Complaint Review: Afni - Bloomington Illinois

- Afni P.O. Box 3427 Bloomington, Illinois U.S.A.

- Phone: 866-308-1160

- Web:

- Category: Collection Agency's

Afni - Afni Collections ripoff Fraudulent billing from 10 yrs. ago wrong address different names on account and I haven't had a phone in my name Bloomington Illinois

*Consumer Comment: Statue of Limitations

*Consumer Comment: Statue of Limitations

*Consumer Comment: Statue of Limitations

*Consumer Suggestion: AFNI is not legitimate, they are a Bottom-Feeder

*UPDATE EX-employee responds: General Advice

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

I was sent a bill for $248.98 on a verizon account.I haven't had a house phone in my name. I called this business to get more details on this matter.

The man said,there are a few different names on the account,and then I asked for the address of the account.It was two wrong addresses,in which I haven't lived at.

I informed the company that it was not my bill.The man said I would need to pay it in full or it will affect my credit score.I then asked for fruadulaent paper work to fill out .

The man said I would need to make a written response within 30 days of the letter.Then they would determine if I could file fruadulent paper work.When I came on the website to see if I could do my response on line,I found that this was a rip off scam.

Now I am not sure of what to do.Any Ideas?

Caprina

porterville, California

U.S.A.

This report was posted on Ripoff Report on 07/13/2007 10:11 AM and is a permanent record located here: https://www.ripoffreport.com/reports/afni/bloomington-illinois-61702-3427/afni-afni-collections-ripoff-fraudulent-billing-from-10-yrs-ago-wrong-address-different-260631. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#5 Consumer Comment

Statue of Limitations

AUTHOR: Gina - (U.S.A.)

SUBMITTED: Tuesday, July 17, 2007

To the ex-employee, who has hopefully move on to gainful employment, did you either stop to consider the statue of limitations for these collection attempts on supposed accounts that are so dated? Most states have a statue of limitation for collections/debts of 3 to 7 years. As it is rate for most people to keep records past 7 years, if even that long, it's nearly impossible to contest a supposed debt that can't even be verified by this company...doesn't it make you wonder if they are doing this on purpose...hence as a scam. Good luck to you and please advise any former co-workers to move on to legitimate employment.

#4 Consumer Comment

Statue of Limitations

AUTHOR: Gina - (U.S.A.)

SUBMITTED: Tuesday, July 17, 2007

To the ex-employee, who has hopefully move on to gainful employment, did you either stop to consider the statue of limitations for these collection attempts on supposed accounts that are so dated? Most states have a statue of limitation for collections/debts of 3 to 7 years. As it is rate for most people to keep records past 7 years, if even that long, it's nearly impossible to contest a supposed debt that can't even be verified by this company...doesn't it make you wonder if they are doing this on purpose...hence as a scam. Good luck to you and please advise any former co-workers to move on to legitimate employment.

#3 Consumer Comment

Statue of Limitations

AUTHOR: Gina - (U.S.A.)

SUBMITTED: Tuesday, July 17, 2007

To the ex-employee, who has hopefully move on to gainful employment, did you either stop to consider the statue of limitations for these collection attempts on supposed accounts that are so dated? Most states have a statue of limitation for collections/debts of 3 to 7 years. As it is rate for most people to keep records past 7 years, if even that long, it's nearly impossible to contest a supposed debt that can't even be verified by this company...doesn't it make you wonder if they are doing this on purpose...hence as a scam. Good luck to you and please advise any former co-workers to move on to legitimate employment.

#2 Consumer Suggestion

AFNI is not legitimate, they are a Bottom-Feeder

AUTHOR: John - (U.S.A.)

