Complaint Review: Suntrust Bank - Dunnellon Florida

- Suntrust Bank 20270 E. Pennsylvania Ave Dunnellon, Florida United States of America

- Phone: 352-489-6411

- Web: https://www.suntrust.com/portal/ser...

- Category: Banks

Suntrust Bank Fraudulent Deposit accepted Dunnellon, Florida

*Consumer Comment: The OP does have a case

*Consumer Comment: To the previous responders

*Consumer Comment: Granted...Husband Intended To Defraud Me....

*Consumer Comment: What did SunTrust do wrong?

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

My husband and I are separated and he had agreed to have the refund deposited into my account to offset child support and alimony he had not paid. Due to circumstances we were forced to live in a homeless shelter at the time. He agreed to remedy the situation with the tax funds.

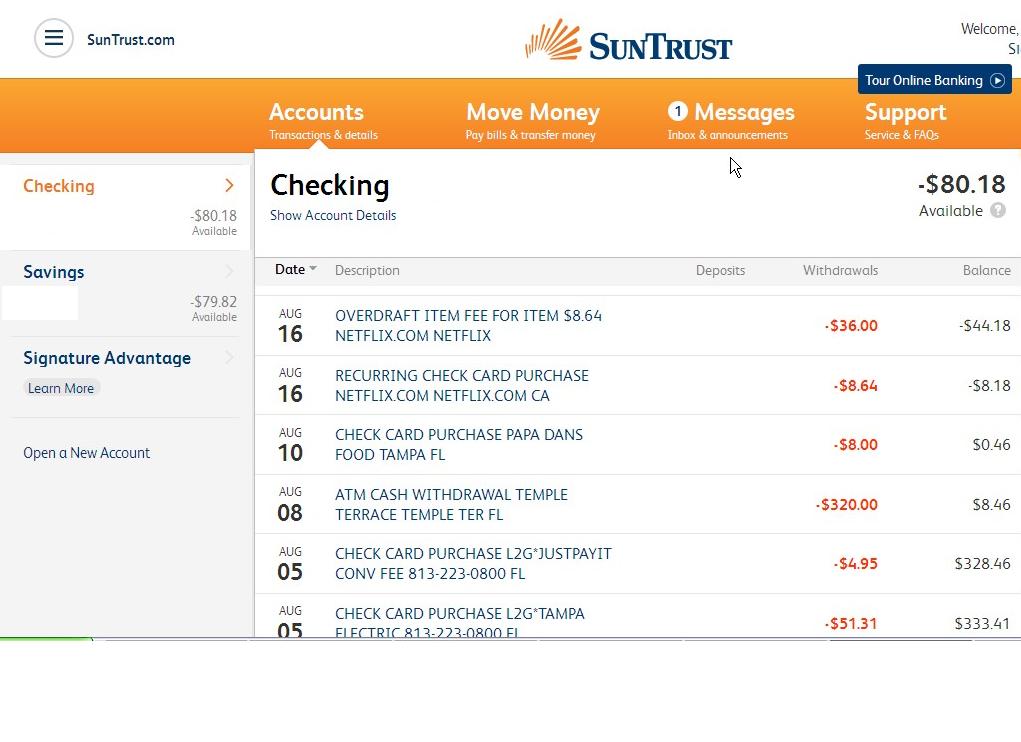

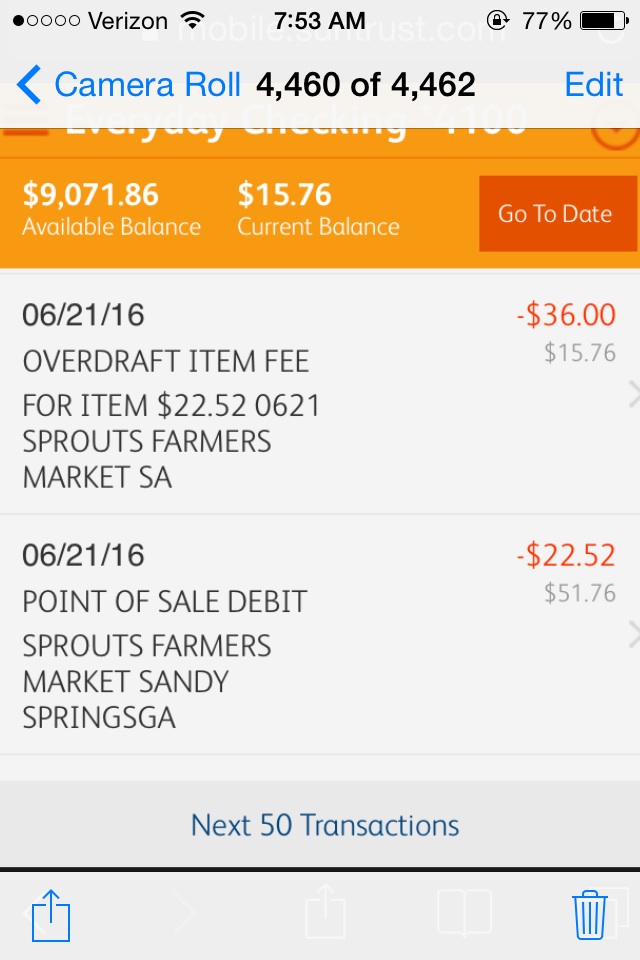

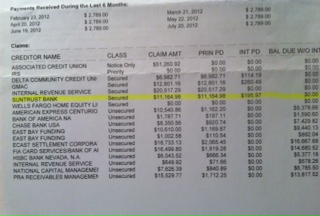

He put his girlfriend's account no. on the direct deposit of the tax refund and Suntrust allowed this wire to be processed, despite the fact that I do not have an account at that bank. Granted my husband intended to defraud me, however, Suntrust allowed him to do so, but the improper handling of this wire.

This caused the children and I to be in the homeless shelter and loose personal items such as clothes, shoes, boots, etc. It also caused emotional damage to the children for having to be exposed to such circumstances. I could not work while we were stuck at the shelter, as the children could not be left there after school for even 15 mins. I now have a job and am trying to rebuild my life, but feel that not allowing my husband or the bank to victimize me is the first step.

IRS suggested that I sue the bank, but have not been able to find any attorney that would consider it.

This report was posted on Ripoff Report on 11/16/2011 09:41 AM and is a permanent record located here: https://www.ripoffreport.com/reports/suntrust-bank/dunnellon-florida-34432/suntrust-bank-fraudulent-deposit-accepted-dunnellon-florida-798584. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#4 Consumer Comment

The OP does have a case

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Thursday, November 17, 2011

The question is against who?

There is one thing that was not mentioned by the OP, if this was a joint or single return. The fact that he was able to put it into his Girlfriends account would seem to indicate it is a single return by the ex. Because if it was a joint the OP should have verified the account before she signed the return. So everything I am mentioning is based on thinking it is a single return.

