Complaint Review: Ally Bank - Internet

- Ally Bank Internet United States of America

- Phone:

- Web: http://ally.com

- Category: Banks

Ally Bank Ally bank doesn't disclose that they run a credit report on you when you try to open an account Internet

*Consumer Comment: Consequences of your actions

*Consumer Comment: In addition...

*Consumer Comment: LEARN TO READ

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

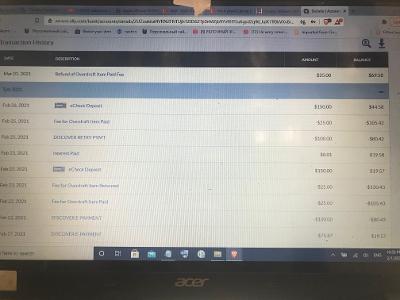

This is what I wrote to Ally after they denied me for a checking account for my credit. They never disclosed they were checking my credit, and what bank denies you for that anyways? I advise not to waste your time applying with them, see below:

I am extremely unhappy with your institution for denying me for my credit score. You are the first bank to do that. I am working to repair it and when I do I won't be reapplying. I needed a solution to Bank of America and you apparently aren't it. I'm very dissatisfied and will be putting out reviews so people can save their time and not apply with you. You should have made it VERY CLEAR on the application that I might be wasting my time for 2 weeks waiting to find out you denied me and why. Ally Bank, thank you for wasting my time.

This report was posted on Ripoff Report on 02/18/2012 12:14 PM and is a permanent record located here: https://www.ripoffreport.com/reports/ally-bank/internet/ally-bank-ally-bank-doesnt-disclose-that-they-run-a-credit-report-on-you-when-you-try-to-841376. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#3 Consumer Comment

Consequences of your actions

AUTHOR: coast - (USA)

SUBMITTED: Saturday, February 18, 2012

This isn't just about credit. Your history of bad checks has caught up to you.

"I won't be reapplying"

It's unlikely that you are welcome to reapply.

#2 Consumer Comment

In addition...

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Saturday, February 18, 2012

As stated by the previous person they did disclose it you just failed to read.

As for your other comments.

and what bank denies you for that anyways?

- They do...and you will find more and more banks and Credit Unions doing this.

Believe it or not Banks are a business not a charity. I would bet that the story behind you wanting to find another bank other than BofA is an interesting one.

Perhaps you had a few overdrafts. Perhaps you even had a negative account balance and they closed your account. I even bet that you think it wasn't your fault.

If this is even remotely the case, I can almost guarantee you that you are in ChexSystems. This is basically a Database used by Banks to see if you owe money to other banks. If you are in ChexSystems you will find that no "main" bank will allow you to open an account. After all if you "stiffed" another bank what makes them think you won't do it to them also.

If this is it the result is that you are going to have to deal with Bank of America to get it cleared up. If you don't then for the next several years you are going to be stuck with either Sub Prime(Second Chance) banks that don't look at ChexSystems or your credit, PrePaid Debit Cards, or your Mattress.

And if you thought BofA was bad or had high fees just wait until you deal with Second Chance Banks or PrePaid debit cards.

Oh and be careful about banks that allow you to open the account. Because you also agree to allow them to check your credit periodically. So at any time they may decide that they no longer want you as a customer. Unfortunately if you have money in the account they will freeze it to make sure you have no outstanding transactions and it may be a 7-10 days before they actually return your money.

#1 Consumer Comment

LEARN TO READ

AUTHOR: Nancy - (U.S.A.)

SUBMITTED: Saturday, February 18, 2012

i went to the ally bank sight. They Do disclose it. YOU just have to READ it.

A. Our Agreement

When we say Ally, it means Ally Bank. If you see the words we us or our, we are talking

about Ally Bank. When you see the words you and your, we mean each person who owns an

account or a trustee who can manage an account. When you see the word Agreement, we are

referring to this Deposit Agreement.

B. Account Basics

1. Opening an Account

For All Accounts: Anyone who is a citizen or a legal permanent resident of the United

States (U.S.), is at least eighteen (18) years old and has a Social Security number and

U.S. address (not just a P.O. box) can open an account.

Additional Rules for Interest Checking Accounts: Interest Checking accounts are only

available to consumers for personal, family and household purposes. You may not use an

Ally checking account that earns interest for business purposes.

Credit Reports and Other Inquiries: We may use credit reports or other information from

third parties to help us determine if we should open your account.

Advertisers above have met our

strict standards for business conduct.