Complaint Review: Financial Recovery Services, Resurgent Capital, LVNV Funding LLC, Citibank - Minneapolis Minnesota

- Financial Recovery Services, Resurgent Capital, LVNV Funding LLC, Citibank 4640 W. 77th St., Suite 300 Minneapolis, Minnesota U.S.A.

- Phone: 888-411-4684

- Web:

- Category: Collection Agency's

Financial Recovery Services, Fran Boyd, Resurgent Capital. LVNV Funding LLC, Citibank FRS-Financial recover Services KNOWINGLY attempts OOS Collections! Minneapolis Minnesota

*UPDATE Employee: You people aren't very bright, are you?

*Consumer Comment: this is sad

*Consumer Comment: You can collect within limits after SOL

*Consumer Comment: Whisperhawk sounds more like loudvulture

*Consumer Comment: When did I say that?

*Consumer Comment: We've resorted to name calling? Very mature..

*General Comment: Arianna- Be better informed

*Consumer Comment: Bill, they can't just "notify the court" to garnish your wages.

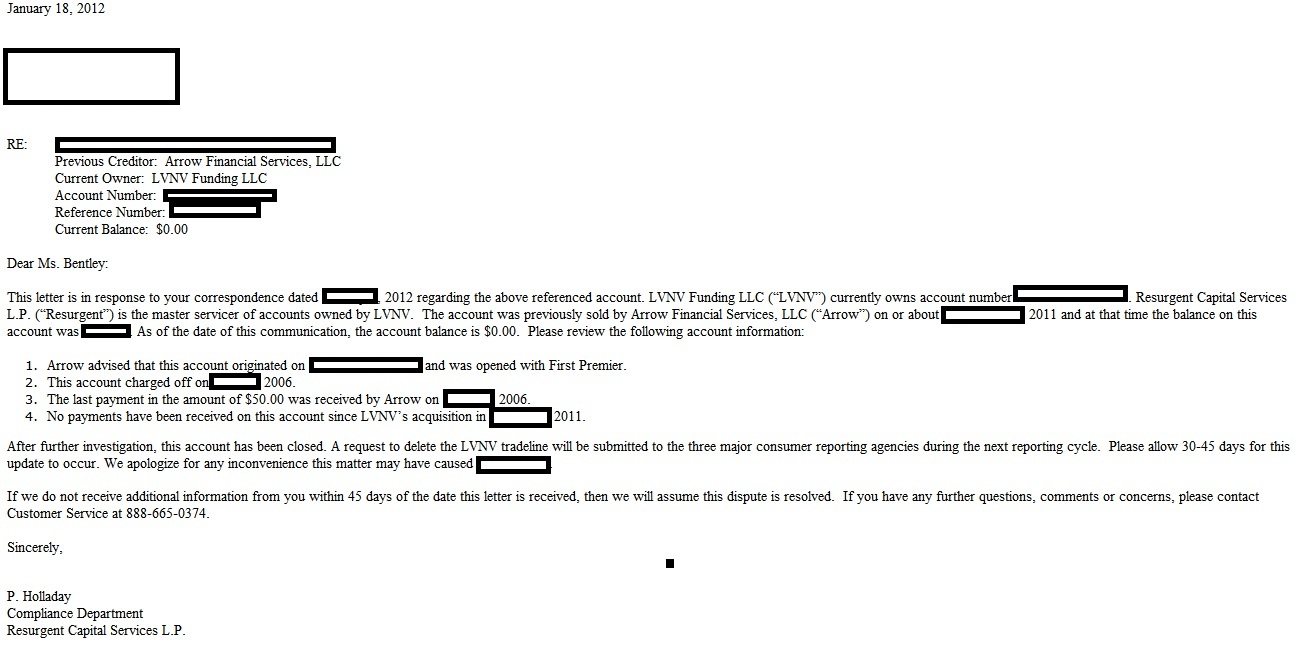

*Consumer Comment: LVNV - get it off your report

*Consumer Comment: Contact Consumer Advocacy

*REBUTTAL Individual responds: lvnv funding

*UPDATE EX-employee responds: Hopefully this will help....

*Consumer Comment: I'm trying to get in contact with "Steve from Bradenton, FL"

*Consumer Comment: Shees.

*Consumer Comment: Financial Recovery Svcs / LVNV Funding Debt collecting SOL thrown out of numerous courts

*Consumer Suggestion: I have an account in collections with them as well

*Consumer Suggestion: Not wrong.

*Author of original report: Robert, you are wrong on this one!

*UPDATE EX-employee responds: Final words to Steve. Read this for FACTUAL information.

*UPDATE EX-employee responds: Final words to Steve. Read this for FACTUAL information.

*UPDATE EX-employee responds: Final words to Steve. Read this for FACTUAL information.

*UPDATE EX-employee responds: Final words to Steve. Read this for FACTUAL information.

*Consumer Comment: get real

*Consumer Comment: Hmmmm.

*Author of original report: "Whisperhawk" needs some education...And..

*UPDATE EX-employee responds: Not entirely accurate, this is slander

*Consumer Suggestion: MUST BE WORKING THE TEXAS AREA. LOOK AT THE NUMBER OF POSTS IN THE PAST MONTH. Resurgent Capital. LVNV Funding, Citibank FRS-Financial

*Consumer Comment: Another vicitim/ just got my letter from Fran boyd @ Financial recovery as well Re: LVNV funding

*Consumer Comment: Another vicitim/ just got my letter from Fran boyd @ Financial recovery as well Re: LVNV funding

*Author of original report: J, You can do it either way

*Consumer Comment: Steve, just how do you go about suing them?

*Author of original report: More dirt on these bottomfeeders known as FRS or Financial Recovery services

*Author of original report: More dirt on these bottomfeeders known as FRS or Financial Recovery services

*Author of original report: More dirt on these bottomfeeders known as FRS or Financial Recovery services

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

These morons are just too much. First, they send a letter to my Mother's house [I have a different address and phone].

Second, they are attempting to skirt a CEASE COMMUNICATIONS request I sent during the past year to their current "client" RESURGENT CAPITAL and the alleged "creditor" LVNV Funding, LLC. with a reference to a CitiBank acct. I would think Citibank would be listed as the creditor as they are the ONLY actual creditor on the list.

They will claim to not know anything about a CEASE COMMUNICATIONS letter, but ignorance is no excuse. It should be in the file if indeed RESURGENT cAPITAL is their "client". It would not apply if they bought the debt.

The "debt" is clearly referenced as "OOS" which means OUT OF STAT, which means LEGALLY UNCOLLECTABLE.

Well, time to hammer some more BOTTOMFEEDERS. It's just more free money!

Also, they use a CA address for the origination of the collection letters, and use only a PO Box for a business address on the collection letter. The only way I got a physical address was to do a web search. A very shady bunch of scumbags here.

Here are the addresses they use:

Financial Recovery Services, Inc.

aka: FRS

P.O. Box 385908

Minneapolis, MN. 55438-5908

888-411-4684

Attn: Fran Boyd

Account Manager

Return address from collection letter:

[No Name]

Dept 813

PO Box 4115

Concord, CA. 94524

Time to educate these monkeys!

Steve

Bradenton, Florida

U.S.A.

