Complaint Review: Aspire Lending - Dallas Texas

- Aspire Lending 4100 Alpha Rd. #1100 Dallas, Texas USA

- Phone: 1-855-200-2774

- Web: www.aspirelending.com

- Category: pure cbeed

Aspire Lending Texas Lending Through Gross Negligence In Performing Their Job Of Expertise Aspire Lending Rendered A Single Mom And Her Daughter Homeless Dallas Texas

*Author of original report: The Laundry List Of Fraud By Aspire Lending

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

Please Help!?

My case is a "Promissory Estoppel/Detrimental Reliance" Case.

Here is the jists of my case:

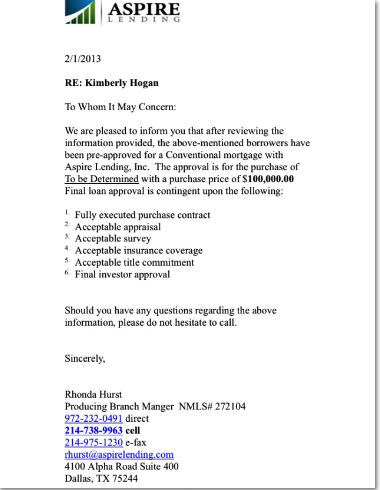

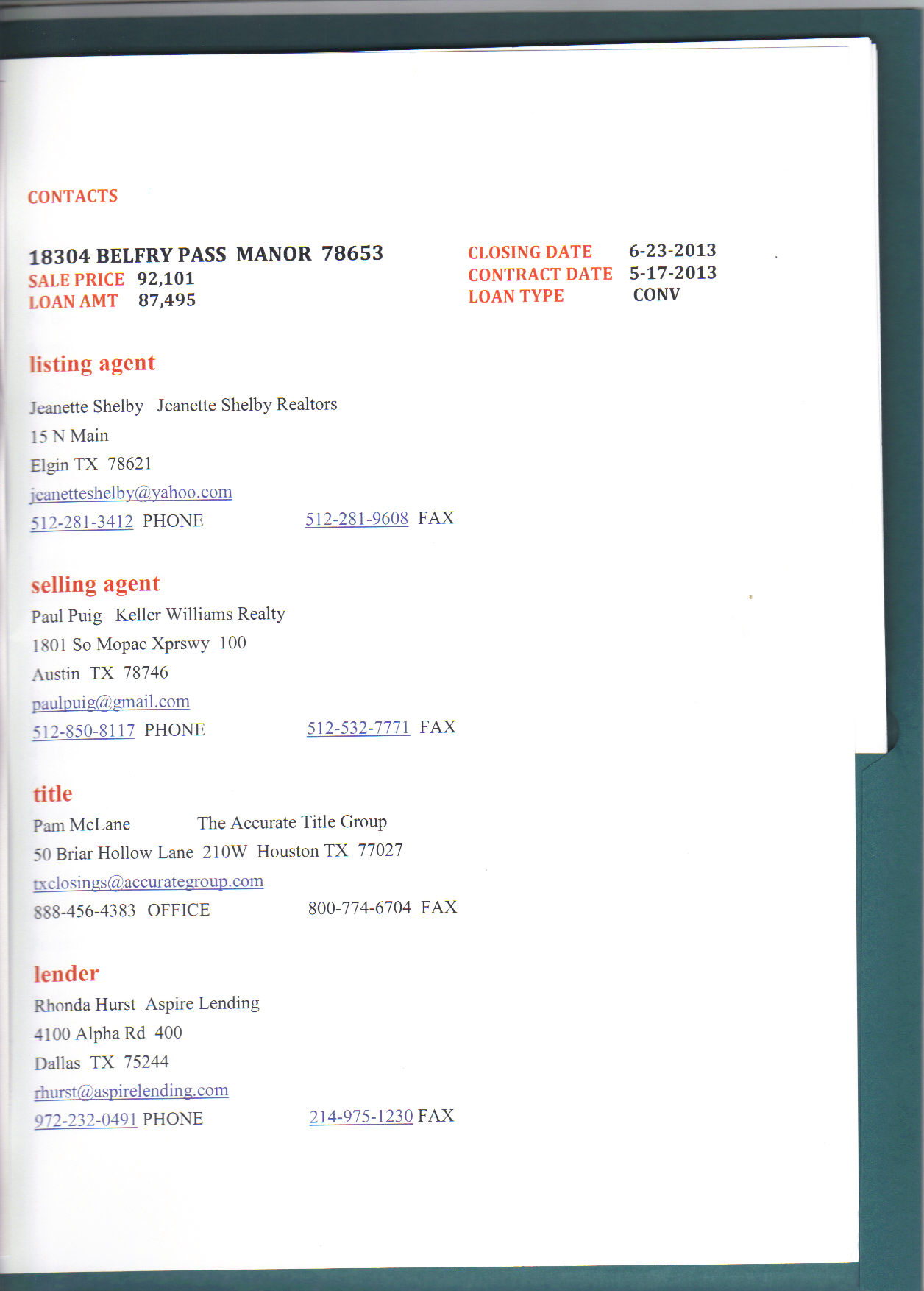

I have been unclear what kind of case I have, up until recently I found out it IS a "Detrimental Reliance" Case. Basically what it all boils down to is I was pre-qualified, then approved for a loan I never should have even made pre-qual status on, due to a 3 year cut off Lending Law/Rule for using child support as one of the sources of income. The lender never looked at my daughter's age or child support obligations expiration before pre-qualifying & approving me, then a week prior to closing date she calls me to break the bad news, after I already sold my other home in Colorado to move to Austin to buy another home. At 1st we looked into being able to qualify for a second mortgage in order to keep my Colorado home as a rental, but the lender determined my income was not sufficient to support 2 mortgages, and suggested if I was set on moving to Austin I needed to sell my Colorado home to get their loan to purchase another home