Complaint Review: EZ Auto Finance - Marietta Georgia

- EZ Auto Finance Marietta, Georgia USA

- Phone: 6785811363

- Web: www.e-zautofinance.net

- Category: Auto Dealers

EZ Auto Finance BAD BUSINESS. SCAM Marietta Georgia

*UPDATE Employee ..inside information: Customer Relations Mgr

*Consumer Comment: Question

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

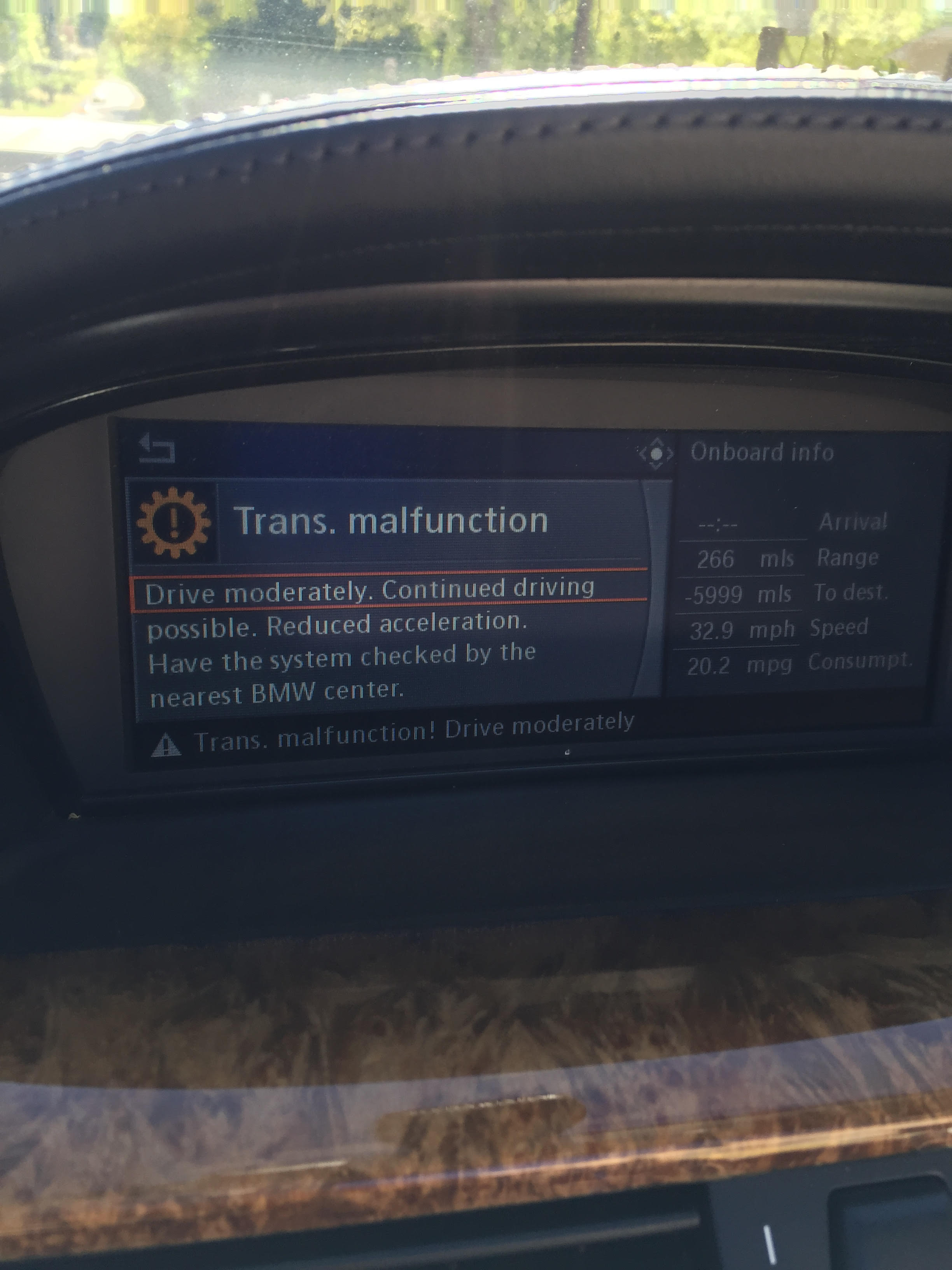

Do not waste your time or money with this so called car dealership.CAR IS A LEMON. NEVER BEEN SERVICED AS THEY SAID IT WAS. BAD DEAL.

