Complaint Review: National Consumer Help Center - Santa ana California

- National Consumer Help Center 1740 E. Garry ave. #206 Santa ana, California United States of America

- Phone:

- Web: helpwithmylender.com

- Category: Consumer Services

National Consumer Help Center National Legal Help Center Modification fraud, Securitizations fraud, deceptive practices, Santa ana, California

*Consumer Comment: Discrimination

*Consumer Comment: Scammed by helpwithmylender.com/National Legal Help (Consumers) Center

*Consumer Comment: BEWARE - Not a single ATTY works there/No State Bar #s on staff

*REBUTTAL Owner of company: Shane and David (aka "Mr. Ash") both admitted that they committed THEFT against National Consumers Help Center. They are the scammers not us.

*UPDATE Employee: Mr. Ash (not his real name) is a LIAR, THIEF, GAMBLING ADDICT - Shane Elmer, David Duarte writing FALSE slanderous complaints after they got FIRED for misuse of company funds!

*UPDATE Employee: Mr. Ash (not his real name) is a LIAR, THIEF, GAMBLING ADDICT - Shane Elmer, David Duarte writing FALSE slanderous complaints after they got FIRED for misuse of company funds!

*REBUTTAL Individual responds: This is A Fake Report -- Placed By LOANFAX -- We are pending a Lawsuit

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

National Consumer Help Center is just another extension of the fraudulent NLHC. If you go to their website and look under the first video at the bottom of the homepage, the video stating Judge Blasts Wells Fargo you will notice in red the abbreviation NLHC which stand for National Legal Help Center. If you were to google that name you will then find out that National Consumer Help center and National legal Help Center are one and the same.

National Legal Help Center is under investigation for loan modification fraud and has charged clients thousands of dollars providing them with no service. Their only goal is to get you for what they can before you lose your home. I have actually spoken to several of their previous clients none of which homes where saved and all of them paid no less the 8500 by the end of their process. First, they want to charge you at least $2000 to stop a sale date which usually results in the client needing to go down to the court house and filing BK papers on their own. Homeowners are paying $2000 for a handful of documents that they can get for free, and that they still need to fill out and file on their own. So why did you just pay them $2000? Because you were scammed into thinking that you couldnt do it on their own and they took advantage of you desperation. Then they want to charge you up to $3500 for a Securitizations Audit that at the end of the day has no bearing on the case even though everything that their sales reps say appears to make clear since. They wont even represent you in court unless you can come up with at least $15000 dollars in advance and they would have to run out and locate the nearest and the neediest attorney to represent you because they don't actually have an attorney of their own. Good Attorneys fear that this company is a risk to their license due to the fact that two attorney's licenses have already been suspended on their behalf.

Once they have milked you out of the fees for the audit and the sale date postponement now you must pay at least $1000 a month for 4 months under the pretense that you are establishing a new payment history for your new lender. Who are these lenders and do they really exist. Answer NO! This company will eventually go down just dont let them take advantage of you and your family in the meantime. The reason their website is now Help with my lender.com is because this site has not yet been linked to their true identity. Why would the website be so different from the company name? Reason being the old company name was putting them out of business. Names in this company to watch out for Sarah (OWNER), James, Johnny, Jaron, Sherwin, Rick, Ricky, and Matt.

This is a team of ruthless sales people who all where once Loan Officers now trying to get rich quick again. All of their fraud investagators are paid 20% to 25% of every dollar you pay this company as a commission. None of them are having a hard time with their mortgage payments.

This report was posted on Ripoff Report on 05/15/2012 10:33 AM and is a permanent record located here: https://www.ripoffreport.com/reports/national-consumer-help-center/santa-ana-california-92705/national-consumer-help-center-national-legal-help-center-modification-fraud-securitizatio-883035. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#7 Consumer Comment

Discrimination

AUTHOR: Realtor Advocate - (United States of America)

SUBMITTED: Thursday, November 29, 2012

This is outright discrimination. The last time I looked it was fairly common for a lot of Muslims after 911 to change their names, especially those raised in the States. I have seen Sarah, and she is not anything like the picture posted here. Nor is she a fraud or a fake. I have witnessed this women get loans restructured, some even up to 200k principle reductions.

She does in fact file Civil complaints though the US Department of Justice on behalf of people across this nation. You sir, are a discriminatory jerk, with nothing better to do than to Harass someone who had done nothing more that protect innocents just because you personally dislike the Muslim race.

This level of liable, personal threats and harassment have gone on long enough. Go crawl back under the rock you climbed out of. Your actions are hostile, and based in discrimination, not truth.

Stay away from this woman.

#6 Consumer Comment

Scammed by helpwithmylender.com/National Legal Help (Consumers) Center

AUTHOR: Anonymous - (Virgin Islands (US))

SUBMITTED: Friday, August 24, 2012

I am a consumer that has been scammed by National Legal Help Center/National Consumers Help Center/helpwithmylender.com/National Consumers Assistance Center. If you call them every month the name of the company changes but the phone number is the same. I signed up with them in September of 2011 and was promised everything that has been reported below. I paid $4,500 for a securitization/forensic audit to litigate against my first mortgage lender. Then I paid $5,500 to do the same for my second mortgage and paid $1,000 supposedly in litigation fee.

I finally realized things were not adding up and tried to get answers but was getting conflicting information. It was difficult to get anyone to call or e-mail me back. I did some research and realized that they were changing Web sites and company name. After a year with them, I have never seen a legal case against my lenders and in fact the company is doing a loan modification when they told me they do not do loan modification but litigate against the banks.

