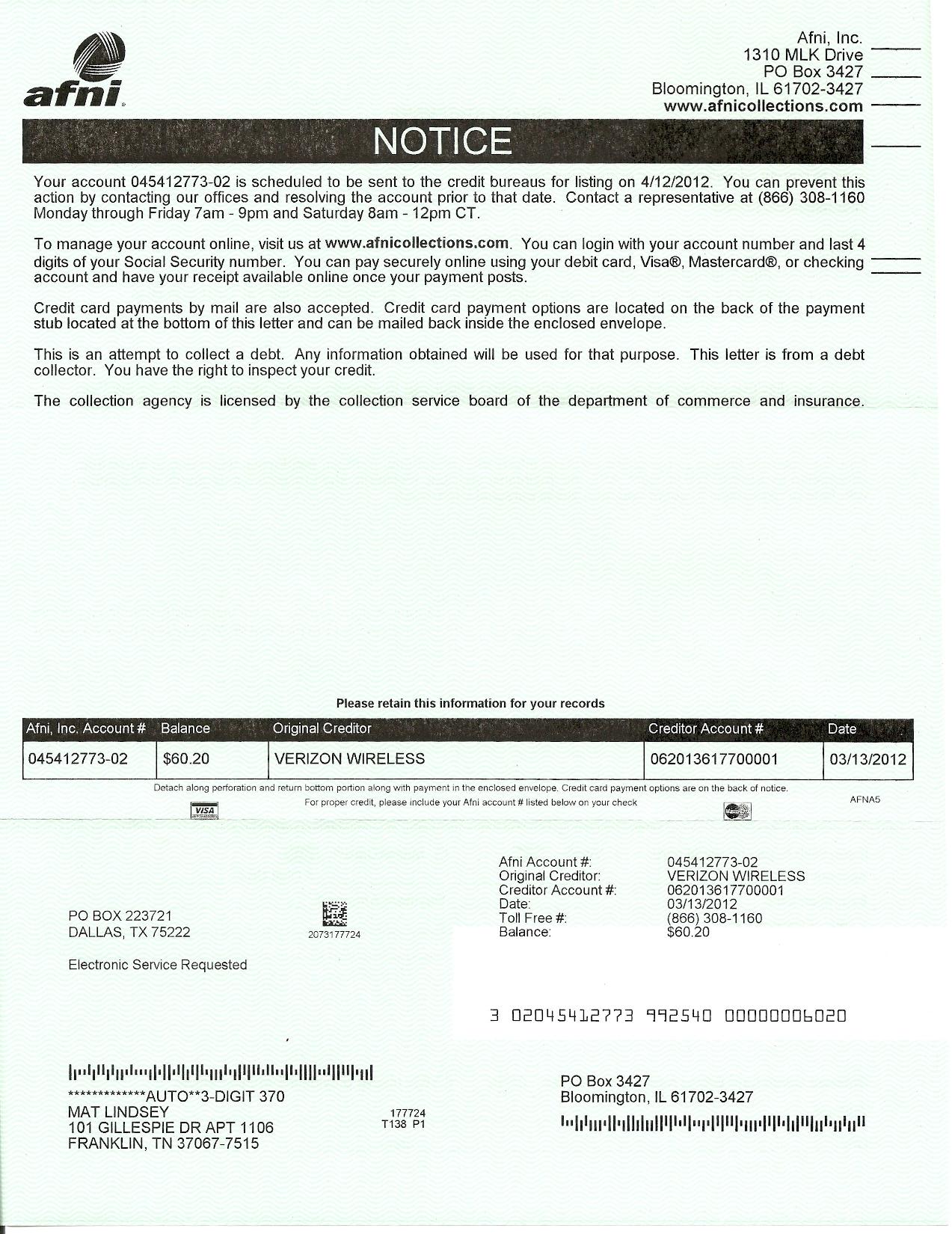

Complaint Review: Afni Collections - Bloomington Illinois

- Afni Collections Po Box3427 Bloomington, Illinois U.S.A.

- Phone: 888-879-6810

- Web:

- Category: Collection Agency's

Afni Collections wanted me to pay a bill from verizon from more than ten years ago' Bloomington Illinois

*Consumer Suggestion: stacey

*Consumer Suggestion: Dispute the debt

*Consumer Suggestion: DO NOT IGNORE - RESPOND WITH A VALIDATION DEMAND - RESPOND WITH A VALIDATION DEMAND - RESPOND WITH A VALIDATION DEMAND

*Consumer Suggestion: Melissa, that information is NOT accurate.

