Complaint Review: BB&T - Wilmington North Carolina

- BB&T 2586 James B White Way Wilmington, North Carolina U.S.A.

- Phone: 910-426-3852

- Web:

- Category: Banks

BB&T CREATIVE STEALING..how BB&T causes NSF fees to your account Wilmington North Carolina

*Consumer Suggestion: Dawn and Andy

*Consumer Suggestion: Dawn and Andy

*Consumer Comment: Response for Andy...

*Consumer Comment: Press release from the American Bankers Association

*Consumer Comment: Andy, you are STILL not getting it! Forget online banking altogether!

*Consumer Comment: Andy....

*Consumer Comment: Andy....

*Consumer Comment: Andy....

*Consumer Comment: Resequencing debits and credits

*Consumer Comment: Andy, I guess I'm just an "idiot" who has NEVER paid an NSF fee! Why is that?

*Consumer Comment: Steve is an idiot

*Consumer Comment: I actually find this whole situation amusing. It proves ONLY one thing.

*Consumer Comment: Unbelievable Ignorance

*Consumer Comment: Response to Davy Jonz...

*Consumer Comment: Response to Davy Jonz...

*Consumer Comment: Response to Davy Jonz...

*Consumer Comment: Response to Davy Jonz...

*Consumer Comment: Why Don"t People get It?

*Consumer Comment: Do you people work for the banks?

*Consumer Comment: Consider this

*Consumer Comment: Get overdraft protection

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

I have beome increasingly frustrated with how BB&T allows debits and charges to go through when all along I DO NOT have overdraft protection. All my other banks decline such charges if an attempt is made to debit or charge when there is not enough money to cover the transaction beyond any overdraft allowance.

BB&T, started allowing debits and charges to go ahead and get approved, when there was not enough money in the account. Even worse, whenever I check my available balance, and "pending" transactions, that information is not accurate either, and many times, after going back now and reviewing when my account has been charged overdraft fees I can see where the online banking display did not reveal other pending transactions, and showed a plentiful available balance when I used my debit card to charge.

Following I make deposits...sometimes they go ahead and credit my paycheck in full, but it seems when it may be convenient for them somehow, they credit the deposit, then debit the deposit, and only credit back a portion, therefore leaving my account negative, and for (3) lousy little $5,$12, $20 charges, they pay them, allow them to go through (because THERE REALLY WAS money in there....)But, then, they debit the deposit??? Seems very unlawful to me how these practices are being allowed. I wake up monday morning 9/15 to over $100 in NSF fees....they email me a break down of how I WENT negative...which only happened after they debited my deposit.

The most important thing I stress is, that I DO NOT have overdraft protection on my account, so why they ALLOW any charges or debits to go through, then charge me $35 NSF fees each before they credit my deposit.

I have made honest mistakes, and wouldn't dream of asking them to refund these fees when I made an error...but when their website tells me I have money, and when I DONT have overdraft, but THEY allow charges to go through...there should be a LAW put into place to prevent banks from doing this. I am closing that account, and plan to tell everybody I know not to use BB&T

Dawn

fayetteville, North Carolina

U.S.A.

This report was posted on Ripoff Report on 09/18/2008 02:37 PM and is a permanent record located here: https://www.ripoffreport.com/reports/bbt/wilmington-north-carolina-28472-8974/bbt-creative-stealinghow-bbt-causes-nsf-fees-to-your-account-wilmington-north-carolina-374164. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#21 Consumer Suggestion

Dawn and Andy

AUTHOR: Jf :( - (U.S.A.)

SUBMITTED: Sunday, February 08, 2009

Dawn,

The bank continues to process your transacions because you continue to swipe. They cannot just not process. You are given this card under this understanding. If you have something pending and it has not came thru yet the bank may not know about it. Then all of your transactions come streaming thru at once. Balance

Andy,

I do understand your frustration, but you have to remember the bank does not know what you have floating out there. They do put money on hold for you when you use your debit card, but the merchant still has to collect it. If you use it at a diner and add a tip then they do not know how much to hold. If you use it at a gas station there is a $1 hold. You must balance. Always balance.

So the following does make sense if the merchant from the intentional $100 purchase (knowingly w/out the funds to cover) collects their $ first. Just because you swipe in a specific order does not mean the bank will process in that order. The merchant is also involved. Just use what you have and read the fine print.

