Complaint Review: MRS BPO LLC - New Jersy New Jersey

- MRS BPO LLC cherry hill New Jersy, New Jersey United States of America

- Phone: 856-396-9991

- Web: www.mrsbpo.com

- Category: Collection Agency's

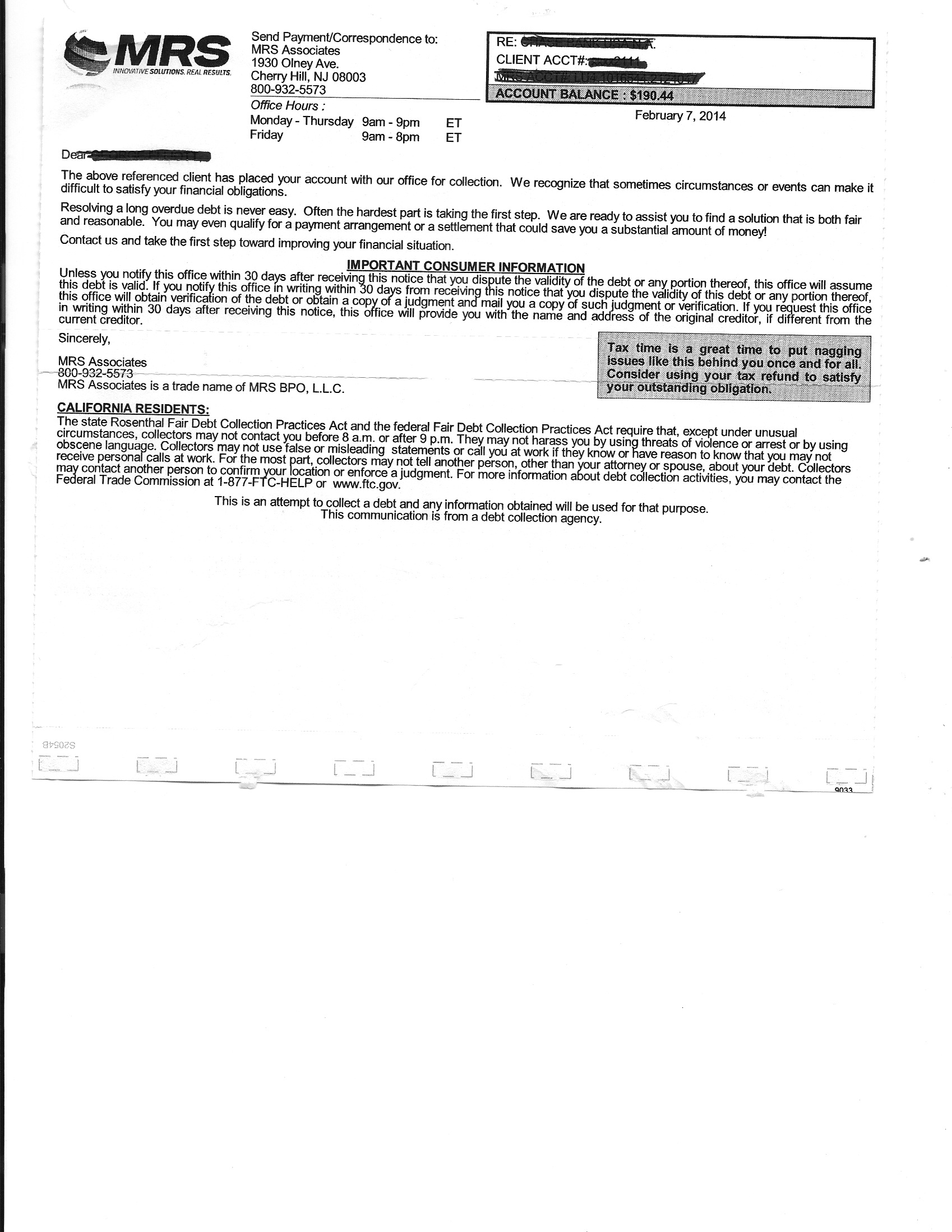

MRS BPO LLC Collecting a debt that was discharged in Chapter 7 bankruptcy. New Jersy, New Jersey

*Consumer Comment: http://www.ftc.gov/os/statutes/fdcpajump.shtm

*Consumer Suggestion: http://www.ftc.gov/os/statutes/fdcpajump.shtm

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

On January 19th 2011 I had my debts discharged thru Chapter 7 bankruptcy. In March 2011 MRS BPO starting calling our home and demading full payment of a discharged debt.They had pulled our credit records in March 2011 and knew it was a debt that had been discharged but went ahead and proceded to contact us. I did try to explain to them that this debt is no longer mine but they refused to listen. I finally agreed to start making payments just so they would stop harrassing me as of Dec 2011 they have been paid $1300.

I recently pulled my credit report to find that they have been collecting all this money but never reported to the credit agency's. I have since stopped any future access to my account and sent a letter demanding the money back. Our laywer who represented us told me we would have to file a injunction on the debt but it would cost just as much to file. Similar to going thru bankruptcy again or we could take them to small claims court but again it would cost more money. Lesson learned when you file a bankruptcy it is not uncommon for collection agency's to start calling and harrassing you and in our case we payed them money instead of contacting the attorney who represented us. If we had and reported MRS BPO we wouldn't be out $1300. If you file bankruptcy and start recieving phone calls DO NOT HESITATE TO CALL THE ATTORNEY WHO REPRESENTED YOU!

And keep a record of all phone calls including the date, time and person calling you.