This report was posted on Ripoff Report on 11/26/2006 08:24 AM and is a permanent record located here: https://www.ripoffreport.com/reports/financial-recovery-services-resurgent-capital-lvnv-funding-llc-citibank/minneapolis-minnesota-55438-5908/financial-recovery-services-fran-boyd-resurgent-capital-lvnv-funding-llc-citibank-frs-222264. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#34 UPDATE Employee

You people aren't very bright, are you?

AUTHOR: Collections101 - (USA)

SUBMITTED: Thursday, September 03, 2015

As any FRS agent will tell you if something is OOS (myself included) the out of stat disclosure strictly says verbatim "The law limits how long you can be SUED for on a debt. Due to the age of this debt (current creditors name) will not sue you for it." Just because it is out of stat does NOT mean you can't collect on the debt. Think of it this way, you loan somebody 5000.00$ and 10 years goes by and you don't see a dime of that money do you still want it back regardless of how long it's been? My guess is that yes you would.

That's how credit card company's are. You can't just loan money or credit and not expect to pay it back. That's just ludicrous. I suggest the author of this get a little better of an education before speaking so lowly about this company. Every person who I work with every single day are there to help you. Now if you want to be rude then they won't feel the need to be as kind. You get what you give. Also, just because you ceased LVNV funding doesn't mean we get all the information from them. When get your name, your account balance, address and social and what card it is. That is it. Nothing more. Time to educate this "monkey". Have a good evening.

#33 Consumer Comment

this is sad

AUTHOR: frmr. sgt christle-anderson - ()

SUBMITTED: Thursday, December 12, 2013

ok so I debt collector is trying to collect a debt You created. The fact that you think all collectors are just trying to get one over on you is sad. They are doing their job. As far as oos bills, they are still valid debts. You just can't get sued for them. They are still on your credit report and you still owe them. If you don't care about your credit and don't care about paying your bills don't pay it, but don't put them blame on the agencies. If your so smart why don't you read the fdcpa and figure out how to inform the collector you have no interest in paying this. Since you are such a intelligent and knowing person, this should be no problem. If you don't want debt collection calls, don't knowingly put yourself in a position to get a call from one.

#32 Consumer Comment

You can collect within limits after SOL

AUTHOR: Steve in NY - (United States of America)

SUBMITTED: Monday, July 09, 2012

Robert in Buffalo your right but within limits.

The spirit of the SOL laws was that debts could only be collected within a defined time. These laws were passed to prevent the kind of forever liability you describe.

The bill / debt collection agency business is full of bottom feeders who flout the loophole you describe. When the SOL for instance on robbery has past you don't see people calling and sending letters to the

alleged criminal. Name me another instance where after SOL individuals get harassed other than the land of bottom feeding bill collectors?

Collection Agencies can't tag your credit report when the debt has aged beyond limits set in the FDCPA, but that doesn't stop them. Many agencies collecting debts that are outside of SOL and reporting limits as collection accounts do so illegally every day. They do this because most consumers don't sue for damages.

So attempting to collect a debt that is outside SOL and aged beyond reporting on a consumer credit report puts the collector in potential jeopardy for damages especially if the reported collection account lowers the consumer credit score resulting in denied credit or higher interest rates. Those damages an attorney costs can be collected in court by the consumer from the collection agent or agency. The ability to have negative information on your consumer credit report is a threat that some bottom feeding collectors use to coerce you into settling with them when you can just tell them to go pound sand.

The bottom line is it is easy to attack the consumer as loud vulture did as someone irresponsible, etc. The facts are that unsecured debt is a risk for the financial institution and to offset that risk higher interest rates are charged. I pay 4.05% on my mortgage because it is secured by an asset but on my credit card the interest rate is 9.99%. The reason for the difference is the risk factor. The problem today with collections becoming so aggressive is the long term economic downturn. The government has made it much harder for banks and other lenders to foreclose or collect unsecured debt. This has bred a business opportunity for the bottom feeding bill collections businesses. When it is harder to collect the loud vultures of the world have to become more aggressive.

I am not condoning people not paying their debts but I also don't feel sorry for financial institutions who made bad lending decisions that caught up with them in the bad economic times. We the taxpayers bailed these folks out so I cry no tears. The real deadbeats, leeches and bottom feeders are these too big to fail institutions who were bailed out by the taxpayers. Many consumers took out debt believing that they could keep up with the payments but like the institutions when the long and deep economic downturn happened it put many consumers in a tight place. What used to happen was people would file Bankruptcy but the government has made it much harder for consumers to do this. What you end up with are consumers who decide between which bills to pay and which not to pay. There is really no reason for people like loud vulture to attack these people as most of them intended to pay for their obligations only to be called names and yelled at by bottom feeders like loud vulture.

I encourage consumers to come here and other consumer debt boards to learn, ask questions and use every legal option afforded to you. There is nothing wrong with this and you should not feel guilty with knowing and using your legal options. The Financial Institutions and Bottom Feeding Collectors use every legal option at their disposal including illegal ones to get you to give them your money.

#31 Consumer Comment

Whisperhawk sounds more like loudvulture

AUTHOR: Steve in NY - (United States of America)

SUBMITTED: Monday, July 09, 2012

I really love when folks from the bottom feeding collection agencies come to this board to defend their practices and attack the consumer.

Now imagine how the "loud vulture" would treat the consumer on the telephone. You just got a preview as the "loud vulture" defends harassing family members as part of their skip-tracing process. The consumer protection laws have continuously been modified because ACA member agencies took advantage of consumers lack of knowledge of the law.

A great example is how the loud vulture surreptitiously states that out of statute debts are "NOT legally uncollectable" I'm sure if the loud vulture was shouting at you on the phone they would not let up until they get the consumer to admit they have an obligation for the debt. The truth is that OOS debt is only collectable if you can trick the consumer to violate their rights by admitting that they owe the original debt. If the consumer denies they ever opened the account the debt is absolutely not collectable and the loud vulture knows it. Agencies like theirs who buy the debts for pennies on the dollar only make money if they get someone to pay so they will do everything and anything to try to get you to pay. Far from the accusation of "slander"

The loud vulture also uses what most bottom feeding bill collectors do is attack the consumer as a deadbeat and tell them to deal with their debt. This is a tactic that is very prevalent in the industry. They insult you, belittle you and really don't care if you have been dealing with death, job loss or any other tragedy. The more you try to tell your story the more aggressive and threatening these vultures will become. They don't care how they get you to pay they just look at you as the mark who they need to get the money from.

Of course the loud vulture finishes up cutely with the "monkeys" and "educated" comments. If this person had you on the phone the name calling would be far worse.

My advice to the consumer is if this debt is truly older than the statute of collections to simply not conduct any phone conversations with these bottom feeders. Never admit any account with any creditor they claim they are collecting for. They can't collect unless you give them information that allows them to restart the clock on the statute of limitations. They won't take you to court because they know they will lose when your attorney makes a motion to dismiss based on the statute of limitations of the alleged debt.

It is these bill collectors who don't act professionally and consumers need to be informed of their rights and if they are being harassed they should get a consumer attorney and make the loud vultures of the world pay up some damages.

#30 Consumer Comment

When did I say that?