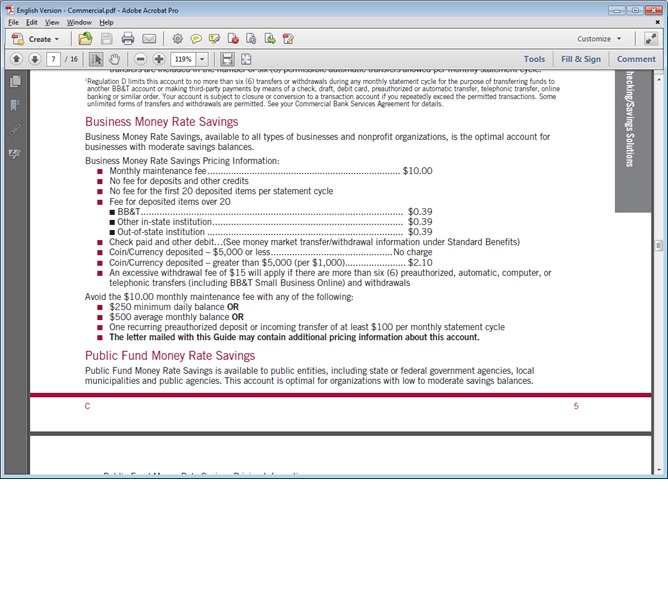

Chronological Order Resequenced

Starting Balance: $100.00 $100.00

-$5.00 P.O.S-covered -$100.00-covered

-$10.00 P.O.S.-covered -$40.00-NSF fee+35

-$10.00 P.O.S.-covered -$10.00-NSF fee+35

-$40.00 ATM-covered -$10.00-NSF fee+35

-$100.00 check-NSF fee+$35.00 -$5.00-NSF fee+35

Ending Bal.=$-100.00 owed to the bank End Bal.= $205.00 owed to the bank

=$35.00 in NSF fees =$140.00 in NSF fees

$35.00 or $140.00 if you don't see something wrong here, you have gone mad.

#20 Consumer Suggestion

Dawn and Andy

AUTHOR: Jf :( - (U.S.A.)

SUBMITTED: Sunday, February 08, 2009

Dawn,

The bank continues to process your transacions because you continue to swipe. They cannot just not process. You are given this card under this understanding. If you have something pending and it has not came thru yet the bank may not know about it. Then all of your transactions come streaming thru at once. Balance

Andy,

I do understand your frustration, but you have to remember the bank does not know what you have floating out there. They do put money on hold for you when you use your debit card, but the merchant still has to collect it. If you use it at a diner and add a tip then they do not know how much to hold. If you use it at a gas station there is a $1 hold. You must balance. Always balance.

So the following does make sense if the merchant from the intentional $100 purchase (knowingly w/out the funds to cover) collects their $ first. Just because you swipe in a specific order does not mean the bank will process in that order. The merchant is also involved. Just use what you have and read the fine print.

Chronological Order Resequenced

Starting Balance: $100.00 $100.00

-$5.00 P.O.S-covered -$100.00-covered

-$10.00 P.O.S.-covered -$40.00-NSF fee+35

-$10.00 P.O.S.-covered -$10.00-NSF fee+35

-$40.00 ATM-covered -$10.00-NSF fee+35

-$100.00 check-NSF fee+$35.00 -$5.00-NSF fee+35

Ending Bal.=$-100.00 owed to the bank End Bal.= $205.00 owed to the bank

=$35.00 in NSF fees =$140.00 in NSF fees

$35.00 or $140.00 if you don't see something wrong here, you have gone mad.

#19 Consumer Comment

Response for Andy...

AUTHOR: Striderq - (U.S.A.)

SUBMITTED: Monday, December 29, 2008

The consumers mentioned are consumers like you that refuse to keep an accurate register and continually overspend their account. Since the account owner is responsible for the account balance and the transactions that post against that balance (except for cases of fraud), then when the owner overspends the balance they are asking the bank to cover the items.

#18 Consumer Comment

Press release from the American Bankers Association

AUTHOR: Andy - (U.S.A.)

SUBMITTED: Sunday, December 28, 2008

Consumers have made it clear that they want banks to pay their overdrafts so they can avoid the inconvenience, embarrassment and potential costs of having a payment or transaction rejected. At the same time, it's important for bank customers to know there are numerous ways to avoid paying overdraft fees, Feddis said.

I'm not sure who these consumers are. This is the Senior Legal Counsel for the ABA. I have not met a consumer yet that has wanted banks to cover overdrafts fees.