SUBMITTED: Saturday, July 14, 2007

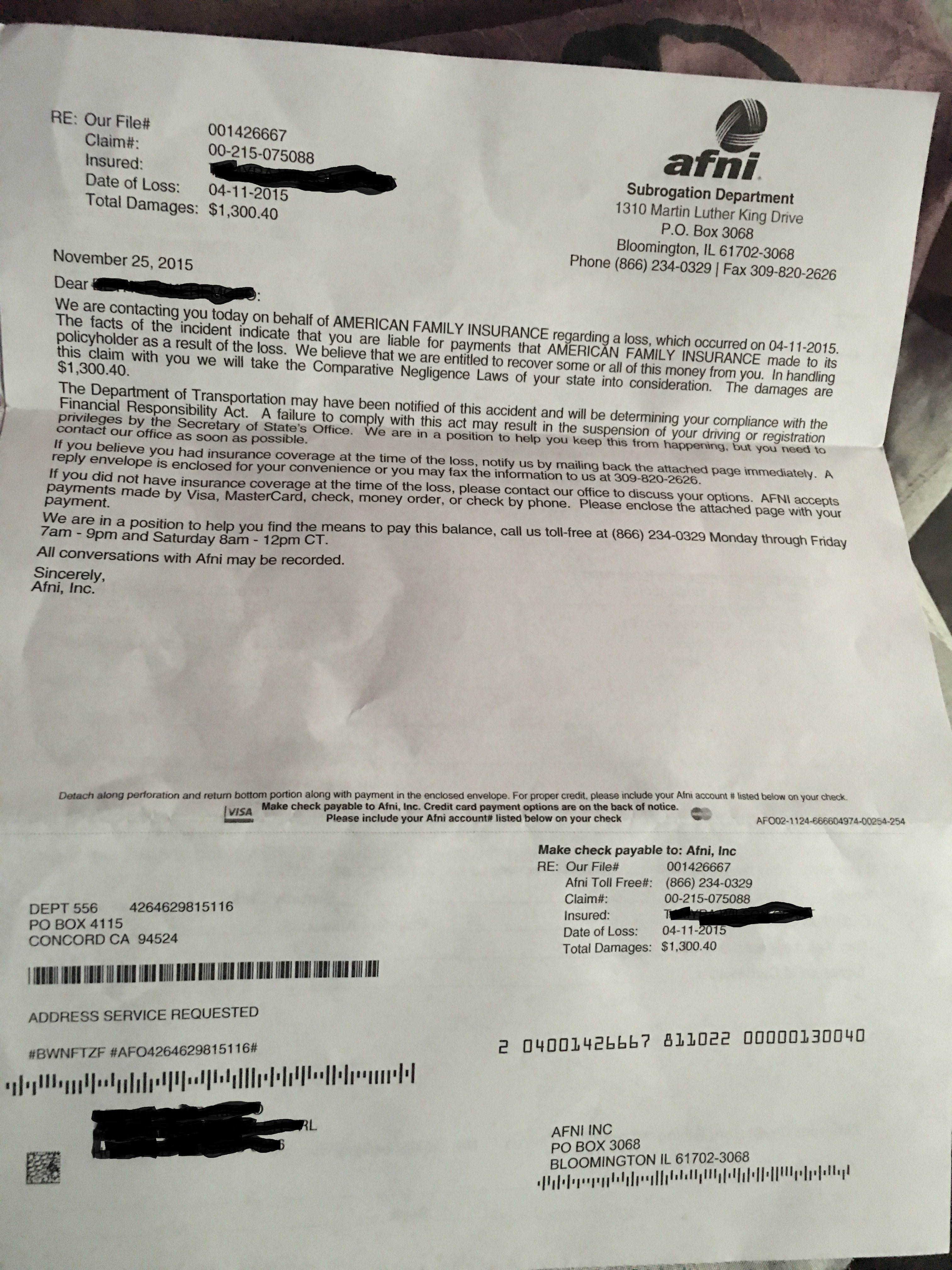

AFNI is in no way a "legitimate" organization. While they may be properly registered to conduct business (I can't verify this), they are the lowest of bottom feeders and should be avoided at all costs. If you get a letter from them dispute it immediately and NEVER talk directly on the telephone to them.