in Texas. After the lender pre-qualified me & said "everything looked fine", one month later (March 2013) I listed my home & it sold immediately (closed April 9th 2013) & headed down here to Texas, found a Forclosure I bid on, won the bid, and began the processes of the purchase. This HUGE MISTAKE of them either not knowing the lending rules with child support as a source of income, or deceiving me, or whatever it is they screwed me over with, has rendered my daughter & I homeless out of 2 homes now, our Colorado home & then now the one we were set to close on here. Now with the 3 year child support cut off rule I cannot even be approved for another home loan now unless I get a co-signer, my daughter was 2 weeks away from turning 16 when the loan got killed on 6/17/13. I was pre-qualed the end of Jan. of 2013, then approved May of 2013, it took them that long to discover my daughter's child support obligations expiration! I notified them her child support would be extended for college, but that did not matter. We have been homeless now due to their HUGE MISTAKE since April 2013 when I was mislead to sell my Colorado home in order to buy a home in Austin. Not having a home/office has destroyed my source of income too , now I have nowhere to practice my profession as an Energy Healer out of, and office space is way too expensive.

I am not clear who I sue for damages, the lending agent, the agency, or the VP, since he was last who promised a written resolution offer, which he failed to do. I have a wiretapped conversation of the VP admitting their Big Mistake:http://youtu.be/-SkslVmUs0w

