Complaint Review: ALLIED INTERSTATE - Internet Internet

- ALLIED INTERSTATE www.iqor.com Internet United States of America

- Phone: 8008114214

- Web:

- Category: Collection Agency's

ALLIED INTERSTATE Intellirisk, Collections Vikas Kapoor president and CEO They have been calling everyday since June, sometimes twice per day. Never is there anyone on the line. The number of 866-526-7795 was googled to find out who these dirt bags are. Internet

*Consumer Comment: those idiots did the same thing to me

*General Comment: For Help

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

Started getting calls in June, but ignored them since they would never answer the phone. Now we are getting calls 2 times a day 7 days a week. I Googled the number and here I am now.... I recently saw the Dateline report by Chris Hansen, episode 2344 on 9-6-09 that documented a similar company. I have recently e-mailed Dateline with all the info about this company, maybe they will do another report and expose these idiots. In any case the best thing to do is never divulge any information to them at all. Never give them a bank acount or credit card number. I don't answer my phone if I don't know who it is and have recently placed a privacy service on my phone that prevents anyone from calling me unless they are given a password. Inconvienient, but worth it.

The president and owner of this company is Vikas Kapoor and is associated with www.iQor.com . It would be nice if everyone started calling this moron at every hour of the day. Unfortunatly I have not found his home number, maybe someone out there can and post it! Look up Vikas in Google and you will see a good photo of a real bad apple. Check out this link and read it all!

Listed below is good information on your rights and lots of numbers to help your fight.