My girlfriend received a letter from them stating that she owed money on a telephone bill from Utah over 4 years ago, beyond the statute of limitations. In addition, all the information on the bill was wrong. Without thinking about it she called them and they asked her for updated information. In a moment without thinking about it, she provided them current name and address information and all they did was say she still owes it, thanks for the update.

We disputed in writing and they wrote her back stating all collection attempts were cancelled.

3 months later, they are after us again for the same thing.

Bottom Feeders like AFNI buy very old and hard to collect debts for pennies on the dollar and use anything and everything, legal or other, to intimidate people into paying, even if it is not your debt. They use only the minimum amount of research to match a name and send you a bill, even if it is not yours, in hopes that some of them will pay something.

Avoid these bottom feeders, dispute in writing by certified mail (do not use PO Box, find their physical address for the letter), and NEVER, EVER talk to them on the telephone: Conduct all business in writing and keep copies of everything.

#1 UPDATE EX-employee responds

General Advice

AUTHOR: Former Afni Employee - (U.S.A.)

SUBMITTED: Saturday, July 14, 2007

First, just for the record, Afni is not a scam. They are a legitimate company that basically provide outsourcing services for other companies. They run call centers, third-party collections, and insurance outsourcing for a number of large businesses. They have been in business for over 70 years and you can find out more at their website, www.afniupsourcing.com.

Afni does not "make up" or fabricate the accounts it collects on. The accounts are obtained from the companies Afni does business with. If there is a discrepancy with the account, it was not produced by Afni, it originated with the initial creditor.

In your situation, you say you never had a phone in your name. Is it possible that you co-signed for anyone at some point in time? Also you say that you never lived at any of the service addresses the representative mentioned. Do you recognize any of the addresses at all? Did you know anyone that lived there? It is possible that you may have co-signed for someone and forgot. It is also possible that an acquaintance may have used your personal information to set up his/her own phone.

If you are positive that you did not co-sign for anyone and feel that this account was set up in your name fraudulently, there are a couple things you should do. Contact Afni and request a statement letter that shows the original creditor's name (Verizon), the original account number, and the balance so you have this for your records. At this time you should also inform the representative that you believe this was a fraudulent account and would like to file fraud. When you do this, make sure they have at least your current mailing address on file so that all this information is sent to the proper address and you receive it.

The procedure for filing fraud varies based on who the original creditor was, but the gist of it is that generally you will be required to send a copy of some form of identification, proof of your residence at the time of the account in question, and a notarized fraud affidavit. Some companies send other additional paperwork and some companies allow you to do it online. Whichever is the case, the representative should know the proper procedure for that specific creditor.

Once you receive the fraud paperwork, complete it and return it within 30 days. When you do send it back, send it by Certified Mail with Return Receipt. This provides you with a receipt from the USPS showing that the papers were sent and what date they were sent on. It also provided you with a tracking number to where you can monitor its delivery online and it also requires someone at the receiving company (Afni) to sign for it, a copy of which is sent to you for your records and also kept on record with the USPS

