Complaint Review: Target Corporation - Minneapolis Minnesota

- Target Corporation 1000 Nicllet Mall Minneapolis, Minnesota United States of America

- Phone: 612-307-8218

- Web:

- Category: Department & Outlet Stores

Target Corporation Target Red Card, Target Pharmacy, Target National Bank How a $1.15 error cost one Target store over $8000 a year in sales? Minneapolis, Minnesota

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

Please be aware of a misrepresentation of services from Target Corporation. Target markets their own branded credit card online, in store and via mass media nd direct mail. The application and card has the Target logo on it. The card is issued by Target National Bank. The customer service line phone is answered as "Target". As such, the consumer has ever right right to assume that they are dealing directly with the retailer when they apply for, accept and use the card. Yet, when I had a problem with credit card services and turned to the local store and eventually to Target Headquarters for assistance, I was told the Red Card is a totally separate and different entity from Target. I was informed Target Corporation had no control, authority or ability to communicate with or help resolve any issues with the credit card company. Any issues must be resolved directly with Red Card by the cardholder. I think you attorneys refer to this as a DIFFERENCE WITHOUT DISTINCTION.

DETAILS: Here's my story. Several weeks ago I received a letter from Target. It stated that my Red Card account had been incorrectly credited approximately $50 due to some unexplained internal error. Fine, except on the next month's statement there was an interest charge of $1.15 for my "borrowing" that $50 for the days it was "incorrectly" credited to account. They were charging me interest for their error.

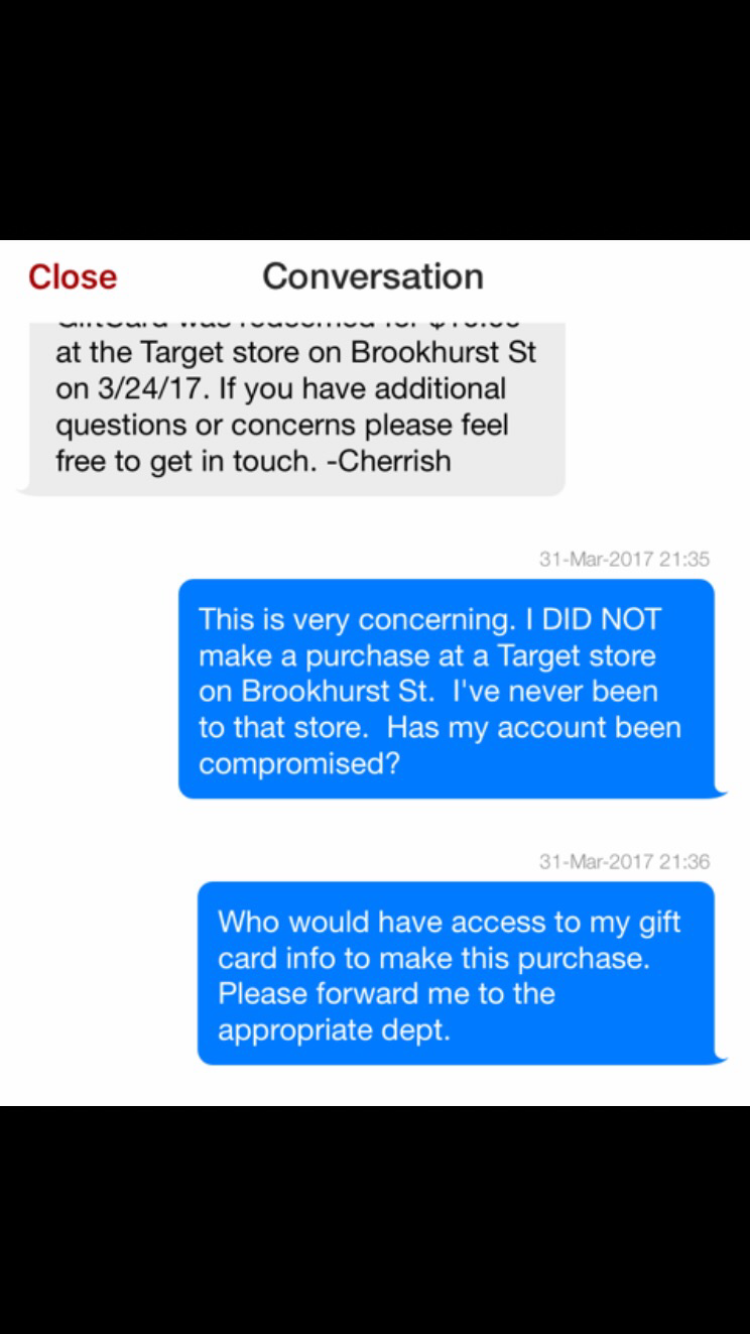

Now for a lousy $1.15 and to protect my excellent credit rating, I am forced to take time out of my busy schedule to get this matter cleared up. Furthermore, with so much identity theft going on I wanted a true explanation as to what prompted Red Card to credit my account in the first place and then charge me a fee for it. Had my account been breached? Did a scammer or an employee tap into my account?

