Complaint Review: America's Home Loan Corporation - Marietta Georgia

- America's Home Loan Corporation 1360 Powers Ferry Road, Suite C100 Marietta, GA 30067 Marietta, Georgia U.S.A.

- Phone: 678-3689398

- Web:

- Category: Brokerage Companies

America's Home Loan Corporation Unfair Business Practices ripoff Marietta Georgia

*REBUTTAL Owner of company: Response to complaint

*REBUTTAL Owner of company: Response to Complaint

*Consumer Comment: I have had similar issues with them

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

For the purpose of my complaint, Argent Mortgage Company LLC located at 44 South Broadway, 16th Floor White Plains, NY 10604 1-866-345-6334 and Fax 1-800-396-2158 will be referred to simply as Argent Mortgage.

For the purpose of my complaint, mortgage brokers: Todd Van Ee and Rob Patti of America's Home Loan Corporation located at 1360 Powers Ferry Road, Suite C100 Marietta, GA 30067 1-678-368-9398 and fax 1-775-295-5385, will be referred to collectively as AHLC.

My complaint comprises of the following statements:

I. Argent Mortgage has caused, encouraged, or permitted AHLC to commit unfair and misleading acts in order to induce myself in entering mortgage transactions for my property located at 3729 SW 15th Street, Gainesville, FL 32608.

II. Argent Mortgage has committed unfair and misleading acts in order to induce myself in signing new loan documents subsequent to already closing a mortgage loan with Argent Mortgage, including making fictitious guarantees.

Several weeks prior to closing a loan with another mortgage company, AHLC contacted me and informed me I could save much more money on a home loan if I applied through their office. Representatives of AHLC told me that only their office could offer rates and terms that are favorable to persons of my credit standing. Within the course of several weeks, AHLC engaged me into a mortgage loan with Argent Mortgage.

AHLC used unfair tactics such as bait and switch, offering me appealing terms at the time of application, however switching them at the time of closing. These terms include but are not limited to: higher note and annual percentage rates than previously offered, the presence of pre-paid penalties and terms not mentioned in previous documents or revealed in TILA disclosures.

AHLC also told me that I would be able to obtain a much more favorable refinance within twelve months. However, due to the loan's 36-month prepayment penalty, I would in fact not.

AHLC misrepresented the terms of the adjustable rate provision in loan xxxxxxxxxx-9607. Failing to describe how the loan would in fact adjust, I was unaware of the variable rate feature included with my loan until closing. Upon contacting AHLC by telephone after the closing, AHLC mentioned, Yes, we did tell you the rate terms were fixed, fixed for three years.

AHLC fabricated a stated income amount to maintain my eligibility for the loan, and instructed me to sign off on the amount so I may be approved for the loan.

AHLC denounced the integrity of the Truth in Lending document and told me to ignore the unfavorable rate and cost figures it contained.

AHLC failed to notify me of the possibility of purchasing points to lower or curve my annual percentage rate.

William

Gainesville, Florida

U.S.A.

This report was posted on Ripoff Report on 01/15/2007 11:18 PM and is a permanent record located here: https://www.ripoffreport.com/reports/americas-home-loan-corporation/marietta-georgia-30067/americas-home-loan-corporation-unfair-business-practices-ripoff-marietta-georgia-230766. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

