Complaint Review: NCO Financial Systems - Trenton New Jersey

- NCO Financial Systems PO Box 4929 Trenton, New Jersey U.S.A.

- Phone: 888-475-6741

- Web:

- Category: Colleges and Universities

NCO Financial Systems Inc On Behalf Of The Department Of Education Violation of Fair Debt Collection Practices Act Trenton New Jersey

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

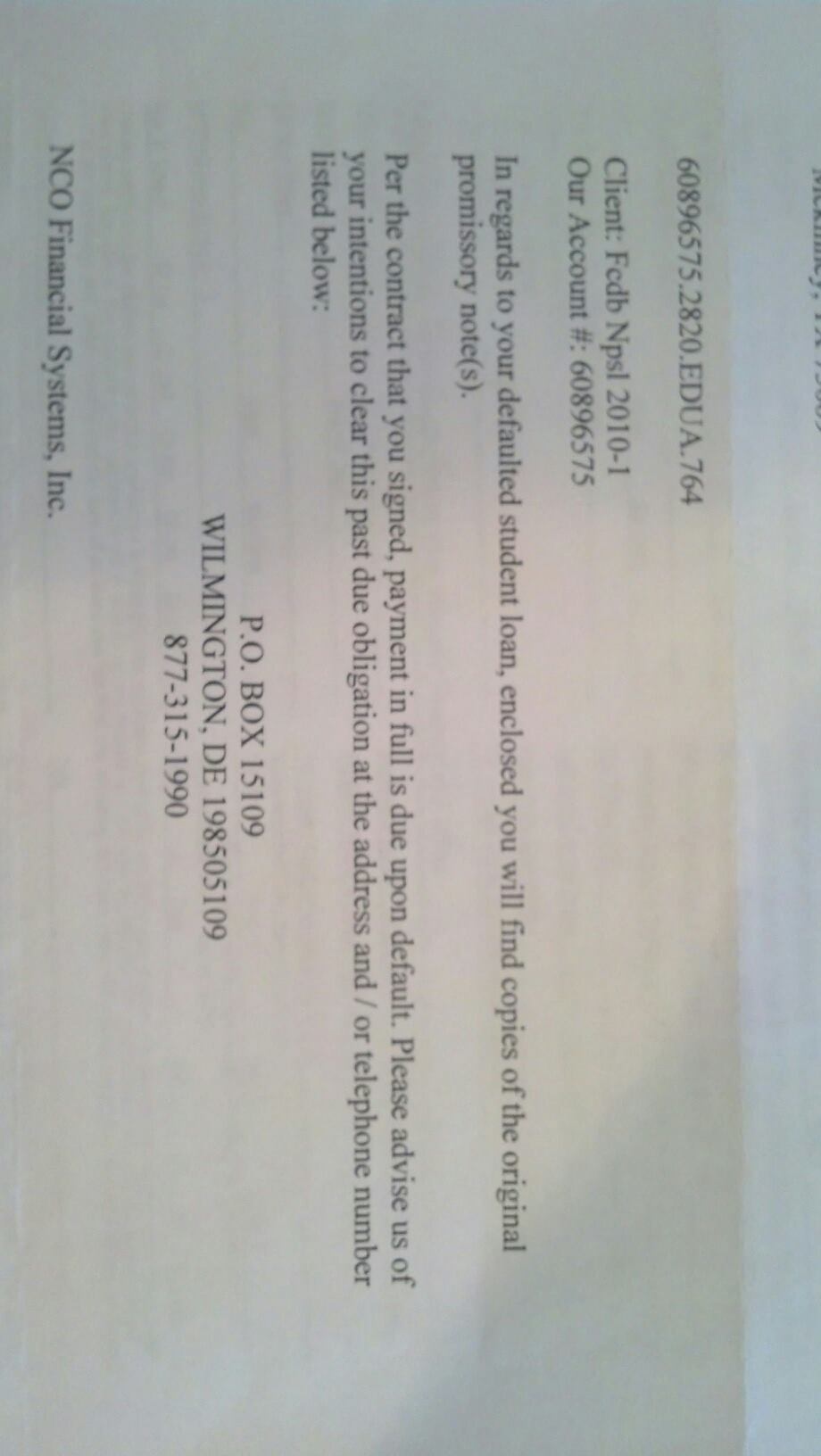

NCO Financial Group Inc acting as agent for The Department of Education (student loan). Violation of Fair Debt Collection Practices Act

I. Major points of Student Loan Dispute:

A. Reporting Errors:

1. Number of Loans:

NCO list of outstanding loans attributed to Student Loan Borrower does not match with documentation information sent by Diane Spadoni, Director of Customer Care, Department of Education.