Here's what I did and what I want to share about Target and the Red Card-

1: The Call Center is way off shore. By that I mean I had an extremely difficult time cutting through the CSR's accent and I don't believe she could understand me. Additionally the static and poor sound quality on the cheap VOIP lines added to the communications gap.

2: The issue of the credit and the explanation for the original error could not be resolved after 4 calls. 3 of the first calls were dropped while I was placed on infinite hold. After over 2 hours I got my $1.15 back. I was scolded by the CSR who actually said if I hadn't requested the original credit this would have never happened. Red Card was doing me a favor by letting me off the hook. Remember, I never requested the credit in the first place and had already received a letter of apology from Target (but apparently not really Target) alerting me to their error. After my scolding, I became even more concerned about identity theft and requested an explanation and details surrounding that mysterious credit. CSR told me told me only one person in the universe could answer that question: Jay.

I asked to be transferred to Jay and got his voice mail. I left my daytime office number and my cell phone number, but Jay only called back my daytime number at 7pm and left me a voice mail and a return number to call him back. In his message he also scolded me for not leaving my home number so he could cross reference my account info before he called. When I returned the call to his direct line, guess what? Back to square one. I got another low level CSR who wanted to start at the beginning again before transferring me to Jay. I told them I had already been escalated to Jay and I did not have the patience to start over. I was told this was impossible. I hung up (thinking I'll just call my local Target manager to get my answer).

3. I called my Target store to discuss with manager on duty. She said she would research and get back to me.

4. Three days later no response so I stopped by store. Manager said she had been off on scheduled break and left note for another manager.. so nothing had been done. She would now get right on it.

5. Later that day, manager notifies me Target Red Card is a different company from Target and there is nothing they can do to help me find out what happened. They cannot even request a person with authority at Red Card contact me. Not the same company??? Wait a minute. They're the same company to me. What are they doing to distinguish themselves as different entities. The Target cashiers are the ones who pushed the card on me every time I checked-out, they have their name & logo on the card, and the call center answers phone as Target. Surely Red Card adds a little something to Target's bottom line. Would I have had second thoughts about applying for the card if it didn't have the Target brand on it? YES!

Not believing what I was hearing I crafted the following email and sent to

Gregg.Steinhafel@Target.com admin@Target.com customerservice@Target.com webmaster@Target.com and a few other email addresses I guessed at.

*** "How can a $1.15 error cost one Target store over $8000 a year in sales?" ***

$8000 is approx how much my household spent at our local Target pharmacy last year. That doesn't include the tens of thousands we've spent on RX over the past several years. Nor does it include all the toys, bicycles, groceries, home goods, cleaning supplies, toiletries, etc we've purchased. Every bit of that business is about to depart forever... all because of a buck and some change. Your store manager says she is helpless to resolve my issue. Call me if you're interested in discussing retaining my business or even if you're just curious. Or you can simply wait until I share my experience on the internet.

END OF LETTER

I can't say I was too surprised but the Next Day I heard from Peggy. (Contact me through this forum if you are having trouble contacting corporate or Peggy) Peggy told me she was not in customer service but actually in the corporate office.

But Peggy only repeated what the manager had told me. Credit Card and Target are separate entities. If I wanted answers I was on my own. I told her it had taken me hours to try to reach someone with the authority to let me know if my account had been breached. With Target's clout could not they at least contact their "Partner" and have a representative call me. Nope. All she said was please call that same number (you've already spent hours getting the run around on). You would think even if Red Card was another company, CEO or board might have some QA plan in place to protect their brand from Red Card's errors or poor relationship with their consumers. But Peggy on behalf of Corporate decided to stand her ground without escalating my issue and told me she was hanging up since we had nothing further to discuss.

So my family, my cash and my insurance walked with our $8000 of business. So beware. Don't sign up for or use the Red Card with the expectation you are working with Target. When this unknown Credit Card company makes an error on your statement, or if you suspect identity theft, you are on your own. You are at the mercy of some offshore CSR whose Americanized name will be Mary or Eric but will barely speak or understand English.

I guess $8000 doesn't mean much to a company glowing in record profits & has reported their top exec received $40 million in compensation last year. But when I returned to gather my records and said my farewell to the part-time pharm tech, I asked if my departure would affect her. She said it definitely would. Her hours are determined by number of scripts they fill and our 10 per month in and month out would be a hit and not easily replaced.

I wonder how many other retailers would chomp at the bit to acquire an $8000/yr account or at least make an effort to retain?

Is Target violating more than just the public trust by not owning up to ownership of Red Card or at least disguising it's involvement? There are all sorts of rewards cards out there. Go with one you know who you are dealing with. Go with one that earns rewards with every purchase, at any store. Go with one concerned with retaining your account...and one with clear phone lines and better communication skills.

This report was posted on Ripoff Report on 09/07/2012 07:08 AM and is a permanent record located here: https://www.ripoffreport.com/reports/target-corporation/minneapolis-minnesota-55403/target-corporation-target-red-card-target-pharmacy-target-national-bank-how-a-115-err-937890. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

Advertisers above have met our

strict standards for business conduct.