Complaint Review: NCO FINANCIAL SYSTEMS - HORSHAM Pennsylvania

- NCO FINANCIAL SYSTEMS 507 PRUDENTIAL ROAD HORSHAM, Pennsylvania U.S.A.

- Phone: 800-477-1827

- Web:

- Category: Collection Agency's

NCO FINANCIAL SYSTEMS ripoff HORSHAM Pennsylvania

*General Comment: NCO report those calls and save your call log

*Consumer Comment: NCO posing as EQUIFAX

*Consumer Suggestion: When you get something from NCO, send them this:

*Consumer Comment: That's right Jace! ... NCO is totally incompetent.

*Consumer Suggestion: NCO - the NC stands for "not competent"

This company keeps sending me a bill that was paid through another agency. today they told me that they just received the account not to long ago. i had talked to them back in may of 2005. they told me they had removed me from there system. what a load of bull.

James

Plymouth, Michigan

U.S.A.

This report was posted on Ripoff Report on 02/27/2006 04:47 PM and is a permanent record located here: https://www.ripoffreport.com/reports/nco-financial-systems/horsham-pennsylvania-19044/nco-financial-systems-ripoff-horsham-pennsylvania-178411. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#5 General Comment

NCO report those calls and save your call log

AUTHOR: susan - ()

SUBMITTED: Monday, April 22, 2013

I'm in shock at all the fraud and cover ups ,NCO needs to be shut down. AG doesn't do anything but slap their hands and make them pay a fine. I also think employees should be held responsible for what they do to the consumers.

#4 Consumer Comment

NCO posing as EQUIFAX

AUTHOR: Michigan Resident - (United States of America)

SUBMITTED: Friday, February 01, 2013

This company keeps doing automated calls to our home and when you look at the display it says EQUIFAX instead of NCO ! They are also using an automated voice message with a female british accent trying to get people to call them!!

