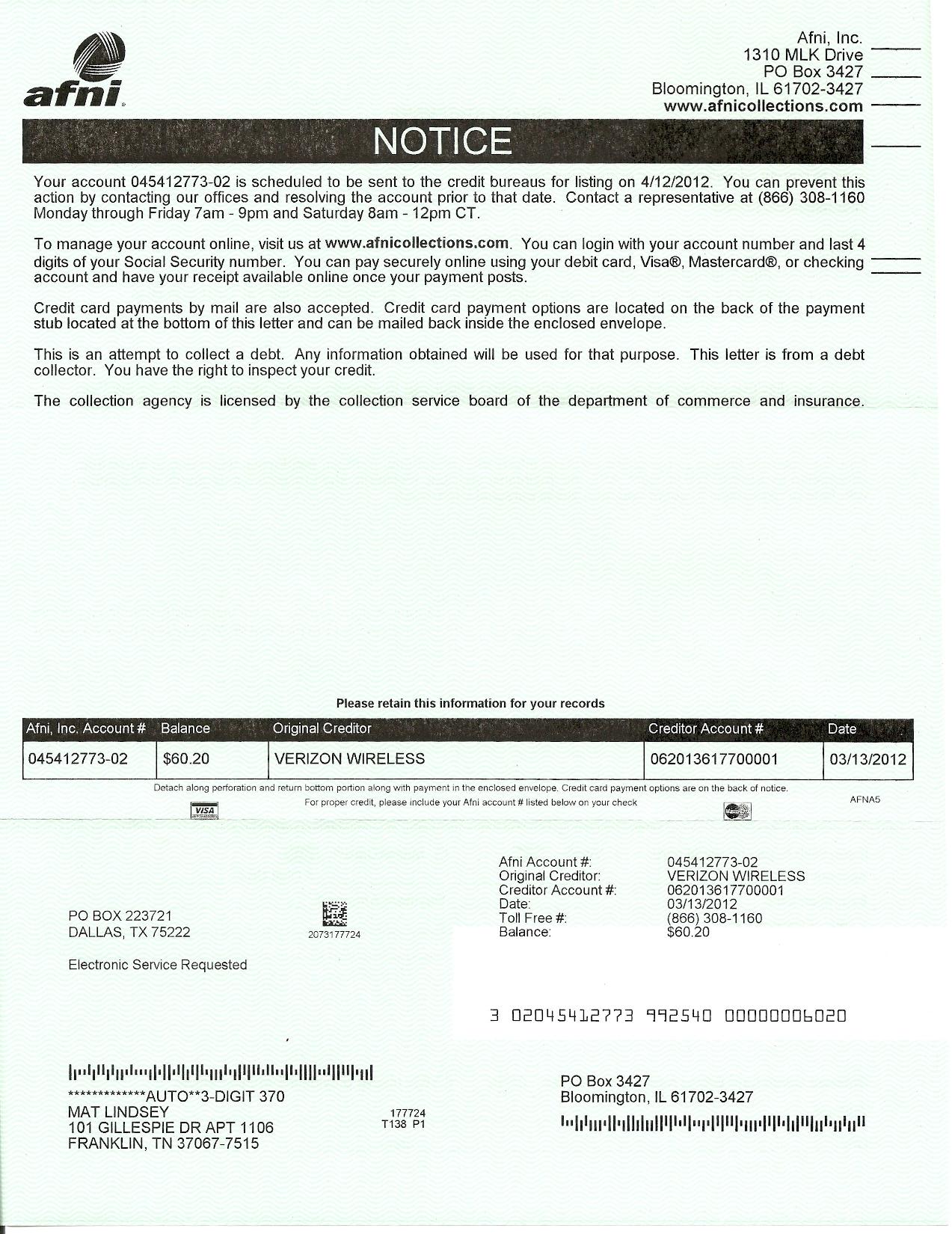

Complaint Review: Afni Collections - Bloomington Illinois

- Afni Collections P.O. Box 3427 Bloomington, Illinois U.S.A.