http://800notes.com/Phone.aspx/1-866-526-7795

Allied Interstate, Inc. 435 Ford Rd. #800 Minneapolis, MN 55426-1066 Phone: (952) 546-6600 1-800-806-3342 1-866-525-7795 Fax: (952) 595-2311 Web Address: was http://800notes.com/awl/nb/r.ashx?ue=8SbvNmLj1mcp5yd3d3LvoDc0RHa now www.iQor.com Head Debt Collectors: Part of the Intellirisk Companies Vikas Kapoor, President & CEO Randy Christofferson, Chairman of the Board Norman Merritt, CFO ALLIED INTERSTATE, INC. (BAD REPUTATION!) Jeff Swedberg, President Jim Pond, Senior Vice President 55 N. Arizona Place, #505 Chandler, AZ 85225 Phone: (480) 722-7810 Fax: (480) 782-7001 5062 N 19th Ave Ste 102 Phoenix, AZ 85015-3225 Phone: (602) 841-4332 Fax: (602) 841-7388 31229 Cedar Valley Dr Westlake Village, CA 91362-4036 Phone: (818) 575-5400 3111 S Dixie Hwy Ste 101 West Palm Beach, FL 33405-1520 Phone: (561) 671-2121 Fax: (561) 671-2165 340 Interstate North Pkwy SE Ste 140 Atlanta, GA 30339-2201 Phone: (770) 989-5700 Fax: (770) 989-5724 7103 Chancellor Dr., Suite 100 Cedar Falls, IA 50613 Phone: (561) 671-2152 Fax: (561) 671-2165 5910 Shingle Creek Pkwy. Brooklyn Cntr, MN 55430-2322 Phone: (763) 503-6595 Fax: (763) 585-7881 435 Ford Rd Ste 800 Minneapolis, MN 55426-1066 Phone: (952) 546-6600 Fax: (952) 595-2311 13777 Ballantyne Corporate Pl Ste 200 Ballantyne Corporate Pk. Charlotte, NC 28277-3425 Phone: (704) 943-1000 Fax: (704) 943-1053 3200 Northline Ave Ste 135 Greensboro, NC 27408-7616 Phone: (336) 333-3100 Fax: (336) 373-4442 15 Hazelwood Dr., Suite 102 Amherst, NY 14228 Phone: (716) 691-1320 Fax: (716) 691-3534 1979 Marcus Ave Ste 100 New Hyde Park, NY 11042-1002 Phone: (516) 437-0800 Fax: (516) 437-6121 3070 Lawson Blvd Oceanside, NY 11572-2711 Phone: (516) 561-6552 Fax: (516) 561-6548 3000 Corporate Exchange Dr. Columbus, OH 43231 Phone: (614) 901-7988 Fax: (614) 901-7794 12655 N Central Expy, Suite 925 Dallas, TX 75243-1700 Phone: (972) 934-8448 Fax: (972) 404-1611 14550 Torrey Chase, Suite 550 Houston, TX 77014 Phone: (281) 580-2000 Fax: (281) 580-0396 -------------------------------------------------------------------------------- Bud Says Consumer Comments Below This company is a class action lawsuit waiting to happen. Sloppy record keeping, failure to validate at every level, under-trained, uneducated collectors SEVERELY lacking in Fair Debt Collection Practices Act training. Intellirisk must be making BIG bucks in collecting because they sure don't spend it to insure they comply with the laws. Student loans with these idiots is a nightmare. Most Allied collector's don't have a clue in handling even the most basic of consumer complaints. Loans that have been paid, in the wrong names and outdated credit bureau reporting are fast targets for lawsuits because Allied is unable or unwilling to respond. If you receive a collection notice from Allied DISPUTE IT! Even though you will never receive a reply, it is important that you use the law to your advantage. Allied aptly fits the saying; "the right hand hasn't a clue what the left hand is doing" Brain-Dead! Idiots! Untrained! May I state again....THANK GOD FOR THE FAIR DEBT COLLECTION PRACTICES ACT!! Someone in Washington must have had a dream about companies like Allied to enact the law. THANK YOU! THANK YOU! WATCH YOUR WALLET, YOUR CHECKBOOK AND YOUR CREDIT CARDS WHEN DEALING WITH THESE SLIPPERY CONS OF THE COLLECTION WORLD, THEY WILL EMPTY YOU OUT! CAUTION: I recommend you NEVER disclose your bank account or credit card information to a debt collector, as you risk them emptying your account, or maxing out your credit card. If you feel they are reporting on your credit bureau files in error or need assistance in dealing with them, email the details w/your location. Assistance and referral to a consumer legal specialist may be available. Debt Collectors DO NOT WANT YOU TO KNOW THIS INFORMATION! The INFORMED CONSUMER IS THE DEBT COLLECTORS WORST ENEMY! Dealing with Debt Collectors http://800notes.com/awl/nb/r.ashx?ue=AbtRHauQnchR3cv02bj5yciJWaoRWdi5yd3d3LvoDc0RHa Statute of Limitations by State always double check YOUR OWN STATE Government Website http://800notes.com/awl/nb/r.ashx?ue=0Gdo5ycu9Wa0FGdp1Was9lZv9VZ0VHdhR3cv02bj5yciJWaoRWdi5yd3d3LvoDc0RHa Recording calls from Debt Collectors - always double check YOUR OWN STATE Government Website http://800notes.com/awl/nb/r.ashx?ue=Qb0hmLkJ3bjVmcv02bj5yciJWaoRWdi5yd3d3LvoDc0RHa From Federal Trade Commission Website FAIR DEBT COLLECTION PRACTICES ACT Debt Collection FAQs: A Guide for Consumers If youre behind in paying your bills, or a creditors records mistakenly make it appear that you are, a debt collector may be contacting you. The Federal Trade Commission (FTC), the nations consumer protection agency, enforces the Fair Debt Collection Practices