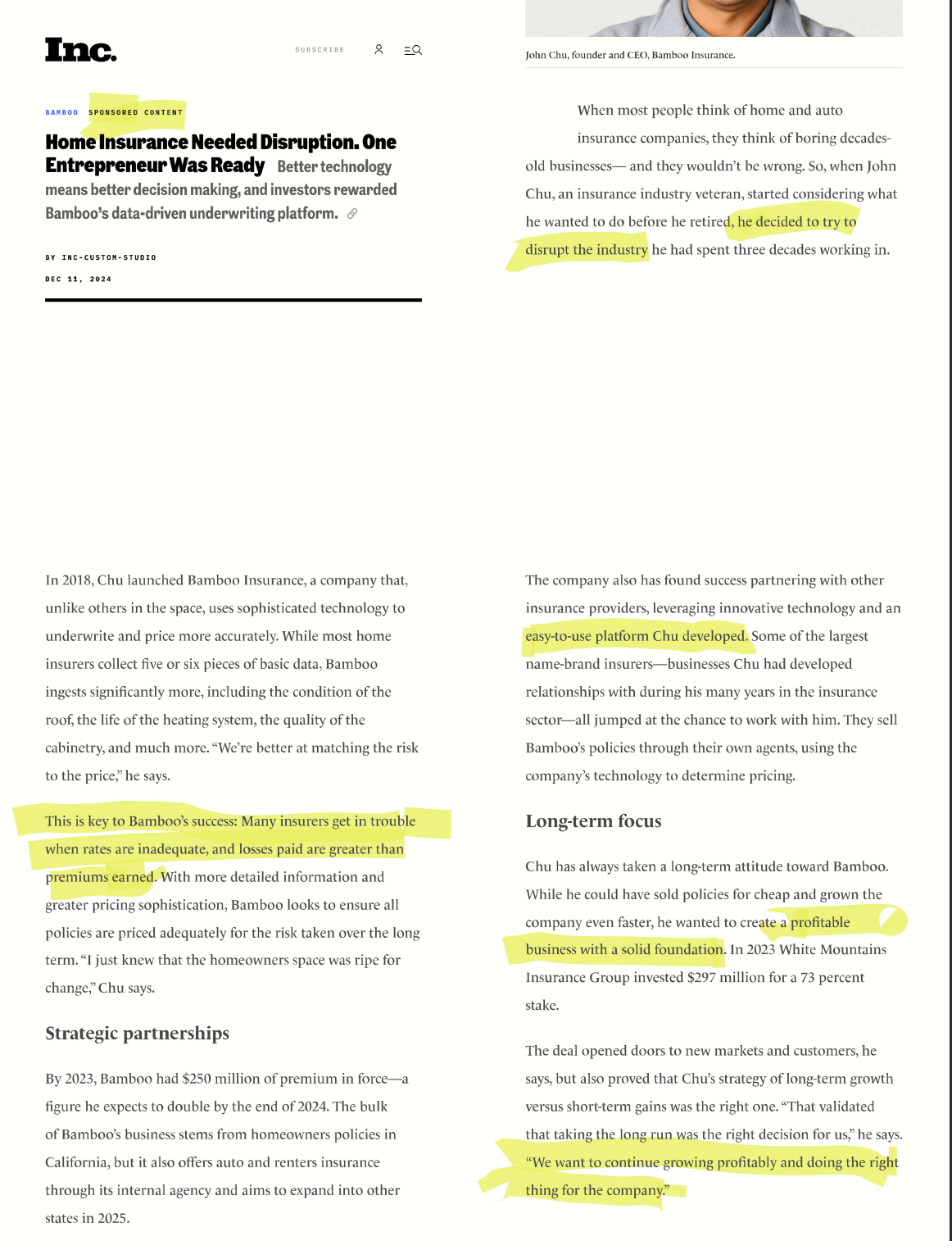

Let’s take a look at the Sponsored material from White Mountain and then from Bamboo, copy attached incase weblink stops working