Do not do business with this company. I have been stressed out through this process. I stopped all business with them when I read that paying for a forensic/securitization audits are a new way for loan modification companies to scam consumers. I found the article on the California State Attorney's office Web site. The article states "Attorney General Edmund G. Brown Jr. today joined the California Department of Real Estate (DRE) and the State Bar of California in warning Californians to avoid forensic loan audits, the loan-modification industrys latest phony foreclosure-relief service, in which homeowners pay up-front fees for a forensic review of their lenders practices, but are provided no actual foreclosure relief." http://oag.ca.gov/news/press-releases/brown-warns-homeowners-avoid-forensic-loan-audits

I am reporting the company to the State Attorney's office and I will do everything to shut them down. I am doing this because I tried to get my money back but they treated me like I was crazy and told me not to yell at them. They actually hung up on me and treated me as if I was the criminal. I will not allow them to scam other consumers.

#5 Consumer Comment

BEWARE - Not a single ATTY works there/No State Bar #s on staff

AUTHOR: Mary Johnson - (United States of America)

SUBMITTED: Saturday, May 26, 2012

There are NO atty's on their staff and NO state Bar #'s or licensed attorneys listed on their website nor will they give you any if you call...Call them and ask for THEIR COMPANY'S ATTY's NAME & State Bar and you will get neither.

This sham legal company caught using company's names and Logos, like CNN; CBS; The Wall St Journal; The NY Times and others recently to claim an endorsement of sorts when none of these companies had ever heard of NLHC and legally forced them to take the false representations down from their website.

To view proof of her shams...view videotapes posted on YOUTUBE by copying and pasting the URLs below in your web browser:

1. http://www.youtube.com/watch?v=onp-K8doeUc&feature=relmfu

2. http://www.youtube.com/watch?v=jJ9pSfJgJSs&feature=related

3. http://www.youtube.com/watch?v=896OehtjFo4

So she lied about her name twice...went by Sarah St. John from 2010 - 2011, then Sarah Johnson from 2011-present but her real name is Najia Jalan! And she lied and was thus FORCED to remove the company's names/logo's she fraudulantly used, but luckily the videos shot above prove she was caught misrepresenting herself before...and she lied before about being an attorney; lied about being associated with CNN; CBS and other companies; and even lied about her real name, how can anyone trust her to NOT lie again...DO NOT DO BUSINESS WITH NLHC!

#4 REBUTTAL Owner of company

Shane and David (aka "Mr. Ash") both admitted that they committed THEFT against National Consumers Help Center. They are the scammers not us.

AUTHOR: NLHC Mortgage Fraud Investigators - (United States of America)

SUBMITTED: Tuesday, May 22, 2012

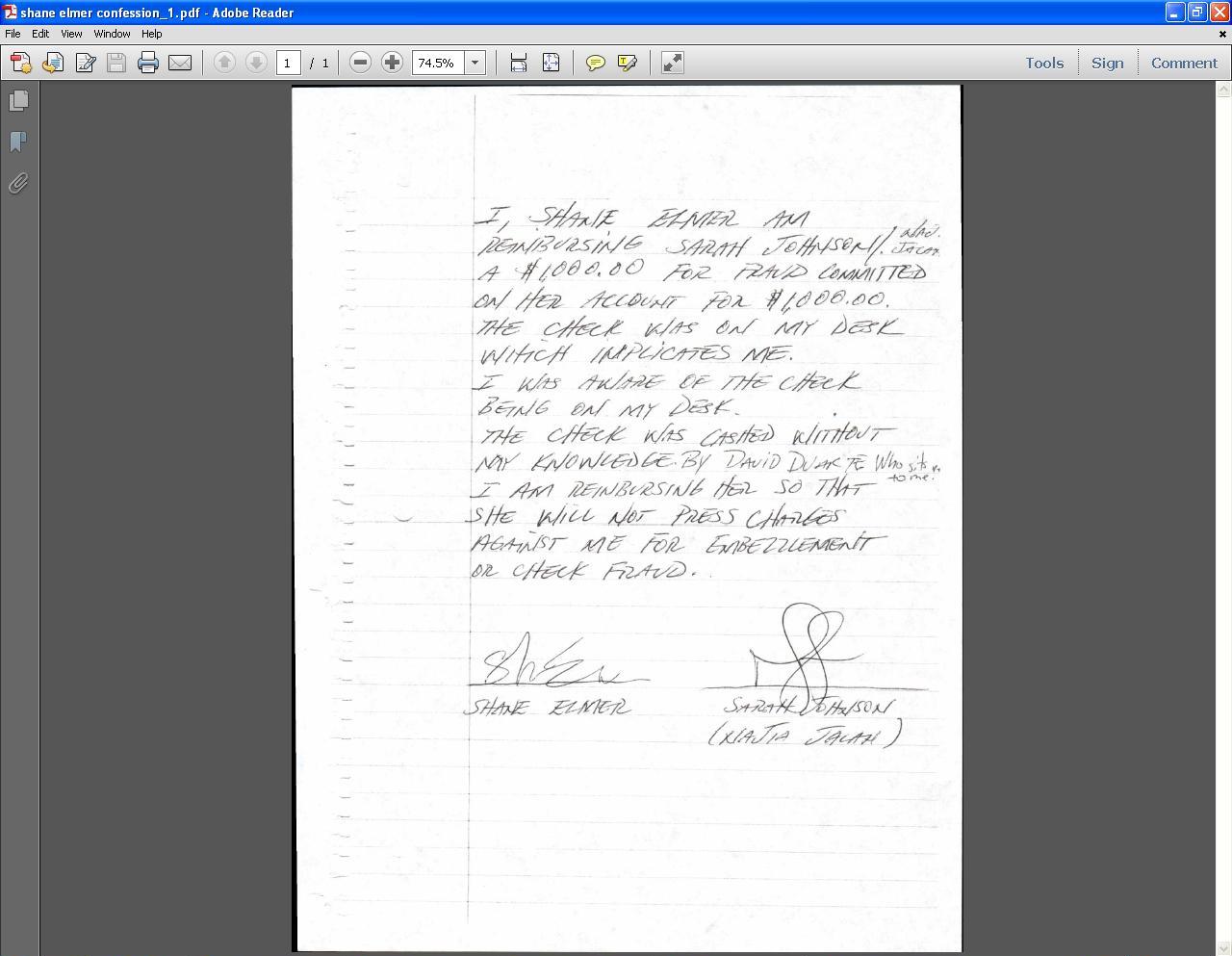

Here you see proof of confession letters they wrote, after being caught stealing company funds.

