Complaint Review: Allied Interstate - West Palm Beach Or Colombus Florida

- Allied Interstate 3111 South Dixie Highway Or Po Box West Palm Beach Or Colombus, Florida U.S.A.

- Phone: 866-825-4570

- Web:

- Category: Collection Agency's

Allied Interstate ripoff shady business and deceptive West Palm Beach Florida

*Consumer Suggestion: YOU WERE CORRECT IN NOT ANSWERING ANY COLLECTION AGENCY QUESTIONS - SEE BELOW

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

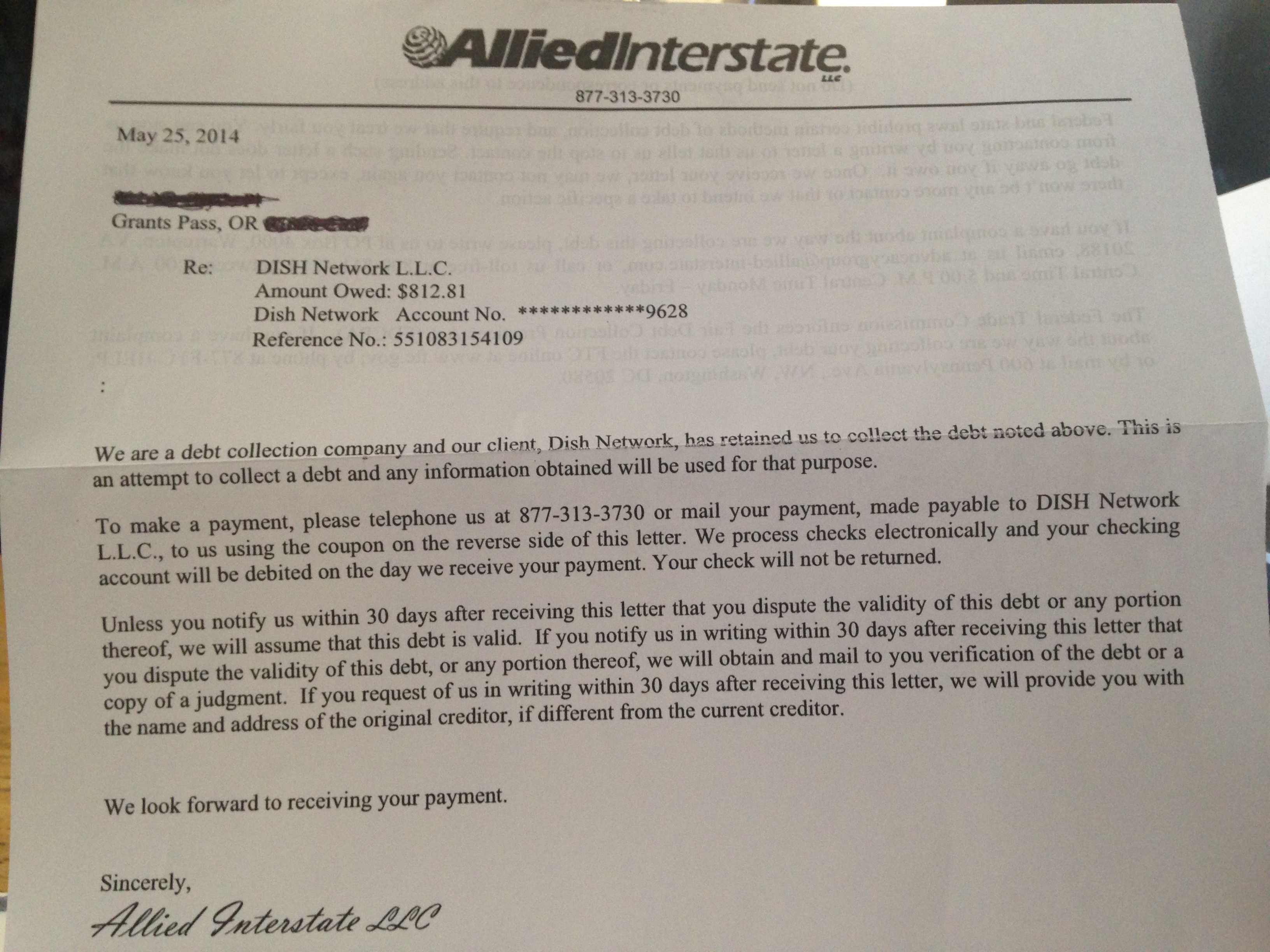

received a call stating i owe them $802.88, and if i give them $200.00 by 5:00pm eastern time it will go away. I was told i owed money and possibly dates back 5 or more years they wern't sure and they bought my alleged debt in september of 2006. I was then asked on 01-18-07 if i had dependants or if i was married after they spoke to my wife and if i was employed. I didnt answer them but what does that have to do with collecting on a debt. I asked for there address was given one for colombus ohio. i contacted the BBB of colombus and when i gave the name they immediatley stated they are in florida and was given all the information. I find this business very shady and filed a complaint with the state of california attorney general office and the BBB of west palm beach florida which co-incidently has numerous complaints against allied interstate. I was wondering how a collection agency can get away with how they treat people. I may have resolve this dispute today. I'm still angry and aggrevated by the system.

