Complaint Review: BHM Financial Group - Internet

- BHM Financial Group Internet USA

- Phone: (514)787-1682 # 224

- Web: http://www.bhmfinancial.com/

- Category: Loans

BHM Financial Group: Sandra (Sandy) in the loan department, Sherry the collections officer Exorbitant interest rates, unfair and unexpected additional fees, shady business practices Internet

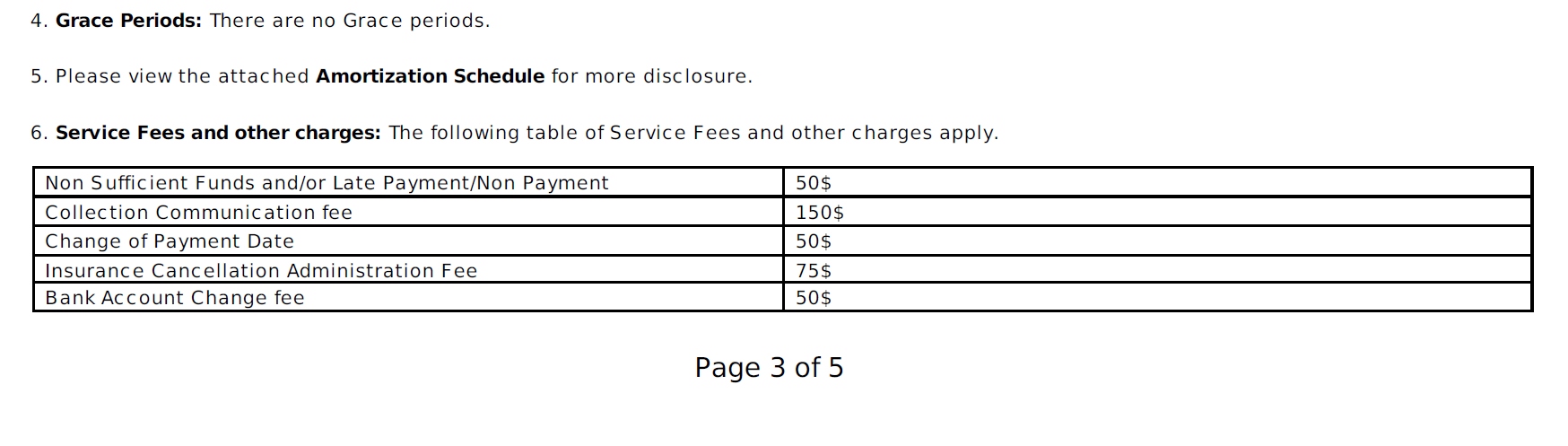

*REBUTTAL Individual responds: BHM is certainly taking advantage of the ones that need these loans due to bad credit

*UPDATE Employee: A Reply From BHM Financial Group

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

In late December 2015, I decided to take out a short-term title loan on my vehicle for $6,500 to cover an upcoming business expense. As a small business owner, sometimes there is a little too much red tape at the bank (even if you have a good credit rating, which I do) and things take a little too long to approve through that route. I wanted a faster loan; so, I thought I'd try out a faster option to cover this expense.

I'd never taken out a vehicle title loan before; and, after this experience, I never will again. But this was an interesting learning experience for me that I will share with others online—just as I'd promised to both the BHM loan officer, Sandra (a.k.a. Sandy), and the BHM credit collector, Sherry, if either of them harassed me by telephone or email even one more time. Sure enough, I received a collection notice via email from Sherry tonight despite the fact that I paid them in full in January, so I am making good on my promise and publishing this consumer alert to warn the public about them.

Before I took out this loan, I researched this company online and found a few negative Rip-Off reports written about them; so I discussed this with the loan officer, Sandy, over the telephone. She assured me that, although their standard rates are obviously higher than a bank's rates due to the type of clientele they usually deal with (high risk ... which I am not), they don't ever charge any exorbitant or unfair fees to their clients. She said I have to understand that the clients who were complaining about additional fees were clients who had neglected to make their payments on time. They were simply late fees. In other words, their past clients were to blame for these issues rather than them. She assured me it would all be fine for me. For some reason, I believed her and I truly regret that now.

** Side note before I continue with my story: not only am I a low risk client with a good credit rating, but I paid them off in full after only one or two weeks, and I was still charged exorbitant fees ... PLUS they are now threatening to send me to collections to charge me another $400+ in additional fees for whatever reason. **

Now, back to my story...

I read over the contract Sandy sent me. Of course, there was much fine print in that contract (along with a surprise additional $520 fee based on"...costs that were accrued on your behalf during the loan process to be deducted before the transfer or added to your first 2 payments.") that I wanted clarification on; so, I not only talked with Sandra over the phone about this, but I also asked her for clarification by email. I wanted her clarification in writing to protect myself.

My email to Sandy, dated Tue, Dec 29, 2015 at 11:14 AM, read:

Hi Sandy,

Please add those costs to the first two payments.

Please confirm again for me:

- My monthly payment amount

- The date of the month you're taking it out

- Additional costs added to the first two payments

- Additional fee I will have to pay you for paying this out early

Please email that info to me so I have it on hand for when I pay you back. Thank you.

