Complaint Review: Best Buy - Santa Rosa California

- Best Buy 1950 Santa Rosa Ave. Santa Rosa, California U.S.A.

- Phone: 707-545-1078

- Web:

- Category: Credit & Debt Services

BEST BUY - Credit Card Deferred Finnce Charges Rip-Off! Santa Rosa California

*Consumer Suggestion: Beware Of This Financing Tactic

*Consumer Suggestion: Beware Of This Financing Tactic

*Consumer Suggestion: Beware Of This Financing Tactic

*Consumer Suggestion: Beware Of This Financing Tactic

*Consumer Suggestion: my take on this...

*UPDATE Employee: HSBC

*Consumer Suggestion: bestbuy choices

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

Best Buy is a pretty great store. They have all the latest gadgets andt their computer prices and accessories are a pretty good deal.

However, there is a BIG problem with their financing. My wife and I went to buy a new computer. We found one for around $1,200. We applied for a Best Buy credit card and were instantly approved for $3,000. We were told there would be no finance charge for 18 months if the purchase was over $499.

When the first bill arrived the minimum payment due was $12. OK. But on the bill it also stated that if we want to stay on the deferred payment plan, we were required to pay $77.72 within 2 months in ADDITION to our minimum payments! What kind of "s***" is that?

There's more. Our payment was due on 1/31/09. We went on-line and submitted our checking account information and paid $15 over the minimum amount due. Then we were advised that since it's a "rush payment" ANOTHER $15 would be deducted from our checking account.

I can hardly live with that but $77.72 (!!!) to keep our deferred payment status?? I'm 61 years old and been around the block a few times but I NEVER heard of anything like that.

I plan to pursue this as far as I can take it. The Rip-off Report is just a start.

ADVISE: Put your purchase on a credit card but don't get a Best Buy Credit Card!

Jim l.

Santa Rosa, California

U.S.A.

This report was posted on Ripoff Report on 02/01/2009 01:24 AM and is a permanent record located here: https://www.ripoffreport.com/reports/best-buy/santa-rosa-california/best-buy-credit-card-deferred-finnce-charges-rip-off-santa-rosa-california-418749. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#7 Consumer Suggestion

Beware Of This Financing Tactic

AUTHOR: John - (U.S.A.)

SUBMITTED: Thursday, February 05, 2009

Free financing is a great thing but you need to look at the big picture. When you get free financing at Home Depot you get 12 months same-as-cash. Pay the balance by the 12th payment date and you've paid no interest. Home Depot does not require monthly payments as Best Buy does. BB requires that niggling payment each month. Why? If you're late with any payment you are on the hook for all of the accrued interest. They're simply playing the odds game. What are the odds of a person making/missing a payment? These days it's fairly good. And at 22+ percent interest that's a lot of gravy to slurp up.

Always avoid free financing offers where monthly payments required.

#6 Consumer Suggestion

Beware Of This Financing Tactic

AUTHOR: John - (U.S.A.)

SUBMITTED: Thursday, February 05, 2009

Free financing is a great thing but you need to look at the big picture. When you get free financing at Home Depot you get 12 months same-as-cash. Pay the balance by the 12th payment date and you've paid no interest. Home Depot does not require monthly payments as Best Buy does. BB requires that niggling payment each month. Why? If you're late with any payment you are on the hook for all of the accrued interest. They're simply playing the odds game. What are the odds of a person making/missing a payment? These days it's fairly good. And at 22+ percent interest that's a lot of gravy to slurp up.

Always avoid free financing offers where monthly payments required.

#5 Consumer Suggestion

Beware Of This Financing Tactic

AUTHOR: John - (U.S.A.)

SUBMITTED: Thursday, February 05, 2009

Free financing is a great thing but you need to look at the big picture. When you get free financing at Home Depot you get 12 months same-as-cash. Pay the balance by the 12th payment date and you've paid no interest. Home Depot does not require monthly payments as Best Buy does. BB requires that niggling payment each month. Why? If you're late with any payment you are on the hook for all of the accrued interest. They're simply playing the odds game. What are the odds of a person making/missing a payment? These days it's fairly good. And at 22+ percent interest that's a lot of gravy to slurp up.

Always avoid free financing offers where monthly payments required.

#4 Consumer Suggestion

Beware Of This Financing Tactic

AUTHOR: John - (U.S.A.)

SUBMITTED: Thursday, February 05, 2009

Free financing is a great thing but you need to look at the big picture. When you get free financing at Home Depot you get 12 months same-as-cash. Pay the balance by the 12th payment date and you've paid no interest. Home Depot does not require monthly payments as Best Buy does. BB requires that niggling payment each month. Why? If you're late with any payment you are on the hook for all of the accrued interest. They're simply playing the odds game. What are the odds of a person making/missing a payment? These days it's fairly good. And at 22+ percent interest that's a lot of gravy to slurp up.

Always avoid free financing offers where monthly payments required.

#3 Consumer Suggestion

my take on this...

AUTHOR: Sylver8248 - (U.S.A.)

SUBMITTED: Thursday, February 05, 2009

Here is where I think they are getting this figure of $77.00 All (or most) deferred interest promotions are conditional on 2 things.

1. Make AT LEAST your minimum payment every month (i.e. dont miss or be late)

2. Pay the balance IN FULL on the last month

It sounds like Best Buy (or whichever bank they use) is showing you how much you should pay (divided by 18 per se) in order to pay your full balance by the end of the promotional time period.

