Complaint Review: Ameriquest - Orange California

- Ameriquest 505 City Parkway West Siute 100 Orange, California U.S.A.

- Phone: 714-634-2474

- Web:

- Category: Mortgage Companies

Ameriquest & AMC Mortgage Services -> This is some helpful INFORMATION to help you Fight Back! against ameriquest rip-off. Orange Orange California

*Consumer Comment: Sarbanes-Oxley Rules & LAWS

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

IMPORTANT LEGAL DEFENSE POST FOR YOU & YOUR LAWYERS

TAKE NOTE & ASSERT THESE DEFENSES IF ORGINAL NOTE IS NOT PRODUCED!!!!! MUST READ!!!!!

From the Internet:

-------------------------

I became aware of this scam in our own case when I demanded the note and was willing to pay off my family's note in 1994. A case in San Antonio, a man went to court on a mortgage suit and as was reported in the WSJ, the bank suing him was not the owner and holder of the note. This was in the early 90s. Since then, Mortgage Servicers and those in the industry have created an elaborate fraud and scheme to cook their books; screw you, then hide who did what they did to you.

IN EVERY CASE YOU ARE IN, DEMAND AND I REPEAT DEMAND PRESENTATION OF THE ORIGINAL NOTE YOU SIGNED IN INK THAT HAS YOUR FINGERTIPS ON IT. NO COPIES OR CERTIFIED COPIES ARE ACCEPTABLE AND YOU ONLY NEED TO INSPECT AND COPY AT THE OFFICE OF THE ATTY. OR AT THE DOCUMENT CUSTODIAN'S LOCATION THE NOTE BY YOU OR YOUR AGENT OR ATTY!!!!.

THIS SHOULD TAKE NO LESS THAT 2 DAYS TO DO VIA FEDEX AND OFFER TO PAY FOR THE FEDEX CHARGE FROM THE CUSTODIAN TO THE LOCATION OF YOUR SUIT OR FORECLOSURE. I CAN PROVIDE YOU WITH EVIDENCE, TAPES AND PROCEDURE MANUALS ON HOW THESE NOTES ARE SAFEGUARDED AND STORED.

IF THEY REFUSE TO PRODUCE THE ORIGINAL NOTE, THEN YOU HAVE A BIG BIG RED FLAG AND THAT MUST BE THE VERY FIRST OBJECT OF YOUR LAWYER'S ATTACK!!!!

READ ON.....

STOPPING FORECLOSURE

To recover on a promissory note, the plaintiff must prove: (1) the existence of the note in question; (2) that the party sued signed the note; (3) that the plaintiff is the owner or holder of the note in due course; and (4) that a certain balance is due and owing on the note.

(1) the existence of the note in question

1) If the "ORIGINAL" note you signed in ink that contains your signature is claimed to be lost, stolen, missing and/or destroyed, then you need to notify me and also put on affirmative defenses that:

a) the "named" Plaintiff is not the 'holder in due course" of the note and only an agent or nominee for the true beneficial owners and holders in due course;

b) there may be fraud upon the court in that the named Plaintiff may not have ANY interest to the note and that the supposedly lost note is not lost, but may have been intentionally destroyed due to missing assignments on the note which may have made it void and a legal nullity, thus they have expoliated key and vital evidence;

c) there is no proof that the named Plaintiff ever held the note or took possession of the note and thus has no claim or right to bringing about the foreclosure;

d) there is no proof, without the note, that a proper chain of assignments took place and that the lien positions were properly perfected;

e) other unnamed and disclosed real parties in interest may have a claim to the note and be the rightful beneficial owners to the note and must be identified and brought before the court;

f) there may be several unnamed and disclosed real parties in interest may have a claim to the note and be the rightful beneficial owners of the note;

(2) that the party sued signed the note

2) If the "ORIGINAL" note you signed in ink that contains your signature is claimed to be lost, stolen, missing and/or destroyed, then you need to notify me and also put on affirmative defenses that:

a) the note in question is not the note you signed and executed in ink and only the one you signed in ink that presumably contains your fingerprints can be relied upon by your handwriting analysis expert;

b) in an electronic age, it is a simple matter to place someone's signature or image upon a document and that it is very difficult to imagine such a valuable negotiable instrument being lost or missing without a nefarious motive.

