Complaint Review: Geico - Internet

- Geico Internet United States of America

- Phone:

- Web: www.geico.com

- Category: Car Insurance

Geico Ignored facts refused evidence from me, Internet

*Consumer Comment: Common insurance company tactic.

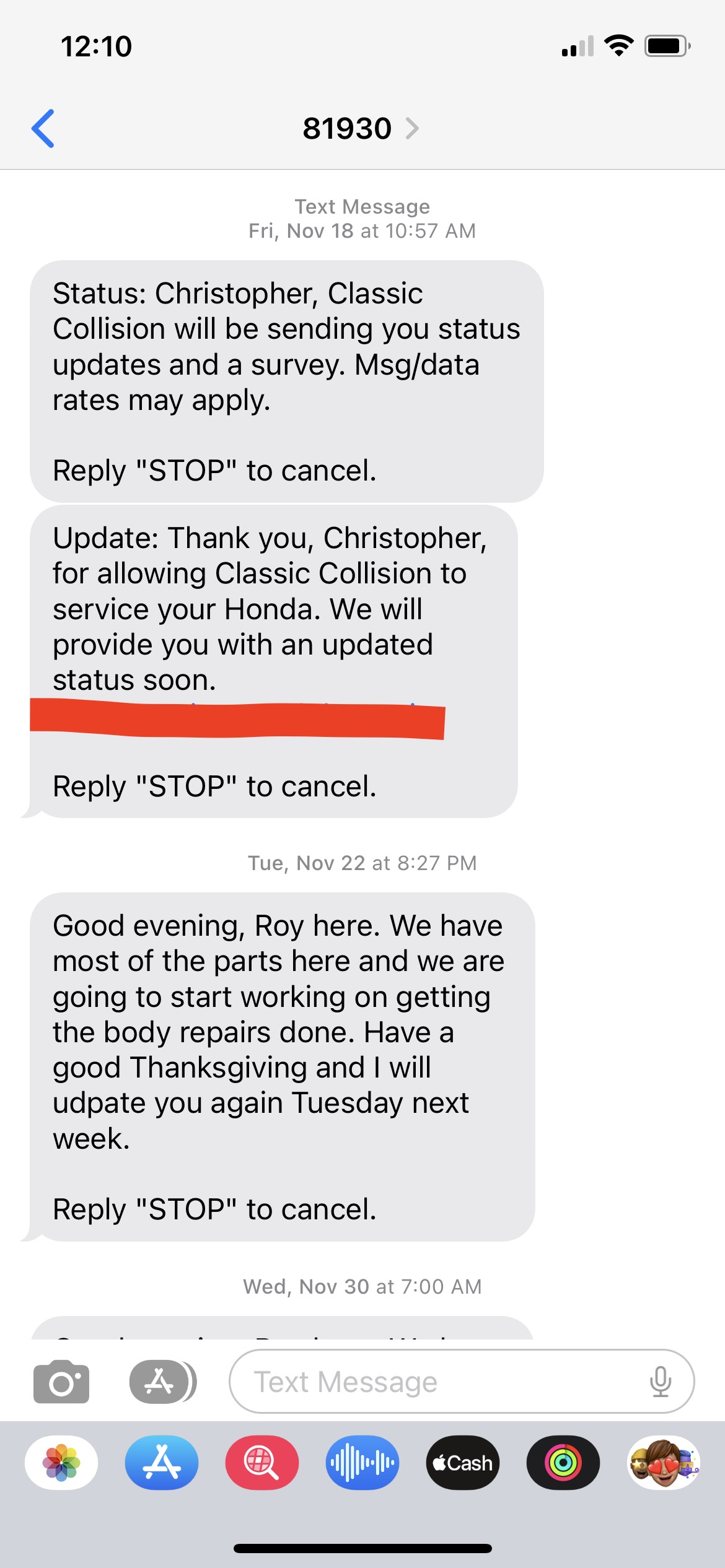

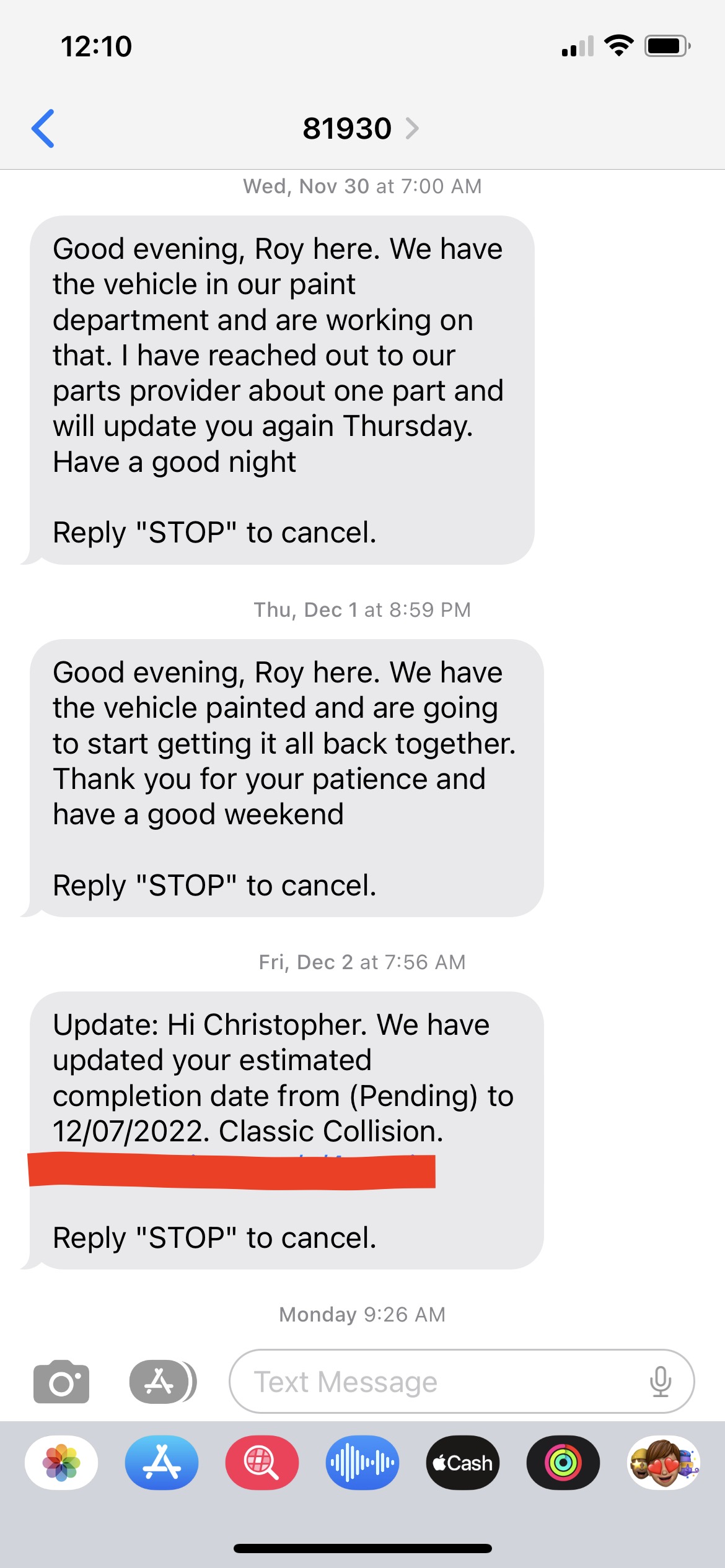

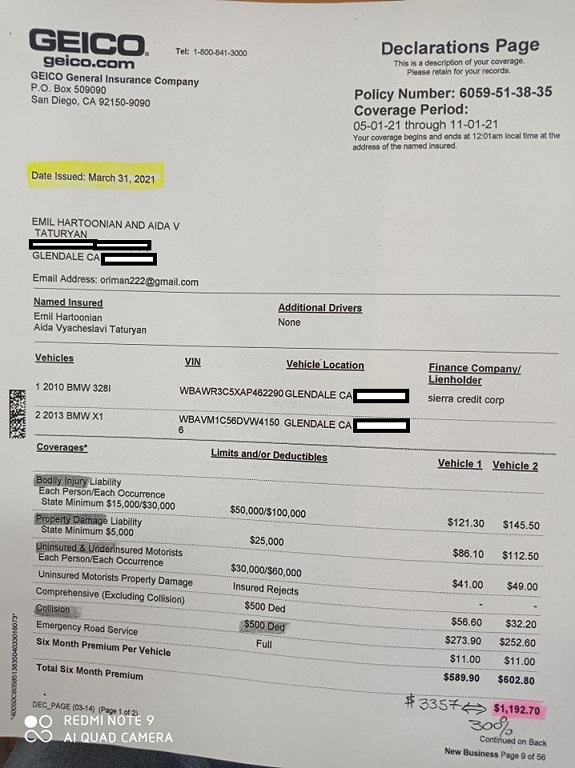

I was visiting Anaheim California when a man hit my car. My insurance told me to contact his insurance. He has Geico. They took my statement. I have a lot of photos showing what happened. They did not want the photos. They called back and found in favor of their customer. His story was the opposite of mine and the photos clearly show that his story was impossible. The response from Gieko was this "Well, we have to side with our customer."

What is the point in investigating anything if you will not look for the truth? If you are just going to side with your customer no matter what the facts are, then you did not investigate anything.

This report was posted on Ripoff Report on 07/30/2012 11:46 AM and is a permanent record located here: https://www.ripoffreport.com/reports/geico/internet/geico-ignored-facts-refused-evidence-from-me-internet-919694. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#1 Consumer Comment

Common insurance company tactic.

AUTHOR: Flynrider - (USA)

SUBMITTED: Monday, July 30, 2012

Since you're not represented by a lawyer or your own insurance company, they feel safe in blowing you off. It's not a Geico thing. It's an insurance industry thing. Apparently, they seem to think that you can't prove that their client was at fault. Hopefully, you have something more than photos taken after the fact (like a police report and a list of witnesses). If you want to see some action by the other driver's insurance company, you'll have to file against him/her in court. If they're not sure about their case, they'll settle before the court date. California now has a $10K limit on small claims cases. If your damages are in that vicinity, you should go that route as it is cheap to file and you do not need an attorney.

Good luck.

Advertisers above have met our

strict standards for business conduct.