#17 Consumer Comment

Andy, you are STILL not getting it! Forget online banking altogether!

AUTHOR: Steve - (U.S.A.)

SUBMITTED: Sunday, December 28, 2008

Andy,

You are still not getting it!

The ONLY source of checking your "available balance" should be your checkbook register. Period.

Banks do NOT "create" overdrafts. However when YOU "create" an overdraft, the bank software does indeed maximize profits on YOUR MISTAKE.

Posting order is ABSOLUTELY IRRELEVENT as long as you had funds available for use in your account PRIOR to initiating your transaction. Period.

Why do you find this basic concept so hard to comprehend?

Forget online banking!!

Do not even look at it until after you learn how to manage your checkbook register.

You are hung up on your online balance which means absolutely NOTHING!!!

What does your CHECKBOOK REGISTER say?

You CANNOT ever use online banking to determine your available balance.

That is NOT the intended purpose of online banking.

Just common sense and third grade math here.

But, THANKS AGAIN for keeping my BB&T checking account ABSOLUTELY FREE!

Keep up the good work overdrafting your account!

>>>>

Submitted: 12/27/2008 9:46:46 PM

Modified: 12/27/2008 10:21:55 PM Andy

Danville, Virginia

U.S.A.

Resequencing debits and credits

Steve, no matter what you think, this not entirely about managing a checkbook. Banks claim these overdraft programs are for the benefit of the consumer. Thus, consumers aren't embarrased when making a point-of-sale transaction and also to assist the consumer if they need to pay a bill and don't have available funds. The only problem with this is that consumers are agreeing to the ONE $35.00 NSF fee, not five or six.

(This actually happened to me).

I.E. Starting Saturday balance in your checking account of $100.00

Sunday P.O.S. transaction for $5.00 then another P.O.S. Tran. for $10.00

Monday P.O.S. tran. for $10.00 and an ATM withdrawal for $40.00

#16 Consumer Comment

Andy....

AUTHOR: Resty - (U.S.A.)

SUBMITTED: Sunday, December 28, 2008

the bottom line is .......

IF the money is there to begin with it won't matter in which order things post. By spending that last $100.....that you already KNEW there was not enough money for.....you set yourself up to fail.

Personally I find it totally foolish to be using a debit card for all these small purchases....it's a recipe for failure. Carry some degree of cash for these rather than continually debiting.

NO....I dont now nor have I ever worked for a bank or any financial institution.....but I do know how to manage a checking account.....check register and all.

I find what Steve, Jim, and Edgeman say here to be virtually 100% accurate. Stop spending what you don't have......pure and simple. Re sequencing of debits / checks / deposits really has next to nothing to do with OD / NSF fees. If you aren't spending what isn't there, it's not going to happen. You can no longer beat checks to the bank. If you have a $100 balance......you cannot spend $101....no matter how they re sequence that, you going to be OD.....and it's STILL not the banks fault.

#15 Consumer Comment

Andy....

AUTHOR: Resty - (U.S.A.)

SUBMITTED: Sunday, December 28, 2008

the bottom line is .......

IF the money is there to begin with it won't matter in which order things post. By spending that last $100.....that you already KNEW there was not enough money for.....you set yourself up to fail.

Personally I find it totally foolish to be using a debit card for all these small purchases....it's a recipe for failure. Carry some degree of cash for these rather than continually debiting.

NO....I dont now nor have I ever worked for a bank or any financial institution.....but I do know how to manage a checking account.....check register and all.

I find what Steve, Jim, and Edgeman say here to be virtually 100% accurate. Stop spending what you don't have......pure and simple. Re sequencing of debits / checks / deposits really has next to nothing to do with OD / NSF fees. If you aren't spending what isn't there, it's not going to happen. You can no longer beat checks to the bank. If you have a $100 balance......you cannot spend $101....no matter how they re sequence that, you going to be OD.....and it's STILL not the banks fault.

#14 Consumer Comment

Andy....

AUTHOR: Resty - (U.S.A.)

SUBMITTED: Sunday, December 28, 2008

the bottom line is .......

IF the money is there to begin with it won't matter in which order things post. By spending that last $100.....that you already KNEW there was not enough money for.....you set yourself up to fail.

Personally I find it totally foolish to be using a debit card for all these small purchases....it's a recipe for failure. Carry some degree of cash for these rather than continually debiting.

