Complaint Review: WellsFargo - Nationwide

- WellsFargo Nationwide USA

- Phone:

- Web: www.wellsfargo.com

- Category: Banks

WellsFargo Deceptive business practices and fees Nationwide

*Consumer Comment: I see your problem...

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

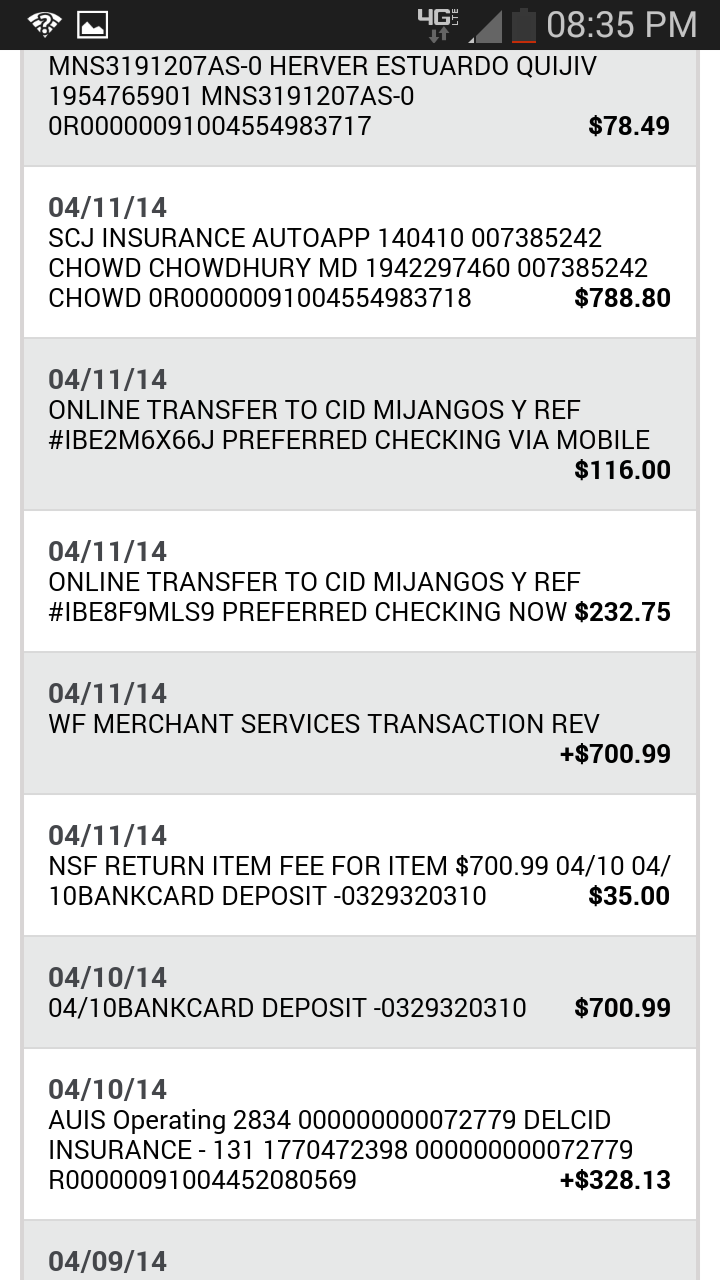

Tired of the transaction process of Wells Fargo. Been banking with them for 24 years and made a complaint about a few transacations and have notices the handling of my transactions have changed since that complaint. Have started to incure overdraft fee now based on the way they handled transactions. Have other accounts but use this mainly for my sons expenses and made a deposit on the 8/4/16 with a Bank of America check over 2000.00 at the ATM and received a notice that funds would not be available until the 5th. Proceeded with transaction and got notification that the deposit had been made and that the account showed a postive balance on the 6th. Went to withdraw funds at the ATM and was told that the account did not have funds so I talked to the banker who notified me it was because of the amount of overdrafts I had incurred in the last 6 months forced the system to put a hold on that check. I explained that I had most of those reversed about 3 months previous due to the process of the bank posting a transaction then unposting it and then posting it again the following week and me not being notified about the unposting. Being a account that I started using for limited transactions it added up real quick due to the fact I knew what I had spent and when I reviewed it prior to making a few small transactions.