Act (FDCPA), which prohibits debt collectors from using abusive, unfair, or deceptive practices to collect from you. Under the FDCPA, a debt collector is someone who regularly collects debts owed to others. This includes collection agencies, lawyers who collect debts on a regular basis, and companies that buy delinquent debts and then try to collect them. Here are some questions and answers about your rights under the Act. What types of debts are covered? The Act covers personal, family, and household debts, including money you owe on a personal credit card account, an auto loan, a medical bill, and your mortgage. The FDCPA doesnt cover debts you incurred to run a business. Can a debt collector contact me any time or any place? No. A debt collector may not contact you at inconvenient times or places, such as before 8 in the morning or after 9 at night, unless you agree to it. And collectors may not contact you at work if theyre told (orally or in writing) that youre not allowed to get calls there. How can I stop a debt collector from contacting me? If a collector contacts you about a debt, you may want to talk to them at least once to see if you can resolve the matter even if you dont think you owe the debt, cant repay it immediately, or think that the collector is contacting you by mistake. If you decide after contacting the debt collector that you dont want the collector to contact you again, tell the collector in writing to stop contacting you. Heres how to do that: Make a copy of your letter. Send the original by certified mail, and pay for a return receipt so youll be able to document what the collector received. Once the collector receives your letter, they may not contact you again, with two exceptions: a collector can contact you to tell you there will be no further contact or to let you know that they or the creditor intend to take a specific action, like filing a lawsuit. Sending such a letter to a debt collector you owe money to does not get rid of the debt, but it should stop the contact. The creditor or the debt collector still can sue you to collect the debt. Can a debt collector contact anyone else about my debt? If an attorney is representing you about the debt, the debt collector must contact the attorney, rather than you. If you dont have an attorney, a collector may contact other people but only to find out your address, your home phone number, and where you work. Collectors usually are prohibited from contacting third parties more than once. Other than to obtain this location information about you, a debt collector generally is not permitted to discuss your debt with anyone other than you, your spouse, or your attorney. What does the debt collector have to tell me about the debt? Every collector must send you a written validation notice telling you how much money you owe within five days after they first contact you. This notice also must include the name of the creditor to whom you owe the money, and how to proceed if you dont think you owe the money. Can a debt collector keep contacting me if I dont think I owe any money? If you send the debt collector a letter stating that you dont owe any or all of the money, or asking for verification of the debt, that collector must stop contacting you. You have to send that letter within 30 days after you receive the validation notice. But a collector can begin contacting you again if it sends you written verification of the debt, like a copy of a bill for the amount you owe. What practices are off limits for debt collectors? Harassment. Debt collectors may not harass, oppress, or abuse you or any third parties they contact. For example, they may not: use threats of violence or harm; publish a list of names of people who refuse to pay their debts (but they can give this information to the credit reporting companies); use obscene or profane language; or repeatedly use the phone to annoy someone. False statements. Debt collectors may not lie when they are trying to collect a debt. For example, they may not: falsely claim that they are attorneys or government representatives; falsely claim that you have committed a crime; falsely represent that they operate or work for a credit reporting company; misrepresent the amount you owe; indicate that papers they send you are legal forms if they arent; or indicate that papers they send to you arent legal forms if they are. Debt collectors also are prohibited from saying that: you will be arrested if you dont pay your debt; theyll seize, garnish, attach, or sell your property or wages unless they are permitted by law to take the action and intend to do so; or legal action will be taken against you, if doing so would be illegal or if they dont intend to take the action. Debt collectors may