*Consumer Suggestion: Melissa, that information is NOT accurate.

*Consumer Suggestion: Melissa, that information is NOT accurate.

*Consumer Suggestion: IGNORE IGNORE IGNORE

they wanted me to pay a 249.98 dollar bill for a pohne bill i never had.they read my sosial security number to me and i never told them what it was. i never lived or even visited the town they said it was made in.

Stacey

belgrade, Missouri

U.S.A.

This report was posted on Ripoff Report on 01/28/2007 07:06 PM and is a permanent record located here: https://www.ripoffreport.com/reports/afni-collections/bloomington-illinois-61702/afni-collections-wanted-me-to-pay-a-bill-from-verizon-from-more-than-ten-years-ago-bloomi-233199. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#7 Consumer Suggestion

stacey

AUTHOR: J - (U.S.A.)

SUBMITTED: Sunday, February 04, 2007

communication fraud is the most common type of fraud there is.

Just because a collection agency has your ssn#, doesn't mean this debt is still your, if you pull your credit report and look under inquiries, your'll see a couple of collection agency there. These company share information and some are owned by the same parent company.

getting someone personal information is not as hard as people would think.

Listen to what Steve and P said to do, that's getting you started in the right direction.

never sign anything you send to a collection agency.

#6 Consumer Suggestion

Dispute the debt

AUTHOR: Max - (U.S.A.)

SUBMITTED: Saturday, February 03, 2007

You were obviously a victim of identity theft. This is not something you should get upset with the collection agency about. They obviously have I would assume a valid debt under your name. If you dispute the debt you should get a letter back with whatever info they can get you.

#5 Consumer Suggestion

DO NOT IGNORE - RESPOND WITH A VALIDATION DEMAND - RESPOND WITH A VALIDATION DEMAND - RESPOND WITH A VALIDATION DEMAND

AUTHOR: P - (U.S.A.)

SUBMITTED: Monday, January 29, 2007

To not respond (should it go to court) will give the company an upper hand.

GENERAL INFORMATION FROM VARIOUS SITES ON DEALING WITH COLLECTION AGENCY'S

Tell them to validate by

. What the money you say I owe is for;

Explain and show me how you calculated what you say I owe;

Provide me with copies of any papers that show I agreed to pay what you say I owe;

Provide a verification or copy of any judgment if applicable;

Identify the original creditor;

Prove the Statute of Limitations has not expired on this account

Show me that you are licensed to collect in my state

Provide me with your license numbers and Registered Agent

1. NEVER talk to a collection agency on the phone. Period.

2. Keep good records. This can be the difference between a good and bad settlement. Don't expect them to remember you or what you agreed upon.

3. Send all correspondence via registered mail, receipt requested and put the registered mail number ON THE LETTER. DO NOT SIGN THE LETTER TYPE YOUR NAME

4. Keep a copy of every letter you send.

5. Penalties and extra interest are typically fictious amounts of money added on by the collection agency to pad their profits. Sometimes as much as to 50% of the debt or more claimed to be owed by a collection agency consisting of interest and fees. This is illegal, every state has usery laws (which dictate the maximum interests allowed to be charged. That is except North Dakota. There are no such laws which is why most credit card companies incorporate there.) Junk debt buyer pay anywhere from 1 cent to 7 cents on the dollar, there is no way there is this much interest.

6. Time is on your side. As time passes, the creditors will likely stop calling and the debt will be filed away for future attention or until the SOL runs out ..

#4 Consumer Suggestion

Melissa, that information is NOT accurate.

AUTHOR: Steve [Not A Lawyer] - (U.S.A.)

SUBMITTED: Monday, January 29, 2007

Melissa,

You wrote:

.."stacey, it seems obvious to me that somebody illegally used your social security number to obtain phone service. if you are confident that it is not your bill, the best thing to do would be to leave it alone!

..do not even acknowledge that the debt is yours to them as it will start the "clock" again and it could be put on your credit for another seven years or so".

>>

Melissa is confusing the SOL for collections and the 7 year negative reporting period. NOTHING restarts the 7 year negative reporting period. However, the SOL is reset when a payment or agreement to pay is made, in most states.

For Stacey the OP,

The first thing is to STAY OFF THE PHONE!! NEVER speak to any debt collector on the phone.

DO NOT ignore this if they have your SS# and it is not your debt. IMMEDIATELY send a DEBT VALIDATION request. DO NOT put your signature on anything! Just print

Send this letter by certified mail, return reciept requested. Be sure to put the certified# on the letter itself, and keep a copy for your records. This is very important as it proves exactly what you sent.