AUTHOR: AriannasMommy - (United States of America)

SUBMITTED: Monday, February 06, 2012

Never did I say that a collection agency cannot sue! Provided they can prove that they are legally authorized to collect on a debt, they can sue, WITHIN the statute of limitations in the state in which the debt was initiated in, or the state you now reside in - it's their choice. They can even attempt to sue AFTER the statute of limitations has expired, then it's up to you to appear for your court date and prove to the judge that the debt is beyond the statute of limitations. I'm honestly not even sure what you are saying that I need to research, because everything you've said has nothing to do with anything I stated!

I never claimed that the BBB had any authority over the CRAs whatsoever! They do however, keep a running tally of all complaints filed against companies, in particularly, those who are BBB accredited. The more unresolved complaints a business has, the worse it looks to consumers and their BBB "grade" goes down.

Please, before you criticize others, at least know what you are talking about yourself. Read things completely before you jump to conclusions and make yourself look silly. And btw, I know for a fact that this site has spell check, you really should check out all the little red lines under your words prior to posting.

#29 Consumer Comment

We've resorted to name calling? Very mature..

AUTHOR: AriannasMommy - (United States of America)

SUBMITTED: Monday, February 06, 2012

An idiot? Hmmm, well we're mature I can see!

If you are sued at some point BEYOND the SOL, it is your responsibility to make sure the judge is aware that the debt is beyond the SOL and therefore can no longer be collected on.

Exactly what part of notification is required within 30 days of initial contact do you not understand? It is written in plain English in the FCRA! Being that I was never sent a dunning letter, initial contact was when I discovered the entry on my credit report!

No, the BBB does not monitor the CRAs, however, they do investigate complaints, especially when it comes to businesses who are BBB accredited. Obviously, LVNV is fully aware that what they've done is wrong, being that they've sent me a letter specifically stating that the original entry on my report was done so in THEIR ERROR!

As far as the attorney general, they DO in fact investigate unfair and illegal debt collection practices! They do not always investigate every case, however, if enough complaints are received regarding one company, the do. Perhaps YOU should do some homework, I'm not your average ignorant blabbermouth - I research before I open my mouth (or in this instance, move my fingers to type).

LVNV are the bottom feeding scum of debt collectors, using illegal tactics to bully people into paying money that they do not owe! Money that, in my case, they were never even authorized to collect!!

Attempting to sound intelligent, while calling people names only proves your true ignorance!

#28 General Comment

Arianna- Be better informed

AUTHOR: Righteous1 - (USA)

SUBMITTED: Monday, February 06, 2012

Arianna, Please read up on How the SOL works in your favor during court proceedings.

A Collector CAN SUE . You are not a consumer lawyer and have a false sense of security based on what the SOL is and how it works in a court decision.

Your debt can be at any time called upon and a judgement cast....its up to you to be diligent and make sure you are within your rights and that the collectors are within their rights.

The BBB has ZERO imput or regulation on the Credit Bureu. I find you to be lacking correct and proper information. See a Consumer Lawyer or at the very least brush up on the regulations before rushing forth and looking like an idiot to the Attorney General or BBB....

#27 Consumer Comment

Bill, they can't just "notify the court" to garnish your wages.

AUTHOR: Southern Chemical and Equipment LLC - (USA)

SUBMITTED: Monday, February 06, 2012

Bill,

That's simply not the way it works.

Before your wages can be garnished for any civil debt, you must first have been sued and lost, and then they must obtain a judgement.

And, the only way they can garnish your wages is if YOU told them where you worked, other than if you have been on the job a long time and it is listed on your credit report.

(This is why you NEVER speak to any debt collector on the phone)

Good luck,

(Steve-Bradenton)

#26 Consumer Comment

LVNV - get it off your report

AUTHOR: AriannasMommy - (United States of America)

SUBMITTED: Monday, February 06, 2012

How close are you to the SOL? Is the SOL expired? If the SOL is expired, you're at an advantage, you can be as nasty as you want to and there's nothing they can o about it. If not, you need to be careful of your tone, because they can and will sue you! Lucky for me, my debts are all past the SOL. In fact almost all of them are scheduled to fall off in January 2013.

LVNV appeared on my report in January 2012, I was sooooo livid!! I had just raised my score about 90 points and this one entry dropped me 60 points. They never sent me a dunning letter or anything they just went ahead and reported it. I disputed it with the CRAs, but I also made complaints to the BBB, the SC Attorney General and the PA Attorney General. They are BBB accredited (which say a lot about the BBB, right?). They responded with a letter stating their apologies, and that the entry was an "error", evidently they couldn't verify the account. They used the same dates I used in my complaint, which is funny because I know 2 of the dates I used were wrong, lol. They immediately removed the entry. I was so excited, until 2 days later they started reporting as RCS/CVF Consumer Acquisitions!!!!! And on a totally different account! I didn't realize this until today. Today I fired off some more complaints to the BBB (again) making it clear that it's really "funny" how it came off and was put back on for the exact same amount with a different OC listed! And referenced my original complaint in the second complaint. I also filed new complaints with both attorneys general against them. Let's see how they talk their way out of this one.

#25 Consumer Comment

Contact Consumer Advocacy

AUTHOR: Righteous1 - (USA)

SUBMITTED: Sunday, January 29, 2012

Research Consumer Advocacy Lawyers. They will best be able to assist on your most recent inquiry.

Based SOLELY on your statement of them seeking garnishment, Refer to your state of jurisdiction on how much they can garnish, etc. 99.9% of the time, Garnishment can be established if the LAWSUIT prevailed in their favor and they received a judgement. IT can not just be randomly done without court proceedings.

They have no reason to negotiate with you on a settlement.....

Did you get served for court? They could have easily gotten a default judgment if you were a no show. That is/was your obligation to defend your financials. Heck you can even go to court and simply say...Judge...its not my debt, and they are required to show proof for the judge to rule on value and all evidence to collection/communicate.

#24 REBUTTAL Individual responds

lvnv funding

AUTHOR: bill - (United States of America)

SUBMITTED: Tuesday, January 17, 2012

hello I am from Ohio and have started receiving letters from this financial recovery services,inc for the past two months.The current creditor lvnv has over inflated the amount owed on the 5 year old debt. It appears they have they have notified the court of the potential to garnish my wages. Can they do this? I am currently working to pay off all my past debt now I am am working but It seems they all are coming at one time. I have paid off one debt and in the process of paying off another. I need some guidance here.I am afraid to contact them as I found out from the first two they give you no break, they just want the money..please help if you can ...thanks

#23 UPDATE EX-employee responds

Hopefully this will help....

AUTHOR: Whisperhawk - (U.S.A.)

SUBMITTED: Saturday, July 11, 2009

Dear Elizabeth,

Please forgive my suspicious tone as I'm assuming you must already know steve or perhaps you are steve pretending to be someone else as I question a "high school teacher" who doesn't know how to spell "legitimate", amongst your other grammatical errors. Even though I doubt the "legitimacy" of your post, I will give you the benefit of the doubt and address the concerns you listed as it may be a good opportunity to help others who may be in a similar situation.

For the record, let me say that I am against the abuse and mistreatment of consumers that has plagued the credit and collections industry for some time now. Debts CAN be collected in a professional and courteous manner, albeit it takes greater self-discipline. Congruently, I am also against the wave of consumers/debtors who look for any loophole to free themselves of their obligations and furthermore seek to recover "damages" simply because they are upset about being contacted by a debt collector. If a debtor does not wish to receive calls or letters from a debt collector, they may submit a written notice to the agency ordering them to cease any further written or verbal communication. The agency is then permitted one final contact with the debtor to advise that they are in receipt of the order. After that, the agency/collector may not communicate with them in any fashion with regards to said debt.