NO....I dont now nor have I ever worked for a bank or any financial institution.....but I do know how to manage a checking account.....check register and all.

I find what Steve, Jim, and Edgeman say here to be virtually 100% accurate. Stop spending what you don't have......pure and simple. Re sequencing of debits / checks / deposits really has next to nothing to do with OD / NSF fees. If you aren't spending what isn't there, it's not going to happen. You can no longer beat checks to the bank. If you have a $100 balance......you cannot spend $101....no matter how they re sequence that, you going to be OD.....and it's STILL not the banks fault.

#13 Consumer Comment

Resequencing debits and credits

AUTHOR: Andy - (U.S.A.)

SUBMITTED: Saturday, December 27, 2008

Steve, no matter what you think, this not entirely about managing a checkbook. Banks claim these overdraft programs are for the benefit of the consumer. Thus, consumers aren't embarrased when making a point-of-sale transaction and also to assist the consumer if they need to pay a bill and don't have available funds. The only problem with this is that consumers are agreeing to the ONE $35.00 NSF fee, not five or six.

(This actually happened to me).

I.E. Starting Saturday balance in your checking account of $100.00

Sunday P.O.S. transaction for $5.00 then another P.O.S. Tran. for $10.00

Monday P.O.S. tran. for $10.00 and an ATM withdrawal for $40.00

All of these transaction will be in a pending status until they are posted to the account. These debits are deducted from the available balance. Chronologically, you have spent $65.00 in your account and you have a remaining balance of $35.00. If you have an extra bill that comes in on Monday you have to decide whether to take a $35.00 NSF fee or go borrow money from a payday lender and pay their fees. You go and pay your bill which is $100.00 and overdraw your account by $65.00 and you expect a $35.00 fee to be added on, meaning you own the bank $100.00.

However, if that $100.00 you paid the bill with and all the P.O.S. fees post to your account on the same day, the bank will first subtract the $100.00 debit, then the $40.00 ATM debit, then both $10.00 P.O.S. debits, and finally the $5.00 P.O.S. debit.

Your account will go to a zero and you will be charged 4 NSF fees for the $40.00 debit, both $10.00 debits, and the $5.00 debit when you though you were only going to be charged with one NSF fee.

Chronological Order Resequenced

Starting Balance: $100.00 $100.00

-$5.00 P.O.S-covered -$100.00-covered

-$10.00 P.O.S.-covered -$40.00-NSF fee+35

-$10.00 P.O.S.-covered -$10.00-NSF fee+35

-$40.00 ATM-covered -$10.00-NSF fee+35

-$100.00 check-NSF fee+$35.00 -$5.00-NSF fee+35

Ending Bal.=$-100.00 owed to the bank End Bal.= $205.00 owed to the bank

=$35.00 in NSF fees =$140.00 in NSF fees

$35.00 or $140.00 if you don't see something wrong here, you have gone mad.

#12 Consumer Comment

Andy, I guess I'm just an "idiot" who has NEVER paid an NSF fee! Why is that?

AUTHOR: Steve - (U.S.A.)

SUBMITTED: Friday, December 26, 2008

Andy,

If I don't know what I'm talking about, explain why I have never paid an NSF fee!

31 years of checking accounts with no NSF fees. Just luck?

I think not.

And, why is it that when someone defends the action of a bank, that person is automatically a bank employee?

What kind of 3 year old mentality is that?

Grow up!

Learn how to do 3rd grade math and 6th grade English and just manage your checking account the same way I do to avoid the fees.

I guess I am an idiot because I never have paid an NSF fee?

So be it. I've been called worse by better than you.

Just keep paying those NSF fees so my checking remains free, ok?

#11 Consumer Comment

Steve is an idiot

AUTHOR: Andy - (U.S.A.)

SUBMITTED: Friday, December 26, 2008

You will have to forgive Steve. He's one of those type of people you would want to watch out for in life. Steve has no idea what he is talking about. Steve claims that he doesn't work for a bank, but we all know better than that, or he wouldn't show up on half of the complaints on ripoff report defending BB&T. Steve please go back to managing your checkbook, improving the education system, preparing for an invasion, and whatever else you like to do in your leisure time.

#10 Consumer Comment

I actually find this whole situation amusing. It proves ONLY one thing.

AUTHOR: Steve - (U.S.A.)

SUBMITTED: Monday, October 13, 2008

After reading "Davy Jonz" post, I have come to a simple conclusion.

