Complaint Review: Allied Interstate - Plymouth Minnesota

- Allied Interstate 12755 Hwy 55, Suite 300 Plymouth, Minnesota United States of America

- Phone:

- Web:

- Category: Collection Agency's

Allied Interstate Possibly Collecting Money I don't need to pay?!?! Plymouth, Minnesota

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

I've run into some trouble defaulting on my loans and have been contacted by Allied. I'm considering my options and trying to figure out what to do ASAP and have been troubled by some things I've read through this site when I was doing research to figure out what I could do. I'm worried now that:

1- I don't need to pay anything off and it's pointless to do so as my debt has possibly simply been sold off from my original debtor and now doesn't need to be paid in theory

2- Anything I pay to Allied wouldn't even be affecting/applied to my original debtor

My situation is potentially different though than those that I have read about as it regards my STUDENT LOANS. I will outline my situation and hope for some help, clarification, direction and understanding from anyone out there.

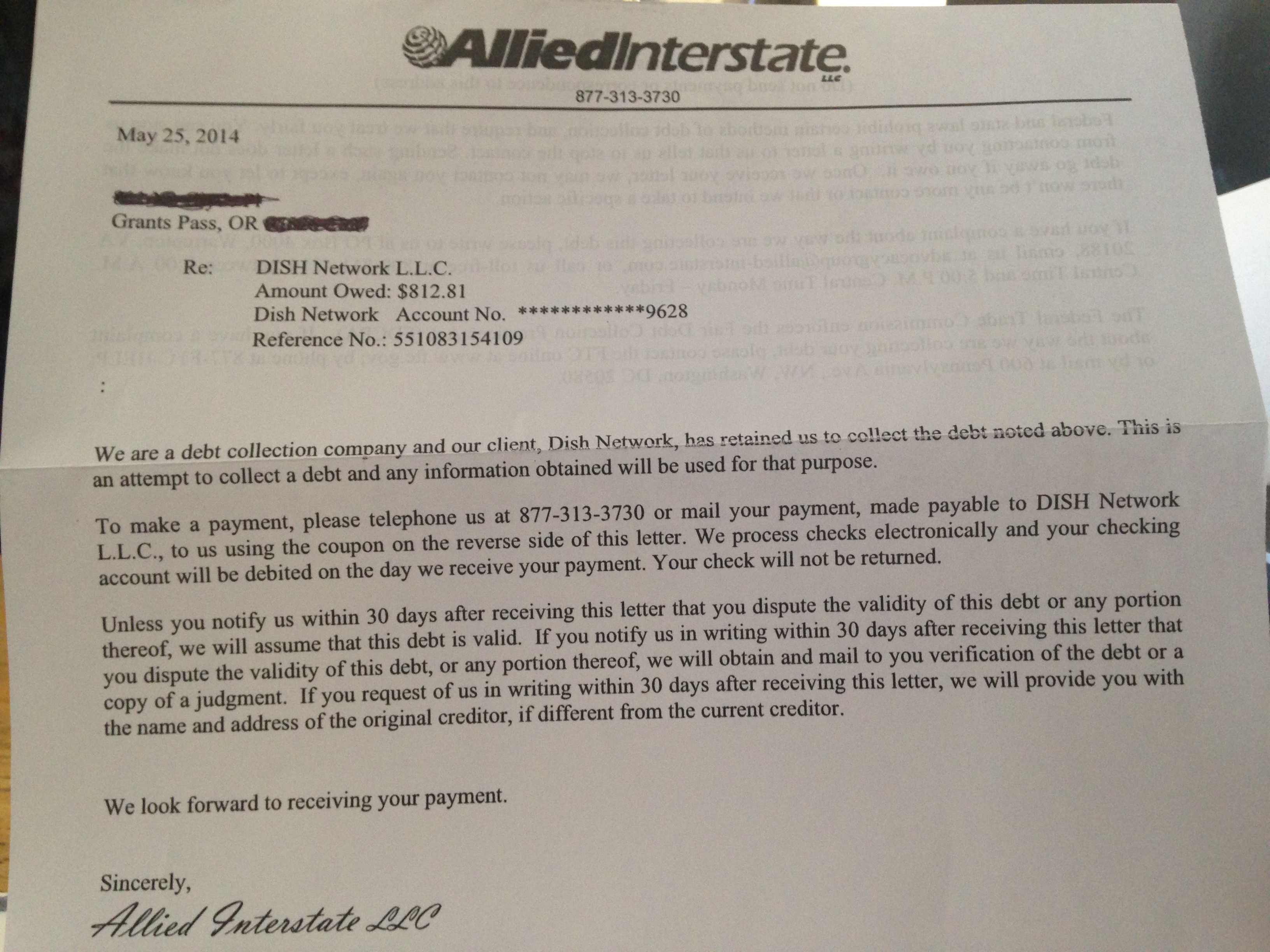

The long story short of my situation is that I had a handful of Federal loans (half subsidized, half unsubsidized) that were consolidated to total about $12,000, and a private loan for about $15,000 through Sallie Mae. Well, they've been put into default and are now in the hands of Allied Interstate.

There's one potential blessing in that I've received a letter that says I can settle the private loan for around $11,000 paid in full by the end of the month. This is a pretty good deal considering it's less than I borrowed. Someone suggested I contact Sallie Mae directly and try to negotiate a deal with them for even less as that $11,000 includes a cut for Allied and Sallie Mae might very well strike a deal directly that would be cheaper for me and in turn mean more for them, but I don't know if they would even do something like that.

My bigger concern is the federal loans being defaulted. Sparing you all the details, this whole thing was a total surprise to me cause I signed up for an economic hardship deferral program which was supposed to put all my payments on hold for my federal loans and even have the government still picking up the interest tab for the time being. Them being defaulted on is a concern because Allied called me and I mentioned this program and they claim "there is no such program". I know I've lost out on forbearance and deferment privileges by being in default, but this deferment I'm talking about is not the one I could pay $50 for 6 months at a time, but an automatic one because I don't make enough money. I've also stumbled on something about IBR (income based repayment program) which I don't think I'll now qualify for either.