Don't trust a word these scammers say about our company (or any of the numbers they are making up). They are full of lies.

#3 UPDATE Employee

Mr. Ash (not his real name) is a LIAR, THIEF, GAMBLING ADDICT - Shane Elmer, David Duarte writing FALSE slanderous complaints after they got FIRED for misuse of company funds!

AUTHOR: NLHC Mortgage Fraud Investigators - (United States of America)

SUBMITTED: Monday, May 21, 2012

The above FALSE ripoff report was written by either Shane Elmer or David Duarte, two bitter former employees out on a vendetta. Both of them are liars working with Russell Awni of Loanfax as well as notorious convicted felon Moe Bedard and disbarred attorney Brian Colombana of LoanSafe.org (which is a ripoff of our old website "loan-safe.org"). Mr. Ash is NOT a real person, our company National Consumer Help Center has NEVER had a client by the name of Mr. Ash. We are NOT under investigation for anything, least of all loan modification fraud. Mr. Ash is lying through his teeth, we are not even a loan modification company, we are Mortgage Fraud Auditors. Our job is to track down and expose predatory lenders and help victims of predatory lending protect their homes through securitization audits. We do NOT charge for loan modifications, in fact that's not even our line of business - our counselors make it clear that a securitization audit will help them FAR more than a loan modification, since only 2% of mods ever get approved, but 85% of loans securitized in the past decade are fraudulent. Better to have proof of fraud to force the bank to restructure the loan, rather than get down and beg them for a mod the way 99% of foreclosure defense companies and law firms do.

The real identity of Mr. Ash is either Shane Elmer or David Duarte. Both of these were former employees working in our accounting department, we paid them by the hour (no 25% commissions, that's a pure fantasy of their twisted minds), yet they barely did any work and were always taking days off or showing up for only two hours out of the day. During the few times they actually bothered to show up at the office they were always goofing off. Shane was gambling his paycheck on internet poker chat rooms (and losing every dime) and David was downloading lord knows what on office computers on COMPANY TIME. They never did any useful work, and they even attempted to STEAL company funds and deposit clients' checks made out to the company into their own personal bank accounts (which resulted in their termination). The content of the fake complaint proves that one or both of these guys are the REAL authors of the complaint and "Mr Ash" is a fictitious name.

First of all "Mr. Ash" claims he lives in Tustin, California. Our office is in Santa Ana, just a few miles away. Shane Elmer lives in Tustin, where he shares his apartment with David. We haven't worked with any clients in Tustin recently, however Shane and David were both fired from our company last month (more on this later).

Second, "Mr Ash" claims that "I have actually spoken to several of their previous clients". How would he know any of our clients, or who has hired our company in the past, unless he worked for us at some point? Shane and David both worked in the accounting department, they were tasked with calling clients to collect case payments and provide them with copies of the audits they had paid for. Shane and David KNOW that we are not a scam, THEY EMAILED OUT THE AUDITS THEMSELVES. THEY COLLECTED THE PAYMENTS THEMSELVES. They call us a scam, well they were part of the company so what does that make them? In fact they attempted to defraud our company after promising clients they would get an audit, they stole their checks for themselves, so they are the worst kind of scammers.

Third, "Mr Ash" claims that a person named Jaron works for our company. There is no such person currently working in our office, in fact he left the company a few days after Shane and David got fired, hence their information is outdated, though they probably think he's still working here (here's the part that relates to them getting fired last month). In fact they are the only people we fired that have ever known Jaron. So this narrows down the list of likely suspects since all other former employees of National Consumer Help Center left the company before Jaron got hired, and hence would not know his name.

Fourth, Shane and David are both avid Pokemon fans despite no longer being kids. They often still played the old Pokemon games on their Game Boy's in the the office despite repeated warnings to get back to work. It's obvious where they came up with their fake name Mr. Ash.

Mr. Ash = Ash Ketchum from Pokemon. See the connection?

Shane and David are both pathological liars, they pretended to be doing their job when in fact they were gambling and embezzling. In addition, Shane worked part time selling defective used cell phones on the side, most likely on craigslist and ebay. He often bragged about his success in selling worthless phones that nobody wanted by refurbishing them with new skins. Shane loaned his car to a "professional gambler" who stole it and drove it all the way to Kansas, he was constantly complaining about how his "friend" betrayed him, and to buy a new car he decided to steal company money.

OTHER LIES FROM SHANE ELMER and/or DAVID DUARTE:

*He claims that we charge $2000 to stop a sale date which is patently false. We stop sale dates for free through a revocable trust once a client has already ordered an audit. If the client waits until the LAST DAY to stop the sale, then they have to do an emergency BK, they have to pay for emergency paralegal services and for a notary to make sure that the BK goes through, but this is a LAST resort and we repeatedly ward clients not to postpone things until the last minute because it will cost them more and due to time constraints there is a risk that it might not go through in time to stop a sale. There is no fixed price for last-minute BK, it depends on their state, county, and the notary's fees. Our company doesn't make a dime off of bankruptcies, we are not a bankruptcy firm and we would rather clients not wait until the last minute to stop a sale.

* He claims that two attorneys have had their licenses suspended thanks to us. This is completely false, no attorney has ever been suspended on account of our company. Why doesn't David/Shane mention WHICH attorneys supposedly got suspended? That's because they DON'T EXIST. We are mortgage fraud investigators, all we do is supply the audits to the client. What their attorney does with our audits is their own decision, we don't force attorneys to do anything. We do NOT tell attorneys what do do, we simply investigate fraud and run securitization audits.