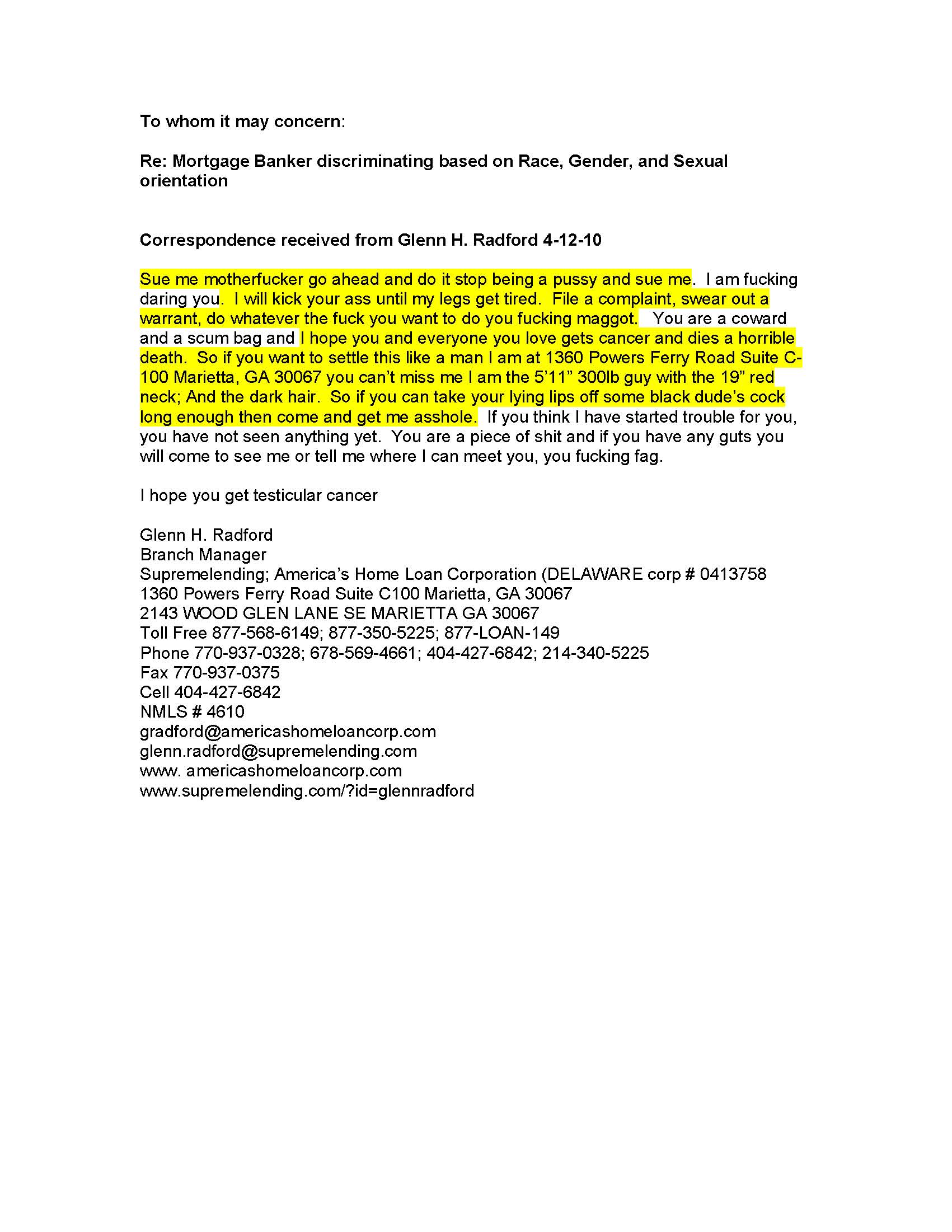

#3 REBUTTAL Owner of company

Response to complaint

AUTHOR: Glenn Radford - (U.S.A.)

SUBMITTED: Thursday, May 14, 2009

Tom and his wife received their paperwork to do a loan and they took 2 months to return it. The entire time we were asking for his wife's social security card. it took two months to take care of this we finally closed their loan and when we went to do the streamline as we promised they were behind on their mortgage and did not qualify for a loan. If they were having problems making their mortgage payments they should have called us so we coould have started the process sooner or secured bridge financing so they would not have had the late payment the deliquent payment lowered thier credit scores to a point we were unable to secure a streamline refinance from the 11 lenders we deal with. As I remember the documents were signed and the payment had been disclosed and if he was unhappy with us as per Federal law he could have rescinded the loan at no cost to him whatsoever.

