Complaint Review: Credit Answers - Addison Texas

- Credit Answers 15305dallas Parkway Suite 1000 Addison, Texas U.S.A.

- Phone:

- Web:

- Category: BBB Better Business Bureau

Credit Answers BEFORE YOU USE CREDITANSWERS READ THIS Addison Texas

*Consumer Comment: Debt settlement is good if you do what they tell you!!

*Consumer Comment: My Experience with Credit Answers

*Consumer Comment: My Experience

*Consumer Suggestion: Instead of blaming the debt settlement companies for your problems how about not using credit cards to finance your lives. Debt settlement is great!

i was told that i could payoff all my credit cards for $7000 instead i had to go to court and deal with lawyers myself and one credit card cost me $10000 and another one that will cost me $6000 and the credit cards they did settle it was 10% differnce from what i owed to begin with

Ralph

jacksboro, Tennessee

U.S.A.

This report was posted on Ripoff Report on 10/08/2008 04:26 PM and is a permanent record located here: https://www.ripoffreport.com/reports/credit-answers/addison-texas-75001/credit-answers-before-you-use-creditanswers-read-this-addison-texas-379471. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#4 Consumer Comment

Debt settlement is good if you do what they tell you!!

AUTHOR: Scott - (U.S.A.)

SUBMITTED: Saturday, December 19, 2009

Why didn't this person just file for a continuance and push the court dates out? It would have given you the time needed to save your money to settle the debt's out. There are a lot of holes in this guys story. If someone in debt settlement told you that they could settle your debts for 7k then you must have had about 14k in debt to begin with. You also have to be actually saving they money to settle with the creditors. Also at the time that this gentleman "Ralph" in Jacksboro,TN. claims to be enrolled. CreditAnswers didn't even work in Tennessee. So that right there is enough for me to say this is just another attempt to bash a good comapny who actually helps people. They are an Accredited member of TASC. And have helped a lot of people that I know of personally.

Scott

The Colony,TX

#3 Consumer Comment

My Experience with Credit Answers

AUTHOR: Okaragozian - (U.S.A.)