* All the numbers they are quoting as company prices are BOGUS. We do not treat clients as cookie-cutter files, everyone's audit and other legal services will have different costs and fees, based on their state laws, case and circumstances, lender, trustee, etc. Furthermore, we have NEVER charged $15,000 upfront to a client. That number is what the typical "local attorney" would demand if you really wanted them to work hard on your case and make it a top priority. Has nothing to do with our company. Yes you can pay a local attorney $2000 to sue your bank but for that amount of money they will barely work on your file at all. That isn't something we set up, it's how the legal system has ALWAYS worked. Attorneys are expensive, period. That's why we actually save clients money by running an audit BEFORE referring anyone to an attorney - after all what's the point of spending money on an attorney if your audit reveals that there's no fraud on your loan and you don't have a case against your lender?

* Shane/David claims that we changed our website because "our old website was losing us money". This is absolutely false. Shane and David are in cahoots with that liar Moe Bedard and his disbarred attorney friend Brian Colombana, selling REST Reports and other useless products, they slandered our business and set up a rival company with the same name, tried to steal our clients with Shane feeding our company's leads to Moe, and David deleting the leads out of our system and trying to erase their records. What's more, Shane is a computer hacker and rerouted our website to point to Moe Bedard's site which also falsely slanders our company (again with NO proof from actual clients of ours), THAT is why we had to set up a new website, the old domain was constantly being hijacked by these predatory people. They are also teaming up with Russell Awni, scammer extraordinaire, to run a huge smear campaign on Youtube trying to slander our company, the same company that gave these two losers a job (and gave them the benefit of the doubt numerous times when they were caught snooping around management offices and computers). Awni also scammed our company and is currently being sued for threats against company personnel.

* Shane/David claims that our company "charged clients thousands of dollars providing them with no service." This is totally false, every service we provide is detailed in a precise contract, written and signed. In fact knowing Shane's tendency towards shady behavior, he probably has stolen some of those from us as well. We charge for very specific services (securitization audits, Homestandings Reports, preparing legal briefs, etc.) which are all detailed in every client's contract. It's beyond stupid how Shane and David never mention the name of a single client whom we supposedly failed to provide with any service. What are they afraid of?

* BOTH Shane and David claimed to be accountants when they got hired, turns out this was a lie as well, they had no accounting credentials or experience, and had no degrees in ANYTHING. They misplaced client files hoping nobody would find out they had never updated the file, they didn't even do data entry correctly (TONS of wrong accounting on how much each client paid and when), we paid them hourly for work which they never did, they should be grateful they weren't fired sooner. By a conservative estimate, their incompetence (to put it politely) cost our company $16,000.

Whatever you do, DO NOT trust a word these liars say about our company. We have never scammed anybody, we don't do loan mods, and we NEVER worked with anyone named Mr. Ash. Mr. Ash is just a fake name made up by David and Shane, they are CON MEN without a conscience, if we had only known this we would never have hired these losers. We paid them by the hour for accounting and processing work that they never did, they attempted to embezzle clients' money that was intended for the company to do audits (pretty hypocritical of them to accuse US of trying to "get you for what they can before you lose your home", both Shane and David were attempting to do just that, which is why they got FIRED!)

Don't trust these guys, and stay FAR FAR away from Russell Awni, Moe Bedard, Brian Colombana, and anyone who has secret dealings with them. These guys all scammed or threatened our company, and they are all

#2 UPDATE Employee

Mr. Ash (not his real name) is a LIAR, THIEF, GAMBLING ADDICT - Shane Elmer, David Duarte writing FALSE slanderous complaints after they got FIRED for misuse of company funds!

AUTHOR: NLHC Mortgage Fraud Investigators - (United States of America)

SUBMITTED: Monday, May 21, 2012

The above FALSE ripoff report was written by either Shane Elmer or David Duarte, two former employees out on a vendetta. Both of them are liars working with Russell Awni of Loanfax as well as notorious convicted felon Moe Bedard and disbarred attorney Brian Colombana of LoanSafe.org (which is a ripoff of our old website "loan-safe.org"). Mr. Ash is NOT a real person, our company National Consumer Help Center has NEVER had a client by the name of Mr. Ash. We are NOT under investigation for anything, least of all loan modification fraud. Mr. Ash is lying through his teeth, we are not even a loan modification company, we are Mortgage Fraud Auditors. Our job is to track down and expose predatory lenders and help victims of predatory lending protect their homes through securitization audits. We do NOT charge for loan modifications, in fact that's not even our line of business - our counselors make it clear that a securitization audit will help them FAR more than a loan modification, since only 2% of mods ever get approved, but 85% of loans securitized in the past decade are fraudulent. Better to have proof of fraud to force the bank to restructure the loan, rather than get down and beg them for a mod the way 99% of foreclosure defense companies and law firms do.

The real identity of Mr. Ash is either Shane Elmer or David Duarte. Both of these were former employees working in our accounting department, we paid them by the hour (no 25% commissions, that's a pure fantasy of their twisted minds), yet they barely did any work and were always taking days off or showing up for only two hours out of the day. During the few times they actually bothered to show up at the office they were always goofing off. Shane was gambling his paycheck on internet poker chat rooms (and losing every dime) and David was downloading lord knows what on office computers on COMPANY TIME. They never did any useful work, and they even attempted to STEAL company funds and deposit clients' checks made out to the company into their own personal bank accounts (which resulted in their termination). The content of the fake complaint proves that one or more of these guys are the REAL authors of the complaint and "Mr Ash" is a fictitious name.

First of all "Mr. Ash" claims he lives in Tustin, California. Our office is in Santa Ana, just a few miles away. Shane Elmer lives in Tustin, where he shares his apartment with David. We haven't worked with any clients in Tustin recently, however Shane and David were both fired from our company last month (more on this later).