not: give false credit information about you to anyone, including a credit reporting company; send you anything that looks like an official document from a court or government agency if it isnt; or use a false company name. Unfair practices. Debt collectors may not engage in unfair practices when they try to collect a debt. For example, they may not: try to collect any interest, fee, or other charge on top of the amount you owe unless the contract that created your debt or your state law allows the charge; deposit a post-dated check early; take or threaten to take your property unless it can be done legally; or contact you by postcard. Can I control which debts my payments apply to? Yes. If a debt collector is trying to collect more than one debt from you, the collector must apply any payment you make to the debt you select. Equally important, a debt collector may not apply a payment to a debt you dont think you owe. Can a debt collector garnish my bank account or my wages? If you dont pay a debt, a creditor or its debt collector generally can sue you to collect. If they win, the court will enter a judgment against you. The judgment states the amount of money you owe, and allows the creditor or collector to get a garnishment order against you, directing a third party, like your bank, to turn over funds from your account to pay the debt. Wage garnishment happens when your employer withholds part of your compensation to pay your debts. Your wages usually can be garnished only as the result of a court order. Dont ignore a lawsuit summons. If you do, you lose the opportunity to fight a wage garnishment. Can federal benefits be garnished? Many federal benefits are exempt from garnishment, including: Social Security Benefits Supplemental Security Income (SSI) Benefits Veterans Benefits Civil Service and Federal Retirement and Disability Benefits Service Members Pay Military Annuities and Survivors Benefits Student Assistance Railroad Retirement Benefits Merchant Seamen Wages Longshoremens and Harbor Workers Death and Disability Benefits Foreign Service Retirement and Disability Benefits Compensation for Injury, Death, or Detention of Employees of U.S. Contractors Outside the U.S. Federal Emergency Management Agency Federal Disaster Assistance But federal benefits may be garnished under certain circumstances, including to pay delinquent taxes, alimony, child support, or student loans. Do I have any recourse if I think a debt collector has violated the law? You have the right to sue a collector in a state or federal court within one year from the date the law was violated. If you win, the judge can require the collector to pay you for any damages you can prove you suffered because of the illegal collection practices, like lost wages and medical bills. The judge can require the debt collector to pay you up to $1,000, even if you cant prove that you suffered actual damages. You also can be reimbursed for your attorneys fees and court costs. A group of people also may sue a debt collector as part of a class action lawsuit and recover money for damages up to $500,000, or one percent of the collectors net worth, whichever amount is lower. Even if a debt collector violates the FDCPA in trying to collect a debt, the debt does not go away if you owe it. What should I do if a debt collector sues me? If a debt collector files a lawsuit against you to collect a debt, respond to the lawsuit, either personally or through your lawyer, by the date specified in the court papers to preserve your rights. Where do I report a debt collector for an alleged violation? Report any problems you have with a debt collector to your state Attorney Generals office ( http://800notes.com/awl/nb/r.ashx?ue=8yZy9mLnFWYu5yd3d3LvoDc0RHa ) and the Federal Trade Commission ( http://www.ftc.gov/ ). Many states have their own debt collection laws that are different from the federal Fair Debt Collection Practices Act. Your Attorney Generals office can help you determine your rights under your states law. For More Information To learn more about debt collection and other credit-related issues, visit www.ftc.gov/credit and MyMoney.gov, the U.S. governments portal to financial education. The FTC works for the consumer to prevent fraudulent, deceptive, and unfair business practices in the marketplace and to provide information to help consumers spot, stop, and avoid them. To file a complaint or to get free information on consumer issues, visit ftc.gov or call toll-free, 1-877-FTC-HELP (1-877-382-4357); TTY: 1-866-653-4261. The FTC enters consumer complaints into the Consumer Sentinel Network, a secure online database and investigative tool used by hundreds of civil and criminal law enforcement agencies in the U.S. and abroad. February 2009