Source: Inc.com, Google, Yelp

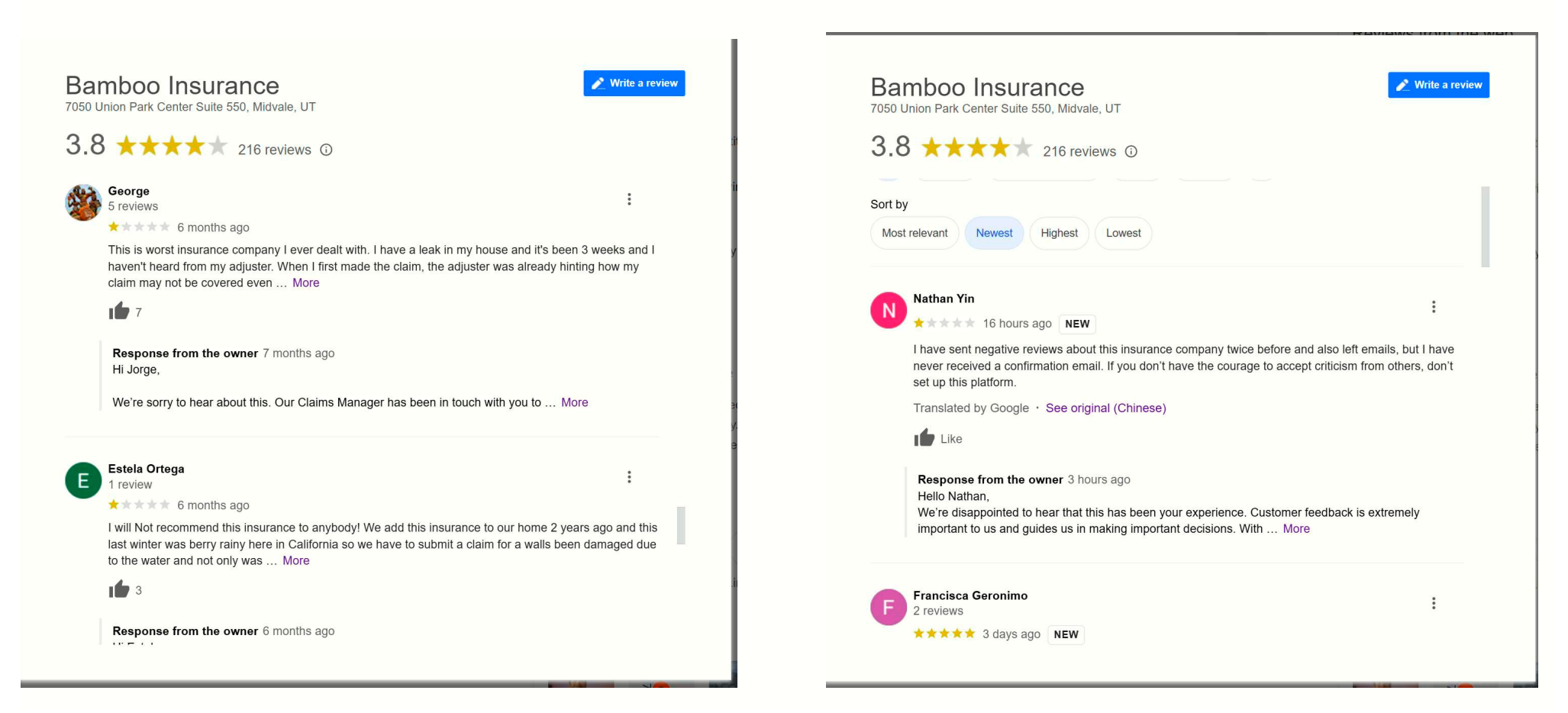

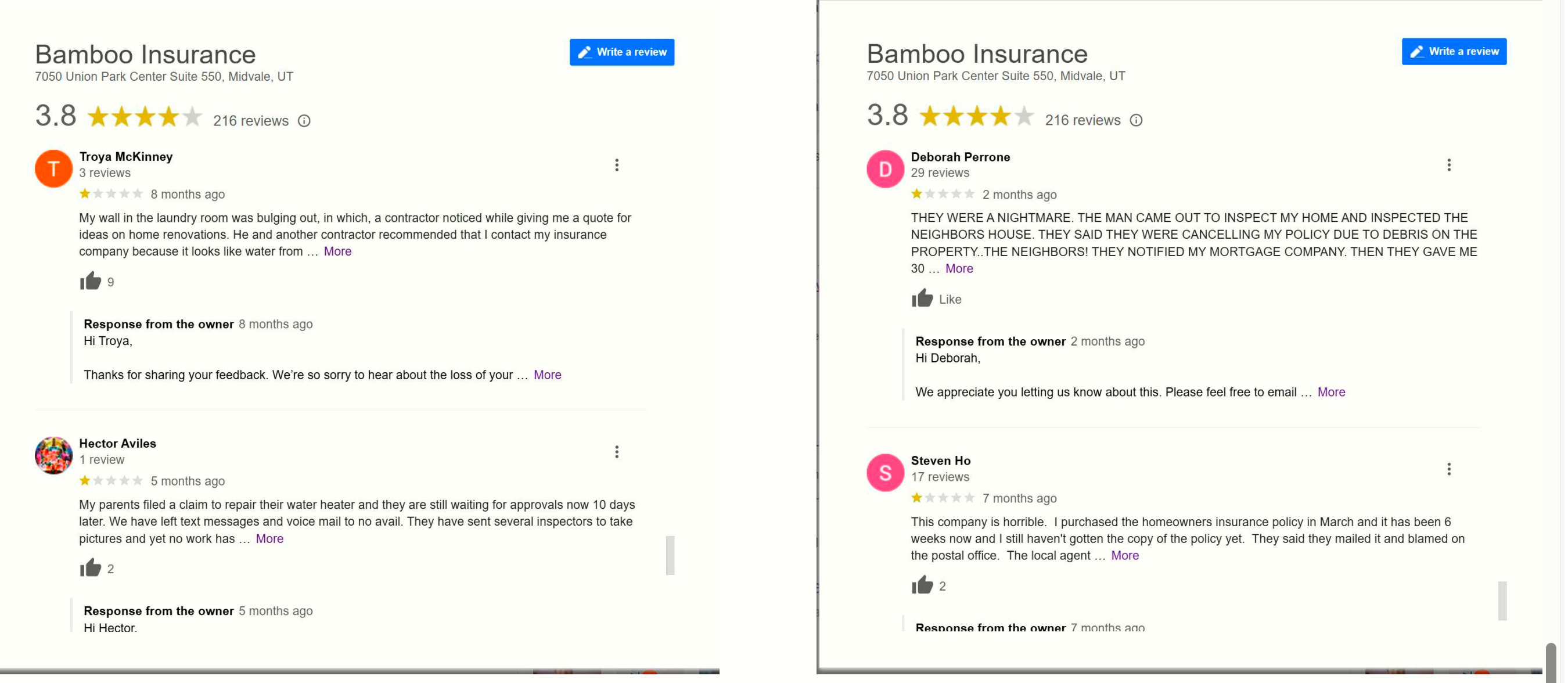

True customer reviews are buried under the paid false reviews so consumer robbing continues.

Notice the open admittance “This is key to Bamboo’s success: Many insurers get in trouble when rates are inadequate, and losses paid are greater than premiums earned.” For a consumer/Policy owner this means unreasonable benefits denials because the agency never intended paying consumers. Their focus is on ensuring consumer benefits paid are lesser than the premium earned.

Notice the self focus “We want to continue growing profitably and doing the right thing for the company.” Further affirmation that consumers/policy holders are just puppets signed up for the non-existing benefits because the carrier is focused on “doing the right thing for the company profitability”.

Notice the rejection “While most home insurers collect five or six pieces of basic data, Bamboo ingests significantly more” so significantly more chances of depriving consumers of their qualified benefits.

Notice the data sharing to trap consumers “The company also has found success partnering with other insurance providers, leveraging innovative technology and an easy-to-use platform Chu developed.” This platform is designed with a goal of 1. “losses paid should be lesser than the premium earned” & 2. ”doing the needful for the company profitability” 3. “Insurance needed disruption” 4. “Agency uses significantly more conditions to deny claims“ 5.Consumer trapping in the policy that doesn’t have any benefits. Policy benefits will not be extended based on facts/ circumstances/ evidence/ legitimate reasons/ good faith.

