Complaint Review: Allied Interstate - New York New York

- Allied Interstate PO Box 5017 New York, New York U.S.A.

- Phone:

- Web:

- Category: Collection Agency's

Allied Interstate ripoff New York New York

*Consumer Suggestion: Pull your credit and see what's on it

*Consumer Suggestion: Pull your credit and see what's on it

*Consumer Suggestion: Utterly amazing!

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

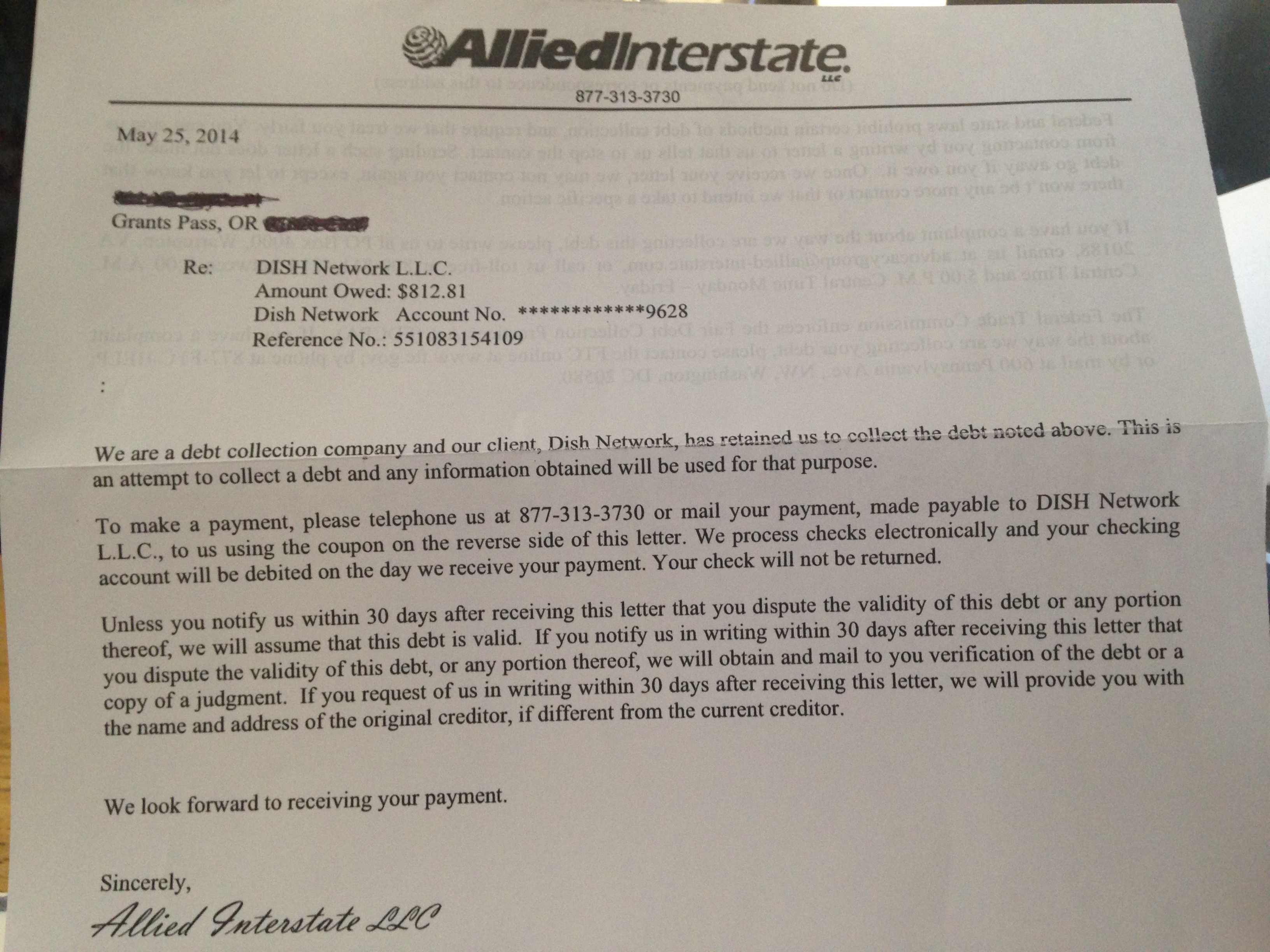

Today was the first day that I actually talked to someone from Allied Interstate Inc. I was told that they were attempting to collect a debt I had from a company.

When she told me what it was for, it put a red flag up immediately. I knew that the company she was claiming I owed money to, I did not owe money to.