So, "Elizabeth", you may find it comforting to know that you live in a very "debtor-friendly" state where the statute of limitations on all contracts is 4 years from the date of last payment. If the SOL has expired, all this means is that the creditor no longer has legal recourse against you. They may legally continue to attempt the collection of said debt indefinitely, whether or not you choose to acknowledge it.

With respect to these items showing up on you credit report, however, the creditors/collectors are governed by the Fair Credit Reporting Act which stipulates the lines of trade may be reported for up to 7 years after delinquency. This is not affected by the statute of limitations.

You mentioned that you feel some of the balances appear inflated on your credit report. This is likely due to a high default interest rate accelerating what is known as the "s****.>

(WARNING: RANT) Many default rates are in the neighborhood of 20 to 30 percent and in some cases the interest balance may even surpass the original principle balance depending on the age of the debt. (Ridiculous, right?) Personally I have a big problem with this as I do not feel it is ethically responsible to assess a high rate of default interest year after year to a debtor's account. I feel it artificially inflates the actual amount owed under contract and further stifles the consumer's ability for repayment. My personal opinion is that a default rate should be allowed for no more than 1-2 years from the date of charge-off by the original creditor, with subsequent interest rates to be determined individually by the state in which the debtor resides. A good model to follow would be the statutory interest rate for judgments, which in most states is about 4 to 6 percent annually. I believe this would facilitate a higher rate of repayment on delinquent accounts while at the same time relieving some of the burden on the debtor, especially considering the current financial stresses felt by most Americans.

If you are who you say, Elizabeth, I sincerely hope this information is useful to you and that it provides you with some working knowledge on how to deal with your current situation. My advice is to step up to the plate and try to work with your creditors on a repayment plan especially considering right now most collection agencies are offering unheard of settlements nearing 30-40 cents on the dollar. If at this point you still do not wish to deal with collectors up front, send a cease letter to these agencies. However, Do not expect your credit rating to improve if you do not intend to repay your debts. When steven purportedly "Walked away" from 170k in debt without recourse (which I sincerely doubt is true) I felt betrayed and so should everyone who reads this because guess who picks up the tab on the prime rate increases. YOU AND I. As Americans, we each should feel an obligation to be fiscally responsible in our own right, as the days of "freebies" and "beating the system" are simply over and done with. We all need to pull together in the spirit of fairness and financial well-being with the goal of putting our great nation back in the driver's seat of the world economy.

W.H.

#22 Consumer Comment

I'm trying to get in contact with "Steve from Bradenton, FL"

AUTHOR: Elizabeth - (U.S.A.)

SUBMITTED: Tuesday, June 02, 2009

I found "Steve from Bradenton, FL" the most helpful at providing relevant information regarding Financial Recovery Services. I'm dealing with them right now myself and I'd really like to get in contact with this "Steve" person. I'd even be happy to pay him for his advice on what I should so in my particular situation. So STEVE, if you are reading this, please email me (missmeli78717@yahoo.com) your contact info (phone? email?) so that I can visit with you. I'm a legitimite consumer who just has some basic debt collection questions that I think you might be able to answer.

My main concern is figuring out how to research when the statute of limitations expires on my debts. I live in Austin, TX if that makes any difference. Some of the 3rd party collectors and payday loan companies are located outside of Texas. Right now I'm most concerned with a couple 3rd party debt collectors who are trying to make me pay a very inflated version of my original credit card debt. Some of these credit card debts have been on my credit report for years and I'm thinking (and hoping) that the statute of limitations has run out. If I can find that information out, I assume my next step would be to send the original credit card company and the new 3rd party debt collector a letter stating that the SOL is now over and that I do not acknowledge the debt...is that correct thing for me to do? Some of the debt collectors have really hurt my credit and if it is legal for me to request that they take their debt off my credit (because of SOL), then I would really like to get moving on writing the letters. I just don't even know where to start. There is so much inaccurate information on my credit report that I'm flustered as to where I should begin. I do honestly want to improve my bad credit rating but I don't know what legal and what's not (for me and the creditors to do) and what my rights are. I will be looking over the Fair Debt Collections Act tonight so I might have even more questions to post tomorrow. Basically I'm just trying to educate myself on all this debt collection stuff...rights, laws, etc. I'm a high school teacher, not an attorney.

Thank you for any information/advice that STEVE or anyone else can offer me! :-)

#21 Consumer Comment

Shees.

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Saturday, April 04, 2009

""Might want to look at all the Judges who have thrown out FRS/LVNV Funding SOL court proceedings , they have all been thrown out of court because they were too old. Sorry guys your WRONG.""

You might want to RE-READ the rebuttals and comprehend what was posted. No where did I or anyone else state that an expired SOL was NOT an affirmative defense against a time barred debt lawsuit - it is.

Further, many junk debt buyers will file a lawsuit on a time barred debt in the hopes that the defendant does NOT show up - then the JDB wins a default judgment. The courts will NOT affirm an expired SOL defense for the defendant - the DEFENDANT MUST respond to the court summons and affirm an expired SOL defense. Once it is established by the defendant that the SOL is expired, the court tosses the suit.

Shees indeed!

#20 Consumer Comment

Financial Recovery Svcs / LVNV Funding Debt collecting SOL thrown out of numerous courts

AUTHOR: Sheesh - (U.S.A.)

SUBMITTED: Thursday, March 26, 2009

Might want to look at all the Judges who have thrown out FRS/LVNV Funding SOL court proceedings , they have all been thrown out of court because they were too old. Sorry guys your WRONG.

#19 Consumer Suggestion

I have an account in collections with them as well

AUTHOR: Laurie - (U.S.A.)

SUBMITTED: Wednesday, October 01, 2008

And the ORIGINAL CREDITOR is responsible for providing correct address when they sell the debt - Can be hard to do when the original creditor changes your address without your knowledge or consent.

In my case this is the third creditor to change my mailing address without my knowledge or consent and the 2nd one that ended up with a collection agency

The first one was resolved in my favor and my credit report was corrected.

I am now in the middle of another one due GE Money Bank posting fraudulent unauthorized charges on my account as well as making the unauthorized address change. And no attempt by original creditor to collect the debt themselves and sold it as JUNK DEBT. As it was a rarely used dept store card and I have not used it since it was last paid in full, getting the call from the collection agency about a debt I know nothing about is quite frustrating.

LVNV is listed on budhibbs as one of the worst junk debt collectors and they always violate FDCPA federal laws and can never validate the debt.

#18 Consumer Suggestion

Not wrong.

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Saturday, September 20, 2008

""Statute of Limitations means exactly that. Once the SOL has expired on anything, not just a debt, the issue at hand is dead, in the eyes of the law.""

