Complaint Review: Residence Mutual - Western Mutual Insurance Company - Internet

- Residence Mutual - Western Mutual Insurance Company Internet United States of America

- Phone: 800-234-2114

- Web: www.arizonahomeinsurance.com

- Category: Insurance Companies

Residence Mutual - Western Mutual Insurance Company Arizona Home Insurance Company Cancellation after one single (denied) claim Internet

*Consumer Comment: I fully retract this statement

*UPDATE EX-employee responds: I retract all posts

*Consumer Comment: I retract this post

*Consumer Comment: Nice Try at Spin

*Consumer Comment: Nice Try at "spin"

*Consumer Comment: Western Mutual Insurance Group and Arizona Home Insurance Company

*Author of original report: Pickier than the pickiest HOA - I always thought that insurance companies insure against risks ???

*REBUTTAL Individual responds: what should i do? where should i go?

*Author of original report: No coverage for fire, burglary or other risks if your roof had a leak....

*Author of original report: Giving it another try

*Author of original report: Here is what to expect from Western Mutual if you ever report a leak on your roof

*Consumer Comment: Probably not that hard to figure out.

*Consumer Comment: To the Underwriter..

*Author of original report: Response to anonymous insurance underwriter

*UPDATE Employee: Regarding the second complaint

*UPDATE Employee: From the company

*Author of original report: Blocked from getting insurance for the next 3 years ?

*Consumer Comment: I know these guys.

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

This insurance company obviously only likes people who pay for their policy without ever making a claim. I received a Notice of Non-Renewal after one single claim that they even denied.

The claim was for a leak on my roof after a storm. After they denied coverage I fixed it myself with torch down roofing material and since then I never had a problem with the roof anymore. Even after several days of strong rain that turned our street into a river there was not a single drop of water coming through the roof. However, when it was time to renew the policy I received a letter from this company that I had to pay a licensed contractor to replace the (entire !!!) roof and provide them with a bill showing that the roof had been replaced.

What a BS - they would not provide coverage for roof damages and still take that for a reason not to renew. to me this looks like they want to send out the message "Dare you try to make a claim - we will show you what is going to happen !"

This report was posted on Ripoff Report on 08/06/2010 03:00 PM and is a permanent record located here: https://www.ripoffreport.com/reports/residence-mutual-western-mutual-insurance-company/internet/residence-mutual-western-mutual-insurance-company-arizona-home-insurance-company-cancell-629592. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#18 UPDATE EX-employee responds

I retract all posts

AUTHOR: Dickeydunkins - ()

SUBMITTED: Monday, June 30, 2014

I retract all posts

#17 Consumer Comment

I retract this post

AUTHOR: Dickeydunkins - ()

SUBMITTED: Friday, June 27, 2014

I retract this post

#16 Consumer Comment

I fully retract this statement

AUTHOR: Dickeydunkins - ()

SUBMITTED: Thursday, June 26, 2014

I wish to fully retract this statement and any which precede it or follow it.

#15 Consumer Comment

Nice Try at Spin

AUTHOR: Dickeydunkins - ()

SUBMITTED: Wednesday, June 25, 2014

All ongoing issues with Western Mutual have been resolved for any and all posts created by this author.

#14 Consumer Comment

Nice Try at "spin"

AUTHOR: Dickeydunkins - ()

SUBMITTED: Saturday, August 17, 2013

What a soft, wet, stinky load you spewed on behalf of the Crail Family Foundation for the promotion of Corruption and Greed. Karma's gonna get your fat, offensive, paranoid psychotic a**, no doubt about it.

#13 Consumer Comment

Western Mutual Insurance Group and Arizona Home Insurance Company

AUTHOR: Dickeydunkins - ()

SUBMITTED: Monday, August 05, 2013

A rip-off family run organization where having a big fat a*s and the last name of Crail or having attended USC is all that matters.

#12 Author of original report

Pickier than the pickiest HOA - I always thought that insurance companies insure against risks ???

AUTHOR: Steve - ()

SUBMITTED: Tuesday, April 09, 2013

This "Insurance company" is a joke they act like a n**i-HOA, looking for problems which are not an insurance company's business, like for example paint:

What kind of risk does old paint impose ? A friend of mine just received a letter telling her to paint her patio and to remove debris from her backyard. It is none of their business and it does not have anything to do with the risk of insuring the property. What is next - a letter telling the homeowner that the policy will be cancelled if he does not wash the curtains or remove the stains on the carpet ?

What a joke of an insurance company.

#11 REBUTTAL Individual responds

what should i do? where should i go?

AUTHOR: Joe C - ()

SUBMITTED: Tuesday, April 09, 2013

I just received a letter, notice of non-renewal for roof conditions, i admit the roof does need some work, but it does not need to be entirely replaced, and it does not leak, will my company insure me if the repairs are made? or do i need to go to a new company, and will they insure me even after receiving a notice of non-renewal?