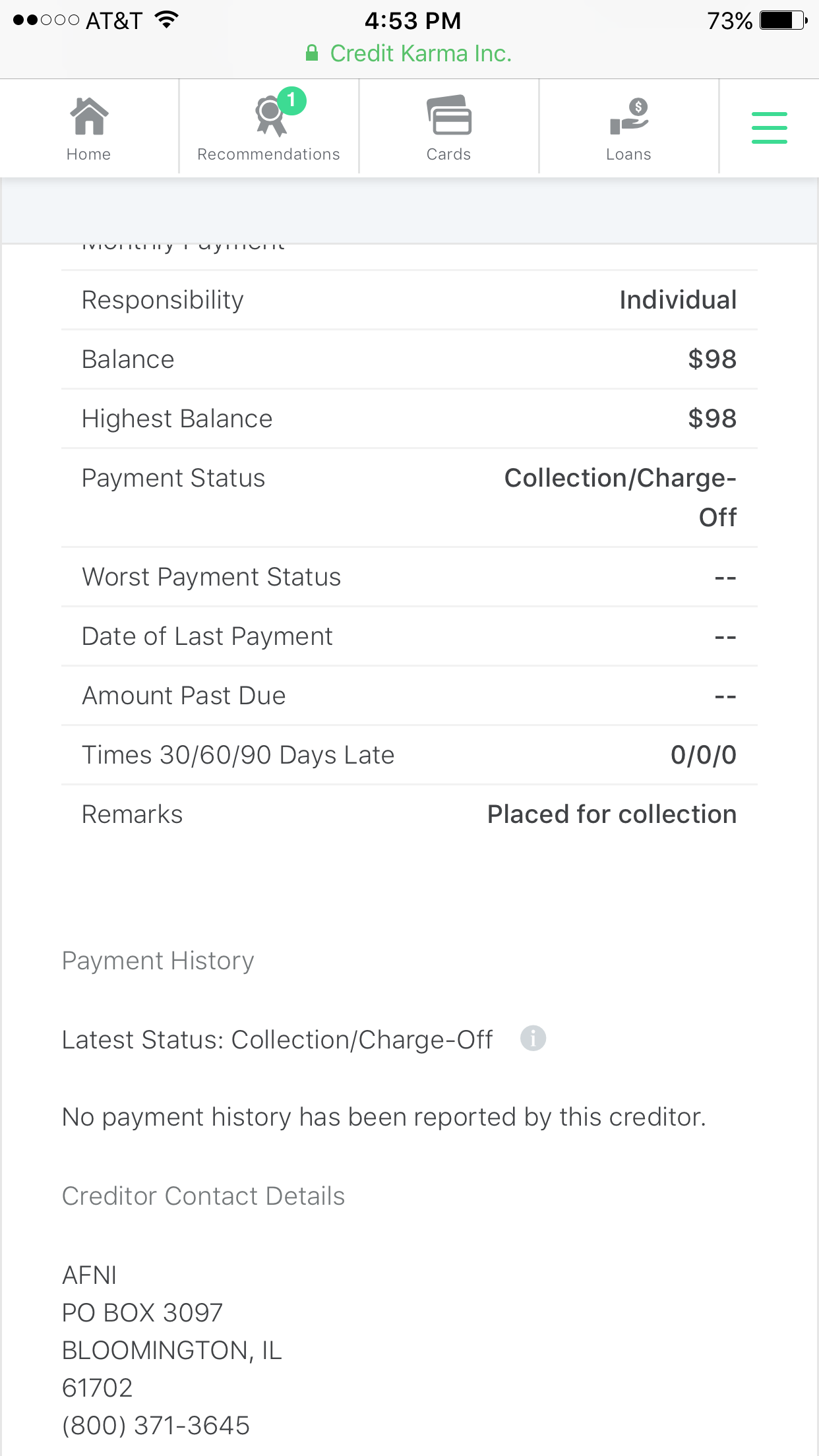

In addition, if this account has been listed to your credit report, file a dispute with each credit reporting agency that has the account listed. Inform them that the account is fraudulent. Follow up with Afni on the status of the claim when you know the paperwork has been received and every 25-30 days after that until the claim is resolved. A lot of times what happens is people will not fill out the paperwork completely, not return it within 30 days, etc and just assume that it's been taken care of and move on. By following up with the company, you can be sure that you know if the claim hasn't been submitted and why so you can remedy that.

One last thing I forgot to mention above, any requests you make for statements, fraud paperwork, etc. by phone also follow up with a like request by mail, Certified with Return Receipt.

Hope this helps. Sorry it was so long. Thanks

Advertisers above have met our

strict standards for business conduct.