(3) that the plaintiff is the owner or holder of the note in due course;

3) If the "ORIGINAL" note you signed in ink that contains your signature is claimed to be lost, stolen, missing and/or destroyed, then you need to notify me and also put on affirmative defenses that:

a) the mortgage industry, investors, and GSE's such as Fannie Mae, Freddie Mac, and FHLBs etc. have a requirement that the last endorsement to them be undated and "BLANK" leaving the payee line blank and making the negotiable instrument a sort of "bearer bond" and instrument. As such, ANY party finding or stealing the note can place their name on the payee line, claim ownership of the note, and sell the note to others who may make a demand upon you in the future. As such, you require money to be deposited in an escrow account or with the court in an amount equal to the amount claimed owed on the note, until such missing note is found or upon your death. Notes have a life of their own...

b) if the note was destroyed or lost intentionally [the industry maintains this practice] then they may be trying to hide the beneficial owners and shield them from any assignee liability arising from the actions of the servicer who they hire, supervise and most importantly AUTHORIZE to foreclose upon you. Without the note, since subsequent endorsements are not recorded to avoid payment of taxes and t hide true and real beneficial interests, there is NO POSSIBLE WAY to determine who ever held a rightful interest in the note and who you may have claims or counter claims against and who should be presently before the court as a real party in interest.

c) furthermore, if there are missing assignments of the original note and the assignment went from Lender A to Lender B to Lender D without an intervening assignment from Lender B to Lender C and From Lender C to Lender D, then the note may be void and a legal nullity in your state.

d) It is industry practice to not name the GSE, investor, or real party in interest in foreclosure and to use as a front for the Plaintiff:

i) The very original lender who may or may not even be in business any more or sold their interest in the note long ago, only to have a claim made upon them for repurchase;

ii) A Servicer of even "special servicer" who is acting as an agent for the investors, GSE's or real party in interest, but has no beneficial ownership in the note since they are only being paid to collect and foreclosure by the real parties in interest

iii) A "nominee" such as MERS who has no legal authority to foreclose upon you and do business in your state and who according to their own written documents and verbal assurances NEVER HOLD THE NOTE OR OWN "ANY" BENEFICIAL INTEREST IN THE NOTE!!!!!

e) Notes are pledged, sold, bifurcated, and traded in various derivative transactions like bubblegum baseball cards and their transfers, sales, pledges etc. are not publicly recorded. As such, only POSSESSION OF THE ACTUAL ORIGINAL NOTE can prove the actual owner and holder in due course of the note and who you can MAKE AN OFFER OF PAYMENT TO for purchase of the note by yourself, another family member or partner. You have a right to know the rightful owner of the note so an offer for payment of the note at a discount and at fair market value can be made. If the note has been pledged and encumbered, then that party must be made aware of the foreclosure and your right to negotiate with them a payment and release of the note by you, other lien holders or private parties;

f) Notes are traded often and you need to inspect the physical note to see who the real prior parties were that held and endorsed your note since you may have counter and cross claims against them and need to bring them before the court for the action, since they may have improperly inflated your principal balance, amount owed or escrow account by not applying your payments correctly; adding fees not legally owed by you to the principal balance; miscalculating the interest and not properly amortizing your loan; fraudulent selling your loan or misreporting you on your credit report.

g) Federal Circuit Courts have ruled that the only way to prove the perfection of any security [including promissory note] is by actual possession of the security. Current or PRIOR possession must be proved up.

(4) that a certain balance is due and owing on the note.