#10 Author of original report

No coverage for fire, burglary or other risks if your roof had a leak....

AUTHOR: Steve - (USA)

SUBMITTED: Friday, October 01, 2010

Update: I proposed to exclude any coverage for water damages (since the roof is repaired and I don't expect any problems with it...)

Yes, this insurance company insists on kicking me out without explaining how a leaking roof could affect the other risks like fire or burglary.

Their demand to have the entire roof replaced for several thousands of dollars (by a licensed, bonded and sworn-in contractor...) clearly shows that their intention is to "punish" me for my claim. Why should someone spend thousands of dollars to replace a roof that is not leaking at all ??? Since I repaired the roof we have had several severe thunderstorms that flooded the entire street but not one single drop entered my house. What happened to Americas Freedom ? It is my home and I don't have the right to repair it ????

#9 Author of original report

Giving it another try

AUTHOR: Steve - (U.S.A.)

SUBMITTED: Saturday, August 14, 2010

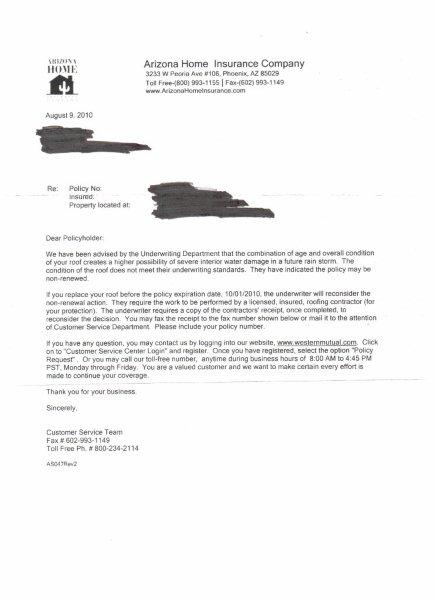

Looks like the attachment did not go through, here we go again...

#8 Author of original report

Here is what to expect from Western Mutual if you ever report a leak on your roof

AUTHOR: Steve - (U.S.A.)

SUBMITTED: Thursday, August 12, 2010

Here is a letter that I received in today's mail, making it clear that fixing the roof myself or to have water / roof damages excluded from the policy is no option for them.

I am surprised that they are not asking me to tear the entire house down and build a new one (by a licensed, insured and sworn-in contractor...)

#7 Consumer Comment

Probably not that hard to figure out.

AUTHOR: Flynrider - (USA)

SUBMITTED: Thursday, August 12, 2010

The point is that their "inspector" appeared to object to the fact that over the years I had replaced some shingles on the roof. Anyone who has a shingled roof in Central AZ knows that high winds caused by seasonal thunderstorms will damage the occasional shingle, even on a fairly new roof. If they are NOT replaced, then you'll have problems and leaks.

I used to put roofs on houses in my younger days and I question their inspector's expertise in this area. Suffice it to say, the roof has still never leaked and most of the houses in my neighborhood still have their original roof (at least those who have properly replaced occasionally damaged shingles).

After the vacant house business, then the roof business, this company was just a waste of time. I haven't had a hint of trouble since going to a major insurance company.

#6 Consumer Comment

To the Underwriter..

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Thursday, August 12, 2010

Could you please tell us based on the information that Flynrider posted how were you able to look up their file and know exactly what their situation was?

#5 Author of original report

Response to anonymous insurance underwriter

AUTHOR: Steve - (U.S.A.)

SUBMITTED: Wednesday, August 11, 2010

Dear anonymous insurance underwriter:

Now you exposed yourself and your company's business practices. What I understand is that you are having a problem with people who file a claim within 6 months of obtaining coverage from your company. Those are probably the "bad apples among your customers" and you try to find a reason to get rid of them, regardless if they had insurance for the last 20 years with a different company for the same property...

Sorry, if my picture does not show each single square inch of my roof but you requested to replace the entire (!!!) roof, so what does it matter to you if the spot that was leaking can't be seen on the picture ?

What you want to say is that someone who makes a claim within 6 month already had the problem for years but was too afraid to make the claim with his old insurance company, so this person switched to your company before making a claim for a problem that he could have reported to the prior company.

I would not have had a problem with an exclusion of water damages from your policy, especially since the roof is no longer leaking and in perfect shape. But the roof or the risk of having to pay for water damages is not what your company is concerned about. What matters to your company is to get rid of customers who make claims, especially those who make claims within the first 6 months.

You know very well that the leak has been fixed by now - I spent almost $ 500,- and several days of work to scratch the old materials off and install the torch down rolled roofing. I own this house and live in it, so why shouldn't I have the right to repair it myself - do you get a commission from roofing companies ? Do you have some kind of a deal with the board of contractors or the State of Arizona ?