Second, "Mr Ash" claims that "I have actually spoken to several of their previous clients". How would he know any of our clients, or who has hired our company in the past, unless he worked for us at some point? Shane and David both worked in the accounting department, they were tasked with calling clients to collect case payments and provide them with copies of the audits they had paid for. Shane and David KNOW that we are not a scam, THEY EMAILED OUT THE AUDITS THEMSELVES. THEY COLLECTED THE PAYMENTS THEMSELVES. They call us a scam, well they were part of the company so what does that make them? In fact they attempted to defraud our company after promising clients they would get an audit, they stole their checks for themselves, so they are the worst kind of scammers.

Third, "Mr Ash" claims that a person named Jaron works for our company. There is no such person currently working in our office, in fact he left the company a few days after Shane and David got fired, hence their information is outdated, though they probably think he's still working here (here's the part that relates to them getting fired last month). In fact they are the only people we fired that have ever known Jaron. So this narrows down the list of likely suspects since all other former employees of National Consumer Help Center left the company before Jaron got hired, and hence would not know his name.

Shane and David are both pathological liars, they pretended to be doing their job when in fact they were gambling and embezzling. In addition, Shane worked part time selling defective used cell phones on the side, most likely on craigslist and ebay. He often bragged about his success in selling worthless phones that nobody wanted by refurbishing them with new skins. Shane loaned his car to a "professional gambler" who stole it and drove it all the way to Kansas, he was constantly complaining about how his "friend" betrayed him, and to buy a new car he decided to steal company money.

OTHER LIES FROM SHANE ELMER and/or DAVID DUARTE:

*He claims that we charge $2000 to stop a sale date which is patently false. We stop sale dates for free through a revocable trust once a client has already ordered an audit. If the client waits until the LAST DAY to stop the sale, then they have to do an emergency BK, they have to pay for emergency paralegal services and for a notary to make sure that the BK goes through, but this is a LAST resort and we repeatedly ward clients not to postpone things until the last minute because it will cost them more and due to time constraints there is a risk that it might not go through in time to stop a sale. There is no fixed price for last-minute BK, it depends on their state, county, and the notary's fees. Our company doesn't make a dime off of bankruptcies, we are not a bankruptcy firm and we would rather clients not wait until the last minute to stop a sale.

* He claims that two attorneys have had their licenses suspended thanks to us. This is completely false, no attorney has ever been suspended on account of our company. Why doesn't David/Shane mention WHICH attorneys supposedly got suspended? That's because they DON'T EXIST. We are mortgage fraud investigators, all we do is supply the audits to the client. What their attorney does with our audits is their own decision, we don't force attorneys to do anything. We do NOT tell attorneys what do do, we simply investigate fraud and run securitization audits.

* All the numbers they are quoting as company prices are BOGUS. We do not treat clients as cookie-cutter files, everyone's audit and other legal services will have different costs and fees, based on their state laws, case and circumstances, lender, trustee, etc. Furthermore, we have NEVER charged $15,000 upfront to a client. That number is what the typical "local attorney" would demand if you really wanted them to work hard on your case and make it a top priority. Has nothing to do with our company. Yes you can pay a local attorney $2000 to sue your bank but for that amount of money they will barely work on your file at all. That isn't something we set up, it's how the legal system has ALWAYS worked. Attorneys are expensive, period. That's why we actually save clients money by running an audit BEFORE referring anyone to an attorney - after all what's the point of spending money on an attorney if your audit reveals that there's no fraud on your loan and you don't have a case against your lender?

* Shane/David claims that we changed our website because "our old website was losing us money". This is absolutely false. Shane and David are in cahoots with that liar Moe Bedard and his disbarred attorney friend Brian Colombana, selling REST Reports and other useless products, they slandered our business and set up a rival company with the same name, tried to steal our clients with Shane feeding our company's leads to Moe, and David deleting the leads out of our system and trying to erase their records. What's more, Shane is a computer hacker and rerouted our website to point to Moe Bedard's site which also falsely slanders our company (again with NO proof from actual clients of ours), THAT is why we had to set up a new website, the old domain was constantly being hijacked by these predatory people. They are also teaming up with Russell Awni, scammer extraordinaire, to run a huge smear campaign on Youtube trying to slander our company, the same company that gave these two losers a job (and gave them the benefit of the doubt numerous times when they were caught snooping around management offices and computers). Awni also scammed our company and is currently being sued for threats against company personnel.

* Shane/David claims that our company "charged clients thousands of dollars providing them with no service." This is totally false, every service we provide is detailed in a precise contract, written and signed. In fact knowing Shane's tendency towards shady behavior, he probably has stolen some of those from us as well. We charge for very specific services (securitization audits, Homestandings Reports, preparing legal briefs, etc.) which are all detailed in every client's contract. It's beyond stupid how Shane and David never mention the name of a single client whom we supposedly failed to provide with any service. What are they afraid of?

* BOTH Shane and David claimed to be accountants, turns out this was a lie as well, they had no accounting credentials or experience, and had no degrees in ANYTHING. They misplaced client files hoping nobody would find out they had never updated the file, they didn't even do data entry correctly (TONS of wrong accounting on how much each client paid and when), we paid them hourly for work which they never did, they should be grateful they weren't fired sooner. By a conservative estimate their incompetence cost our company $16,000.

Whatever you do, DO NOT trust a word these liars say about our company. We have never scammed anybody, we don't do loan mods, and we NEVER worked with anyone named Mr. Ash. Mr Ash is just a fake name made up by David and Shane, they are CON MEN without a conscience, if we had only known this we would never have hired these losers. We paid them by the hour for accounting and processing work that they never did, they attempted to embezzle clients' money that was intended for the company to do audits (pretty hypocritical of them to accuse US of trying to "get you for what they can before you lose your home", both Shane and David were attempting to do just that, which is why they got FIRED!)