This report was posted on Ripoff Report on 01/26/2012 09:30 AM and is a permanent record located here: https://www.ripoffreport.com/reports/mrs-bpo-llc/new-jersy-new-jersey-/mrs-bpo-llc-collecting-a-debt-that-was-discharged-in-chapter-7-bankruptcy-new-jersy-new-828941. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#2 Consumer Comment

http://www.ftc.gov/os/statutes/fdcpajump.shtm

AUTHOR: client#8 - (United States of America)

SUBMITTED: Thursday, January 26, 2012

CORRECTION:

The sentence above,

[If you live in a two party consent state (both parties must agree to

being recorded) you cannot legally record with their permission.]

Should have read,

[If you live in a two party consent state (both parties must agree to

being recorded) you cannot legally record without their permission.]

Sorry, should have proofread more carefully before submitting.

#1 Consumer Suggestion

http://www.ftc.gov/os/statutes/fdcpajump.shtm

AUTHOR: client#8 - (United States of America)

SUBMITTED: Thursday, January 26, 2012

I was just looking around this site and ran across your complaint and felt compelled to reply.

I'm sorry to read about your unfortunate experience, but I'm sorry to say its your own fault due to ignorance and lack of knowledge about "3rd party collection agencies" (those parties other than the original creditor, seeking to collect a debt).

Most of these so called businesses are sleazy, unscrupulous, low life scum akin to ambulance chasing and class action lawyers, and communist dictators. And typically try to frighten and intimidate you using devious, deceitful, and 'VERY OFTEN ILLEGAL' threats.

The general technique of these intimidators is taking advantage of your ignorance of your legal rights and scaring you with threats of legal actions, arrest, and-or prosecution, and inflating your original debt with additional fees like court costs, attorney fees, interest, etc. Most, if not all of these threats (depending on certain circumstances), and others methods of intimidation are illegal. Generally speaking they bark loud but they have no teeth in their bite.

ANY ONE and EVERY ONE who is dealing with, or might be dealing with debt collectors MUST read and have a copy of the US Government, Federal Trade Commission, "Fair Debt Collection Practices Act".

http://www.ftc.gov/os/statutes/fdcpajump.shtm

If your attorney was really looking out for your best interest and not his next Mercedes payment, he would have provided you with this, and other information that is available. But if you were better informed and more knowledgeable about these matters you might be better able to handle your circumstances on your own, and may be less inclined to be in need of his 'valuable' services. But I digress.

These are a few suggestions regarding dealing with these diseases on the phone. There are certainly other tips and techniques so DO YOUR HOMEWORK.

1. NEVER give a collector ANY personal information, confirm or deny any information they may have about you, or make ANY kind of payment or settlement agreement over the phone.

GET 'EVERYTHING' IN WRITING!

2. NEVER let a collector dominate the conversation. Remember most, if not all of their threats are usually bluster.

DEMAND full documentation from them on their letter head BEFORE you engage in any further conversation. a) The legal name, business address, and phone number, and the legal owner or person in charge and legally liable for the actions of the collection agency. b)Proof of their legal status to collect debts (debt collectors by law must be licensed and I believe also bonded).

c) The legal name of the individual you are dealing with. If they try to pull a rope-a-dope on you and change persons, start all over and tell them you expect to deal with one and only one representative and every time they change to another person they will have to start over. d) Proof of the validity of the debt; the amount of the debt, and the original creditor of the debt. Remember DO NOT LET THEM BULLY YOU. Do not discuss any thing else, if they refuse any or all of your demands HANG UP.

3. Record ALL phone conversations. Many will tell you this is illegal but you may do so legally if you follow a couple of simple rules. Most states have a one party consent law. This means simply if only one of the two parties engaged in a conversation (you) agree to be recorded, it is completely legal. CHECK THE LAW IN YOUR PARTICULAR STATE. Inform them at the beginning of the conversation you are recording. I always use this "For purposes of legal documentation I am recording this conversation" They will often reply with something like "I do not give you permission to". Again if you are in a one party consent state tell them so, and you 'do not need their permission' and any subsequent conversation will be recorded. If they chose not to have the conversation recorded their only option is for them to disconnect.

If you live in a two party consent state (both parties must agree to being recorded) you cannot legally record with their permission. This is simple. Inform them you are recording as above, if they refuse, tell them you will not engage in any further communication until they agree, then hang up.

Remember consent laws apply to the state YOU reside in regardless of the law in any other state they may be operating from since any legal action taken against you must be done where you live.

You may be amazed how this technique changes attitudes and gives you an upper hand in the conversation. This has worked well for me in dealing with numerous situations. DO NOT BLUFF. If you do not have the ability or the intention to record then don't wast your time. It could come back to bite you in the a**

4. Never call them. Keep all phone communications incoming only. All correspondence from you to them should be done by mail only, make copies and get a return receipt.

5. Should you negotiate and agree to terms of payments or settlement, get it in writing. Don't give them one red cent without documentation. Believe it or not there have been people who have settled debts with collection agencies who later had to battle another collector over the same debt. That's why #2 is very important.

5. Finally an most importantly. NEVER NEVER NEVER make payments using checks, or credit/debit cards, or god forbid allow them to draft your account. Arrange to pay them by cashiers checks or money orders or prepaid credit card. NEVER give ANY banking or personal finances information.

As I said above these are only a few suggestions, and mostly apply to dealing with harassing collectors over the phone. Individual circumstances will vary. There is plenty of help and information out there, do your research BEFORE you become another victim.

Advertisers above have met our

strict standards for business conduct.