4) You must have the MASTER TRANSACTION HISTORIES & GENERAL LEDGERS for the account since a "dump," "summary," or REDACTED RECORD cannot be relied upon to determine the rightful amounts owed by having a complete audit of your account. In order to conduct a proper audit, master records and ALL PRIOR records must be compiled, reviewed, analyzed, and reconciled. IN is NOT YOU RESPONSIBILITY TO PROVE EACH PAYMENT WAS MADE. IT IS YOUR RESPONSIBILITY TO SAY A PAYMENT WAS MADE AND PROVIDE EVIDENCE, INCLUDING YOUR WORD THAT IT WAS MADE. It is the note holder's duty and responsibility to validate the claims being made on the note and the amount owed. If they have the master records or claim that the records of prior servicers are missing, then there is no rightful way for anyone to PROVE UP THE BALANCES AND AMOUNTS THEY CLAIM ARE OWED!!!! Furthermore, you must claim:

a) That the principal balance claimed owed, is not owed, and is the wrong amount.

b) That the loan has not been properly credited and amortized;

c) That the current servicer cannot be relied upon to testify and certify that prior amounts, transactions, credits, debits, charges and fees added by prior servicers were indeed proper and correct and that the account they were transferred was properly amortized and credited. As such, the person holding the ledgers at the prior servicer must come and testify as to the amounts owed on the note.

d) Dumps and summaries of amounts owed cannot be relied upon and only original ledgers and master records and the KEEPER of those records cant testify as to the amounts claimed owed and due.

e) There are many cases and evidence [provided upon request] that clearly demonstrate that servicers and banks miscalculated the rightful amounts owed and due. Evidence includes the Plaintiff's own due diligence reports that need to be provided to demonstrate what the average error rate and amount of average error was when doing quality controls, audits and due diligence on loan pools. Further, the Spitzer mortgage case shows a man that was foreclosed upon after paying off his mortgage 10 years earlier and the lenders kept sending him demands for money not owed. Further cases show that amounts from $2500 to over $100,000 have been wrongly claimed to be owed and due.

___________________________

Fraud:

fraud n. the intentional use of deceit, a trick or some dishonest means to deprive another of his/her/its money, property or a legal right. A party who has lost something due to fraud is entitled to file a lawsuit for damages against the party acting fraudulently, and the damages may include punitive damages as a punishment or public example due to the malicious nature of the fraud. Quite often there are several persons involved in a scheme to commit fraud and each and all may be liable for the total damages. Inherent in fraud is an unjust advantage over another which injures that person or entity. It includes failing to point out a known mistake in a contract or other writing (such as a deed), or not revealing a fact which he/she has a duty to communicate, such as a survey which shows there are only 10 acres of land being purchased and not 20 as originally understood. Constructive fraud can be proved by a showing of breach of legal duty (like using the trust funds held for another in an investment in one's own business) without direct proof of fraud or fraudulent intent. Extrinsic fraud occurs when deceit is employed to keep someone from exercising a right, such as a fair trial, by hiding evidence or misleading the opposing party in a lawsuit. (See: constructive fraud, extrinsic fraud, intrinsic fraud, fraud in the inducement, fraudulent conveyance) damages)

_________________________________

Forgery:

n. 1) the crime of creating a false document, altering a document, or writing a false signature for the illegal benefit of the person making the forgery. This includes improperly filling in a blank document, like a automobile purchase contract, over a buyer's signature, with the terms different from those agreed. It does not include such innocent representation as a staff member autographing photos of politicians or movie stars. While similar to forgery, counterfeiting refers to the creation of phoney money, stock certificates, or bonds which are negotiable for cash. 2) a document or signature falsely created or altered. (See: forger, counterfeit, fraud)

---------------------------

forgery, in criminal law

forgery, in criminal law, willful fabrication or alteration of a written document with the intent to injure the interests of another in a fraudulent manner. The crime may be committed even though the fraudulent scheme fails. The forgery of government obligationse.g., money, bonds, postage stampsconstitutes the separate offense of counterfeiting. Typical examples of forgery are making insertions or alterations in otherwise valid documents and appending another's signature to a document without permission. It is, of course, lawful to sign another's signature as his attorney or representative so long as there is no plan to commit fraud. Most instances of forgery occur in connection with instruments for the payment of money. The crime may also concern documents of title, e.g., deeds, or public documents, including birth and marriage certificates. In the United States forgery ordinarily is a state crime; but to send forged documents through the post office may constitute the federal crime of mail fraud.