#1 REBUTTAL Individual responds

This is A Fake Report -- Placed By LOANFAX -- We are pending a Lawsuit

AUTHOR: NLHC Mortgage Fraud Investigators - (United States of America)

SUBMITTED: Friday, May 18, 2012

This is a fake report created or sponsored by a company called LoanFax.... We have a pending court date on May 25 2012 for a restraining order. We have a pending lawsuit. I'm sorry to anyone of our clients that read the nasty complaints. We have tried our best to ignore Russell Awni and his company but he will not go away... I feel like my life is in danger after he was in front of my garage on Sunday for Mothers Day. I had to file a police report.

Why don't you name some of the clients that have been effected by this company. The company does not charge up from to stop a sale date. Mr. Ash educate yourself and read up about mortgage backed securities before you go around making up lies about organizations that is up to date with whats going with the banking industry... I guess everyone that has a securitized loan is a scam... Why do you think people get denied for a loan mod Mr. Ash? It's because the loan is securitized Mr. Ash.. Go look up securitization before you start posting lies. Which attorneys lost their license because of us??? Mr. Ash everyone should know your claims are nothing but lies because this company builds Pro Per lawsuit packages for struggling homeowners who were denied for assistance. Mr. Ash Pro Per educate yourself once again .... The consumers know what's up and never signed a Retainer Agreement for the services... A flat fee agreement ... The Face of an attorney is not the reason why consumers sign up... it's because of the private investors that purchase the non-performing note and offer the client the opportunity to stay in the home at fair market value.

Ask yourself Mr. Ash what the Bloomsburg report is used for ? Do you even know what Bloomsburg means? Did you know it's a $50,000 Dollar contact to sign up and have access to this information for the securitization report... Why would any organization waste time and money when the reports are useless. Why would the banks have so many problems and settle with the consumers who have signed up if it's not the Securitization problems then what is it MR.ASH?

In or around the fall of 2011, I began negotiating with Awni as CEO of Loanfax, to provide leads to my company, National Consumer Help Center, for marketing purposes to be utilized in my business. My company provides services to distressed homeowners and the leads from Loanfax would have helped me to significantly expand my business. Awni represented his company as a reputable lead generator associated with well-known companies such as Carfax. I later learned some of Awnis representations were completely false.

On March 16, 2012, my company entered into a contract with Loanfax wherein I agreed to make an initial payment to Loanfax in the amount of $2,500.00. Thereafter a monthly service fee would be required to be paid on the 15th of each month. Thus, a second payment was not to be due until April 15, 2012. In exchange Loanfax agreed to, provide 25,000 leads per month in consideration for the monthly other compensation. Awni added a handwritten note which reads, Up to 50k records. Thus, I reasonably expected Loanfax to provide a minimum of 25,000 leads within the first month.

Upon executing the contract I hired additional employees, invested in additional equipment and software and made other significant preparations for the anticipated leads which Awni indicated would be forthcoming and were guaranteed to result in a significant increase in business for my company.

However, as the days turned into weeks Loanfax provided no leads at all to my company. I attempted to contact Awni and Loanfax on several occasions to inquire as to when the leads would be provided. I set up conference calls to discuss the transfer of leads, but Awni would not attend, claiming that he had other matters that needed his attention. On numerous occasions I called Awni on his personal cell phone, but Awni would not answer. Notwithstanding all of this, Awni and Loanfax reassured me that the leads would be provided. April 15, 2012 passed with no leads being delivered by Loanfax. As I was awaiting the leads I began to call other companies with whom Loanfax had done business to discuss my concerns. Through these conversations and other investigation, I learned that Awni and Loanfax had previously entered into similar contracts with other companies but failed to perform. I also learned that Loanfax had a history of engaging in questionable business practices. For example, I spoke with a representative of Carfax who expressly stated that they had no affiliation whatsoever with Loanfax, even though Awni had told me that Loanfax was affiliated with Carfax in an effort to boost Loanfaxs credibility and gain my business.

When I complained to Awni and Loanfax regarding their failure to perform under the contract Awni became aggressive. Then when I requested a refund of the money paid to Loanfax, Awni refused and became even more threatening towards me. Awni and his employee, Elaine Silva, sent vulgar and harassing emails to me in an effort to intimidate her. Refusing to be intimidated by Awni and Silvas email threats, I persisted in requesting either the promised leads or a refund of the money paid to Loanfax.

On April 7, 2012, in an effort to further harass and intimidate me, Awni posted two false and defamatory videos on Youtube, claiming that NCHC was a disreputable company and that I had a substance abuse problem. On April 8, 2012, Awni posted another video on Youtube containing false and hateful statements regarding me and my company. On April 19, 2012, Awni once again posted a video on Youtube containing false and hateful statements regarding me and my company.

In spite of Awni, Silva and Loanfaxs actions, I have remained professional and attempted to cut off all communication with them, writing off the $2,500.00 paid to Loanfax as a loss. However, Awni has continued to harass me with vulgar threats and has contacted my clients to slander my company. Also, Awni continues to post defamatory videos about NCHC and me on Youtube.

My company has suffered thousands of dollars in damages as a result of Awni, Silva and Loanfax's actions. Additionally, I have been forced to lay off employees who were hired in anticipation for the extra business provided by the leads from Loanfax. Not only has my company suffered a loss in reputation, but I am concerned about my personal safety. Awni continues to harass me and my company to this date.

Mortgage-Backed Securities

A mortgage is a kind of loan that's easy to understand: somebody who

wants to buy a house goes to a bank, which puts up most of the money

needed, in return for a promise that the debt will be repaid with

interest at stated times in stated amounts. Mortgage-backed securities

take many of these simple loans and put them together into a single debt

instrument that is far larger and more complicated.

For several decades after they were introduced in the 1970's

mortgage-backed securities worked as they were intended, increasing the

amount of money available for borrowers and spreading the risk of

default. But during the housing boom that peaked in 2005 the process

went deeply awry, as the issuance and trading of securities based on

shaky mortgages infested the financial system with assets that later

produced huge losses.

The key to the development of mortgage-backed securities was the

realization that individual loans, hammered out by a banker and a

homebuyer, could be transformed into what were in effect financial

commodities.