File FTC complaints at 877 382 4357. Try to get a live person if possible. File a complaint every time these idiots call you. The more calls the FTC gets the better the chance they will do something. Send Dateline NBC an e-mail about your plight. Enough stories from the public may encourage them to do a story on this company for all to see!

Fight Back!

This report was posted on Ripoff Report on 09/17/2009 05:01 PM and is a permanent record located here: https://www.ripoffreport.com/reports/allied-interstate/internet/allied-interstate-intellirisk-collections-vikas-kapoor-president-and-ceo-they-have-been-c-496613. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#2 Consumer Comment

those idiots did the same thing to me

AUTHOR: msmontecarlo - (USA)

SUBMITTED: Thursday, March 10, 2011

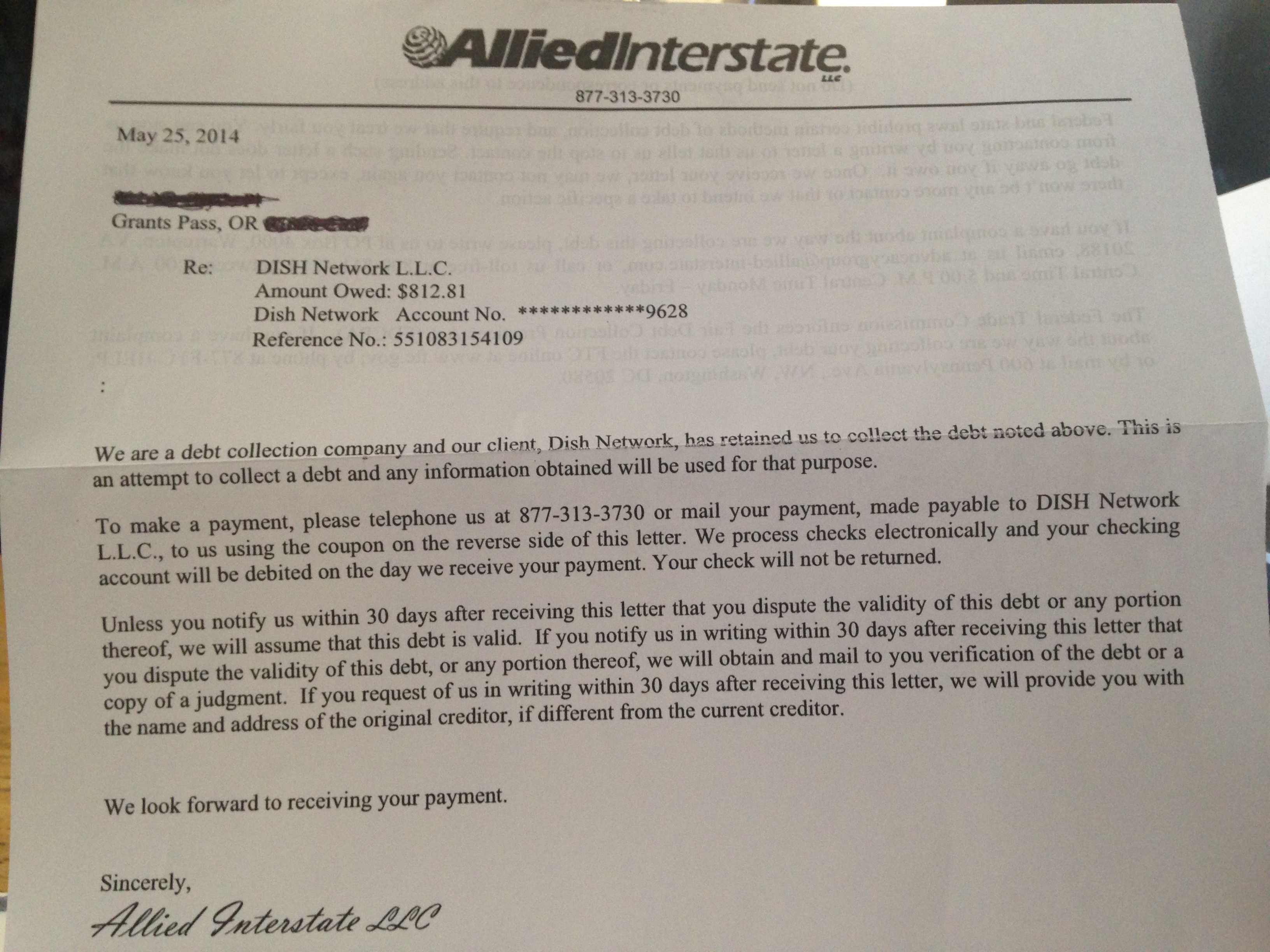

This agency did the same thing to me so I sent them a cease commuications letter certified return receipt after they got the letter they never called again. Send the letter but keep a copy to yourself. Calling twice a day or more I consider harrassment.

If I had call reject on my phone when they called I would of used it

#1 General Comment

For Help

AUTHOR: BuckeyeLuv - (United States of America)

SUBMITTED: Thursday, March 10, 2011

You can contact their Consumer Advocacy Group at 800-811-4214 or email advocacy.group@iqor.com If you are in Cananda, you can call 888-804-8198 or email omb@iqor.com. Hope this helps!

Advertisers above have met our

strict standards for business conduct.