She asked me for my credit card number or my checking account number so they could process the money immediately. I told her that I did not have a credit card or checking account (both lies) and she asked for my spouse's information.

I told her that I wasn't married and she was like "oh". I asked for a phsyical address so that I may send a money order. She gave it to me hesitantly and asked when she could expect the money.

I told her that I would send payment out immeidately. Well then I came on here and found all kinds of complaints about them and plan to not send the money.

I also noted that I have NEVER received a letter from them stating I had collections, nor from the alleged company I owe money to. I would not send my money to them because I know that this ia a fradulent claim and I plan to dispute it.

Amanda

Beaver Dam, Wisconsin

U.S.A.

This report was posted on Ripoff Report on 10/19/2005 11:56 AM and is a permanent record located here: https://www.ripoffreport.com/reports/allied-interstate/new-york-new-york/allied-interstate-ripoff-new-york-new-york-161316. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#3 Consumer Suggestion

Pull your credit and see what's on it

AUTHOR: Joe - (U.S.A.)

SUBMITTED: Friday, October 21, 2005

Amanda,

I've responded to others on this company...I would suggest (like others have on other responses) to pull your credit on all 3 major bureaus (Equifax, Experian, TransUnion) immediately to see what you owe and to whom.

On there should be contact information for each line item as to who or how to contact for further information about the item showing up. If it isn't there, you can call the particular bureau directly who's reporting it for that information.

Sometimes, they won't have it. If they don't, then dispute it, and they are required to remove the item from the credit bureau within 30 days if they cannot make contact or get no response from that creditor. If Allied Interstate legitimately bought a collection from someone you owed money to, it should show up on your credit bureau most times. If it's not there, then it's not impacting your credit or they are scamming you...either way I wouldn't send money unless a court order told me to. That's also unlikely.

If the collection is nearing 7 years, it will drop of the bureau automatically. Some collectors buy old collections, then try to collect them again as if they are new and report them as new on the bureau. This is illegal and subject to serious penalties. Report it to the bureaus also and the state attorney general.

If you legitimately owe money...or went bad on a debt, that creditor may have sold it to Allied for a fraction of what was owed.

See my other response as to how to make settlements and otherwise get the items off of your credit...just do a search for this company and you will see a more recent article.

#2 Consumer Suggestion

Pull your credit and see what's on it

AUTHOR: Joe - (U.S.A.)

SUBMITTED: Friday, October 21, 2005

Amanda,

I've responded to others on this company...I would suggest (like others have on other responses) to pull your credit on all 3 major bureaus (Equifax, Experian, TransUnion) immediately to see what you owe and to whom.

On there should be contact information for each line item as to who or how to contact for further information about the item showing up. If it isn't there, you can call the particular bureau directly who's reporting it for that information.

Sometimes, they won't have it. If they don't, then dispute it, and they are required to remove the item from the credit bureau within 30 days if they cannot make contact or get no response from that creditor. If Allied Interstate legitimately bought a collection from someone you owed money to, it should show up on your credit bureau most times. If it's not there, then it's not impacting your credit or they are scamming you...either way I wouldn't send money unless a court order told me to. That's also unlikely.

If the collection is nearing 7 years, it will drop of the bureau automatically. Some collectors buy old collections, then try to collect them again as if they are new and report them as new on the bureau. This is illegal and subject to serious penalties. Report it to the bureaus also and the state attorney general.

If you legitimately owe money...or went bad on a debt, that creditor may have sold it to Allied for a fraction of what was owed.

See my other response as to how to make settlements and otherwise get the items off of your credit...just do a search for this company and you will see a more recent article.

#1 Consumer Suggestion

Utterly amazing!

AUTHOR: Dawn - (U.S.A.)

SUBMITTED: Wednesday, October 19, 2005

She got right down to business didnt she? Talk about the direct approach. You did the right thing by not telling her any of your financial information. NEVER give credit/debit cards and checking account information to a JDB they will only use it to drain your account and the time spent recouping your money will take much longer than it took for you to give it to them. Have they ever sent you anything in writing at all? If not, they have violated the FDCPA law. Pull your credit report and see whats on it. If they are collecting for a recent (within past 7 years) debt it should be there if not, you can request that they send you the bill they claim you owe in writing (key word "in writing"), if they send it, dispute/validate, JDB's dont take to kindly to consumers who are getting more and more educated about what their rights are. They are quick to call and say you owe this or that, and have the nerve to ask for financial credentials? Thats insulting. I say prove it, if I owe it, prove it. If Jesus isnt standing by my phone with me nodding his head saying "its true", I am not believing any CA/JDB. Get anything they say in writing, that way when you update with the CRA's you have documentation.

Advertisers above have met our

strict standards for business conduct.