Why should I call a company (licensed, insured and sworn in....) to replace the entire roof for several thousands of Dollars if there are no leaks or any kind of problems ? Do you think I spent all that money for fun, did all that work because I was bored and did not have anything better to do ? All what this is about is to find a reason to get rid of me because those who make claims are your company's enemies.

#4 UPDATE Employee

Regarding the second complaint

AUTHOR: wmemp - (United States of America)

SUBMITTED: Wednesday, August 11, 2010

Again, I work for this company and would also like to address the circumstances of the second complaint (by "Flynrider"). According to our files we insured this property for 15 years. When we did a routine exterior inspection in 2006, the inspector noted that the dwelling appeared to be vacant, and was in need of paint and some repairs. The photographs of the home supported the inspector's conclusion as to vacancy, but he did not specifically photograph the lock box so there weren't any photos of that to show the insured. As the insured noted, we cancelled the policy for vacancy at that time and advised the lender as required by the policy conditions. The insured contacted us and advised that he lived in the home, and we asked for documentation that he resided at the property. We also advised the insured that repairs and maintenance were necessary, including roof repair/ replacement.

We accepted the insured's response regarding living in the home, so the policy was reinstated and the lender was advised of the reinstatement. However, the insured advised us that he was doing a major exterior renovation - including paint and landscaping - but he did not intend to replace the roof. When we reinspected about eight months later, the reinspection showed that there were still damaged shingles on the roof, which increased the likelihood of future leaks. Since we will cover interior water damage if the roof leaked, we conditionally nonrenewed the policy indicating that if the roof were replaced, we would continue coverage. We never heard back from the policyholder after that. As the author noted, we advised the lender that the policy was nonrenewed and apparently he found another policy that he was happy with.

#3 UPDATE Employee

From the company

AUTHOR: wmemp - (United States of America)

SUBMITTED: Wednesday, August 11, 2010

I work in the Underwriting Department of Arizona Home Insurance Company and this matter was brought to my attention. We work hard to maintain good business and concerns of this nature are taken seriously. I was able to locate the above mentioned file and there are a couple of things I would like to address. First, the water damage occurred to the leaking roof over the Arizona room, which is in the back of the house and not shown in the photograph online.

Second, our company did pay for the water damage repairs, but did not pay for a new roof because the damage to the roof was not sudden and accidental, but appeared to have occurred over a long period of time. Homeowners policies are intended to cover accidents, like roof shingles blowing off in heavy winds; they are not warranty policies that replace roofs or other items that have worn out over time. As an underwriter, the concern is that the roof, if not replaced, could leak again so we require the homeowner to replace the roof to continue coverage. We had insured this home for less than six months when the loss occurred, and as he mentioned, we are willing to renew the policy if he chooses to replace his roof. We hope he will contact us to resolve the matter.

#2 Author of original report

Blocked from getting insurance for the next 3 years ?

AUTHOR: Steve - (U.S.A.)

SUBMITTED: Tuesday, August 10, 2010

Follow up: I called some insurance companies today and their answer was:

"Our policy is not to issue a policy if there has been a claim within the past 3 years"

It looks like I will not even be able to get insurance against fire because my roof had a leak almost a year ago, I really start to hate the insurance industry - why don't they just exclude water damage or roof damage from their policy if they believe that the roof is an unbearable risk for them ?

I believe that the problem is not the roof or the house itself, it is just about getting rid of certain customers. The roof is just an excuse.

#1 Consumer Comment

I know these guys.

AUTHOR: Flynrider - (USA)

SUBMITTED: Friday, August 06, 2010

I was with Arizona Home Insurance company for 20 yrs.

"This insurance company obviously only likes people who pay for their policy without ever making a claim."

Not exactly. See, I was insured by them for 20 yrs. and never made a single claim and they did the same thing. For some weird reason, they want to get rid of good customers.

First they told me they were cancelling because my house was unoccupied. That was totally bogus. I have lived in the house since it was brand new and it's been continually occupied since 1986. After I got that squared away, they started it all over again claiming they had pictures of a lockbox on my door (pictures they wouldn't show me) and the house was for sale. I bought the house new and it's never been on the market. Complete fabrication.

Soon after, they sent another notice of cancellation because they claimed my roof was too old. They wouldn't reconsider unless I showed them proof that a licensed contractor had replaced the roof (sound familiar?). The roof is fine and has never leaked since it was new. I told them to go pound sand. About 3/4 of the houses on my street are still wearing their original shingles (kudos to the builder!). Their demands were unreasonable.

I switched to a real insurance company and they had no problem with my old roof, and they turned out to be 20% less expensive with more coverage. I recommend you do the same. It's been over 3 years and I still have the same roof and a lower insurance bill.

I have no problems if this compay doesn't want my business, but they were constantly reporting to my mortgage holder that the insurance was being cancelled and the chain of events that set off was getting out of hand. I'd recommend no one do business with these bozos.

Advertisers above have met our

strict standards for business conduct.