Complaint Review: NCO Financial Systems INC. - Horsham Pennsylvania

- NCO Financial Systems INC. 507 Prudential road Horsham, Pennsylvania United States of America

- Phone: 215-441-3000

- Web: www.ncogroup.com

- Category: Collection Agency's

NCO Financial Systems INC. Trying to charge me court and lawyers fees for an amount that was charged off by hospital Horsham, Pennsylvania

*Consumer Suggestion: File Answer to Suit

*Author of original report: Thank you

*Consumer Comment: Suggestion

*Consumer Comment: I would tell them flat out

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

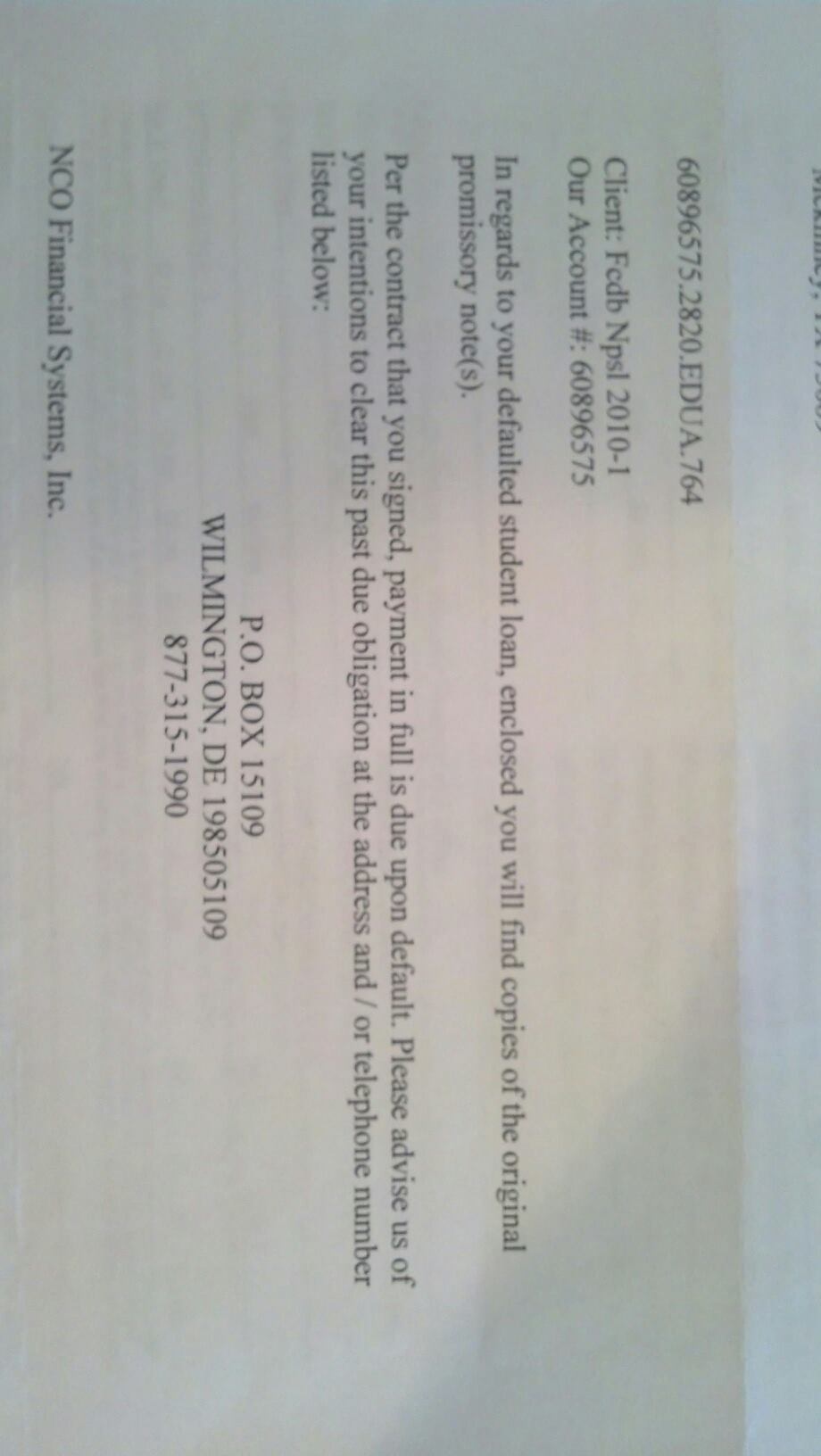

I need advice to see if what NCO is doing is legal.