No it's not. It means that a civil judgment cannot be granted because the SOL is expired. This is NOT the same thing as a debt being absolved-the debt is still owed but there is NO judicial recourse for the creditor. Look at it this way. You owe me $1000 back rent (SOL in NY is 3 years for back rent) but I was fool enough not to sue for it before the SOL expired. I cannot honestly win a lawsuit for it but I can continue to call you or mail you notices demanding payment (This does not mean I can call you 20 times a day-that's harassment and a violation of Article 29-H or the NYS General Business Law.) Further, I can pay a fee and have this bad debt put on credit reports about you with the 3 CRAs. This listing of the money you owe me may stay on the credit reports for up to 7 years. Additionally, say 4 years later, someone calls me (a landlord checking your references for a unit you wish to rent) asking about you as a tenant of mine. I tell him that you owe me $1000 in back rent. All this is legal Steve. If you were to attempt to sue me over this (for defamation or whatever,) I would successfully countersue YOU for bringing a frivolous lawsuit against me.

""I know debt collectors hate to accept this fact, but it is true.""

Indeed. I'm not a debt collector. I also stated in my other rebuttal that I wouldn't pay any debt that is beyond the SOL.

""Once a debtor notifies a debt collector that the debt is past SOL and is no longer legally collectable, that is the end of it in the eyes of the law. The debtor then informs the collector that they have no intention to pay the debt.""

I would agree with this statement. However, if you reread what I posted I was commenting from a CREDITOR perspective.

""Any further actions past this point become frivolous, and in any court I could prove harassment and/or stalking. I could get them prosecuted criminally here in Florida. I have already had the conversation with the DA here for the 12th Circuit.""

NOT under the circumstances that I prescribed. Here in NY, as the CREDITOR, I may legally attempt to collect the debt owed to ME indefinitely. I know of no US jurisdiction where a CREDITOR can be prosecuted for harassment or stalking for lawfully attempting to collect a debt. Do not confuse this with suing.

""I walked away from 34 creditors in 2002 for approximately $170,000.

As of today, I have not paid 1 cent to anyone, and have no judgements against me.""

Perhaps. Not my fault folks didn't sue you quick enough! LOL!

""Therefore, I think I know just a little more than you on debt collections and SOL.""

I know you THINK that, but that doesn't make it so. I've been working with consumers with credit issues since 1982. I have testified in court numerous times and in every case where I testified against a debt collector, the debt collector LOST.

Also, if my memory serves, I believe I was the one who educated you as to charge-offs and what they actually do.

There is another ROR where I notified you that although the FDCPA requires a validation request to be written, a court ruled that a validation request over the phone was valid and determined that the debt collector violated the FDCPA by continuing to attempt collection without validating the debt.

""But thanks for your input anyway!""

You're welcome I'm sure!

#17 Author of original report

Robert, you are wrong on this one!

AUTHOR: Steve - (U.S.A.)

SUBMITTED: Saturday, September 20, 2008

Robert,

Statute of Limitations means exactly that. Once the SOL has expired on anything, not just a debt, the issue at hand is dead, in the eyes of the law.

I know debt collectors hate to accept this fact, but it is true.

Once a debtor notifies a debt collector that the debt is past SOL and is no longer legally collectable, that is the end of it in the eyes of the law. The debtor then informs the collector that they have no intention to pay the debt.

Any further actions past this point become frivolous, and in any court I could prove harassment and/or stalking. I could get them prosecuted criminally here in Florida. I have already had the conversation with the DA here for the 12th Circuit.

I walked away from 34 creditors in 2002 for approximately $170,000.

As of today, I have not paid 1 cent to anyone, and have no judgements against me.

I have gotten 1 collection attorney disbarred and have gotten paid by 2 others for FDCPA violations.

I have been sued 3 times, and have beaten each suit, and those were all within SOL!

Therefore, I think I know just a little more than you on debt collections and SOL.

But thanks for your input anyway!

#16 UPDATE EX-employee responds

Final words to Steve. Read this for FACTUAL information.

AUTHOR: Whisperhawk - (U.S.A.)

SUBMITTED: Friday, September 19, 2008

The BEST?!!! Steven, you are a joke and it should be clear to everyone who reads your posts that you have nothing better to do with your time than spread disinformation. By seeing what you have written, people will see you for what you REALLY are; An angry child with too much time on his hands who is a victim of his own entitlement mentality.

FYI

You are partially correct in that many years ago I was a project manager for this company. After completing my education (something you obviously have not done) I have since gone on to work in the legal department of a major financial institution. It is clear to me and anyone else that you didn't even read my rebuttal, let alone your credit contracts. (is that because you have difficulty reading?)

1. If the company sent a letter in good faith and had no reason to believe the address was incorrect, then it is NOT illegal. What IS illegal is opening someone else's mail without their consent, instead of marking it return to sender if they do not presently reside there. (Funny though, that you did receive the letter)

2. You DO have a legal obligation per your contract with the original creditor to update your address and those obligations DO transfer to any subsequent owner of your delinquent account.

3. Again, if you had read my rebuttal you would know that the account is NOT "legally uncollectable". It means only that the owner of your debt can no longer sue you in conciliation or district court. And it most certainly does NOT mean collecting on said debt puts any collector or agency in any actionable position whatsoever. Again, the ONLY states in which it IS illegal to collect on post statute debts are WI and MS.

4. I must apologize to you for using the term "Cease and Desist" as that is a term that most attorneys would use. Whereas "Cease Communication" is a term frequently used by people who click their mouse a couple times and then consider themselves experts.

I love how you say you "walked away from your debts". That's hilarious. You ran away instead of facing your financial problems. Man up.

After my first four years of college, I too was in debt. But I worked hard and paid my debts off over time, instead of running away from them. Now my median credit score is 767. What's yours, Steven?

You are a prime example of someone who abuses the financial system and then acts as though they are the victim to cover up for their own fiscal irresponsibility. You lash out at people by calling them "bottom-feeders", "monkeys" and "morons" when it is YOU who is financially insolvent and refuses to take responsibility for your situation. Psychologists call this behavior transference.

You have done nothing but made a fool of yourself and brought shame to this site and everyone who uses it for legitimate purposes. You are far from an "educator" and have done all who read these posts a great disservice by spouting your asinine opinions and ramblings.

Even though you will undoubtedly respond to this post, it will be my final rebuttal as I have better things to do with my time and you obviously have no capacity or desire to absorb relevant, factual, or otherwise scrupulous information.

So go back to your tilt-a-whirl, multi-level marketing, door-to-door knife sales or whatever it is that you do, Steven and I will go back to my office. (which actually has its own door) When you get home from your shift make sure you don't forget to write that rent check to your landlord. (out of your closed account) Meanwhile I'll be in my house (which I have a mortgage for at 5.5%) thinking about how I can improve my family's financial future.

You are truly a skidmark on the underwear of society. The next time you feel like sharing your colorful yet uneducated opinions, pull your head out of your rectum so that you can see clearly enough to get your facts straight.

Good luck.

My guess is you will need it.

#15 UPDATE EX-employee responds

Final words to Steve. Read this for FACTUAL information.

AUTHOR: Whisperhawk - (U.S.A.)

SUBMITTED: Friday, September 19, 2008

The BEST?!!! Steven, you are a joke and it should be clear to everyone who reads your posts that you have nothing better to do with your time than spread disinformation. By seeing what you have written, people will see you for what you REALLY are; An angry child with too much time on his hands who is a victim of his own entitlement mentality.

FYI

You are partially correct in that many years ago I was a project manager for this company. After completing my education (something you obviously have not done) I have since gone on to work in the legal department of a major financial institution. It is clear to me and anyone else that you didn't even read my rebuttal, let alone your credit contracts. (is that because you have difficulty reading?)

