Complaint Review: First Convenience Bank - Pasadena Texas

- First Convenience Bank 6767 Spencer Hwy Pasadena, Texas USA

- Phone:

- Web:

- Category: Banks

First Convenience Bank Overdraft Scam! Pasadena Texas

*General Comment: A few things...

*Author of original report: yes.. really

*Consumer Comment: No, it's not a scam

*Consumer Comment: Really???

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

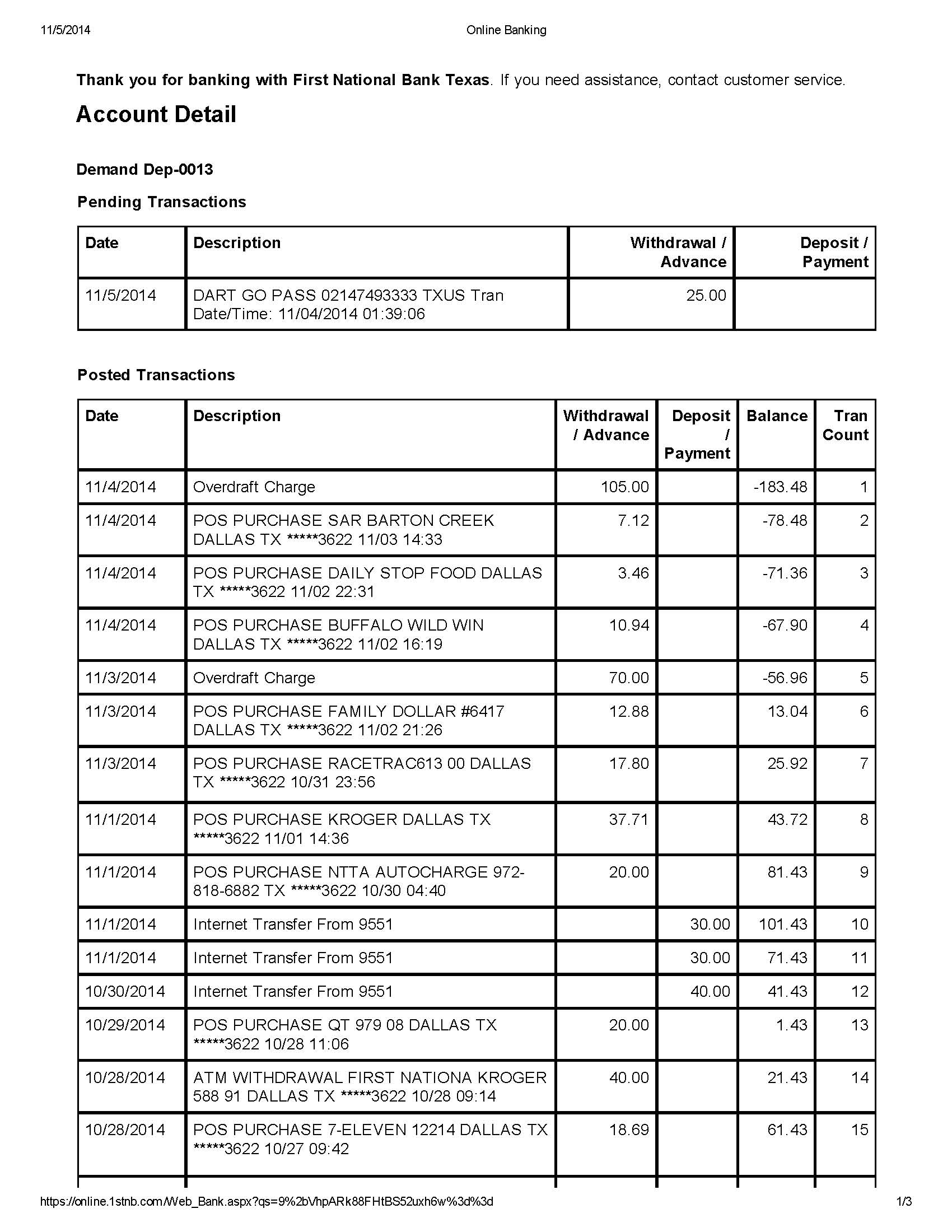

I have had this bank for 3 years, and just rebutcently have had problems with overdraft fees. The bank is charging me overdraft fees when I am not negative. They corrected it once and the next 2 times told me since they fixed it one time that they will not do it again. They are denying that they are at fault. I was told that according to their computers my account drops below what I have available, but my internet banking, mobile banking, and daily balance texts from the bank show I have money available. I showed this to a teller on my phone who agreed that it didn't make sense. She told me it was a matter for the manager, who wasn't available. The manager continued to be unavailable for the next week. The assistant manager called the manager of a nearby branch and talked about my account in spanish. When I infomed her I understood spanish she told me nothing could be done, ut wasn't their fault and they weren't going to fix it. I called and spoke with a regional manager who did not listen I told her that one of the branch tellers even agreed that I was receiving charges that didn't make since according to my online bankings available balance. She said that it wasn't their fault and they weren't going to do anything to help me. I tried to file a complaint on the assistant manager for switching to spanish while talking about my account, and the regional manager disregaurded it. She said she had to go and would call me back but didn't (big surprise). this particular instance has cost me $280. In the process of switching my finances to another bank I continued to use this one to pay bills. I was told today that my account was negative and that I had 8 pending transactions, despite my online banking not showing this. I tried to deposit cash to cover the pending charges so they wouldn't all cost me overdaft fees and I was told that I would take 2 days, I repeat 2 days for a cash deposit to clear! This is ridiculous! So by the time my cash deposit "clears" I will assume 8 OD fees at $35 each! I have always in the past put in cash so it would clear immediatley, and now all of the sudden it will take 2 business days!? I don't know what to do, I am facing another 280 dollars in overdraft fees that I wasn't expecting based off the account balance available to me from their services, then when I try to prevent it by covering my account before pending items post they tell me that it won't matter, that they are going to hold a cash deposit for 2 days. I have no idea what to do but this is causing me to get behind on bills and rent. As soon as everything posts I am closing my account. I do hope that sometimes files a class action suit to get people their OD fees back from this institution, everything I hear about and read tells me that this kind of business practice is very very common with First Convenience Bank.

This report was posted on Ripoff Report on 08/22/2013 06:33 PM and is a permanent record located here: https://www.ripoffreport.com/reports/first-convenience-bank/pasadena-texas-77505/first-convenience-bank-overdraft-scam-pasadena-texas-1078255. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#4 General Comment

A few things...

AUTHOR: Striderq - ()

SUBMITTED: Friday, August 23, 2013

#1. I don't work for the bank so please don't try that tired excuse.

#2. If you deposit cash after Friday cutoff it will not credit until Monday's posting. So you won't see it until Tuesday and it can't help cover anything that posts as Friday's business.