And her emailed reply to me, dated Tue, Dec 29, 2015 at 11:16 AM, read:

Hi Sandy,

- My monthly payment amount[Sandy] $426.57

- The date of the month you're taking it out[Sandy] 22nd

- Additional costs added to the first two payments[Sandy] $260 for Jan and Feb

- Additional fee I will have to pay you for paying this out early[Sandy] $650.00

This report was posted on Ripoff Report on 03/01/2016 11:01 PM and is a permanent record located here: https://www.ripoffreport.com/reports/bhm-financial-group/internet/bhm-financial-group-sandra-sandy-in-the-loan-department-sherry-the-collections-office-1291115. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#2 REBUTTAL Individual responds

BHM is certainly taking advantage of the ones that need these loans due to bad credit

AUTHOR: Chris - (Canada)

SUBMITTED: Friday, January 20, 2017

I took out a loan with this comapnay as well in May 2015 , kept my payments as required . In October of 2016 had some unexpected bills arise and missed a payment , trying to get a response from these people was absolutely impossible until the 10 day legal notice came . Anyways to make a long story short the fees they add onto missed payments are exubarant and they present that they want to work with you . Yet when i asked for the full balance owing on my loan so i can pay it off , never got a response . Had 3 different agents sending me threatenong messages yet even working out something with one never got passed onto the other . Caught up payments in Novemeber then foolishly missed anothe r in December . January i wanted to move my payment date to mid month so i could have the money and unbelievably the agent Molly emails me to say they dont defer payments as it would extend my loan etc etc. ANd in her email states that i need to go to my bank and put a freeze on the payment , Wow so talk about shady business , so now get dinged with a fee from BMH and my bank . Very interesting how this company is supposed to help people with bad credit yet feels its no problem throwong all these fees onto stuff making it more and more difficult for the borrower to be able to catch up.

Anyways i used my vehicle as collateral and i woke up the other morning to my vehicle gone out of my driveway . I of course thought my vehicle was stolen and called the local police dept because there was absolutely nothing left on my dorr, step or mailbox indicating that my vehicle was repoed , which something a card or paperwork from the bailiff should have been left . Police dept gave me the info on the towing company and the bailaff used . NOt one email or call from this comapny to let me know this happened and how i can go about retrieving my vehicle back. I left a message with one of the loan assistance and yup got no call back . Finally got a hold of the ignorant and arrogant Molly . I asked her to forward the info i needed to go pay the loan off asap so i can get my vehicle back that was at 930 am , her words were i will do that . 3 hours later i still had not recieved the info i requested so that i could get the money and pay the loan off . I called Molly the oh so pleasant loan agent again and asked her where the info was . Her response was in a sarcastic and condencending manner was " I said today sometime , the days not over yet "" Which i can tell you was not what she said to me in the first phone call as i had a witness beside me with every call and conversation i had with these people. Funny how she didnt want me to get this settled . Im going to believ its because they had my vehicle that was worth alot more then the loan owing amount and they were hoping i wuld just walk away from my vehicle and let them keep it.

Anyways finally got the bankikng info i needed to deposit and pay my loan which it took her 2 minutes after the second call to send , interesting. As well on the enail it was clearly stated to send her the reciept of deposit of full payment . I asked her once i did that was i clear to go pick my vehicle up . Her response was YES. I go pay the loan owing amount in full as a direct transfer from my TD account to the acount she provided also a TD account. I paid this in full over 5000.00 and got the recipet and cashier stamp etc. I emailed her the reciept and requested a confirmation email that she got it and was heading out to go pick my vehicle up in another city mind you over and hour away . As we are on the highway she proceeds to email me to say she needs certified funds only . Im likme pardon me , in your email you clearly stated cash or certified funds. In which i paid cash. Not sure where this woman was getting mixed up but then proceeded to say she had to see if it cleared on there end im like ok it should as it was a direct transfer of cash to td account from td account . Of course the next email i get is from her saying no i had to go to my bank and have someone call her . Im like wtf it was a cash payment , the reciept is clearly stating this and why would you have not stated that when i went to pay. Another 45 mins of time , anyways get to the bank ,bank speaks with her . Bank fellow states that he can see whay i felt the way i did about her in his own words Isn't she a treat . Anyways got my vehicle back . Take in mind i never recieved anything stating info about bailiff and ok by court etc. Absolutley nothing and nothing from this company to say they repod my vehicle pleaase contact us etc to arrange how we can work this out . Pretty frigging pathetic if you ask me . I get i took the loan and obligated to pay , but i have dealt with another finace company in past and they were so flexible and willing to help the consumer not try to destroy them .. Stay away from thiscompany . They act all nice and that they are willing to help you with your fiancial problems but its all about getting you the high paying interest consumer and then you are stuck . Prudent Financial in Toronto much nicer and are willing to work with you if you need help .

#1 UPDATE Employee

A Reply From BHM Financial Group

AUTHOR: BHM Financial - (Canada)

SUBMITTED: Thursday, October 27, 2016

Advertisers above have met our

strict standards for business conduct.

As anyone in the lending industry can attest, a lot of hard work and money goes into the financing of a loan. There is the background check, the credit check and the asset information that needs to be verified. The work triples when dealing with people that have bad credit. BHM Financial Group advised the borrower in question that this would be an expensive option for her. We don’t encourage people that can get less expensive loans with banks to come to us. We are here to help people that banks send away and don’t look at. We save the day when no one else bothers to help good people with bad credit. And the borrower was made aware of that. She said she was desperate and is ok with paying a bit more but needs it funded ASAP. Which BHM Financial did. Every single charge was in her contract, properly disclosed, according to federal and provincial legislation. If she didn’t read it, it is her fault. If she thought she’d get a loan for free, that is her mistake. BHM Financial made no profit on this loan, served her with respect and professionalism and assisted her in her time of need.