1. If the company sent a letter in good faith and had no reason to believe the address was incorrect, then it is NOT illegal. What IS illegal is opening someone else's mail without their consent, instead of marking it return to sender if they do not presently reside there. (Funny though, that you did receive the letter)

2. You DO have a legal obligation per your contract with the original creditor to update your address and those obligations DO transfer to any subsequent owner of your delinquent account.

3. Again, if you had read my rebuttal you would know that the account is NOT "legally uncollectable". It means only that the owner of your debt can no longer sue you in conciliation or district court. And it most certainly does NOT mean collecting on said debt puts any collector or agency in any actionable position whatsoever. Again, the ONLY states in which it IS illegal to collect on post statute debts are WI and MS.

4. I must apologize to you for using the term "Cease and Desist" as that is a term that most attorneys would use. Whereas "Cease Communication" is a term frequently used by people who click their mouse a couple times and then consider themselves experts.

I love how you say you "walked away from your debts". That's hilarious. You ran away instead of facing your financial problems. Man up.

After my first four years of college, I too was in debt. But I worked hard and paid my debts off over time, instead of running away from them. Now my median credit score is 767. What's yours, Steven?

You are a prime example of someone who abuses the financial system and then acts as though they are the victim to cover up for their own fiscal irresponsibility. You lash out at people by calling them "bottom-feeders", "monkeys" and "morons" when it is YOU who is financially insolvent and refuses to take responsibility for your situation. Psychologists call this behavior transference.

You have done nothing but made a fool of yourself and brought shame to this site and everyone who uses it for legitimate purposes. You are far from an "educator" and have done all who read these posts a great disservice by spouting your asinine opinions and ramblings.

Even though you will undoubtedly respond to this post, it will be my final rebuttal as I have better things to do with my time and you obviously have no capacity or desire to absorb relevant, factual, or otherwise scrupulous information.

So go back to your tilt-a-whirl, multi-level marketing, door-to-door knife sales or whatever it is that you do, Steven and I will go back to my office. (which actually has its own door) When you get home from your shift make sure you don't forget to write that rent check to your landlord. (out of your closed account) Meanwhile I'll be in my house (which I have a mortgage for at 5.5%) thinking about how I can improve my family's financial future.

You are truly a skidmark on the underwear of society. The next time you feel like sharing your colorful yet uneducated opinions, pull your head out of your rectum so that you can see clearly enough to get your facts straight.

Good luck.

My guess is you will need it.

#14 UPDATE EX-employee responds

Final words to Steve. Read this for FACTUAL information.

AUTHOR: Whisperhawk - (U.S.A.)

SUBMITTED: Friday, September 19, 2008

The BEST?!!! Steven, you are a joke and it should be clear to everyone who reads your posts that you have nothing better to do with your time than spread disinformation. By seeing what you have written, people will see you for what you REALLY are; An angry child with too much time on his hands who is a victim of his own entitlement mentality.

FYI

You are partially correct in that many years ago I was a project manager for this company. After completing my education (something you obviously have not done) I have since gone on to work in the legal department of a major financial institution. It is clear to me and anyone else that you didn't even read my rebuttal, let alone your credit contracts. (is that because you have difficulty reading?)

1. If the company sent a letter in good faith and had no reason to believe the address was incorrect, then it is NOT illegal. What IS illegal is opening someone else's mail without their consent, instead of marking it return to sender if they do not presently reside there. (Funny though, that you did receive the letter)

2. You DO have a legal obligation per your contract with the original creditor to update your address and those obligations DO transfer to any subsequent owner of your delinquent account.

3. Again, if you had read my rebuttal you would know that the account is NOT "legally uncollectable". It means only that the owner of your debt can no longer sue you in conciliation or district court. And it most certainly does NOT mean collecting on said debt puts any collector or agency in any actionable position whatsoever. Again, the ONLY states in which it IS illegal to collect on post statute debts are WI and MS.

4. I must apologize to you for using the term "Cease and Desist" as that is a term that most attorneys would use. Whereas "Cease Communication" is a term frequently used by people who click their mouse a couple times and then consider themselves experts.

I love how you say you "walked away from your debts". That's hilarious. You ran away instead of facing your financial problems. Man up.

After my first four years of college, I too was in debt. But I worked hard and paid my debts off over time, instead of running away from them. Now my median credit score is 767. What's yours, Steven?

You are a prime example of someone who abuses the financial system and then acts as though they are the victim to cover up for their own fiscal irresponsibility. You lash out at people by calling them "bottom-feeders", "monkeys" and "morons" when it is YOU who is financially insolvent and refuses to take responsibility for your situation. Psychologists call this behavior transference.

You have done nothing but made a fool of yourself and brought shame to this site and everyone who uses it for legitimate purposes. You are far from an "educator" and have done all who read these posts a great disservice by spouting your asinine opinions and ramblings.

Even though you will undoubtedly respond to this post, it will be my final rebuttal as I have better things to do with my time and you obviously have no capacity or desire to absorb relevant, factual, or otherwise scrupulous information.

So go back to your tilt-a-whirl, multi-level marketing, door-to-door knife sales or whatever it is that you do, Steven and I will go back to my office. (which actually has its own door) When you get home from your shift make sure you don't forget to write that rent check to your landlord. (out of your closed account) Meanwhile I'll be in my house (which I have a mortgage for at 5.5%) thinking about how I can improve my family's financial future.

You are truly a skidmark on the underwear of society. The next time you feel like sharing your colorful yet uneducated opinions, pull your head out of your rectum so that you can see clearly enough to get your facts straight.

Good luck.

My guess is you will need it.

#13 UPDATE EX-employee responds

Final words to Steve. Read this for FACTUAL information.

AUTHOR: Whisperhawk - (U.S.A.)

SUBMITTED: Friday, September 19, 2008

The BEST?!!! Steven, you are a joke and it should be clear to everyone who reads your posts that you have nothing better to do with your time than spread disinformation. By seeing what you have written, people will see you for what you REALLY are; An angry child with too much time on his hands who is a victim of his own entitlement mentality.

FYI

You are partially correct in that many years ago I was a project manager for this company. After completing my education (something you obviously have not done) I have since gone on to work in the legal department of a major financial institution. It is clear to me and anyone else that you didn't even read my rebuttal, let alone your credit contracts. (is that because you have difficulty reading?)

1. If the company sent a letter in good faith and had no reason to believe the address was incorrect, then it is NOT illegal. What IS illegal is opening someone else's mail without their consent, instead of marking it return to sender if they do not presently reside there. (Funny though, that you did receive the letter)

2. You DO have a legal obligation per your contract with the original creditor to update your address and those obligations DO transfer to any subsequent owner of your delinquent account.

3. Again, if you had read my rebuttal you would know that the account is NOT "legally uncollectable". It means only that the owner of your debt can no longer sue you in conciliation or district court. And it most certainly does NOT mean collecting on said debt puts any collector or agency in any actionable position whatsoever. Again, the ONLY states in which it IS illegal to collect on post statute debts are WI and MS.

4. I must apologize to you for using the term "Cease and Desist" as that is a term that most attorneys would use. Whereas "Cease Communication" is a term frequently used by people who click their mouse a couple times and then consider themselves experts.