#2 REBUTTAL Owner of company

Response to Complaint

AUTHOR: Glenn Radford - (U.S.A.)

SUBMITTED: Thursday, May 14, 2009

I never received a call from this customer. His problem was with how Argent Mortgage handled his loan. There was nothing unfair nor dishonest about his loan and ultimately the customer had a 3 day right of recission on the loan if he was truly unhappy he would have executed it. I was 2 years after the loan was done that a letter was sent to us and basically the entire problem was with Argent funding and how they serviced the loan. We explained everything to the State of Florida and in the judgenent of the state we did nothing wrong. We were not sanctioned, reprimanded, fined or given any negative rating whatsoever from the State of Florida. Furthermore these loan officers are not with my company any longer and ultimately the customer had a 3 day right to cancel the loan for any reason he was fully aware of this right to cancel the loan for any reason with out any penalty whatsoever and he ultimately choose to keep the loan he had with us.

#1 Consumer Comment

I have had similar issues with them

AUTHOR: Tom - (U.S.A.)

SUBMITTED: Tuesday, January 06, 2009

My broker's information is:

Wes Hendrix

Senior Loan Officer

America's Home Loan Corp.

(Cell) 404-934-4935

(Toll Free) 888-405-7822

(Office) 678-569-4667

(Fax) 678-374-4888

He told me that I would be able to adjust my mortgage for a lower rate whenever the rate adjusted for the low amount of just a couple hundred dollars.

He said that by getting the FHA loan, I could streamline it anytime the rates went down.

He said that they would save me money, and that this was the best possible loan that I could get.

They did the bait and switch where he told me it would be 2100 a month, then when the notary comes with the final papers to sign, magically it is 2800.

He then tries to convince me that somehow this is my best option, and it is because it includes insurance, which my house only costs 700 a year to insure, and taxes, which are less than $3000 a year.

So, I do not understand how that adds up to the extra 700 a month. 700*12=8400.

Anyway, he tells me to trust him, and he will make sure to streamline the loan as soon as possible, and because of my credit situation, nobody else would help me, and that they are the only ones that could give me a loan.

I made the mistake of trusting him.

As soon as the rate adjusted, I tried to contact him, to streamline my loan.

He did not return calls, or emails.

The rate adjusted downwards 3 times more before he contacted me.

Then he said that he could streamline my loan for me.

So I said ok, please do it.

He asked me for all kinds of paperwork, then it took us a couple of months to get everything together, and get the estimates from him, etc...

He once again tells me that it will be $2100 a month.

When I get the paperwork, it is with a new bank, including all kinds of fees, and pre-payment penalties.

I ask him for the reasoning behind changing banks, when I was told that because of the type of loan that I have I would just have to pay a small fee, and my current lender would adjust the rate.

He told me to trust him, and that the current lender would not be able to do my loan, because of changes in the laws.

I made the mistake of trusting him once again.

He got all of the paperwork that he asked me for, and assured me that someone would be at my home that night to sign, and lower my rate.

Nobody showed up.

I contacted him, to ask him why the person did not show up.

He did not even reply to me for 3 days.

When he replied, he told me that he did not know why they did not show up, and said that this would be taken care of, within the week.

He then sent paperwork back saying that the bank wanted us to re-sign a paper because there was not a date next to a name.

The new document said $2600 a month.

I signed and faxed the document back.

He then stopped contacting me for weeks.

I sent him an email telling him that I was upset with the way he did business.

This was the only thing that caused him to respond to me.

His response was "Good luck getting a loan".

I contacted his boss, and his boss said that the reason that the bank did not show up, is that I did not send a copy of my social security card.

I have email proof that I did.

I did not end up getting refinanced, and am still stuck in the initial loan that I got through them.

I have talked to others that state that nothing that he told me about this is true, and that the original lender could have modified the loan.

I believe based on my experience that they lie to you, convince you that they are the best place to go, that nobody else will do your loan, and then stick you with the highest bill.

Advertisers above have met our

strict standards for business conduct.