75K+ consumers are at the mercy of the legitimacy of the algorithm developed by the founder and partnering with other insurance providers is a defrauding conspiracy. Consumer reviews are documenting struggles, dissatisfaction, false marketing and lack of fair loss settlements- this should call for a thorough investigation into the legitimacy of the algorithm/platform/partnership etc. practices.

Bamboo was founded in 2018, garnered 75M+ by 2023, consumer lawsuits are starting to pile up, it’s on the path to disappearance/investigation. Agency needs to be investigated about their disruption agenda/method/consumer depriving, fraud. Consumers need an alert about protecting themselves.

Experience is not xenophobic, that's not the point, important fact is this insurance was launched in CA with benefits that were never extended to consumers and because claims were filed consumers are now trapped with the carrier. These trapped, suffering policyholders were marketed to investors like White Mountains and further their data is used for nationwide ripoff launch as ‘we have CA policyholders’ & great Investors. In reality they are failing to inform constomers that their policy only serves good to satisfy mortage terms conditions. It's going to be a struggle to find a coverage once claim is filed and number of policyholders is then marketed as we have policyholders. Can't belive White Mountain is participating in this.

This report was posted on Ripoff Report on 12/17/2024 05:21 PM and is a permanent record located here: https://www.ripoffreport.com/report/insurance-stakes/internet-customer-ripoff-1535301. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

Advertisers above have met our

strict standards for business conduct.