Jeff

roseville, California

U.S.A.

This report was posted on Ripoff Report on 01/18/2007 12:31 PM and is a permanent record located here: https://www.ripoffreport.com/reports/allied-interstate/west-palm-beach-or-colombus-florida-33405/allied-interstate-ripoff-shady-business-and-deceptive-west-palm-beach-florida-231263. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#1 Consumer Suggestion

YOU WERE CORRECT IN NOT ANSWERING ANY COLLECTION AGENCY QUESTIONS - SEE BELOW

AUTHOR: P - (U.S.A.)

SUBMITTED: Thursday, January 18, 2007

Another consumer advocate budd hibbs budhibbs.com has them listed on his site too. I have cut and pasted his information regarding them for you and also some recommendations taken off the web in dealing with agencies. the SOL has expired on the account ...

Allied Interstate, Inc.*

435 Ford Rd. #800

Minneapolis, MN 55426-1066

Phone: (952) 546-6600

Fax: (952) 595-2311

Web Address: www.irmc.com

Head Debt Collectors:

Part of the Intellirisk Companies

Vikas Kapoor, President & CEO

Randy Christofferson, Chairman of the Board

Norman Merritt, CFO

ALLIED INTERSTATE, INC.(BAD REPUTATION!)

Jeff Swedberg, President

Jim Pond, Senior Vice President

55 N. Arizona Place, #505

Chandler, AZ 85225

Phone: (480) 722-7810

Fax: (480) 782-7001

5062 N 19th Ave Ste 102

Phoenix, AZ 85015-3225

Phone: (602) 841-4332

Fax: (602) 841-7388

31229 Cedar Valley Dr

Westlake Village, CA 91362-4036

Phone: (818) 575-5400

3111 S Dixie Hwy Ste 101

West Palm Beach, FL 33405-1520

Phone: (561) 671-2121

Fax: (561) 671-2165

340 Interstate North Pkwy SE

Ste 140

Atlanta, GA 30339-2201

Phone: (770) 989-5700

Fax: (770) 989-5724

7103 Chancellor Dr., Suite 100

Cedar Falls, IA 50613

Phone: (561) 671-2152

Fax: (561) 671-2165

5910 Shingle Creek Pkwy.

Brooklyn Cntr, MN 55430-2322

Phone: (763) 503-6595

Fax: (763) 585-7881

435 Ford Rd Ste 800

Minneapolis, MN 55426-1066

Phone: (952) 546-6600

Fax: (952) 595-2311 13777

Ballantyne Corporate Pl

Ste 200

Ballantyne Corporate Pk.

Charlotte, NC 28277-3425

Phone: (704) 943-1000

Fax: (704) 943-1053

3200 Northline Ave Ste 135

Greensboro, NC 27408-7616

Phone: (336) 333-3100

Fax: (336) 373-4442

15 Hazelwood Dr., Suite 102

Amherst, NY 14228

Phone: (716) 691-1320

Fax: (716) 691-3534

1979 Marcus Ave Ste 100

New Hyde Park, NY 11042-1002

Phone: (516) 437-0800

Fax: (516) 437-6121

3070 Lawson Blvd

Oceanside, NY 11572-2711

Phone: (516) 561-6552

Fax: (516) 561-6548

3000 Corporate Exchange Dr.

Columbus, OH 43231

Phone: (614) 901-7988

Fax: (614) 901-7794

12655 N Central Expy, Suite 925

Dallas, TX 75243-1700

Phone: (972) 934-8448

Fax: (972) 404-1611

14550 Torrey Chase, Suite 550

Houston, TX 77014

Phone: (281) 580-2000

Fax: (281) 580-0396

Bud Says...

This company is a class action lawsuit waiting to happen. Sloppy record keeping, failure to validate at every level, under-trained, uneducated collectors SEVERELY lacking in Fair Debt Collection Practices Act training.