We, as Americans, have failed in our educational system.

We have, indeed, raised about 2 generations of genuine MORONS. The majority of these last 2 generations have absolutely no common sense at all.

They want everyone else to be responsible for them, and thier bad choices, and actions.

They are mostly illiterate.

That is the real rip off here.

Just the mentality of these posters who use the rational that since there are so many posts against banks regarding NSF fees, they must be legitimate, just proves this IGNORANCE.

The fact of the matter is, that the real problem lies with that many people who are just too stupid and/or lazy to properly manage a checkbook register!

Think about it. Maintaining a checkbook register involves ONLY third grade math!

So, how many of you are actually smarter than a THIRD GRADER?

It is an invasion.

Stupidity has landed.

>>>

Submitted: 10/10/2008 4:52:18 AM

Modified: 10/10/2008 9:25:52 AM Davy Jonz

Hanover, Pennsylvania

U.S.A.

Do you people work for the banks?

Its not about blancing a checkbook, etc etc....its about imorral and illegal fees that banks charge, It doesnt matter what you sign. If I drew up a contract and loaned you 500.00 and expected youo to pay me back 50,000 i would go to jail for loan sharking!

in this day and age its possible for banks to give you current balances everytime you use your card, and there are banks that offer this. If a bank doesnt then its just another scam to assist you in overdrawing your account and with ther procedures on debit/credits it increase thier revenue!

>>>

#9 Consumer Comment

Unbelievable Ignorance

AUTHOR: Jim - (U.S.A.)

SUBMITTED: Sunday, October 12, 2008

DavyJonz, your post reminded me why there is so much ignorance in the world regarding the proper management of money. This really has nothing to do with greed, nothing to do with charging interest, and certainly nothing criminal the bank has done. Fees are not interest; they are penalties the bank imposes upon account holders for mismanaging their accounts. Those fees are documented in the account agreement all account holders sign. As I said, nothing illegal, nothing immoral, nothing to do with interest, and nothing greedy about it. If you choose to mismanage your money, that's your choice.

Your comment regarding the bank's ability to tell you what the balance in your account is upon your request is a perfect example of the ignorance you shared with us. There is not one bank out there that can give you an accurate representation of what the balance is in your account because the balance won't include (1) pending charges to your account done from a debit card, and (2) outstanding checks you wrote that the bank has yet to receive. If you are properly managing your accounts, you will NEVER have to ask what the balance is in your account, because that balance is in your check register.

Do yourself a favor: please take whatever time is necessary to learn what you need to know about handling money properly, starting off with the shredding of your debit card. Then I would learn the fine art of keeping a written check register, followed by learning to manage your life to live only on cash and checks. The bank will never get another overdraft fee from you ever again if you do these things I recommend. If you choose not to, you can just hand your money over to the bank for them to keep since you won't be keeping any of it....

#8 Consumer Comment

Response to Davy Jonz...

AUTHOR: Edgeman - (U.S.A.)

SUBMITTED: Sunday, October 12, 2008

"Its not about blancing a checkbook, etc etc..."

Actually, it's about not going below the account balance.

"its about imorral and illegal fees that banks charge,"

Illegal? Really? The fees are illegal? And if they are so immoral, why would anyone sign that they agree to these terms and conditions?

"It doesnt matter what you sign."

Yes, it does. If one were to sign that they agree to the terms and conditions of the bank, then they agree to be subject to OD and NSF fees when they go below their account balance. When they sign that receipt at the retialer, they are guaranteeing that transaction.

"If I drew up a contract and loaned you 500.00 and expected youo to pay me back 50,000 i would go to jail for loan sharking!"

Irrelevant. OD and NSF fees are not interest. They are a flat fee charged per occurance. It doesn't matter if you overdraft by a penny or a thousand dollars, the fee is the same.

"in this day and age its possible for banks to give you current balances everytime you use your card, and there are banks that offer this."

Really? Tonight I bought gasoline and paid at the pump. I bought about ten gallons worth of gas, yet the station only put a $1 hold on my card. How is the bank to know how much the merchant is going to claim? Also, how is the bank supposed to know if I have a check out there that's going to be presented on the next business day? They can't.

On the other hand, it is possible to know your own balance every time you use your card. Simply enter every transaction and deposit you make into a ledger, spreadhseet or check register.

"If a bank doesnt then its just another scam to assist you in overdrawing your account and with ther procedures on debit/credits it increase thier revenue!"