forgery - criminal falsification by making or altering an instrument with intent to defraud

falsehood, falsification - the act of rendering something false as by fraudulent changes (of documents or measures etc.) or counterfeiting

crime, law-breaking - (criminal law) an act punishable by law; usually considered an evil act; "a long record of crimes"

___________________________

breach of contract:

n. failing to perform any term of a contract, written or oral, without a legitimate legal excuse. This may include not completing a job, not paying in full or on time, failure to deliver all the goods, substituting inferior or significantly different goods, not providing a bond when required, being late without excuse, or any act which shows the party will not complete the work ("anticipatory breach.") Breach of contract is one of the most common causes of law suits for damages and/or court-ordered "specific performance" of the contract. (See: breach, anticipatory breach, specific performance)

Keep good records, get names and teller numbers, ex, they all have them.

Good Luck and Fight Back!!!

Bill & Ted

Orange, California

U.S.A.

Click here to read other Rip Off Reports on Ameriquest Mortgage Company

This report was posted on Ripoff Report on 09/18/2005 12:20 PM and is a permanent record located here: https://www.ripoffreport.com/reports/ameriquest/orange-california-92868/ameriquest-amc-mortgage-services-this-is-some-helpful-information-to-help-you-fight-b-157501. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#1 Consumer Comment

Sarbanes-Oxley Rules & LAWS

AUTHOR: Bill & Ted - (U.S.A.)

SUBMITTED: Sunday, September 25, 2005

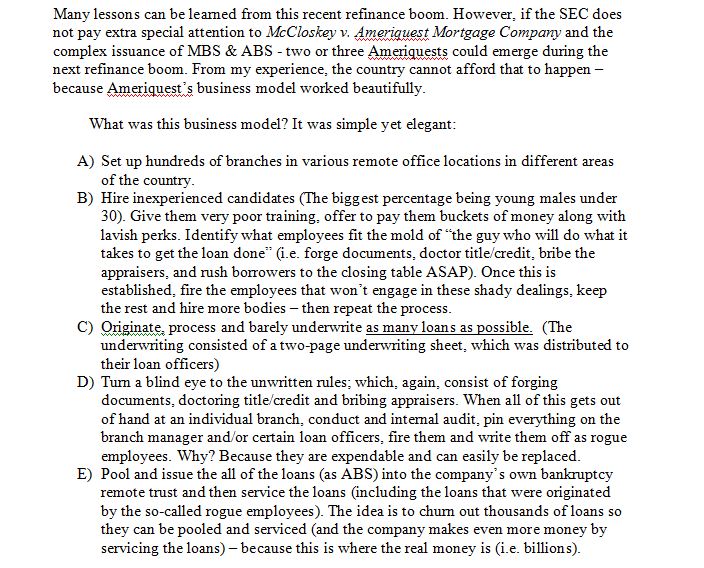

SEC Adopts Attorney Conduct Rule Under Sarbanes-Oxley Act

FOR IMMEDIATE RELEASE

2003-13

Washington, D.C., January 23, 2003 The Securities and Exchange Commission today adopted final rules to implement Section 307 of the Sarbanes-Oxley Act by setting "standards of professional conduct for attorneys appearing and practicing before the Commission in any way in the representation of issuers." In addition, the Commission approved an extension of the comment period on the "noisy withdrawal" provisions of the original proposed rule and publication for comment of an alternative proposal.

On Nov. 6, 2002, the Commission voted to propose the standards of professional conduct in a new Part 205 of 17 CFR. That proposal defined who is appearing and practicing before the Commission in the representation of an issuer. Attorneys were required to report evidence of a material violation "up-the-ladder" within an issuer. In addition, under certain circumstances, these provisions permitted or required attorneys to effect a so-called "noisy withdrawal" -- that is, to withdraw from representing an issuer and notify the Commission that they have withdrawn for professional reasons.