No one ever tried to reach me or even call me back to make arrangements to repair my car that is a lemon. Very unprofessional and not helpful.

In fact, you all were never available to take my call until I requested my money back from you for selling me a lemon.

I called 15 times in the last two months and left voicemails, messages with reps to have you call me which you never did. I saw several reports on ripoff report.com that are simular to my issue. I

have been trying to call, left voicemails, and emails and no reply from anyone there

I put down $4,000 on my car for down payment and was still waiting for paperwork from the bank..

Now 2 months later you all come and take my car and tell me that there is no bank approval.

They are in the business of selling lemons and ripping people off for a down payment on lemon cars.

Why would I call you all at the dealership numerous times on numerous occasions to make arrangements to bring the car up there for repair if I was hiding my car? I have car insurance and registration and a valid license. I am not a thief. I worked hard for what I have and don't appreciate someone trying to flip the script and discredit my character or dignity. After all I am the consumer and tried to do business with you all. Y

ou all know you sold me a lemon and are now trying to turn it around on me.

The purpose of me buying the car was to rebuild my credit not to destroy it.

I had good faith in your business and trusted that I was dealing with a company about business

. Boy was I wrong. Is the

fiance department aware of my down payment? If they aware that I put down $4,000 they probably wouldn't have repossessed my vehicle. I have receipts and my bank statement.

Sounds to me that you all are not about business and instead about scamming people into buying lemon cars and taking my down payment money knowing the car would break down in less than 30 days.

EZ AUTO FINANCE AT 72 ATLANTA STREET IN MARIETTA, GA 30060

.

This report was posted on Ripoff Report on 02/17/2015 05:19 AM and is a permanent record located here: https://www.ripoffreport.com/reports/ez-auto-finance/marietta-georgia/ez-auto-finance-bad-business-scam-marietta-georgia-1209649. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#2 UPDATE Employee ..inside information

Customer Relations Mgr

AUTHOR: Customer Relations Mgr - ()

SUBMITTED: Friday, February 27, 2015

Hello, I am the customer relations manager for E-Z Auto Finance. I'm sorry that you have experienced such a bad time with either your vehicle or the service provided to you. While I'm glad that you were able to air your frustration, I have all the infomration about the deal and will explain the multiple areas that you seemed to forget to include.

"The customer filled out an online application for financing and the lead was given to our top sales person (with multiple wonderful reviews about him and his customer service) same day. Sales person contacted customer and set up appointment for her / him to come down and select a vehicle from the 100+ we have in inventory. After reviewing the invetory and seeing the different payments arrangements the customer agreed to purchase a vehicle. We had two options for financing available to the customer, one with a retail traditional lender (C.A.C - the only lender that would qualify the customer for approval) and one with our in-house finance company. The customer selected the option with the retail lender for a longer term but much lower payments. The customer then agreed to an in-house financing option if for any reason the bank didn't finalize the loan pre-approval, and we spot delivered the car. (actually asking during the process "If I lost my job in two years, how long do I have to give the car back and get a refund")

When the lender called to verify the customers job the underwriter for the bank was informed the customer had actually quit working at the employer that was stated on the application. In the meantime, we had set 5 different appointments for the customer to drop the vehicle off for us to address whatver issues the customer said was going on with the car. Only 2 of which the customer made and each time were both late in the day, and demanded we fix it immediately, and refused to leave the vehicle with us. After we infomred the customer of the lenders findings (and that the lender would not accept a re-submission) we told the customer again to bring the car by so we could look at it, but was going to be required to honor the agreement she signed for the in-house lender and taking delivery of the vehicle. We have multiple notes in our DMS system with dates and time where we tried with no success to resolve the issue with the customer.

The end result becuase the customer never allowed us time to look at the issues stated, and the customer not honring the contractual commitment, the in-house finance company had no other choice but to send the account to collection and repo the vehicle.

While we try our best to have happy customers at the end of every deal, we understand that you cannot please everyone and most people would rather take to the internet and trash an honest business than give the real story and own up to their own mistakes. Had the customer maintaned the employment that was stated on the orginal credit application, this issue would be with the retail lien holder. At least this won't show up on their credit profile as a repo.

If the customer, or anyone from this website has any questions, please feel free to contact us directly.

#1 Consumer Comment

Question

AUTHOR: coast - ()

SUBMITTED: Tuesday, February 17, 2015

What are the terms of the written warranty?

Advertisers above have met our

strict standards for business conduct.