I love how you say you "walked away from your debts". That's hilarious. You ran away instead of facing your financial problems. Man up.

After my first four years of college, I too was in debt. But I worked hard and paid my debts off over time, instead of running away from them. Now my median credit score is 767. What's yours, Steven?

You are a prime example of someone who abuses the financial system and then acts as though they are the victim to cover up for their own fiscal irresponsibility. You lash out at people by calling them "bottom-feeders", "monkeys" and "morons" when it is YOU who is financially insolvent and refuses to take responsibility for your situation. Psychologists call this behavior transference.

You have done nothing but made a fool of yourself and brought shame to this site and everyone who uses it for legitimate purposes. You are far from an "educator" and have done all who read these posts a great disservice by spouting your asinine opinions and ramblings.

Even though you will undoubtedly respond to this post, it will be my final rebuttal as I have better things to do with my time and you obviously have no capacity or desire to absorb relevant, factual, or otherwise scrupulous information.

So go back to your tilt-a-whirl, multi-level marketing, door-to-door knife sales or whatever it is that you do, Steven and I will go back to my office. (which actually has its own door) When you get home from your shift make sure you don't forget to write that rent check to your landlord. (out of your closed account) Meanwhile I'll be in my house (which I have a mortgage for at 5.5%) thinking about how I can improve my family's financial future.

You are truly a skidmark on the underwear of society. The next time you feel like sharing your colorful yet uneducated opinions, pull your head out of your rectum so that you can see clearly enough to get your facts straight.

Good luck.

My guess is you will need it.

#12 Consumer Comment

get real

AUTHOR: Stacey - (U.S.A.)

SUBMITTED: Friday, September 19, 2008

This is third party collection agency who buys old debts then tries to re-age them by claiming " you made a payment on the account" or "you agreed to make payments" - old hat - spent 5 days in court with a jury suing idiots like this one and won!

Screw em - and sue em

#11 Consumer Comment

Hmmmm.

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Friday, September 19, 2008

""Fourth, all of the debts I walked away from are now past SOL and are legally uncollectable. Thats right. Not you or any other bottomfeeder can get one red cent from me now. Too bad. So sad.""

Partially correct (at least in NY) in that the debtor has to agree to pay the debt. An expired SOL is an affirmative defense against any civil suit against the debtor, hence no debtor I know would (or should) agree to pay a debt that is beyond the SOL.

""Fifth, a debt that is past SOL is LEGALLY UNCOLLECTABLE. It is dead in the eyes of the law, and under the law it no longer exists. That is the law.""

NOT correct in any jurisdiction I know of. If this were true, then it would be appropriate for the CREDITOR to execute a 1099 for imputed income immediately after the SOL is expired. I know of no US jurisdiction where this is done.

The debt DOES exist and is valid and collection attempts may continue. Here in NY, lawful collection attempts may continue FOREVER. However, an expired SOL is an affirmative defense against a lawsuit to obtain a judgment for the debt.

""As a matter of fact, attempting to collect on a debt that you know is past SOL can open you up to a criminal fraud charge, and / or a lawsuit for frivolous collections action.""

This would depend on the METHOD deployed to attempt to collect the debt. If I were to file a civil suit while KNOWING that the SOL is expired, I might indeed face a countersuit for presenting a frivolous lawsuit. However, I may call, mail notices and such to attempt to collect the debt INDEFINITELY. I am not aware of any criminal penalties for attempting to collect a VALID debt which is past the SOL. Remember, an expired SOL does NOT ABSOLVE a debt.

There are 3 methods to absolve a debt: pay it off, the creditor forgives it, or a court orders it absolved.

#10 Author of original report

"Whisperhawk" needs some education...And..

AUTHOR: Steve - (U.S.A.)

SUBMITTED: Thursday, September 18, 2008

"Whisperhawk" the bottomfeeder will now get educated by the best. [Me].

First of all, it makes me wonder why this bottomfeeder is trolling the ROR on the debt collection threads, most likely looking for the company he works for.

Second, it IS illegal to knowingly send one persons mail to another person. All you have to do is read the mail fraud statutes, as well as the FDCPA. My Mother was considered a "third party" at the time the mail was sent as per the guidelines of the FDCPA. Therefore, they disclosed collections actions to a third party by that communication being sent.

Third, I have no LEGAL "obligation" to keep an address updated with any bottomfeeder or the original creditor. I walked away from the debt for a reason, so why would I give them my address? Are you a total moron?

Fourth, all of the debts I walked away from are now past SOL and are legally uncollectable. Thats right. Not you or any other bottomfeeder can get one red cent from me now. Too bad. So sad.

Fifth, a debt that is past SOL is LEGALLY UNCOLLECTABLE. It is dead in the eyes of the law, and under the law it no longer exists. That is the law.

As a matter of fact, attempting to collect on a debt that you know is past SOL can open you up to a criminal fraud charge, and / or a lawsuit for frivolous collections action.

Sixth, ther is NO SUCH thing in collections as "cease and desist". The exact verbage directly from the FDCPA is CEASE COMMUNICATIONS.

Therefore it IS you that is the MONKEY here, and YOU have been "educated"!!

Go back to your cubicle now.

>>>

Submitted: 9/17/2008 9:49:08 PM

Modified: 9/18/2008 10:50:04 AM Whisperhawk

Eden Prairie, Minnesota

U.S.A.

Not entirely accurate, this is slander

First of all, if they sent a letter to your mother's house it is because you have failed to provide an updated address to your current creditor. That is your responsibility. Collection agencies attempt to locate consumers via skiptracing when they don't have a deliverable address on file. This greatly increases their chances of collecting said debt.

If a cease and desist letter is sent to a previous creditor and/or agency, collection agencies are not responsible for the information sent prior to their involvement. This is defensible under the bona fide error defense. No agency affiliated with the ACA would ever knowingly attempt to 'skirt' a cease and desist order. The potential legal ramifications are simply not worth it.

An out of stat debt or 'OOS' as you put it is NOT legally uncollectable. It simply means that the owner of the account can no longer file suit against you. Attempting to collect on out of stat debts is perfectly legal in all states except for MS and WI.

My best suggestion is to deal with your debt in a more professional manner and take a good hard look at why they are contacting you in the first place.

Perhaps you should reconsider which 'monkeys' need to be 'educated'.

>>>

#9 UPDATE EX-employee responds

Not entirely accurate, this is slander

AUTHOR: Whisperhawk - (U.S.A.)

SUBMITTED: Wednesday, September 17, 2008

First of all, if they sent a letter to your mother's house it is because you have failed to provide an updated address to your current creditor. That is your responsibility. Collection agencies attempt to locate consumers via skiptracing when they don't have a deliverable address on file. This greatly increases their chances of collecting said debt.

If a cease and desist letter is sent to a previous creditor and/or agency, collection agencies are not responsible for the information sent prior to their involvement. This is defensible under the bona fide error defense. No agency affiliated with the ACA would ever knowingly attempt to "skirt" a cease and desist order. The potential legal ramifications are simply not worth it.

An out of stat debt or "OOS" as you put it is NOT legally uncollectable. It simply means that the owner of the account can no longer file suit against you. Attempting to collect on out of stat debts is perfectly legal in all states except for MS and WI.

My best suggestion is to deal with your debt in a more professional manner and take a good hard look at why they are contacting you in the first place.

