Complaint Review: ACE Incorporation - Internet

- ACE Incorporation Internet USA

- Phone:

- Web:

- Category: Loans

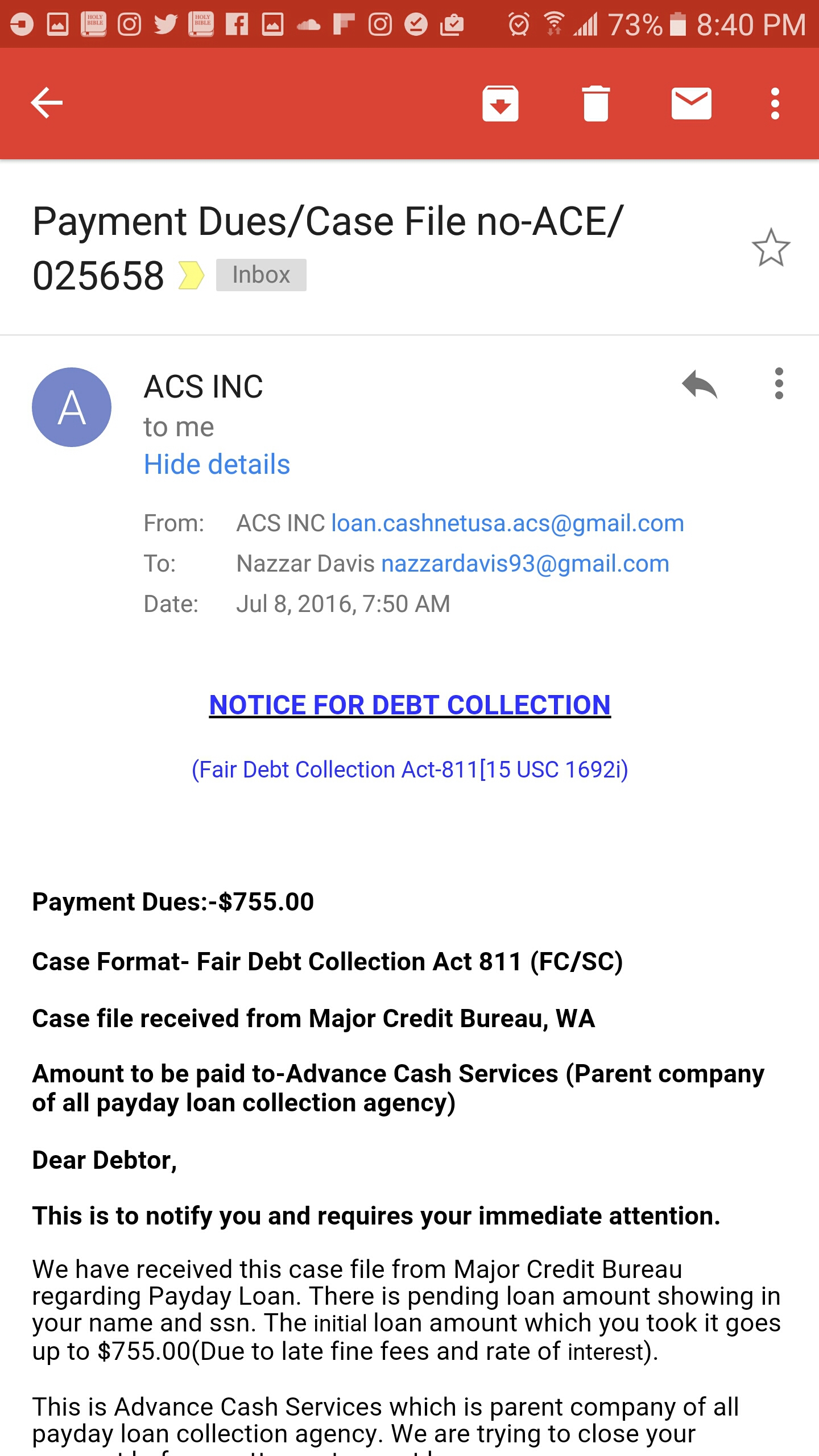

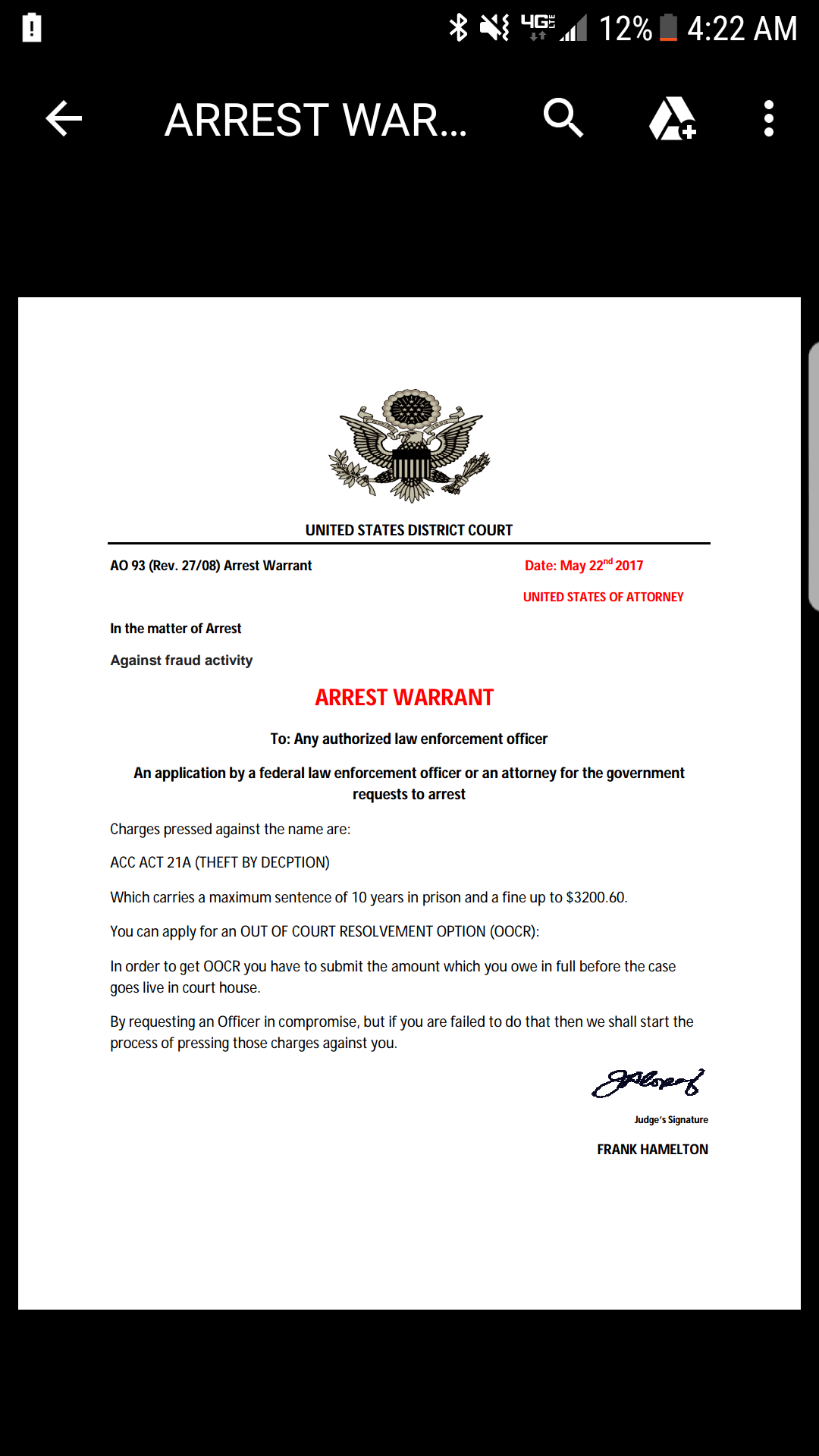

ACE Incorporation james Wood Advance Cash Services Threat to send me to prison for 3years and A fine of $5825.36 and gave me 15 days to respond back in the email. They Added late fees. Internet

*Consumer Suggestion: Dealing with Collection Companies

They have been trying to come at me for years for loan thats been fake for years. Payday Loan collection saying that they will put it on my credit and stil they did not put it on my cridet. Now today they contacting me with big compines saying they will send me to jail for 3 years for $799. They been sending me letters like this for years.

This started when I was 18 and now I am 22 and they still threated me over and over.

This report was posted on Ripoff Report on 07/08/2016 05:26 PM and is a permanent record located here: https://www.ripoffreport.com/reports/ace-incorporation/internet/ace-incorporation-james-wood-advance-cash-services-threat-to-send-me-to-prison-for-3years-1315840. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#1 Consumer Suggestion

Dealing with Collection Companies

AUTHOR: Blue88487 - (USA)

SUBMITTED: Sunday, July 10, 2016

Dealing with collection companies can be tough, especially when the debt isn't really yours. First thing you need to know is, you won't be going to jail over any debt. This is a dirty tactic that slimy collection agencies use to "scare" you into making a payment, or calling them to arrange payments. Under NO circumstance should you do either, especially if the debt isn't yours. If you make a payment, or call to arrange payments, you are accepting liability for the debt even if the debt want yours to begin with. Second, if the debt truly isn't yours, by law you have a right to dispute it. This must be done within 30 days of receiving the collection letter, and must be done in writing. Here is a sample letter you can use our there are many others you can find by searching "debt dispute letter" https://consumerist.com/2007/07/18/sample-letter-for-disputing-a-debt-collection-notice/ Again, this must be mailed within 30 days and you should send it certified mail, return receipt requested. The post office will mail you back a receipt once the letter is delivered with the name and signature of the person who accepted the letter. This is your proof that they actually got the letter so make sure you keep it as well as any other correspondence with them. Once the collection agency has your letter, they can take no further legal action against you, or try to further collect on the debt, unless they can send you proof that the debt is indeed yours. If they do proceed with legal action, or try and further collect, without sending you proof, they will be in violation of federal law. If they can't send you proof, because the debt isn't actually yours, they will likely sell the debt to another collection agency, at which time you will likely get another collection letter, or offer of settlement, and the process begins all over again with the next collection agency. Hope this helps you out. Good luck!

Advertisers above have met our

strict standards for business conduct.