Complaint Review: NCO Financial Systems Inc. - bALTIMORE Maryland

- NCO Financial Systems Inc. 1804 Washington Blvd Mailstop 450, bALTIMORE, Maryland United States of America

- Phone:

- Web:

- Category: Credit & Debt Services

NCO Financial Systems Inc. THIS COMPANY THINK THEY ARE ABOVE FEDERAL LAWS bALTIMORE, Maryland

*Consumer Comment: Of course nco denied there collector was abusive & degrading towards me

*Consumer Comment: advise

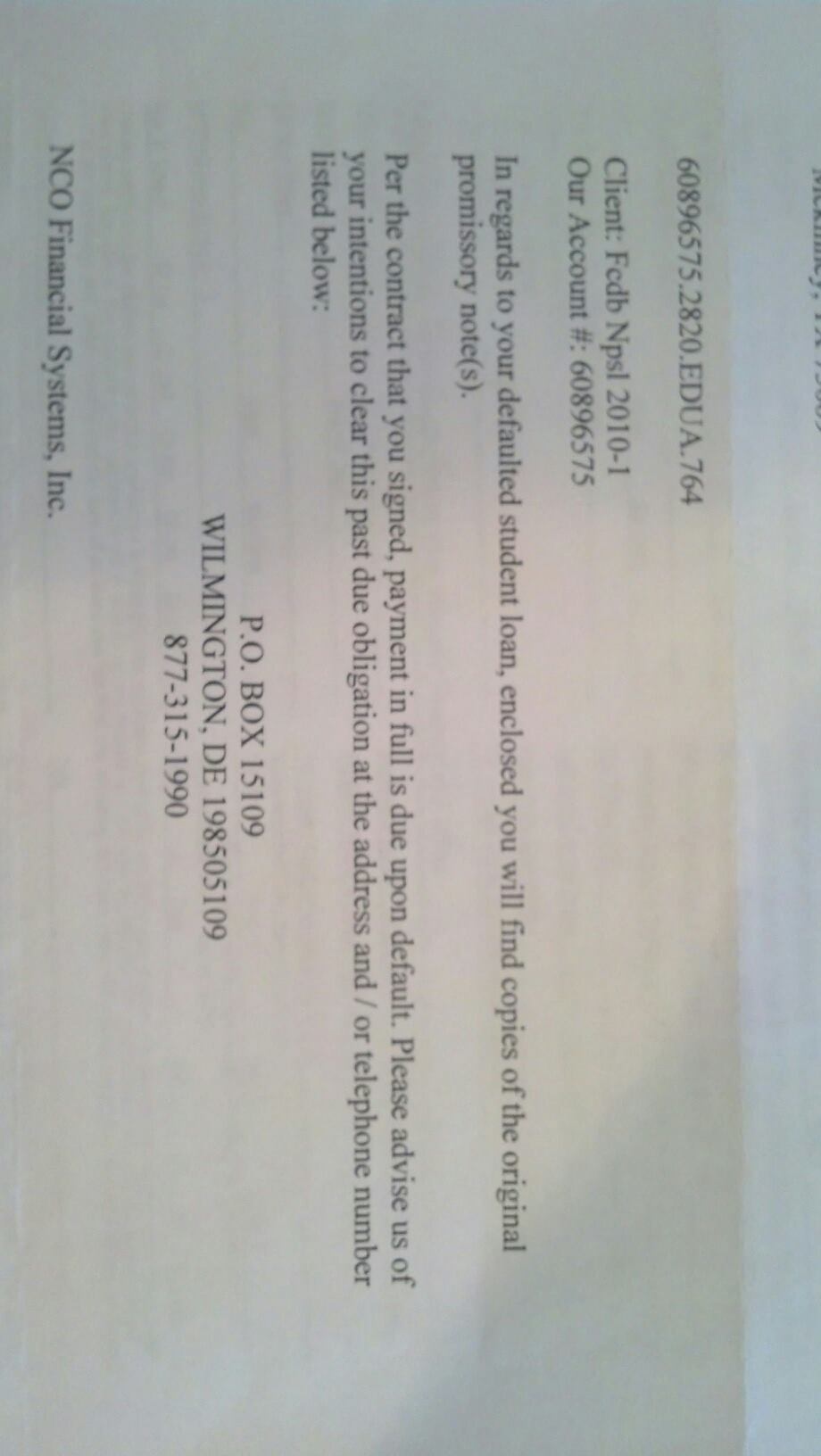

I received a letter on Jan 07 2010 from NCO representing an old credit card the $ limit in this card was $250.00 . It was from cross country . my last payment was in March o4 ,this c/c company went under, I never did a letter from them or notice stating merges or bought out etc.... I did called NCO when I did notice the balance over $1.800. I spoke with a lady from hell . I told this parasite that this account is S.O.L under 42 PA.C.S 5525(a) Her response was that was not true.

Can somebody tell if I am correct in this matter.

THANKS.

This report was posted on Ripoff Report on 01/16/2010 06:27 PM and is a permanent record located here: https://www.ripoffreport.com/reports/nco-financial-systems-inc/baltimore-maryland-21230/nco-financial-systems-inc-this-company-think-they-are-above-federal-laws-baltimore-ma-555648. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#2 Consumer Comment

Of course nco denied there collector was abusive & degrading towards me

AUTHOR: Charles - (USA)

SUBMITTED: Wednesday, January 20, 2010

Of course nco denied, there collector was abusive & degrading towards me. This was 4 years ago. I am still, wondering why isn't nco shut down. For there abusive law breaking tatics.

Why are they allowed to. Continue to abuse people.

#1 Consumer Comment

advise

AUTHOR: John - (U.S.A.)

SUBMITTED: Saturday, January 16, 2010

It depends on what state you live in:

There is a statute of limitations for credit card debt, which is the amount of time that they can successfully take legal action against you for the debt. This time period varies for each state. You can find this time period for your state by going to the link below and looking under "Open Accounts."

http://www.creditinfocenter.com/rebuild/statuteLimitations.shtml

If the number of years since you defaulted on this account and stopped making payments on it is greater than the number listed for your state, then they can no longer defeat you in any court action because the debt is time-barred and you dont have to pay it back.

=================

Stay off the phone...don't make any payments towards this debt or admit that you owe it!

When a debt collector first contacts you, you have rights under a federal law called the Fair Debt Collection Practices Act. Your first step should always be to request validation of the debt. Even if the debt is valid, request validation anyway.

Send them a letter via Certified Mail + Return Receipt (do not use regular mail) stating:

Per the Fair Debt Collection Practices Act, I am requesting written validation of this alleged debt, which includes:

- a copy of the original signed contract with my signature. A typed letter showing an account number and balance due will not be accepted as validation.

- validation of the original "Date of Delinquency" for this alleged debt

- validation of the "Date of Last Activity" for this alleged debt

- validation that this alleged debt is within the statute of limitations.

Per the Fair Debt Collection Practices Act, cease all verbal communications with me about this alleged debt

Advertisers above have met our

strict standards for business conduct.