That is just silly. It is ultimately the customer who overdraws their account. Occasionally it is bank error but more often than not it is on the part of the account owner. The bank cannot force you to overdraw your account. It's simply a matter of not allowing your balance to go negative.

And to answer your question, some of us work at banks. I do not. I simply don't see any reason to pay OD or NSF fees. They are too expensive and ultimately unecessary.

#7 Consumer Comment

Response to Davy Jonz...

AUTHOR: Edgeman - (U.S.A.)

SUBMITTED: Sunday, October 12, 2008

"Its not about blancing a checkbook, etc etc..."

Actually, it's about not going below the account balance.

"its about imorral and illegal fees that banks charge,"

Illegal? Really? The fees are illegal? And if they are so immoral, why would anyone sign that they agree to these terms and conditions?

"It doesnt matter what you sign."

Yes, it does. If one were to sign that they agree to the terms and conditions of the bank, then they agree to be subject to OD and NSF fees when they go below their account balance. When they sign that receipt at the retialer, they are guaranteeing that transaction.

"If I drew up a contract and loaned you 500.00 and expected youo to pay me back 50,000 i would go to jail for loan sharking!"

Irrelevant. OD and NSF fees are not interest. They are a flat fee charged per occurance. It doesn't matter if you overdraft by a penny or a thousand dollars, the fee is the same.

"in this day and age its possible for banks to give you current balances everytime you use your card, and there are banks that offer this."

Really? Tonight I bought gasoline and paid at the pump. I bought about ten gallons worth of gas, yet the station only put a $1 hold on my card. How is the bank to know how much the merchant is going to claim? Also, how is the bank supposed to know if I have a check out there that's going to be presented on the next business day? They can't.

On the other hand, it is possible to know your own balance every time you use your card. Simply enter every transaction and deposit you make into a ledger, spreadhseet or check register.

"If a bank doesnt then its just another scam to assist you in overdrawing your account and with ther procedures on debit/credits it increase thier revenue!"

That is just silly. It is ultimately the customer who overdraws their account. Occasionally it is bank error but more often than not it is on the part of the account owner. The bank cannot force you to overdraw your account. It's simply a matter of not allowing your balance to go negative.

And to answer your question, some of us work at banks. I do not. I simply don't see any reason to pay OD or NSF fees. They are too expensive and ultimately unecessary.

#6 Consumer Comment

Response to Davy Jonz...

AUTHOR: Edgeman - (U.S.A.)

SUBMITTED: Sunday, October 12, 2008

"Its not about blancing a checkbook, etc etc..."

Actually, it's about not going below the account balance.

"its about imorral and illegal fees that banks charge,"

Illegal? Really? The fees are illegal? And if they are so immoral, why would anyone sign that they agree to these terms and conditions?

"It doesnt matter what you sign."

Yes, it does. If one were to sign that they agree to the terms and conditions of the bank, then they agree to be subject to OD and NSF fees when they go below their account balance. When they sign that receipt at the retialer, they are guaranteeing that transaction.

"If I drew up a contract and loaned you 500.00 and expected youo to pay me back 50,000 i would go to jail for loan sharking!"

Irrelevant. OD and NSF fees are not interest. They are a flat fee charged per occurance. It doesn't matter if you overdraft by a penny or a thousand dollars, the fee is the same.

"in this day and age its possible for banks to give you current balances everytime you use your card, and there are banks that offer this."

Really? Tonight I bought gasoline and paid at the pump. I bought about ten gallons worth of gas, yet the station only put a $1 hold on my card. How is the bank to know how much the merchant is going to claim? Also, how is the bank supposed to know if I have a check out there that's going to be presented on the next business day? They can't.

On the other hand, it is possible to know your own balance every time you use your card. Simply enter every transaction and deposit you make into a ledger, spreadhseet or check register.

"If a bank doesnt then its just another scam to assist you in overdrawing your account and with ther procedures on debit/credits it increase thier revenue!"

That is just silly. It is ultimately the customer who overdraws their account. Occasionally it is bank error but more often than not it is on the part of the account owner. The bank cannot force you to overdraw your account. It's simply a matter of not allowing your balance to go negative.

And to answer your question, some of us work at banks. I do not. I simply don't see any reason to pay OD or NSF fees. They are too expensive and ultimately unecessary.

#5 Consumer Comment

Response to Davy Jonz...