SUBMITTED: Thursday, April 09, 2009

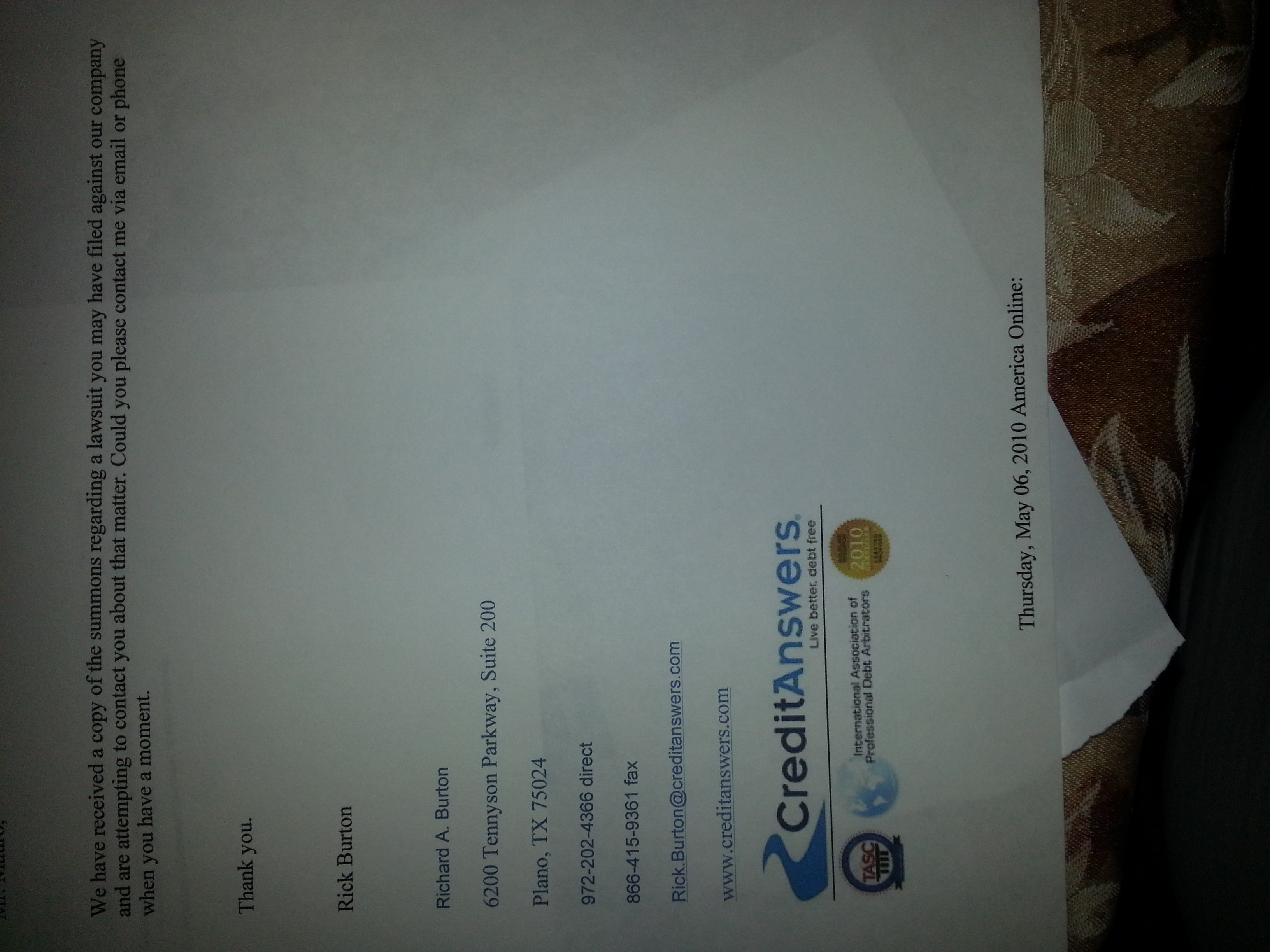

The Credit Answers company I used is located at 6200 Tennyson Pkwy, Suite 200

Plano, Texas 75024 and their phone number is 1-800-297-6417.

I have used Credit Answers to settle my debt, and they have worked with me. I settled one of the accounts myself, prior to their involvement and they made an adjustment to my payments to reflect the fact that they did not have to settle that account. I was given a $400 credit towards what I owed. I had to reason with them since I signed a contract, and they relented understanding that they didn't have to settle that one credit card on my behalf. It took a little bit of convincing on my part and that I was paying 12% on the debt that needed to be settled, I only got a a partial credit.

That being said, a person must recognize that there are no guarantees in life, but that Credit Answers does say that they will save you at least as much as you paid them. The one thing to understand is that you got yourself in this hole and are asking for help and that they are willing to help for a fee.

Could I have negotiated the settlement of my debt for all of the cards that I had? Perhaps I could have, but I will never know if I would have been able to do this as well as they did for me. Settling credit card debt is not as easy as screwing in a lightbulb. I don't know all of the in's and out's like Credit Answers or other comapnies like them. I would compare the settlement of my debt with creditors to dealing with a clogged septic system. Very messy and one wrong move you're in deep s**t.

Not being completely aware of the details, I believe that Credit Answers conatcts persons they have familiarity with inside the creditors companies with whom the've dealt with in the past to help their clients. The idea being is that when you walk into a store to purchase an item you pay the marked price, but if you walk up to the store manager and tell them that your uncle is married to their cousin, you may get a better deal. Further, I beleive that Credit Answers may embelish your situation a bit to get a more favorable outcome. I am not saying they would lie about you being out-of-work or don't have any money, but they can't say if they don't know. The other thing is that if you have to sign a document telling your creditors about your finances, you better not lie because you will be violating federal laws not just state since the information is going over the mail, internet or the phone.

The thing that is most important is that you maintain ongoing communication with your representative at Credit Answers- try to be cordial and sympathetic. Let them feel your pain. Remember that you hired someone to help you, so you can't be a tyrant or mean-spirited. If you act like an as***le, you're going to get fu**ed. But this holds true in life in general. You can't get someone to help you if you are beligerent. If Credit Answers feels your pain then they would have a better chance of getting the point accross to your creditors.

Either I didn't read carefully what Credit Answers sent me, or didn't understand credit forgiveness clearly, but that the money the credit card comapnies forgive and you don't pay is considered income by the IRS. If you get $10,000 worth of debt forgiven, you owe taxes in that $10,000 at the end of the year. But this has nothing really to do with Credit Answers help you out to forgive debt by your creditors. This one is on you.

#2 Consumer Comment

My Experience

AUTHOR: Okaragozian - (U.S.A.)

SUBMITTED: Thursday, April 09, 2009

I have used Credit Answers to settle my debt, and they have worked with me. I settled one of the accounts myself, prior to their involvement and they made an adjustment to my payments to reflect the fact that they did not have to settle that account. I was given a $400 credit towards what I owed. I had to reason with them since I signed a contract, and they relented understanding that they didn't have to settle that one credit card on my behalf. It took a little bit of convincing on my part and that I was paying 12% on the debt that needed to be settled, I only got a a partial credit.

That being said, a person must recognize that there are no guarantees in life, but that Credit Answers does say that they will save you at least as much as you paid them. The one thing to understand is that you got yourself in this hole and are asking for help and that they are willing to help for a fee.