Perhaps you should reconsider which "monkeys" need to be "educated".

#8 Consumer Suggestion

MUST BE WORKING THE TEXAS AREA. LOOK AT THE NUMBER OF POSTS IN THE PAST MONTH. Resurgent Capital. LVNV Funding, Citibank FRS-Financial

AUTHOR: P - (U.S.A.)

SUBMITTED: Friday, May 04, 2007

Texas is a ONE PARTY CONSENT TAPE RECORDING STATE. ALWAYS HAVE YOUR TAPE RECORDER AND RECORDING DEVICE READY.

The federal law makes it unlawful to record telephone conversations except in one party consent cases which permit one party consent recording by state law. What that means is a person can record their own telephone conversations without the knowledge or consent of the other party in those states that allow one party consent. One party consent simply means that one party to the conversation must have knowledge and give consent to the recording. THAT MEANS ONLY YOU HAVE TO KNOW THE CONVERSATION HAS BEEN RECORDED.

#7 Consumer Comment

Another vicitim/ just got my letter from Fran boyd @ Financial recovery as well Re: LVNV funding

AUTHOR: Robin - (U.S.A.)

SUBMITTED: Friday, May 04, 2007

J. in Anna Texas

Going through the same crap with this company who by the way adds LP and LLPs and transferes your supposed debt they cannot prove is yours and real debt,around the country from one company to another. Please take my advice: Keep each and every letter in order of date.

They act as if nothing is wrong and you are a thief and owe them money.

One girl went so far as to lie to me and tell me that they had proof that payments were made on the account for two years, but when I asked her, she could not provide proof of the original debt. I asked her how she knew there were payments made on it then? She got ruder (I have her name and the company she was with and the date of conversation by the way with a live witness) and she just hung up on me. RUDE! Un-professional.

If you go to the Federal Trade Commission web site and search any of these companies you will find old coplaints on LVNV funding (I did)

but remember these guys are real good at what they do. Ithink their real business is harrassment and money grubbing!

The bottom line is all coorespondence should be by certiied mail. Be sure to print out others complaints from this website as well as the FTC site and tell them to cease and desist all collection on this debt as there is NO verifiable proof and they harrassing you and if they do not drop this entirely, including info. on your credit report cleared.

You have the right ( 5th ammendment)to slam them all over the wall street journal and all the newspapers Television companies who would take the story as well as federal, state and local commissioners.

Remember, do not talk with them any of them on the phone. Waste of time. Although I wrote and have witnesses to some of these terrible conversations. I might sure for mental grief.

Send all letters (CERTIFIED MAIL)

Hope this helps.

R in Dallas

#6 Consumer Comment

Another vicitim/ just got my letter from Fran boyd @ Financial recovery as well Re: LVNV funding

AUTHOR: Robin - (U.S.A.)

SUBMITTED: Friday, May 04, 2007

J. in Anna Texas

Going through the same crap with this company who by the way adds LP and LLPs and transferes your supposed debt they cannot prove is yours and real debt,around the country from one company to another. Please take my advice: Keep each and every letter in order of date.

They act as if nothing is wrong and you are a thief and owe them money.

One girl went so far as to lie to me and tell me that they had proof that payments were made on the account for two years, but when I asked her, she could not provide proof of the original debt. I asked her how she knew there were payments made on it then? She got ruder (I have her name and the company she was with and the date of conversation by the way with a live witness) and she just hung up on me. RUDE! Un-professional.

If you go to the Federal Trade Commission web site and search any of these companies you will find old coplaints on LVNV funding (I did)

but remember these guys are real good at what they do. Ithink their real business is harrassment and money grubbing!

The bottom line is all coorespondence should be by certiied mail. Be sure to print out others complaints from this website as well as the FTC site and tell them to cease and desist all collection on this debt as there is NO verifiable proof and they harrassing you and if they do not drop this entirely, including info. on your credit report cleared.

You have the right ( 5th ammendment)to slam them all over the wall street journal and all the newspapers Television companies who would take the story as well as federal, state and local commissioners.

Remember, do not talk with them any of them on the phone. Waste of time. Although I wrote and have witnesses to some of these terrible conversations. I might sure for mental grief.

Send all letters (CERTIFIED MAIL)

Hope this helps.

R in Dallas

#5 Author of original report

J, You can do it either way

AUTHOR: Steve - (U.S.A.)

SUBMITTED: Monday, November 27, 2006

J,

I just file where I live, but you can do it either way.

I suggest you get a lawyer, as almost always your legal fees and costs are awarded as well.

Budhibbs.com has some good resources including a link to the NACA where you can find a lawyer to help, as well as ongoing cases on these collectors.

Good luck.

#4 Consumer Comment

Steve, just how do you go about suing them?

AUTHOR: J - (U.S.A.)

SUBMITTED: Sunday, November 26, 2006

Do you have to file the charges in their state or your state, or is a federal matter?

#3 Author of original report

More dirt on these bottomfeeders known as FRS or Financial Recovery services

AUTHOR: Steve - (U.S.A.)

SUBMITTED: Sunday, November 26, 2006

According to the "Privacy Notice" they supplied with the collections letter, they are part of the following group of companies.

Sherman Acquisition, LP

Sherman Acquisition, LLC

Sherman Acquisition II, LP

Sherman Acquisition TA, LP

Ascent Card Services, LLC

Acsent Card Services II, LLC

Resurgent Capital Services, LP

FNBM, LLC

LVNV Funding, LLC

All of these aliases are the same bunch of scumbags.

Why so many aliases? Its to minimize losses when sued or prosecuted. They only lose 1 business instead of the whole illegal operation!

A main# for all companies is:

866-438-2860

#2 Author of original report

More dirt on these bottomfeeders known as FRS or Financial Recovery services

AUTHOR: Steve - (U.S.A.)

SUBMITTED: Sunday, November 26, 2006

According to the "Privacy Notice" they supplied with the collections letter, they are part of the following group of companies.

Sherman Acquisition, LP

Sherman Acquisition, LLC

Sherman Acquisition II, LP

Sherman Acquisition TA, LP

Ascent Card Services, LLC

Acsent Card Services II, LLC

Resurgent Capital Services, LP

FNBM, LLC

LVNV Funding, LLC

All of these aliases are the same bunch of scumbags.

Why so many aliases? Its to minimize losses when sued or prosecuted. They only lose 1 business instead of the whole illegal operation!

A main# for all companies is:

866-438-2860

#1 Author of original report

More dirt on these bottomfeeders known as FRS or Financial Recovery services

AUTHOR: Steve - (U.S.A.)

SUBMITTED: Sunday, November 26, 2006

According to the "Privacy Notice" they supplied with the collections letter, they are part of the following group of companies.

Sherman Acquisition, LP

Sherman Acquisition, LLC

Sherman Acquisition II, LP

Sherman Acquisition TA, LP

Ascent Card Services, LLC

Acsent Card Services II, LLC

Resurgent Capital Services, LP

FNBM, LLC

LVNV Funding, LLC

All of these aliases are the same bunch of scumbags.

Why so many aliases? Its to minimize losses when sued or prosecuted. They only lose 1 business instead of the whole illegal operation!

A main# for all companies is:

866-438-2860

Advertisers above have met our

strict standards for business conduct.