#2 UPDATE Employee

HSBC

AUTHOR: Dane - (U.S.A.)

SUBMITTED: Monday, February 02, 2009

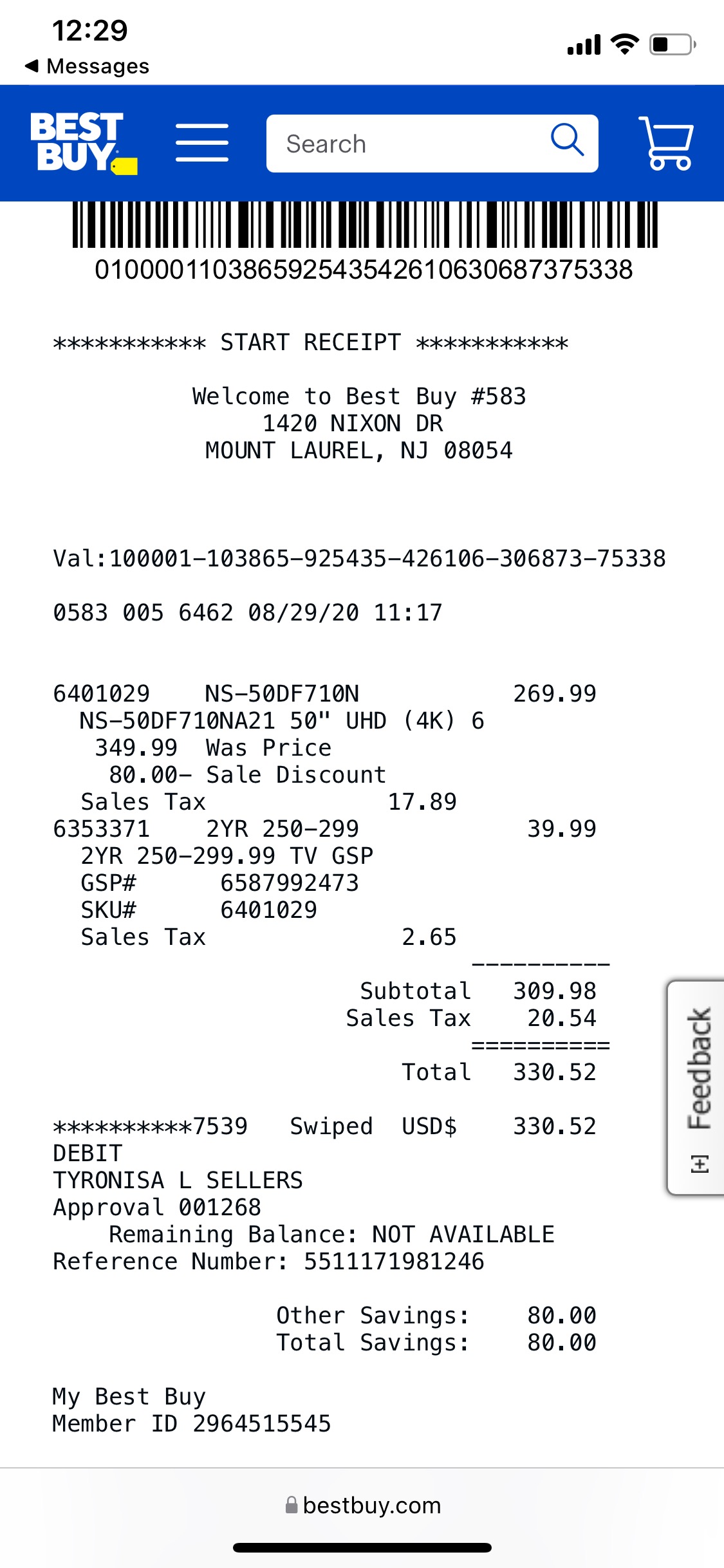

the Best Buy card is all taken care of by HSBC. I would check the bottom of your receipt, it tells you there what payment plan you are on, it should say someting like "18 months no interest". the bill will tell you how much finance charges you are incurring,but they will not be billed unless you haven't payed off the balance by the 18th month. HSBC has a chart on the payment site that tells you when the payment will be posted.

#1 Consumer Suggestion

bestbuy choices

AUTHOR: Paul - (U.S.A.)

SUBMITTED: Sunday, February 01, 2009

Um....thats why you buy only on sale with zer rate purchases.

I never buy anything at any dept store or retail of a 'high end amt' on the stores card unless i get terms similar to many months before 1st payment and also zero interest rate.

If I dont get that I go elsewhere.

That happened here with I went to circuit city last summer and they had the perfect package but would only give me 6months no interest.

Bestbuy, had the same package at $150 more...but gave me 24months at zero interest.

Point, I setup a automatic payment of $19/week to the bestbuy card and also setup the card to be autodrafted on minimumum payment if I fail to do the $19/wk.

It will be paid 2-3 months ahead of schedule without me even trying hard.

Btw, I am unemployed but have the cash flow (even with unemployment $$) to pay this plus a tv I bought that I pay $45/wk on a similar 3yr no interest rate deal.

If not for the above, I would put it on my visa whcih is a 6% visa (per mortgage).

But then I likely would not have bought either of the above.

Advertisers above have met our

strict standards for business conduct.