I have some unpaid medical bills which the hospital sent to collections. My husband was out of work, as many people are during these tough economic times. The hospital has assistance programs to people who are unable to pay their bills. I filled out the application, and was awaiting the approval to get the 10% my insurance did not cover charged off.

In the mean time, I was served papers stating NCO was taking me to court, which the date was sometime at the end of this month. Last week I received papers from the hospital stating that I was relieved of all my hospital debt. I called NCO just to make sure they recieved that information, which they did, but asked me when I would be able to pay off the $328 I still owed. I asked them from what doctor that debt was, and they told me it wasnt hospital debt, it was attorney and court fees. When I asked why should I pay that, and that I never went to court, or signed any papers the woman (with a major attitude) told me I had to pay it because it was money they had to pay to file court papers.

This sounds like a personal problem to me, and I don't think I should have to pay those fees. I told her that there is no way I can pay that right now, and I have much more important bills to pay. She told me with an attitude, that I should "sit down and go over your bills, and figure out when you can pay us".

Is it legal for them to make me pay THEIR court filing fees?? Thanks for the help ahead of time.

This report was posted on Ripoff Report on 10/11/2011 01:18 PM and is a permanent record located here: https://www.ripoffreport.com/reports/nco-financial-systems-inc/horsham-pennsylvania-/nco-financial-systems-inc-trying-to-charge-me-court-and-lawyers-fees-for-an-amount-that-787531. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#4 Consumer Suggestion

File Answer to Suit

AUTHOR: Judicial - (United States of America)

SUBMITTED: Friday, October 21, 2011

Just some free advice. You seem to think you can appear and give the court your paperwork showing you no longer owe the debt, which may be the case. Here is the problem, collection companys can not file in small claims where you could do what you are saying.

You have to file an answer to the complaint or the judge will NOT allow you to say anything or file any papers with the court and you will lose by default. When you were served with the suit it clearly states how long you have to file an answer if you fail to file in time it is an automatic default, even if the judge believes you have been relieved of the debt, you will then have to file an appeal to the Judgement, which is way more complicated.

I suggest if you still have time file the answer.

If you need additional help you can contact me sourcemaster@juno.com

#3 Author of original report

Thank you

AUTHOR: michellehelenec - (United States of America)

SUBMITTED: Tuesday, October 11, 2011

I really appreciate the advice. I will contact the courts and see if there is still a court date, and if there is I will definitely go with my documentation from the hospital showing that there is no longer a balance.

#2 Consumer Comment

Suggestion

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Tuesday, October 11, 2011

If they filed suit and you have a court date. Unless you have something in writing from the Clerk of the Court that says the case was dismissed, regardless of what they tell you..GO TO COURT.

The reason is very simple. If the suit is still pending they can still go to court. If they do they may "forget" that the hospital has said you have no debt and then get a default judgment against you for not only the fees but the amount of the debt as well. If you go to court and they try to pull that, you can bring out your proof that there is no debt.

This also applies to the fees. While I am not 100% sure on this if you go to court and can show that the suit should never have been filed the judge should rule in your favor. But at the very least you will be there to explain your situation. Once the judge decides on the case, and if the judge decides in your favor, or NCO did officially withdraw the suit before it went to the judge. If they ever attempt to collect on those fees again you can basically tell them to go pound sand.

But do not pay them, or even offer to pay them a single penny until the case is settled.

#1 Consumer Comment

I would tell them flat out

AUTHOR: msmontecarlo - (USA)

SUBMITTED: Tuesday, October 11, 2011

I am not paying your court cost and attorneys fees. I am not paying 1 red dime of those costs. Do not pay the court costs and attorneys fees those fees are not your responsibility

Advertisers above have met our

strict standards for business conduct.