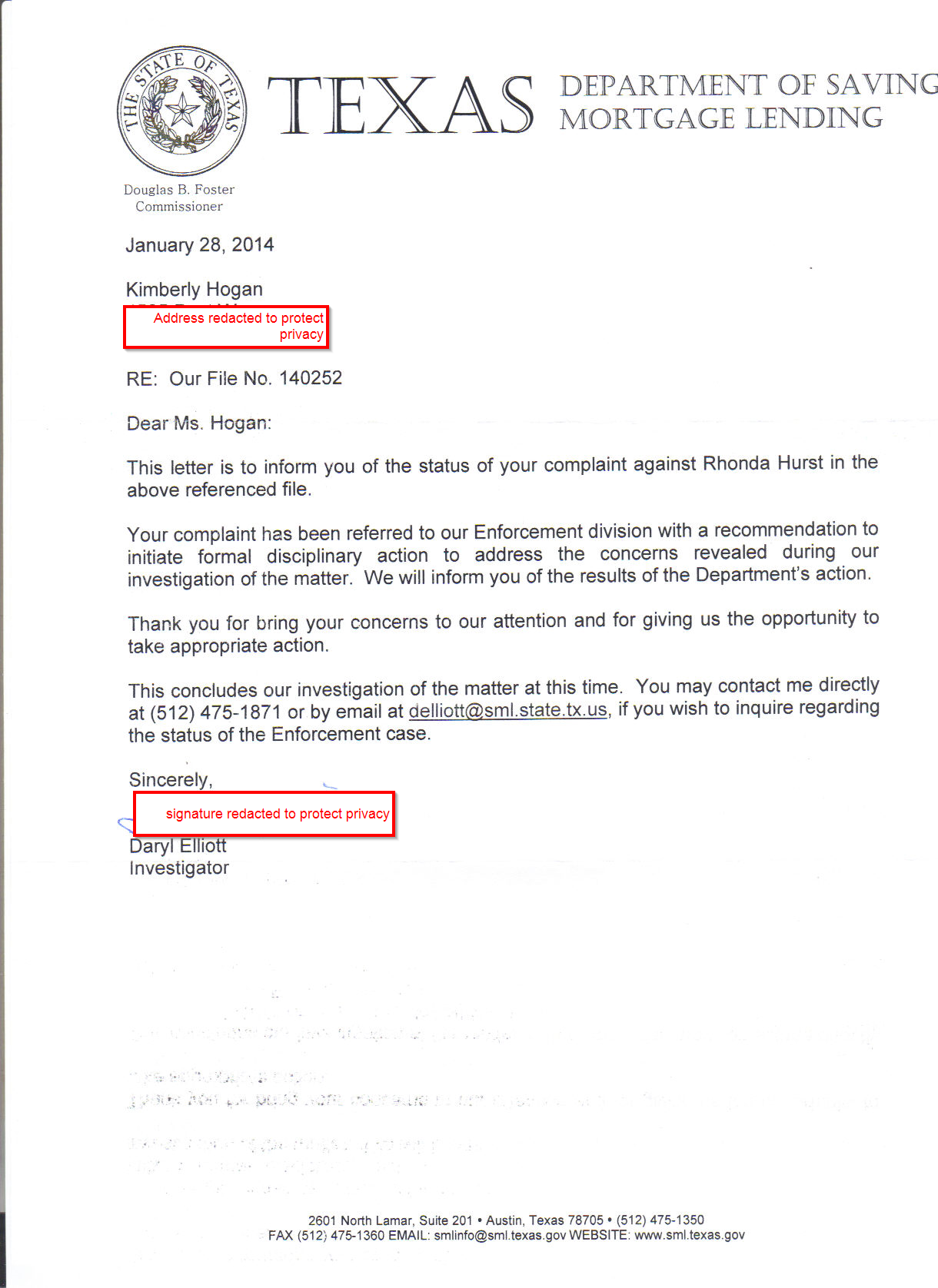

Also, the Texas Dept. Of Mortgage and Lending did an investigation and found fault with the lender's handling of my loan, and initiated formal disciplinary action. I also collected 100's of signatures & letters in a Change.org Petition, from people disgusted by Aspire Lending's handling (lack there of!) of my case, demanding they Right their Wrong & Settle with me. Aspire Lending has continued to ignore me & everyone else.

I would appreciate this case to be Resolved once & for all through Mediation ASAP. I also feel my daughter & I are owed $500K in Damages for the Hell this has caused our lives since April of 2013.