- Phone: 866-3081160

- Web:

- Category: Collection Agency's

Afni Collections - Afni Sent collection letter for bill never incurred or never received bill for Bloomington Illinois

*Consumer Comment: Next time...stand up for your rights under federal law (Fair Debt Collection Act)

*Author of original report: Update if anyone cares

*Consumer Comment: re: comment

*Author of original report: I'm paying and getting over this

*Author of original report: Please Advise!

*Author of original report: Case action in their hometown

*Consumer Suggestion: You should not have paid them a cent - but since you did...

*Consumer Suggestion: You should not have paid them a cent - but since you did...

*Consumer Suggestion: You should not have paid them a cent - but since you did...

*Consumer Suggestion: Ace, tips for dealing with collectors

*Consumer Suggestion: Ace, tips for dealing with collectors

*Consumer Suggestion: Ace, tips for dealing with collectors

*Consumer Suggestion: Ace, tips for dealing with collectors

*Consumer Comment: RE: comment

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

On October 12, 2007 I received a collection letter for an alleged disconnected phone number under my name for Verizon California Inc. Alarmed and very concerned I called them immediately and got a live person on the phone. I was told that I had phone service under my name between the dates of 9/97 - ? that had incurred unpaid charges in the amount of $322.02. They had my parent's address and I did live there at the time but I have no recollection of ever owing this money! They had all my personal information and even my SS #.

I figured maybe memory was not serving me well and agreed to pay half of the balance with my credit card. That evening a nagging feeling kept telling me to investigate this company further...especially since I have had Verizon phone service AND wireless service since then and no mention that I owed anything. I found this website and our stories all sound the same and so I closed my credit card account immediately so that I can hold on for payment until I have proof that this debt is in fact mine.

I have been working hard to clean up my credit and this is the absolute last thing I need. If they can prove this debt is mine, fine, I will pay but if not I pray they will leave me alone.

Are they even allowed to collect on a debt 10 years old?? Someone please shed some light!

Ace

Palmdale, California

U.S.A.

This report was posted on Ripoff Report on 10/14/2007 06:58 PM and is a permanent record located here: https://www.ripoffreport.com/reports/afni-collections/bloomington-illinois-61702/afni-collections-afni-sent-collection-letter-for-bill-never-incurred-or-never-received-b-278705. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#14 Consumer Comment

Next time...stand up for your rights under federal law (Fair Debt Collection Act)

AUTHOR: John - (U.S.A.)

SUBMITTED: Friday, October 19, 2007

If these people come after me again what is my recourse?

---------

I hope this has been a learning experience. If they come after you again, put your check book away. Don't let them bully you into making a payment. Tell them that you do not recognize the debt and that per the Fair Debt Collection Act you are requesting that it be validated. If they state: "We don't do that." Tell them that it is required by federal law.

#13 Author of original report

Update if anyone cares

AUTHOR: Ace - (U.S.A.)

SUBMITTED: Friday, October 19, 2007

So, I asked Afni to fax me over a settlement offer and I paid them with a USPS money order for $161. Can I still ask them for proof of this bill?

I know I paid prematurely but I was scared because of the reports that they report to the credit bureaus. If these people come after me again what is my recourse?

I don't see how the courts can see that a payment can be seen as an admission and not out of duress in some cases. I was mor fearful of having to deal with court and a negative report to the 3 CRAs then I was just paying the darn thing. Now I feel like I got...ripped off.

#12 Consumer Comment

re: comment

AUTHOR: John - (U.S.A.)

SUBMITTED: Tuesday, October 16, 2007

AFNI specializes in filing bogus collection accounts for accounts you never had. AFNI is the bottom of the barrel. They are slime. When a debt is ten years old, it is beyond that statue of limitations, which means that they can't take ANY legal action against you. IF this is really your debt. they can still try to collection by annoying you with phone calls, but that's all.

As others stated above. If this company did manage to get a payment on your card before you canceled it, you have validated this debt as real, regardless of whether it's yours or not.

#11 Author of original report

I'm paying and getting over this

AUTHOR: Ace - (U.S.A.)

SUBMITTED: Tuesday, October 16, 2007

I'm done. I'm paying them off and should be done with them. I think this bill is mine; I just don't remember. I'd rather pay them off and be conscience free.

Good luck to you all and I hope that those that really don't owe anything or have paid their accounts get some answers and justice. For those who owe, just pay the people...