The model was the bonds issued by governments and large companies.

Investors who put up money to buy bonds are promised repayment at

specified times; that amounts to being promised a share of a stream of

revenue delivered by the borrower. When many mortgages are pooled

together, the monthly payments from homeowners add up to a comparable

revenue stream.

The banks and other lenders who originate mortgages are generally

happy to sell them because they can use the proceeds to make more loans

right away, rather than waiting for payments to dribble in each month.

The companies that pool the mortgages together then sell pieces of the

revenue stream to investors eager for a predictable return.

Over the decades, mortgage-backed securities came to be considered to

be as safe as -- well, as safe as houses. That was both because default

rates were historically low and because in most cases the mortgages

were guaranteed by a third party: a government agency like Ginnie Mae, a

government-sponsored entity like Fannie Mae or Freddie Mac or a private

insurer.

One reason the securities took off was that the housing boom came

along at a time when there large piles of capital building up in China

and oil producing countries looking for safe investments that paid

better than Treasury bills. As more of the securities were issued, the

forms they took grew more complicated.

As lending standards fell, banks began creating what were termed

collateralized mortgage (or debt) obligations, in which the shares in a

mortgage-backed security were organized into different levels (or

tranches) according to their perceived risk. Billions of dollars in

these instruments were sold and resold.

As the mortgage market soured in 2007, the financial world came to

two sickening realizations about mortgage-backed securities. They were

not nearly as safe as had been expected -- partly because securitization

meant that banks originating loans for a quick sale did not have to be

as careful about their soundness as when they held mortgages to

maturity. And both the ratings agencies that analyze securities and many

of those who bought or traded them had turned a blind eye to warning

signs, like an increase in foreclosures. In addition, the complexity of

the securities and the arrangements made to insure them turned out to

have amplified the risks, not diluted them.

In March 2011, federal regulators voted to propose new rules that

would prohibit Wall Street banks from unloading packages of risky

mortgages on investors without keeping some of the risk on their own

books. The proposed rule would require banks to retain 5 percent of the

credit risk on certain securities backed by mortgages, leaving the

banks with the so-called skin in the game on all but the safest

loans.

The rules are unlikely to cause much of a shakeup in the mortgage

business, as regulators drafted a gaping exemption: mortgage-backed

securities sold or guaranteed by Fannie Mae and Freddie Mac.

Now in government hands, the two collectively cover more than 90

percent of the market, which froze up in the financial crisis.

ARTICLES ABOUT MORTGAGE-BACKED SECURITIESNewest First

| Oldest FirstPage: 1 | 2 | 3 | Next >>

Fed Ends Its Purchasing of Mortgage SecuritiesBy SEWELL CHANThe

$1.25 trillion Federal Reserve program has been credited with keeping

interest rates low and slowing the fall in home prices that threatened

to send the economy into an extended slump.April 1, 2010

MORE ON MORTGAGE-BACKED SECURITIES AND: MORTGAGES, UNITED STATES ECONOMY, PRICES (FARES, FEES AND RATES), INTEREST RATES, STOCKS AND BONDS, HOUSING AND REAL ESTATE, BANKS AND BANKING, FEDERAL RESERVE SYSTEM

Loan Pools That Need Some SunBy GRETCHEN MORGENSONA

lawsuit accuses a group of Wall Street companies of misrepresenting the

mortgages underlying $5.4 billion in securities that they sold.March 21, 2010

MORE ON MORTGAGE-BACKED SECURITIES AND: SUBPRIME MORTGAGE CRISIS, MORTGAGES, BANKING AND FINANCIAL INSTITUTIONS, UNITED STATES ECONOMY, SUITS AND LITIGATION, BANKS AND BANKING, WALL STREET (NYC), FEDERAL HOME LOAN BANK OF SAN FRANCISCO

Fed Board Diverged on Timing of Policy Shift, Minutes s****.>

MORE ON MORTGAGE-BACKED SECURITIES AND: UNITED STATES ECONOMY, BUILDING (CONSTRUCTION), STOCKS AND BONDS, HOUSING AND REAL ESTATE, CREDIT AND DEBT, BANKS AND BANKING, FEDERAL RESERVE SYSTEM

Program to Buy Bad Assets Nearly in Place, U.S. SaysBy EDMUND L. ANDREWSTreasury

Department says its scaled-down Public-Private Investment Program which

would help banks unload troubled mortgages and mortgage securities,

will begin operating at full strength by end of month, more than year

after Congressional authorization; says five of nine firms selected for

program have raised enough financing to qualify for matching investments

and federal loans October 5, 2009

MORE ON MORTGAGE-BACKED SECURITIES AND: MORTGAGES, UNITED STATES ECONOMY, FINANCES, CREDIT, STOCKS AND BONDS, BUDGETS AND BUDGETING, FORECLOSURES, HOUSING AND REAL ESTATE, BANKS AND BANKING, UNITED STATES, TREASURY DEPARTMENT

Troubled Assets Still on Books Could Pose Risk, Panel SaysBy EDMUND L. ANDREWSCongressional

oversight panel reports Treasury Department's $700 billion bailout

program has stabilized banking system, but it has done little to prod

banks to fully deal with troubled loans on their books August 11, 2009

MORE ON MORTGAGE-BACKED SECURITIES AND: FINANCES, BUDGETS AND BUDGETING, REGULATION AND DEREGULATION OF INDUSTRY, BANKS AND BANKING, UNITED STATES, TREASURY DEPARTMENT

HIGH & LOW FINANCE; Findings, But No Final WordBy FLOYD NORRISFloyd

Norris High & Low Finance column on results of government's stress

test for nation's banks; holds specific numbers that came from test

should not be taken as anything approaching final word; holds numbers

are most impressive are estimates of possible losses from differing

categories of assets May 8, 2009

MORE ON MORTGAGE-BACKED SECURITIES AND: UNITED STATES ECONOMY, STOCKS AND BONDS, TESTS AND TESTING, BANKS AND BANKING, TREASURY DEPARTMENT