In this letter, clearly dispute this debt as not yours, and demand that all phone calls stop immediately. Also demand to see the original signed contract, as well as a full account history and itemization of charges.

Now, until they fully comply with this request, all collections activity must cease. If they violate, you sue them.

Don't get mad, GET PAID!!

#3 Consumer Suggestion

Melissa, that information is NOT accurate.

AUTHOR: Steve [Not A Lawyer] - (U.S.A.)

SUBMITTED: Monday, January 29, 2007

Melissa,

You wrote:

.."stacey, it seems obvious to me that somebody illegally used your social security number to obtain phone service. if you are confident that it is not your bill, the best thing to do would be to leave it alone!

..do not even acknowledge that the debt is yours to them as it will start the "clock" again and it could be put on your credit for another seven years or so".

>>

Melissa is confusing the SOL for collections and the 7 year negative reporting period. NOTHING restarts the 7 year negative reporting period. However, the SOL is reset when a payment or agreement to pay is made, in most states.

For Stacey the OP,

The first thing is to STAY OFF THE PHONE!! NEVER speak to any debt collector on the phone.

DO NOT ignore this if they have your SS# and it is not your debt. IMMEDIATELY send a DEBT VALIDATION request. DO NOT put your signature on anything! Just print

Send this letter by certified mail, return reciept requested. Be sure to put the certified# on the letter itself, and keep a copy for your records. This is very important as it proves exactly what you sent.

In this letter, clearly dispute this debt as not yours, and demand that all phone calls stop immediately. Also demand to see the original signed contract, as well as a full account history and itemization of charges.

Now, until they fully comply with this request, all collections activity must cease. If they violate, you sue them.

Don't get mad, GET PAID!!

#2 Consumer Suggestion

Melissa, that information is NOT accurate.

AUTHOR: Steve [Not A Lawyer] - (U.S.A.)

SUBMITTED: Monday, January 29, 2007

Melissa,

You wrote:

.."stacey, it seems obvious to me that somebody illegally used your social security number to obtain phone service. if you are confident that it is not your bill, the best thing to do would be to leave it alone!

..do not even acknowledge that the debt is yours to them as it will start the "clock" again and it could be put on your credit for another seven years or so".

>>

Melissa is confusing the SOL for collections and the 7 year negative reporting period. NOTHING restarts the 7 year negative reporting period. However, the SOL is reset when a payment or agreement to pay is made, in most states.

For Stacey the OP,

The first thing is to STAY OFF THE PHONE!! NEVER speak to any debt collector on the phone.

DO NOT ignore this if they have your SS# and it is not your debt. IMMEDIATELY send a DEBT VALIDATION request. DO NOT put your signature on anything! Just print

Send this letter by certified mail, return reciept requested. Be sure to put the certified# on the letter itself, and keep a copy for your records. This is very important as it proves exactly what you sent.

In this letter, clearly dispute this debt as not yours, and demand that all phone calls stop immediately. Also demand to see the original signed contract, as well as a full account history and itemization of charges.

Now, until they fully comply with this request, all collections activity must cease. If they violate, you sue them.

Don't get mad, GET PAID!!

#1 Consumer Suggestion

IGNORE IGNORE IGNORE

AUTHOR: Melissa - (U.S.A.)

SUBMITTED: Sunday, January 28, 2007

stacey, it seems obvious to me that somebody illegally used your social security number to obtain phone service. if you are confident that it is not your bill, the best thing to do would be to leave it alone!

whatever you do, do not try to get them to leave you alone by agreeing to a convenient payment plan. do not even acknowledge that the debt is yours to them as it will start the "clock" again and it could be put on your credit for another seven years or so.

you should check your credit reports to see if this debt is listed, and if it is dispute it right away. by law, they have 30 days to respond with proof that it is your debt. it they do not respond it gets taken off your credit report automatically.

you say it is from ten years ago. even if it was your debt it is well beyond the time limit to be able to be put against your credit.

i too am harassed by a collection agency for some years-old debt. i get periodic phone calls and letters in the mail giving me the "opportunity" to make a payment plan, but i NEVER respond. no response is your best weapon here, stacey. i have nothing negative on my credit reports from anybody including this debt collector. if they even tried to mark my credit report i would have it taken off in a heartbeat because of how old the debt is.

Advertisers above have met our

strict standards for business conduct.