The rules adopted by the Commission today will

require an attorney to report evidence of a material violation, determined according to an objective standard, "up-the-ladder" within the issuer to the chief legal counsel or the chief executive officer of the company or the equivalent;

require an attorney, if the chief legal counsel or the chief executive officer of the company does not respond appropriately to the evidence, to report the evidence to the audit committee, another committee of independent directors, or the full board of directors;

clarify that the rules cover attorneys providing legal services to an issuer who have an attorney-client relationship with the issuer, and who have notice that documents they are preparing or assisting in preparing will be filed with or submitted to the Commission;

provide that foreign attorneys who are not admitted in the United States, and who do not advise clients regarding U.S. law, would not be covered by the rule, while foreign attorneys who provide legal advice regarding U.S. law would be covered to the extent they are appearing and practicing before the Commission, unless they provide such advice in consultation with U.S. counsel;

allow an issuer to establish a "qualified legal compliance committee" (QLCC) as an alternative procedure for reporting evidence of a material violation. Such a QLCC would consist of at least one member of the issuer's audit committee, or an equivalent committee of independent directors, and two or more independent board members, and would have the responsibility, among other things, to recommend that an issuer implement an appropriate response to evidence of a material violation. One way in which an attorney could satisfy the rule's reporting obligation is by reporting evidence of a material violation to a QLCC;

allow an attorney, without the consent of an issuer client, to reveal confidential information related to his or her representation to the extent the attorney reasonably believes necessary (1) to prevent the issuer from committing a material violation likely to cause substantial financial injury to the financial interests or property of the issuer or investors; (2) to prevent the issuer from committing an illegal act; or (3) to rectify the consequences of a material violation or illegal act in which the attorney's services have been used;

state that the rules govern in the event the rules conflict with state law, but will not preempt the ability of a state to impose more rigorous obligations on attorneys that are not inconsistent with the rules; and

affirmatively state that the rules do not create a private cause of action and that authority to enforce compliance with the rules is vested exclusively with the Commission.

In addition, the final rules modify the definition of the term "evidence of a material violation," which defines the trigger for an attorney's obligation to report up-the-ladder within an issuer. The revised definition confirms that the Commission intends an objective, rather than a subjective, triggering standard, involving credible evidence, based upon which it would be unreasonable, under the circumstances, for a prudent and competent attorney not to conclude that it is reasonably likely that a material violation has occurred, is ongoing or is about to occur.

The Commission voted to extend for 60 days the comment period on the "noisy withdrawal" and related provisions originally included in proposed Part 205. Given the significance and complexity of the issues involved, including the implications of a reporting out requirement on the relationship between issuers and their counsel, the Commission decided to continue to seek comment and give thoughtful consideration to these issues.

The Commission also voted to propose an alternative to "noisy withdrawal" that would require attorney withdrawal, but would require an issuer, rather than an attorney, to publicly disclose the attorney's withdrawal or written notice that the attorney did not receive an appropriate response to a report of a material violation. Specifically, an issuer that has received notice of an attorney's withdrawal would be required to report the notice and the circumstances related thereto on form 8-K, 20-F or 40-F, as applicable, within two days of receiving the attorney's notice. Accordingly, the proposal includes proposed amendments to forms 8-K, 20-F, and 40-F to require issuers to report an attorney's written notice under the proposed rule. The proposing release also will seek comment on whether there are circumstances in which an issuer should be permitted not to disclose an attorney's written notice.

The proposed rules also would permit an attorney, if an issuer has not complied with the disclosure requirement, to inform the Commission that the attorney has withdrawn from representing the issuer or provided the issuer with notice that the attorney has not received an appropriate response to a report of a material violation.

The final rules will become effective 180 days after publication in the Federal Register to provide issuers, attorneys, and law firms sufficient time to put in place procedures to comply with their requirements, and to allow the Commission the opportunity to consider the adoption of the proposed noisy withdrawal provision or the alternative disclosure procedure proposed today.

The full text of detailed releases concerning each of these items will be posted to the SEC Web site as soon as possible.

http://www.sec.gov/news/press/2003-13.htm

Advertisers above have met our

strict standards for business conduct.