Intellirisk must be making BIG bucks in collecting because they sure don't spend it to insure they comply with the laws. Student loans with these idiots is a nightmare. Most Allied collector's don't have a clue in handling even the most basic of consumer complaints. Loans that have been paid, in the wrong names and outdated credit bureau reporting are fast targets for lawsuits because Allied is unable or unwilling to respond.

If you receive a collection notice from Allied DISPUTE IT! Even though you will never receive a reply, it is important that you use the law to your advantage. Allied aptly fits the saying; "the right hand hasn't a clue what the left hand is doing" Brain-Dead! Idiots! Untrained!

May I state again....THANK GOD FOR THE FAIR DEBT COLLECTION PRACTICES ACT!! Someone in Washington must have had a dream about companies like Allied to enact the law. THANK YOU! THANK YOU!

WATCH YOUR WALLET, YOUR CHECKBOOK AND YOUR CREDIT CARDS WHEN DEALING WITH THESE SLIPPERY CONS OF THE COLLECTION WORLD, THEY WILL EMPTY YOU OUT!

Tell them to validate by

. What the money you say I owe is for;

Explain and show me how you calculated what you say I owe;

Provide me with copies of any papers that show I agreed to pay what you say I owe;

Provide a verification or copy of any judgment if applicable;

Identify the original creditor;

Prove the Statute of Limitations has not expired on this account

Show me that you are licensed to collect in my state

Provide me with your license numbers and Registered Agent

1. NEVER talk to a collection agency on the phone. Period.

2. Keep good records. This can be the difference between a good and bad settlement. Don't expect them to remember you or what you agreed upon.

3. Send all correspondence via registered mail, receipt requested and put the registered mail number ON THE LETTER.

4. Keep a copy of every letter you send.

5. Penalties and extra interest are typically fictious amounts of money added on by the collection agency to pad their profits. Sometimes as much as to 50% of the debt or more claimed to be owed by a collection agency consisting of interest and fees. This is illegal, every state has usery laws (which dictate the maximum interests allowed to be charged. That is except North Dakota. There are no such laws which is why most credit card companies incorporate there.) Junk debt buyer pay anywhere from 1 cent to 7 cents on the dollar, there is no way there is this much interest.

6. Time is on your side. As time passes, the creditors will likely stop calling and the debt will be filed away for future attention or until the SOL runs out ..

Tell them to provide the following:

What the money they say you owe is for;

Explain and show me how they calculated what they say you owe;

Provide copies of any papers that show you agreed to pay what they say you owe;

Provide a verification or copy of any judgment if applicable;

Identify the original creditor;

Prove the Statute of Limitations has not expired on this account

Show that they are licensed to collect in my state

Provide your license numbers and Registered Agent

The agency has 30 days to provide the proper documentation as requested in the letter.

STATUTES OF LIMITATIONS

Collectors only have a certain amount of time to sue you for payments. The first thing you should do is determine if the statute of limitations for collecting a debt in your state have past. If the debt is older than the statute of limitations, tell the bill collectors they are wasting their time by harassing you for an uncollectable debt, as the original creditor or the assigned collection agency cannot take you to court to get a judgement. To see the time limitations on the different kinds of debt

1. NEVER talk to a collection agency on the phone. Period. Send the validation letter via registered mail return receipt requested. ***DO NOT SIGN THE LETTER *** Type your name. CA's have been known to forge signatures on documents to re-age the accounts.

2. If you feel you must negotiate with a collection agency Get your terms in writing before you pay. DO NOT PAY ANY AMOUNT FROM YOUR PERSONAL/BUSINESS CHECKING ACCOUNT. OBTAIN A CERTIFIED CHECK OR MONEY ORDER FROM A BANK WHERE YOU DO **NOT** DO BUSINESS. CA's have been known to try to attach more than you agreed to. Everything must be in writing and, even then, you will probably have to fight to make the creditor live up to his end of the bargain.

3. Keep good records. This can be the difference between a good and bad settlement. Don't expect them to remember you or what you agreed upon.

4. Send all correspondence via registered mail, receipt requested(about $3-$4 a letter).

5. Keep a copy of every letter you send.

6. Penalties and extra interest are typically fictious amounts of money added on by the collection agency to pad their profits. Sometimes as much as to 50% of the debt or more claimed to be owed by a collection agency consisting of interest and fees.

7. Time is on your side. As time passes, the creditors will likely stop calling and the debt will be filed away for future attention. The longer the debt remains uncollected, the better your chances will be of getting a good settlement. Eventually, the creditor will consider the bad debt a loss in order to receive a corporate tax write-off. This does not necessarily mean that they won't pursue you for the debt. The corporation may then collect on the debt themselves, sell or assign the debt to a collection agency, press for a judgment

Advertisers above have met our

strict standards for business conduct.