AUTHOR: Edgeman - (U.S.A.)

SUBMITTED: Sunday, October 12, 2008

"Its not about blancing a checkbook, etc etc..."

Actually, it's about not going below the account balance.

"its about imorral and illegal fees that banks charge,"

Illegal? Really? The fees are illegal? And if they are so immoral, why would anyone sign that they agree to these terms and conditions?

"It doesnt matter what you sign."

Yes, it does. If one were to sign that they agree to the terms and conditions of the bank, then they agree to be subject to OD and NSF fees when they go below their account balance. When they sign that receipt at the retialer, they are guaranteeing that transaction.

"If I drew up a contract and loaned you 500.00 and expected youo to pay me back 50,000 i would go to jail for loan sharking!"

Irrelevant. OD and NSF fees are not interest. They are a flat fee charged per occurance. It doesn't matter if you overdraft by a penny or a thousand dollars, the fee is the same.

"in this day and age its possible for banks to give you current balances everytime you use your card, and there are banks that offer this."

Really? Tonight I bought gasoline and paid at the pump. I bought about ten gallons worth of gas, yet the station only put a $1 hold on my card. How is the bank to know how much the merchant is going to claim? Also, how is the bank supposed to know if I have a check out there that's going to be presented on the next business day? They can't.

On the other hand, it is possible to know your own balance every time you use your card. Simply enter every transaction and deposit you make into a ledger, spreadhseet or check register.

"If a bank doesnt then its just another scam to assist you in overdrawing your account and with ther procedures on debit/credits it increase thier revenue!"

That is just silly. It is ultimately the customer who overdraws their account. Occasionally it is bank error but more often than not it is on the part of the account owner. The bank cannot force you to overdraw your account. It's simply a matter of not allowing your balance to go negative.

And to answer your question, some of us work at banks. I do not. I simply don't see any reason to pay OD or NSF fees. They are too expensive and ultimately unecessary.

#4 Consumer Comment

Why Don"t People get It?

AUTHOR: Purplenights - (U.S.A.)

SUBMITTED: Saturday, October 11, 2008

The OP is simply stating that if he overdraws his account, why does the bank go ahead and PAY the OD, rather than reurn the check or debit, as would normally happen? The bank need to understand that they cannot make a loan to the OP without his permission. If they (the Bank) goes ahead and pays any overdrafts on their own, then the OP should be able to go take out a loan for whatever amount with the bank, since they deem him worthy of obtaining bank loans.

#3 Consumer Comment

Do you people work for the banks?

AUTHOR: Davy Jonz - (U.S.A.)

SUBMITTED: Friday, October 10, 2008

Its not about blancing a checkbook, etc etc....its about imorral and illegal fees that banks charge, It doesnt matter what you sign. If I drew up a contract and loaned you 500.00 and expected youo to pay me back 50,000 i would go to jail for loan sharking!

in this day and age its possible for banks to give you current balances everytime you use your card, and there are banks that offer this. If a bank doesnt then its just another scam to assist you in overdrawing your account and with ther procedures on debit/credits it increase thier revenue!

#2 Consumer Comment

Consider this

AUTHOR: Ken - (U.S.A.)

SUBMITTED: Tuesday, September 30, 2008

The debit card is a replacement for a check. If you were standing at the register writing a check, would you expect someone from the bank to run out and stop you because you had insufficient funds? I realize this analogy is a stretch, but the fact of the matter is that debit cards do not work like credit cards. They go through a completely different system, and the authorization is not always at the instant you swipe. Nonetheless, the bank is obliged to make good on that debit whether you have the funds or not.

You cannot depend on the transaction to be declined, nor can you depend on online balances to track your account. As has been said counteless times here, your only reliable way to avoid fees is to maintain a check register. You can choose to not do so, but expect these fees to continue if you do.

#1 Consumer Comment

Get overdraft protection

AUTHOR: Anonymous - (U.S.A.)

SUBMITTED: Friday, September 26, 2008

Hmmmm why not get overdraft protection? You complain, but do nothing about it? You need to take responsibilty for your own actions. You swipe your card, you are telling that merchant you have the money in your account. And just for your information, EVERY bank is different. It doesn't take a smart one to figure that one out. They tell you upfront the fees. Do you remember all that lovely brochures that they give you? Did you even read them? Do you own a checkbook register? Maybe you should invest in one. Oh and maybe a calculator?

Advertisers above have met our

strict standards for business conduct.