#10 Author of original report

Please Advise!

AUTHOR: Ace - (U.S.A.)

SUBMITTED: Tuesday, October 16, 2007

So, when I called Afni she said the bill was from 1997. I gave them my c/c debit number but called back and they agreed to cancel the payment until they could provide validation. Just in case, I cancelled my credit card in time. I don't feel this is an admission of anything. More like confused to all heck.

Now, I am a firm believer that if I owe the money I will pay it. The phone number doesn't sound familiar but that was 10 years ago! I don't even remember! I would want them to send me an itemized bill with my name with phone calls that I've made. Even then how can I prove that I hadn't paid them already. I don't keep copies for 10 years!

Can they really collect on a debt 10 years old or not? Please advise. I'm about ready to be clear of this!!

#9 Author of original report

Case action in their hometown

AUTHOR: Ace - (U.S.A.)

SUBMITTED: Tuesday, October 16, 2007

I hear there's a case action against Afni filed in September. Anyone hear of this?

#8 Consumer Suggestion

You should not have paid them a cent - but since you did...

AUTHOR: Truth Detector - (U.S.A.)

SUBMITTED: Monday, October 15, 2007

you have now re-affirmed a debt that was legally uncollectable per the statute of limitations in CA. Now, they can sue you successfully for this entire balance PLUS any fees they may try to tack on top of it - as any judge will see your payment as an admission that you do owe the debt (if you didn't owe it, why would you pay? that's what AFNI will say in court). My best suggestion to you is to pay the full balance via money order and be done with it. If you do not, the balance will grow to whatever limits AFNI feels like setting - and you will find a summons to appear in court before long.

Let this thread be a warning for anyone who receives this type of letter from a lowlife, bottom-feeding parasite like AFNI. EDUCATE YOURSELVES BEFORE YOU ACT. They will try any method possible to scare you into paying a debt that is legally uncollectable. The problem in this case is you have now re-started the SOL for this debt - and have no recourse but to pay them before more mysterious charges find their way to your mailbox accompanied by a lawsuit that you cannot win.

#7 Consumer Suggestion

You should not have paid them a cent - but since you did...

AUTHOR: Truth Detector - (U.S.A.)

SUBMITTED: Monday, October 15, 2007

you have now re-affirmed a debt that was legally uncollectable per the statute of limitations in CA. Now, they can sue you successfully for this entire balance PLUS any fees they may try to tack on top of it - as any judge will see your payment as an admission that you do owe the debt (if you didn't owe it, why would you pay? that's what AFNI will say in court). My best suggestion to you is to pay the full balance via money order and be done with it. If you do not, the balance will grow to whatever limits AFNI feels like setting - and you will find a summons to appear in court before long.

Let this thread be a warning for anyone who receives this type of letter from a lowlife, bottom-feeding parasite like AFNI. EDUCATE YOURSELVES BEFORE YOU ACT. They will try any method possible to scare you into paying a debt that is legally uncollectable. The problem in this case is you have now re-started the SOL for this debt - and have no recourse but to pay them before more mysterious charges find their way to your mailbox accompanied by a lawsuit that you cannot win.

#6 Consumer Suggestion

You should not have paid them a cent - but since you did...

AUTHOR: Truth Detector - (U.S.A.)

SUBMITTED: Monday, October 15, 2007

you have now re-affirmed a debt that was legally uncollectable per the statute of limitations in CA. Now, they can sue you successfully for this entire balance PLUS any fees they may try to tack on top of it - as any judge will see your payment as an admission that you do owe the debt (if you didn't owe it, why would you pay? that's what AFNI will say in court). My best suggestion to you is to pay the full balance via money order and be done with it. If you do not, the balance will grow to whatever limits AFNI feels like setting - and you will find a summons to appear in court before long.

Let this thread be a warning for anyone who receives this type of letter from a lowlife, bottom-feeding parasite like AFNI. EDUCATE YOURSELVES BEFORE YOU ACT. They will try any method possible to scare you into paying a debt that is legally uncollectable. The problem in this case is you have now re-started the SOL for this debt - and have no recourse but to pay them before more mysterious charges find their way to your mailbox accompanied by a lawsuit that you cannot win.