#3. Most if not all banks process the same way. The only possible differences are: dey credit the deposits before or after the debits and how much do they charge for each OD fee.

#4. According to your original the, the teller said "it didn't make sense" not that the bank was wrong. This reaction is not surprising because tellers don't need to understand how posting works. That'swhy you should always contact Customer Support.

#5. The online/phone banking will only sow the transactions the bank knows about. Items that have already posted and debit card transactins that created a hold. This will give you the online available balance. But it doesn't show debit card transactions that don't create holds (hotel/motel reservations, carental reservtions, plane ticket reservations and gs purchases to name a few). These items don't affect the online balance until they post.

#6. Posting works as follows: Take your previous business day's closing balance. Subtract all debit card holds. This leaves your available balance. Subtract all debits (usually largest to smallest) to get current business day's closing balance. If the balance goes negative, you get a fee for each negative item. Example: Previous balance $250. Subtract $80 in DBC holds. Available balance $170. Subtract check written last week $100, avail bal $70. Subtract DBC purchase $50., avail bal $20. Subtract check written yesterday $40, avail bal -$20. Subtract DBC purchase $10, avail bal -$30. You could be charged 2 OD fees. When you look at your online banking, you'll see the balance showing as $50 because the DBC holds don't show, so you "never went negative". But as far a the bank is concerned, you spent more money than you had available.

#3 Author of original report

yes.. really

AUTHOR: James - ()

SUBMITTED: Friday, August 23, 2013

I'm not claiming that I'm without fault. You guys must work for the bank.. Did you not read that i could not deposit cash into my own account with out waiting 2 days for it to clear. Or how about that in the first instance a teller even told me the bank was incorrect, and yes my register was positive just as the online banking statement said i was. A bank employee told me that three bank wad wrong but that her manager was off on vacation and that she could not correct it without the manager present.

#2 Consumer Comment

No, it's not a scam

AUTHOR: coast - ()

SUBMITTED: Thursday, August 22, 2013

"The bank is charging me overdraft fees when I am not negative."

A checking account can be charged an overdraft fee without having a negative balance. If a deduction would have created a negative balance but is declined by the bank, the account could retain a positive balance.

"my internet banking, mobile banking, and daily balance texts from the bank show I have money available"

That information does not reflect outstanding transactions. That is why you must maintain a current check register as noted by the previous commenter.

"I tried to deposit cash to cover the pending charges so they wouldn't all cost me overdaft fees and I was told that I would take 2 days"

Never attempt to draw against funds until after those funds are available.

"this kind of business practice is very very common with First Convenience Bank"

All banks charge for overdrafts.

"I don't know what to do"

Maintain a check register and don't attempt to draw against unavailable funds.

#1 Consumer Comment

Really???

AUTHOR: Stacey - ()

SUBMITTED: Thursday, August 22, 2013

What did your check register state your balance was??? My best guess would be you do not keep a check register or even balance your monthly bank statement. Oneline, ATM and phone balances are not accurate so the reason you overdraft your account is YOUR fault not the banks.

Advertisers above have met our

strict standards for business conduct.