Complaint Review: Chase Banking - Watsonville California

- Chase Banking 630 main st Watsonville, California United States of America

- Phone:

- Web: Chase.com

- Category:

Chase Banking did not refund my fraudulent purchases of 3000 dollars Watsonville, California

*General Comment: The Pin Number tells it all

*Author of original report: Need help with Chase Banking

*Consumer Comment: Details?

I am writing this for my for my poor mother who was a victim of fraudulent bank charges. The Total amount was about 3000 dollars and i wasnt really worried at first because i thought chase would reimburse the 3000 dollar loss.To My surprise the claim she made was denied. Now Im sitting here with her as we are both severly overwhelmed from the current situation. If anyone has any advice as what to do it would be greatly and deeply appreciated.. This kind of treatment is not now and never will be OK. We need to figure something out business cant be treating people this way.. Now how is my family supposed to live and eat.

Please add me to the list...

This report was posted on Ripoff Report on 01/19/2010 03:46 PM and is a permanent record located here: https://www.ripoffreport.com/reports/chase-banking/watsonville-california-95076/chase-banking-did-not-refund-my-fraudulent-purchases-of-3000-dollars-watsonville-califor-556928. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#3 General Comment

The Pin Number tells it all

AUTHOR: IamGood - (USA)

SUBMITTED: Friday, January 22, 2010

Since the pin number was being used to withdrawl cash, the bank suspects one of two things.

1). It was an inside Job. either one of your mother's friend's, or family members commited the crime.

2). You mother did not safeguard the pin number, and someone found the pin number, and got ahold of her card, and used it. The banks have been using the "Safeguarding of the Pin" as an reason for not reimbursing for Fraud.

I have a question for you that could help to disprove theory #2. Did your mother ever use her ATM card at a gas station, movie theater, or anywhere else to pay for goods or services?

If the answer is yes, then it could have left her open for fraud, because savy criminals have been placing devices inside the card reader, that captures the information on the card, and the criminals retreive this information later, and they then produce atm cards, and use the pin to clean out the account. This practice is knowm as skimming.

The fact that she cancelled her card, and probably got a new pin indicates 1 of two things. 1). Either this was an inside job,or 2) she went back to the same merchant who's machine was set up for "skimming", and they got her information again.

Your mother is a victim, and proving skimming will be very difficult. Even if you can prove skimming took place, you only have 30 days to file a fraud claim. If it takes you longer than 30 days to prove fraud, you will not get your money back.

Tell your mother to stop using her atm card to pay for transactions, where she is required to enter a pin. Have her use her ATM card, as a credit instead, so no pin will have to be entered instead.

She needs to change her ATM card again, this time she needs to be careful where she uses it. If she needs cash have her go to the bank, but be careful there too, because skimming was even found to be done at banks.

#2 Author of original report

Need help with Chase Banking

AUTHOR: Chase Victim 916872 - (USA)

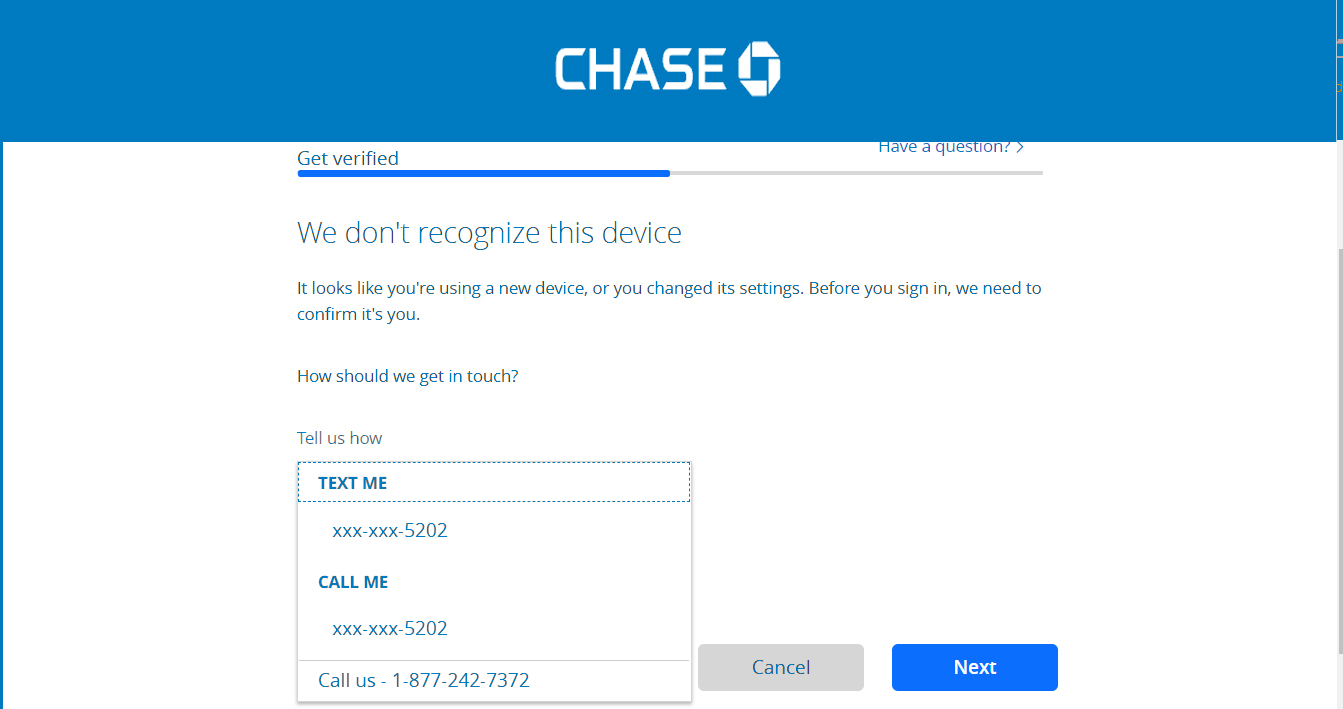

SUBMITTED: Thursday, January 21, 2010

The details are Someone got a hold of my mothers Credit Card And her pin number. I know it wasnt her card because she still had her card and hasnt used it since the theif took out money numerous times. Burglaries were happening sporratically for around a month my mother tried to tell chase about this and chase said since the person took out money with an authorized pin number that there was nothing they could do about it. that was to about a some of 1300 dollars. all fraudulent too because my mom never makes withdrawls for anythin over 60 dollars and the crook had obviously fraudulent charges making substantial withdrawls at over 400 dollars each time. 400 dollars is also over the daily limit that my mom has on this card. If my mom wanted to take out 400 the bank would not let her, So how did this criminal with a clone card do it???

My mother changed her card hoping that this was just a one time inconvenience but we were not so lucky.. It happened again with a brand new card. This time totaling at around 1700.. Bringing the total to near 3000 dollars. this time it was also about a month span . The weird thing is Chase banking is supposed to notify you when you make fraudulent purchases that are not of your normal spending habits. Since my mother never spends over 100 dollars at one time how come Chase never notified my mother of the 400 dollar spending splurges of the identity theif?? The reason chase told me mother she was denied.. "Because it would inconvenience them too much".. The man was very rude..

#1 Consumer Comment

Details?

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Tuesday, January 19, 2010

What are the details of the Fraud?

What was the source of the Fraud, Credit Card, Debit Card, Checks?

What was the reason for the Denial?

Advertisers above have met our

strict standards for business conduct.