Even if the bank is at fault by allowing the deposit, it does not mean that the OP would get the funds. The best that would happen is that the funds would be returned to the IRS and the IRS would either require him to provide a valid account, or send him a check.

Since this appears to be an agreement between the OP and her ex, she needs to go after her ex in civil court. Then as to her chances of collecting is what type of agreement it is, such as is it an actual court order for support?

Now, since this is not the OP's return, the OP's account, or even the OP's bank, the OP has nothing to do with this if there was something illegal done, as that is between the IRS, Suntrust and the Ex.

#3 Consumer Comment

To the previous responders

AUTHOR: Ashley - (U.S.A.)

SUBMITTED: Thursday, November 17, 2011

the OP may have a case, if I remember reading it correctly, IRS regulations state that tax refunds can only be placed in your own bank account. If the husband's name did not appear on the girlfriend's account then it was not legal to have it direct deposited to that account. There are many reports on this site of accounts being frozen for this exact reason. So if the bank DID allow it to occur, they could have broken IRS regulations. The OP still can't do anything, its not her money to make a case over.

#2 Consumer Comment

Granted...Husband Intended To Defraud Me....

AUTHOR: Jim S - (United States of America)

SUBMITTED: Wednesday, November 16, 2011

I mean this is where you lose everyone in your complaint against the bank. If your husband intended to defraud you, I guarantee you no bank would ever be able to stop him. The bank has no knowledge of your agreement with scumbag husband - so why blame the bank? Is it the bank's responsibility to ask why a depositor is putting money into their account at a bank? Even if they could (privacy forbids it)...do you expect your husband to tell the bank the truth?? Really???

The IRS doesn't know what they're talking about - if you've ever dealt with the IRS as a preparer, you know that to be case. Your action should be against your husband, and I would use your divorce attorney to not only secure those funds back (if the attorney hasn't done so already), but to seek punitive damages as a result of that attempted defrauding..... that is who your action should be against. Best of luck to you.

#1 Consumer Comment

What did SunTrust do wrong?

AUTHOR: coast - (USA)

SUBMITTED: Wednesday, November 16, 2011

It isn't the bank's fault if your husband deposited funds into the wrong account. It is not clear as to why you think SunTrust allowed your husband to defraud you.

Advertisers above have met our

strict standards for business conduct.