Seriously,

This report was posted on Ripoff Report on 11/13/2014 03:55 PM and is a permanent record located here: https://www.ripoffreport.com/reports/aspire-lending/dallas-texas-75244/aspire-lending-texas-lending-through-gross-negligence-in-performing-their-job-of-expertis-1188754. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#1 Author of original report

The Laundry List Of Fraud By Aspire Lending

AUTHOR: Kim Hogan - ()

SUBMITTED: Tuesday, February 24, 2015

HUD,I Kimberly D. Hogan am writing to you today to make a complaint and turn in Rhonda Hurst NMLS #272104 for a laundry list of reasons that wound up rendering my daughter & I homeless since April of 2013.Here is the jists of my case:

I have been unclear what kind of case I have, up until recently I found out it IS a "Detrimental Reliance" Case. Basically what it all boils down to is I was pre-qualified, then approved for a loan I never should have even made pre-qual status on, due to a 3 year cut off Lending Law/Rule for using child support as one of the sources of income. The lender never looked at my daughter's age or child support obligations expiration before pre-qualifying & approving me, then a week prior to closing date she calls me to break the bad news, after I already sold my other home in Colorado to move to Austin to buy another home. At 1st we looked into being able to qualify for a second mortgage in order to keep my Colorado home as a rental, but the lender determined my income was not sufficient to support 2 mortgages, and suggested if I was set on moving to Austin I needed to sell my Colorado home to get their loan to purchase another home in Texas. After the lender pre-qualified me & said "everything looked fine", one month later (March 2013) I listed my home & it sold immediately (closed April 9th 2013) & headed down here to Texas, found a Forclosure I bid on, won the bid, and began the processes of the purchase. This HUGE MISTAKE of them either not knowing the lending rules with child support as a source of income, or deceiving me, or whatever it is they screwed me over with, has rendered my daughter & I homeless out of 2 homes now, our Colorado home & then now the one we were set to close on here. Now with the 3 year child support cut off rule I cannot even be approved for another home loan now unless I get a co-signer, my daughter was 2 weeks away from turning 16 when the loan got killed on 6/17/13. I was pre-qualed the end of Jan. of 2013, then approved May of 2013, it took them that long to discover my daughter's child support obligations expiration! I notified them her child support would be extended for college, but that did not matter. We have been homeless now due to their HUGE MISTAKE since April 2013 when I was mislead to sell my Colorado home in order to buy a home in Austin. Not having a home/office has destroyed my source of income too , now I have nowhere to practice my profession as an Energy Healer out of, and office space is way too expensive.

I am not clear who I sue for damages, the lending agent, the agency, or the VP, since he was last who promised a written resolution offer, which he failed to do. I have a wiretapped conversation of the VP admitting their Big Mistake:http://youtu.be/-SkslVmUs0w

Also, the Texas Dept. Of Mortgage and Lending did an investigation and found fault with the lender's handling of my loan, and initiated formal disciplinary action, Rhonda Hurst was fired from Aspire Lending & also had to pay a fine to the Texas Department of Mortgage and Lending for her fault in mishandling my loan. I have received No Restitution! I also collected 100's of signatures & letters in a Change.org Petition, from people disgusted by Aspire Lending's handling (lack there of!) of my case, demanding they Right their Wrong & Settle with me. Aspire Lending has continued to ignore me & everyone else.

I would appreciate this case to be Resolved once & for all through Mediation, otherwise I am filing a Lawsuit ASAP. I also feel my daughter & I are owed Treble or Punitive Damages, or whatever you want to call it, in the amount of at least $1 Million now, for the Hell this has caused our lives since April of 2013.The Laundry List of Rhonda Hurst's Mistakes:HUD Handbook was Not Used / Violations of HUD Handbook for Soft MoneyNo HUD Settlement SheetNo RESPANo TLANo RescissionViolation of Honest Services (Fraud) 18 U.S.C. 1346Violations of False and Misleading Representation = US Code 15 sub chapter 1692 EAnd Last But Not Least I.D. Theft For Holding My Financial InformationI have two media sources now covering my story, and have an upcoming live radio interview in regards to this case. Citizens Action Network is posting it to have it exposed too.

Sincerely,

Kim Hogan

(((phone number and link redacted)))

Advertisers above have met our

strict standards for business conduct.