Complaint Review: American Credit Acceptance - Spartanburg South Carolina

- American Credit Acceptance 961 E Main St. Spartanburg , South Carolina United States

- Phone: 1-866-54434030

- Web: https://www.americancreditacceptanc...

- Category: Automotive loan servicing company

American Credit Acceptance All we asked is to remove all late payment and repossess off the credit report this stop us to get our loan on home. has there money what the problem you know this was your fault and now trying to cover it.. Spartanburg South Carolina

*Consumer Comment: Auto pay doesn't mean you don't check status each payment period

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

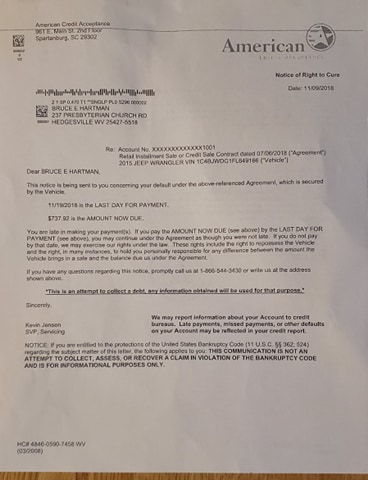

We have numerous time have call this company since 2/21/19 about our account which they take us off auto-pay try repossess our vehicle knowing we don't authorized this. The company don"t call or email or text or send a letter in the mail saying payment not been made. So they decide try repossess our vehicle saying we were 4 month late take in mind this supposed to be in auto-pay we should not had to worried about this . At this time my husband was taking care of his mom before she pass away in Jan 2019 and I was working about 70 hour a week.

We don't have time to look at our bank account.again the payment should be coming out of our account All we asked is to remove all late payment and repossess off the credit report this stop us to get our loan on home. American Credit Acceptance has there money what the problem you know this was your fault and now trying to cover it..

All we asked is to remove all late payment and repossess off the credit report this stop us to get our loan on home. American Credit Acceptance has there money what the problem you know this was your fault and now trying to cover it..

All we asked is to remove all late payment and repossess off the credit report this stop us to get our loan on home. Plus we never got a certified letter and the way we found this out went I report you to Federal Commission .

We have documents to back our story .

Thank you

This report was posted on Ripoff Report on 05/05/2020 05:54 PM and is a permanent record located here: https://www.ripoffreport.com/report/american-credit-acceptance/spartanburg-south-carolina-1494851. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#1 Consumer Comment

Auto pay doesn't mean you don't check status each payment period

AUTHOR: FloridaNative - (United States)

SUBMITTED: Wednesday, September 30, 2020

I just saw your report. You are blaming the auto finance company (doesn't matter which one) for the failure of the auto pay feature on your auto loan. That's incredible. The auto pay feature is to make it easier for you to manage your accounts, not make it management free. You still have to check each payment period to make sure the payment goes through on time. It's a good thing you didn't end up with the house loan or you would have an issue with paying that mortgage as well - since you don't have time to look at your bank accounts.

Until you understand that it is your responsibility to review all of your payments each payment period, even those on auto pay, you shouldn't apply for any additional loans (or credit cards). It is up to each of us as consumers to manage our own accounts even when they are on auto pay.

Your credit report is a reflection of your payment history. It's a good thing the lender didn't change the credit report entries because, according to you, you actually missed those payments. The credit report is a warning to other creditors that you don't know how to handle your credit. That's it. You can change this anytime going forward by learning how to manage your credit and loan accounts. One you learn, then it will be time to buy a home and get a mortgage.

PS - You don't have to authorize the lender to repo your vehicle when you fail to make payments. You authorized the lender in writing to repo it in the case of default when you signed for the loan.

Advertisers above have met our

strict standards for business conduct.