Let me also note here that Sallie Mae still has record of my private loan on file, but the federal loans have been shown to be paid in full and out of their system, so they can no longer do ANYTHING with those. They were passed to USA funds, but their system now directs me to contact Allied as well and there's nobody I can talk to regarding it.

I only work part time and make less than $10,000 a year as far as factoring in for repayment abilities go. The idea for cutting a deal and paying off the loan would require me to have a family member pay it and me just pay them back to get all this off my credit and if I'm gonna be paying interest and whatnot I might as well give it to them. Also, it would eliminate any unavoidable extraneous fees that would be tacked into my loans through the Collection Agency. They threatened to go through wage garnishment if I don't work with them to set up a payment plan.

I received a letter a few weeks ago that wage garnishment was going to start if I didn't contest it and be paid to Pioneer Credit Recovery (from Arcade, NY) on behalf of USA Funds for my federal loans. The calls I'm receiving from Allied are regarding these same loans, so it's kind of interesting/confusing that Pioneer is garnishing my wages and Allied is calling me saying that they will put that through. Anyhow, it said they could take up to 15% or the maximum allowed. Well, I make about $225 a week gross and about $150 after taxes and deductions. The wage garnishment they have been allowed to take out only comes to $1.72 a paycheck! That's got to mean something with respect to my financial position as a bargaining tool to cut a deal because of how little I'm legally considered to be able to pay..

Please offer me any advice you can as I don't want to make a wrong move. I feel like I have an opportunity to make something positive come from this negative situation and am believing for that to happen.

This report was posted on Ripoff Report on 05/25/2011 12:15 AM and is a permanent record located here: https://www.ripoffreport.com/reports/allied-interstate/plymouth-minnesota-55441/allied-interstate-possibly-collecting-money-i-dont-need-to-pay-plymouth-minnesota-732862. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

Advertisers above have met our

strict standards for business conduct.