An additional student loan has been appended to Student Loan Borrower account for collection by the NCO Financial Group Inc.

Written signed certified letters to NCO Financial Group requesting a complete and verifiable student loan documentation set have been made by Student Loan Borrower on four separate occasions between August 2007 and December 2007.

No loan verification documents for the appended loan in dispute have ever been received by Student Loan Borrower s CPA who is acting on her behalf as an independent third-party to correspondence and financial transactions.

Outcome: Outstanding Student Loan Balance is unverified and in dispute.

2. Total Payments made have not been credited to outstanding student loan account balance:

NCO Reports Outstanding Student Loan Balance of approximately $10,200 (in dispute see above).

IRS Federal Tax Offset (TRO) for years 1995 to 2007, verified by CPA which has not been credited to Borrower's Student Loan account balance is approximately $8,200.

Written signed certified letters to NCO Financial requesting a complete and verifiable IRS Federal TRO documentation set have been made by Student Loan Borrower on four separate occasions to NCO Financial between August 2007 and December 2007.

No IRS TRO verified documents for the total IRS Federal Offsets balance applied to Millers student loan account have ever been received by Student Loan Borrowers CPA from NCO Financial Group.

Motion for IRS TRO Audit has been filed with the Financial Management Service of the Department of Treasury on Student Loan Borrowers behalf between the IRS and the Department of Education. An audit is currently underway between the IRS and the Department of Education on the Student Loan Borrower account.

Outcome: Outstanding IRS TRO Offset paid to Borrower's Student Loan Balance is in dispute.

B. NCO Financial Group Inc. Violations of Fair Debt Collections Practices Act (Source: Federal Student Aid Web Site, The Borrower's Rights and Responsibilities: Administrative Wage Garnishment)

1. The Borrower has the right to:

Be sent a notice 30 days prior to ED ordering wage garnishment that explains ED's intention to garnish, the nature and amount of the debt, an opportunity to inspect and copy records relating to the debt, object to garnishment to collect the debt, and avoid garnishment by voluntary repayment;

An opportunity to enter into a written agreement under terms agreeable to ED to establish a voluntary repayment agreement;

An opportunity for a hearing to present and obtain a ruling on any objection by the borrower to the existence, amount, or enforceability of the debt;

An opportunity for a hearing to present and obtain a ruling on any objection that garnishment of 15% of the borrower's disposable pay would produce an extreme financial hardship;

An opportunity for a hearing to present and obtain a ruling on any objection that garnishment cannot be used at this time because the borrower is now employed within a 12-month period after having been involuntarily separated from employment;

Having garnishment action withheld by filing a timely request for a hearing, until the hearing is completed and a decision issued;

Not to be discharged from employment, refused employment, or subject to disciplinary action due to the garnishment, and to seek redress in federal or state court if such action occurs; and

Not to have any information provided to the employer but what is necessary for the employer to comply with the withholding order.

2. On May 10, 2008 NCO Financial Group notified intention to Garnish Wages.

3. On May 13, 2008 Miller filed formal affidavits with Department of Education Hearings Group, requesting a hearing based on the dispute of the number of loans, the amount balance due, and the right to inspect records requested from NCO Financial Group from August to December 2007.

4. Hearing has been granted by the Department of Education, date has not been set.

5. On June 10, 2008. NCO Financial commenced wage garnishment in Violation of the Fair Debt Collections Practices Act and right to due process under the law.

6. On July 4, 2008 Student Loan Borrower will commence a Class Action Suit against NCO Financial Group Inc, the Department of Education and their agent representatives.

Student Loan Borrower

Seattle, Washington

U.S.A.

This report was posted on Ripoff Report on 06/20/2008 01:07 PM and is a permanent record located here: https://www.ripoffreport.com/reports/nco-financial-systems/trenton-new-jersey-08650/nco-financial-systems-inc-on-behalf-of-the-department-of-education-violation-of-fair-debt-342420. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

Advertisers above have met our

strict standards for business conduct.