Well upon calling WellsFargo to ask what was up with this transaction they told me funds would not be available until 8/11/16 now and that there was nothing I could do about it. Well I wanted my check back then so I can walk across the street and cash it. They could not do that. I ask if they could verify funds and they told me that Bank of America does not verify funds. Now I'm hot and realize what they are doing. Well I ask if the transaction that my sons tuition comes out of will be covered and if I will be charge overdraft fees. The represenative tells me no but checking this morning on the 8th a $35.00 fee has occured. So now I call this morning and the represenative says yes there is a overdraft fee due to the transaction on the 5th. Well not being a rock scientist I asked why if there was a deposit on the 4th? Well I was told that transaction was held, then I asked, "Why was I told differently on the the 6th?" The response I got was there is nothing I can do. I asked" Why was the transaction was being held due to overdrafts. Would the deposit help stop the overdrafts?" Then I was told that due to the overdrafts that the deposit needed to be verifed it to make sure funds where there with the check I deposited and it was not fraudulant. So I asked the customer service rep to look at the amount of fraudulant checks I had deposited in the last 24 years and she could not answer that. Its hard to believe that a bank these days could not verify funds of a check in a day but I'm sure Wellls Fargo has that money already and is making money on it some where. So in short if you have a high amount of overdrafts Wells Fargo will hold funds in order to increase the amount of overdrafts in your account. I could have called in advance and pushed back the transaction to my account but was told that I would not be charged a overdraft fee. So funds are being held for 11 days to verify a check unbelievable. I know I'm not alone in this and heard a number that Wells Fargo makes on overdraft charges and it was staggering. Could not verify it so I will not post the number.

Know this is long but have to get it out there.

I was reading the response to some of the similar complaints and was amazed at how people think that these banks are great insitutions and work to benifit the customer

This report was posted on Ripoff Report on 08/08/2016 02:54 PM and is a permanent record located here: https://www.ripoffreport.com/reports/wellsfargo/nationwide/wellsfargo-deceptive-business-practices-and-fees-nationwide-1321376. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#1 Consumer Comment

I see your problem...

AUTHOR: Robert - (USA)

SUBMITTED: Monday, August 08, 2016

Your problem is very easy to see. It is YOUR failure to maintain a WRITTEN REGISTER and rely instead on the on-line banking which was NEVER meant to replace your own register.

It can be seen in this one statement....

I explained that I had most of those reversed about 3 months previous due to the process of the bank posting a transaction then unposting it and then posting it again the following week and me not being notified about the unposting.

Banks DO NOT "post" and then "unpost" a transaction. What you are seeing is a PENDING transaction from your Debit Card. This is where you have attempted to use your card, the merchant has sent in an authorization request to your bank to see if you have the funds. In doing so a "hold" is placed on those funds. The hold remains until the merchant sends in the final authorization at which time the transaction is actually posted. But this final authorization could come anywhere from 1 to 7 days AFTER the transaction. This is not the fault of the bank but the sending merchant for failing to send in the final request.

Now, as procedure the bank will release this hold after a certain amount of time. Depending on the bank it is generally 2-5 days. If during that time the merchant has not sent in the final authorization the hold is released and the funds are made available. BUT..and this is where you screwed up, you are not relieved of the oblgiation to the merchant. If the merchant at a later time sends in the final request the bank is required by regulation to pay it. Even if this puts you into an "overdraft" situation.

This is why you MUST keep a written register of all of the transactions you made. This way it doesn't matter if the hold is released or not, YOU still know that the funds will come out and that you do not have those funds available.

Now, you say..but..but.but the bank refunded me the overdraft fees before so they knew they were wrong. Nope, they did this out of COURTESY because they gave you the benefit of the doubt that you didn't understand the process. However, while most people would learn..you failed to..which is why you are now in the position you are in.

As for this hold for an extended period of time. Again they are following FEDERAL regulation in holding your funds based on your past activity. Just go look up Regulation CC AKA the Expedited Funds Availability Act. If you have a problem with this then go talk to your Government Representatives..you know the ones who made that regulation to begin with.

Oh and before you go off and say that your other banks don't do the same thing..BUZZ wrong answer this is standard with every major bank and credit union because this is how Debit Cards work.

Advertisers above have met our

strict standards for business conduct.