Banks Are Set to Receive More Leeway on Asset ValuesBy FLOYD NORRISUnder

Congressional pressure, the board that sets accounting standards is

preparing to alter a rule in a way that will let banks report smaller

losses.April 1, 2009

MORE ON MORTGAGE-BACKED SECURITIES AND: ACCOUNTING AND ACCOUNTANTS, MORTGAGES, STOCKS AND BONDS, FORECLOSURES, HOUSING AND REAL ESTATE, BANKS AND BANKING, FINANCIAL ACCOUNTING STANDARDS BOARD, CFA INSTITUTE, SCHACHT, KURT

Mathematical Model and the Mortgage MessBy DENNIS OVERBYEThere

was no mathematical elegance to the mortgage-backed securities that

helped lead to the market crash of recent months. In these deals,

interest and principal payments from mortgages were bundled into

different packages called tranches, each with different risks and

interest rates.March 10, 2009

MORE ON MORTGAGE-BACKED SECURITIES AND: MORTGAGES, FORECLOSURES, BANKS AND BANKING

Declining Exports Weaken Once-Powerful Asian EconomiesBy

KEITH BRADSHER; REPORTING WAS CONTRIBUTED BY CHOE SANG-HUN IN SEOUL,

SOUTH KOREA; CARLOS H. CONDE IN MANILA; THOMAS FULLER IN BANGKOK; ANAND

GIRIDHARADAS IN MUMBAI, INDIA; AND HILDA WANG IN HONG KONG.Evidence is mounting that Asias growing economies will not escape unscathed as economic turmoil spreads across the globe.October 11, 2008

MORE ON MORTGAGE-BACKED SECURITIES AND: SUBPRIME MORTGAGE CRISIS, ECONOMIC CONDITIONS AND TRENDS, BANKS AND BANKING, FAR EAST, SOUTH AND SOUTHEAST ASIA AND PACIFIC AREAS

Savings and Loan Crisis May Be Guide for Bank BailoutBy BARRY MEIERThe

Resolution Trust Corporation, which helped to sort out the S.&L.

debacle, found itself dealing with people trying to game the system to

their financial advantage.September 29, 2008

MORE ON MORTGAGE-BACKED SECURITIES AND: SUBPRIME MORTGAGE CRISIS, FINANCES, SAVINGS AND LOAN ASSOCIATIONS, LAW AND LEGISLATION, MORTGAGES, HOUSING, ETHICS, POLITICS AND GOVERNMENT, TROUBLED ASSET RELIEF PROGRAM (2008), STOCKS AND BONDS, BUDGETS AND BUDGETING, FORECLOSURES, BANKS AND BANKING, UNITED STATES, RESOLUTION TRUST CORP

Bailout Plan Is Only One Step on a Long RoadBy STEVE LOHRThe next administration will need to shape policy for a nation that will be less accustomed to easy credit.September 29, 2008

MORE ON MORTGAGE-BACKED SECURITIES AND: SUBPRIME MORTGAGE CRISIS, MORTGAGES, UNITED STATES ECONOMY, HOUSING, FINANCES, TROUBLED ASSET RELIEF PROGRAM (2008), LAW AND LEGISLATION, STOCKS AND BONDS, BUDGETS AND BUDGETING, FORECLOSURES, BANKS AND BANKING, UNITED STATES

The Buck Stopped ThenBy JAMES GRANTSince

1971, nothing has stood behind the American dollar except the worlds

good opinion of the United States. And now, the world is changing its

mind.September 24, 2008

MORE ON MORTGAGE-BACKED SECURITIES AND: MORTGAGES, INTERNATIONAL TRADE AND WORLD MARKET, US DOLLAR (CURRENCY), INFLATION (ECONOMICS), UNITED STATES ECONOMY, HOUSING, CURRENCY, INTEREST RATES, CREDIT, STOCKS AND BONDS, FORECLOSURES, BANKS AND BANKING

The Wall Street Bailout Plan, ExplainedBy DAVID STOUT; STEPHEN LABATON and DAVID M. HERSZENHORN CONTRIBUTED REPORTING.The

upheaval in the world of finance has resonated for people who know

little about Wall Street. Here are questions and answers of concern to

Main Street Americans.September 21, 2008

MORE ON MORTGAGE-BACKED SECURITIES AND: UNITED STATES POLITICS AND GOVERNMENT, MORTGAGES, UNITED STATES ECONOMY, FINANCES, CREDIT, STOCKS AND BONDS, BUDGETS AND BUDGETING, HOUSING AND REAL ESTATE, BANKS AND BANKING, UNITED STATES, WALL STREET (NYC), TREASURY DEPARTMENT

Dr. DoomBy STEPHEN MIHMTwo years ago, Nouriel Roubini predicted the current economic crisis. Now he sees things becoming far worse.August 17, 2008

MORE ON MORTGAGE-BACKED SECURITIES AND: AUTOMOBILES, OIL (PETROLEUM) AND GASOLINE, ECONOMICS, INTEREST RATES, ECONOMIC CONDITIONS AND TRENDS, CREDIT CARDS AND MONEY CARDS, RECESSION AND DEPRESSION, HOME EQUITY LOANS, CONSUMER CREDIT, MORTGAGES, MERGERS, ACQUISITIONS AND DIVESTITURES, UNITED STATES ECONOMY, STUDENT LOANS, HOUSING, COLLEGES AND UNIVERSITIES, OFFICE BUILDINGS AND COMMERCIAL PROPERTIES, CREDIT, BANKS AND BANKING, ROUBINI, NOURIEL

Deutsche Bank Posts Quarterly Loss, Evidence of the Reach of the Financial CrisisBy MARK LANDLERThe

bank, which had won praise in financial circles for seeming to weather

the credit storm better than most of its peers, reported a $395 million

first-quarter loss.April 30, 2008

Advertisers above have met our

strict standards for business conduct.