Could I have negotiated the settlement of my debt for all of the cards that I had? Perhaps I could have, but I will never know if I would have been able to do this as well as they did for me. Settling credit card debt is not as easy as screwing in a lightbulb. I don't know all of the in's and out's like Credit Answers or other comapnies like them. I would compare the settlement of my debt with creditors to dealing with a clogged septic system. Very messy and one wrong move you're in deep s**t.

Not being completely aware of the details, I believe that Credit Answers conatcts persons they have familiarity with inside the creditors companies with whom the've dealt with in the past to help their clients. The idea being is that when you walk into a store to purchase an item you pay the marked price, but if you walk up to the store manager and tell them that your uncle is married to their cousin, you may get a better deal. Further, I beleive that Credit Answers may embelish your situation a bit to get a more favorable outcome. I am not saying they would lie about you being out-of-work or don't have any money, but they can't say if they don't know. The other thing is that if you have to sign a document telling your creditors about your finances, you better not lie because you will be violating federal laws not just state since the information is going over the mail, internet or the phone.

The thing that is most important is that you maintain ongoing communication with your representative at Credit Answers- try to be cordial and sympathetic. Let them feel your pain. Remember that you hired someone to help you, so you can't be a tyrant or mean-spirited. If you act like an as***le, you're going to get fu**ed. But this holds true in life in general. You can't get someone to help you if you are beligerent. If Credit Answers feels your pain then they would have a better chance of getting the point accross to your creditors.

Either I didn't read carefully what Credit Answers sent me, or didn't understand credit forgiveness clearly, but that the money the credit card comapnies forgive and you don't pay is considered income by the IRS. If you get $10,000 worth of debt forgiven, you owe taxes in that $10,000 at the end of the year. But this has nothing really to do with Credit Answers help you out to forgive debt by your creditors. This one is on you.

Overall, even after figuring what I have paid Credit Answers, I beleive that I have saved about 40% on what I owe creditors. That is not bad. Reducing your debt by 40% is not bad. Could I have done better with another company? Could I have done better doing it myself? Maybe, but I don't want to risk doing something I am not professional at. I am not a plumber, I am not an electrician and I am not a car mechanic. Credit Answers did good for me and I am not sure how they did with anyone else.

My case is not like everone else's case. I lost my job 5 1/2 months ago, I'm on Food Stamps, no money in the bank and my Dad has my back helping when he can with my debts. If you have a good job, money in IRAs, 401(k)'s, CD's in the bank, and money in savings accounts and checking accounts and so on but just don't want to pay your creditors, then you've got a problem. The reason is that your creditors will track down everything you have and if you are not 100% up front with your creditors, then you can't ask Credit Answers to do much for you. Now if you don't tell Credit Answers about your finaces, then that is a different story, but don't be surprised if your creditor tells Credit Answers that you are multi-millionaire with a mansion and yacht and millions in Swiss bank accounts.

I believe that Credit Answers has good negotiators who point out to your creditors your problems, the possible solutions and nudge the creditors to see things your way. This a benefit to you. How much is this type of service worth? Well, you have to decide on your own. And just because I got a fair shake from Credit Answers doesn't mean that everything is 100%. Every company has a few screwballs and if you representative is not 100% then you are not going to see good results. Like life, it's a roll of the dice. I called my phone company about my dire straits and they reduced my phone bill by $15 a month for 6 months. That is only because the person I spoke with had gone through something similar herself. Would any other customer rep at the phone company given me $15 off my phone bill for 6 months - probably not. It's all chances.

#1 Consumer Suggestion

Instead of blaming the debt settlement companies for your problems how about not using credit cards to finance your lives. Debt settlement is great!

AUTHOR: Scott - (U.S.A.)

SUBMITTED: Friday, March 27, 2009

Instead of blaming the debt settlement companies for your problems how about not using credit cards to finance your lives. Debt settlement is a viable option to eliminate your debt. Maybe in the future you should research the company that you choose. CreditAnswers is a full disclosure company and should not be blamed for the debt that consumers have built on their own. many creditors settle debts with debt settlement companies. If it weren't for the crooked banking industries raising the interest rates and lowering peoples available limits which also affects your credit negatively, we wouldn't be in this mess in the 1st place. Since I have been studying the secret society's of this planet and the complete take over of the economy of the world none of us are safe. look up Alex Jones 911 on google. there is a 2:22 minute documentary about how our goverment and the elite people of the world have been working to herd us into such a crisis so that we give up civil libertys for security. What people dont realize is that the media is owned by the banking industries. And the BBB and the rip-off report are being financed by the banking institutions. Look up the BBB on the rip off report and see for yourself. But watch Alex Jone 911 and look up New World Order on You tube. get a clue america!!!! You better wake up before it's to late. Remember No empire lasts forever!!!

Advertisers above have met our

strict standards for business conduct.