#5 Consumer Suggestion

Ace, tips for dealing with collectors

AUTHOR: Steve - (U.S.A.)

SUBMITTED: Monday, October 15, 2007

Ace,

First, I'll give you the bad news. When you made that agreement to pay, you legally affirmed the debt. Now it is legally collectable due to you making a payment / agreement to pay.

1. NEVER call, or speak to any collector on the phone. ALWAYS demand debt validation IN WRITING and send by certified mail, return reciept requested. Be sure to put the certified# on the letter itself.

2. Never in any way give a collector access to any checking account or credit card, or other financial account. Even if you do decide at some point to pay a collector, use a postal money order only.

3. Go to Bud Hibbs . com and read all about these lowlife. They are the lowest of the low in the bottomfeeder business.

Good luck.

#4 Consumer Suggestion

Ace, tips for dealing with collectors

AUTHOR: Steve - (U.S.A.)

SUBMITTED: Monday, October 15, 2007

Ace,

First, I'll give you the bad news. When you made that agreement to pay, you legally affirmed the debt. Now it is legally collectable due to you making a payment / agreement to pay.

1. NEVER call, or speak to any collector on the phone. ALWAYS demand debt validation IN WRITING and send by certified mail, return reciept requested. Be sure to put the certified# on the letter itself.

2. Never in any way give a collector access to any checking account or credit card, or other financial account. Even if you do decide at some point to pay a collector, use a postal money order only.

3. Go to Bud Hibbs . com and read all about these lowlife. They are the lowest of the low in the bottomfeeder business.

Good luck.

#3 Consumer Suggestion

Ace, tips for dealing with collectors

AUTHOR: Steve - (U.S.A.)

SUBMITTED: Monday, October 15, 2007

Ace,

First, I'll give you the bad news. When you made that agreement to pay, you legally affirmed the debt. Now it is legally collectable due to you making a payment / agreement to pay.

1. NEVER call, or speak to any collector on the phone. ALWAYS demand debt validation IN WRITING and send by certified mail, return reciept requested. Be sure to put the certified# on the letter itself.

2. Never in any way give a collector access to any checking account or credit card, or other financial account. Even if you do decide at some point to pay a collector, use a postal money order only.

3. Go to Bud Hibbs . com and read all about these lowlife. They are the lowest of the low in the bottomfeeder business.

Good luck.

#2 Consumer Suggestion

Ace, tips for dealing with collectors

AUTHOR: Steve - (U.S.A.)

SUBMITTED: Monday, October 15, 2007

Ace,

First, I'll give you the bad news. When you made that agreement to pay, you legally affirmed the debt. Now it is legally collectable due to you making a payment / agreement to pay.

1. NEVER call, or speak to any collector on the phone. ALWAYS demand debt validation IN WRITING and send by certified mail, return reciept requested. Be sure to put the certified# on the letter itself.

2. Never in any way give a collector access to any checking account or credit card, or other financial account. Even if you do decide at some point to pay a collector, use a postal money order only.

3. Go to Bud Hibbs . com and read all about these lowlife. They are the lowest of the low in the bottomfeeder business.

Good luck.

#1 Consumer Comment

RE: comment

AUTHOR: John - (U.S.A.)

SUBMITTED: Sunday, October 14, 2007

Are you sure they haven't already charged you prior to your closing the account? I'm guessing that they put the charge through 20 seconds after getting the card info from you. Next time, do research FIRST before giving out your card info.

If they have charged you and this is a credit card (not debit card), request a "charge-back" for the entire amount. If they haven't charged anything...CANCEL the card and have it re-issued under a different card number. If you don't it's guaranteed that they'll try to run charges through. These people are scammers.

For your future reference: NEVER NEVER EVER give your checking account info or debit card info to pay ANY collection agency electronically. They will almost always take out way more than you authorized, which can wreak havoc with your checking account. This usually results in an avalanche of bounced check fees.

DO NOT allow yourself to be bullied by a collection agency. Do research before paying them anything. If you pay any collection agency, get the terms in WRITING before giving them one penny. Pay ONLY via USPS money orders.

Advertisers above have met our

strict standards for business conduct.