Complaint Review: ACS Inc - Internet

- ACS Inc Internet USA

- Phone: 1-208-881-0005

- Web:

- Category: Collection Agency's

ACS Inc ACS Corps They continue to email me saying I owe them money. I have borrowed from payday loans, but not them. Internet

*Consumer Comment: same amount

*Consumer Suggestion: Ask for proof and company permit number :P

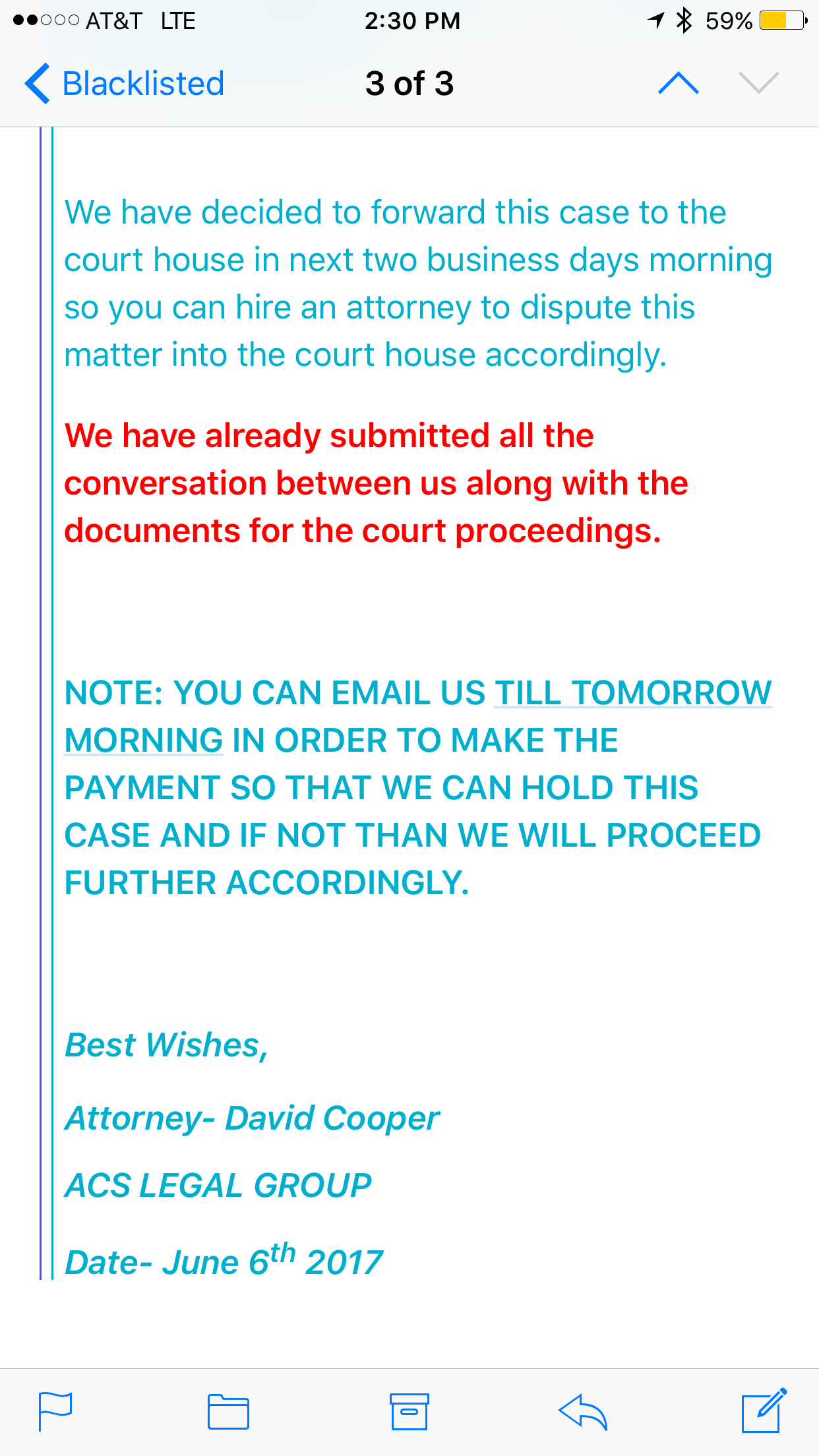

On August 5th, 2014 I received an email from ACS Collection telling me that they have checked my SSN and credit history and have noticed that I have never been charged for fraud and therefore they will settle with me out of court. They then tell me that if I want to avoid a lawsuit I have to pay them $2,873.81 as well as a court restitution amount of $935.76. It seems a little strange as I have taken out a couple of payday loans but I have never been late on a payment nor have I defaulted on them. I have never heard of ACS and none of the links at the bottom of their email are active.

This report was posted on Ripoff Report on 08/05/2014 07:35 AM and is a permanent record located here: https://www.ripoffreport.com/reports/acs-inc/internet/acs-inc-acs-corps-they-continue-to-email-me-saying-i-owe-them-money-i-have-borrowed-fro-1167462. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#2 Consumer Comment

same amount

AUTHOR: LGag - ()

SUBMITTED: Thursday, August 07, 2014

Its funny how the amounts change.....and funny how we owe the same amount......935.76. I wonder if this is just a standard amount to say someone owes?.....SMH this is crazy.

#1 Consumer Suggestion

Ask for proof and company permit number :P

AUTHOR: boxingurl - ()

SUBMITTED: Thursday, August 07, 2014

Research ACS, if I remember correctly they were some company with some affiliation with New Jersey or at least some warehouse address there. But when I looked deeper I think they were some offshore company. I asked them about their license to operate within the U.S., their permit number, the associates identification number, etc., they didn't call back. It's always fun when they hang up on you after this. Companies like this that threaten are often scammers and legal companies must provide certain information to consumers. If there was a court fee, you would have seen mail about litigation or some mention of the debt and lawyers/settlement.

To everyone with a payday loan issue (online in particular):

If by chance this is some loan you took out long ago, take my advice. Research the laws of your state.

-Do you live in a state that permits payday loans? (AK, CT, GA, MD, NJ, NY, NC, PA, VT, WV illegal)

-Does the law apply to online loans?

-Does the interest charged in any of your current or prior payday loans exceed what is (or was at the time of the loan) allowed by your state law?

-Have you already paid back the principal amount, the amount you initially received?

I had several payday loans I found many of them had already had an order placed against them to cease and desist operations within my state where it was a known illegal activity anyways. So i told them I've paid the amount of the original loan back, you are not permitted to operate in my state and your company charges over 20% more than what is allowed for any type of small loan anyways. That company never called. I issued emails to the remaining online sites listing what orders and laws of my state they had violated, within the week the balances were changed to paid. They haven't called and some have since been shut down.

(I had already paid the principal balance back in my case and they were all online.) Hope this helps someone.

Advertisers above have met our

strict standards for business conduct.