#3 Consumer Suggestion

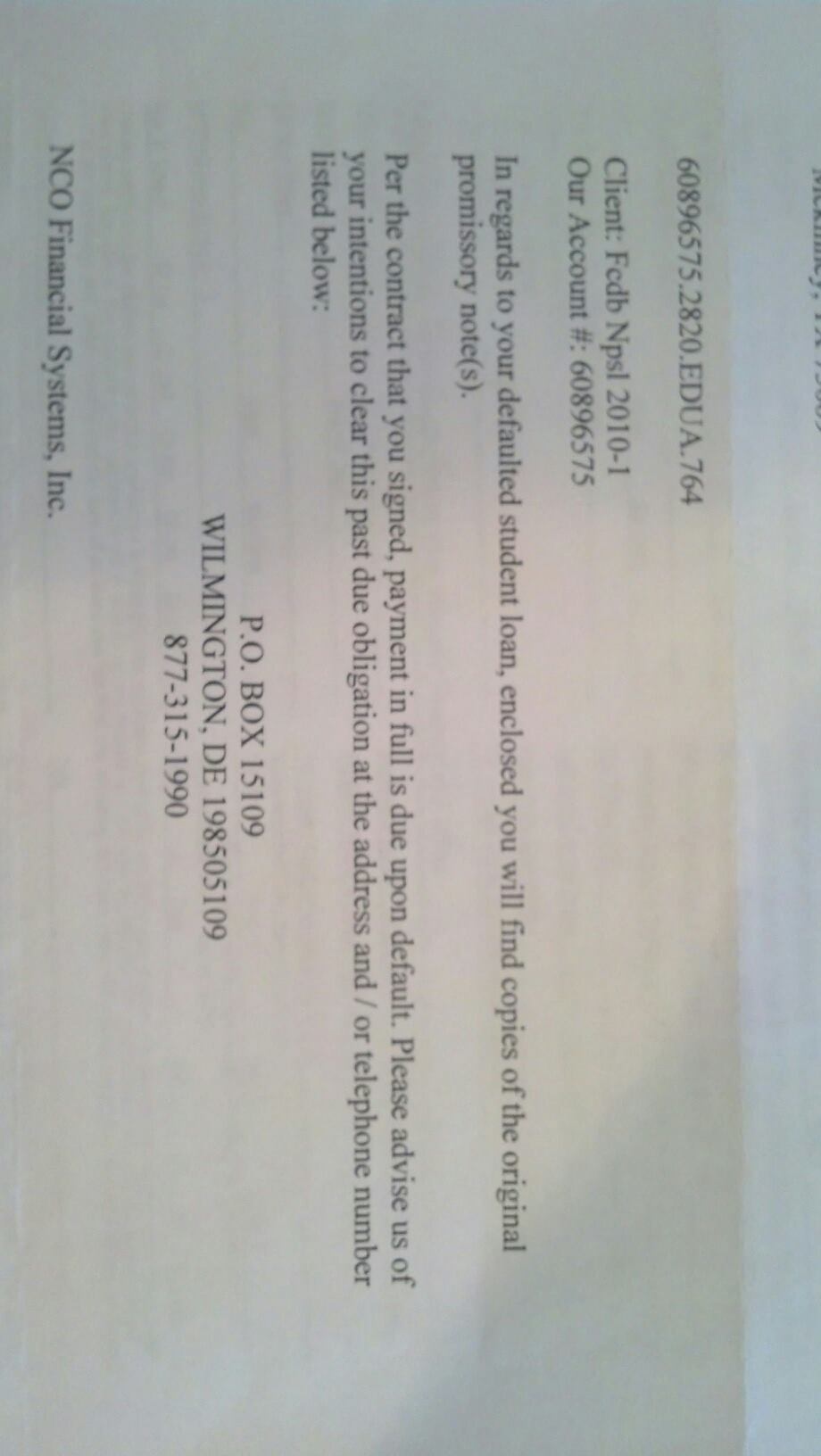

When you get something from NCO, send them this:

AUTHOR: Tony - (U.S.A.)

SUBMITTED: Tuesday, February 28, 2006

Certified Mail Return Receipt Article #:

COLLECTION AGENCY NAME AND ADDRESS

DATE

Re: Legal Dispute of Alleged Collection Claim

Account: #

Control #:

Amount: $

Your Client:

Attention: Account Manager (legal department)

It has been brought to my attention that your attempt to collect an account/liability that is not only invalid, but is also illegitimate and in legal dispute. Therefore, please consider this response as my formal legal dispute pursuant to Public Law 95-109, 15 USC 1692f 808 and 1692g 809. I furthermore request the name, address, department and phone (including any extensions) of the original creditor who is stating that this alleged liability belongs to me, so that civil action can be implemented, if necessary, to resolve this egregious accusation.

Any further attempt to collect and/or continue to falsely report this disputed information on my personal credit file without complying with the above stated provisions will be deemed as non-compliance and you will be held liable under 15 USC 1692 (k) (civil liability) to one or more of the following:

1) All actual damage sustained by a consumer as a result of such failure;

2) (A) included above, additional damages allowed by the court, not exceeding $1,000; or

3) If a class action is filed, such amount for each named plaintiff, recovered under subparagraph (A) of the stated Title, and an amount not to exceed the lesser of $500,000 or 1 per centum of the net worth of the debt collector; and

4) All cost accrued by the consumers' successful action to enforce the foregoing liability, along with attorney's fee.

It is my intention to resolve your inaccurate reporting of this activity contained in my file amicably. However, rest assured I will pursue all legal rights necessary to resolve this matter.

If and when the accuracy of this liability is legally proven to be valid, it will be my intention to rectify it post haste. Thank you for your cooperation.

Sincerely,

#2 Consumer Comment

That's right Jace! ... NCO is totally incompetent.

AUTHOR: Steve - (U.S.A.)

SUBMITTED: Tuesday, February 28, 2006

They get upset so easily and they have no educational or communications skills so all they can do is throw a tantrum like a three year old.

They have the IQ of a houseplant. I really hate to insult the houseplant!

I really laughed when that TROLL "Stef" came on here and stated how ALL banks liked and trusted them. I really had to laugh on that one.

Like they really deal with every bank, and know what every bank REALLY thinks of them.

I looked at the pay scales at NCO, and for each area they operate, the pay is far below a living wage. The local grease monkey she was putting down makes TWICE what the so called "professional" at NCO makes.

What a joke. NCO will get closed down by the FTC, or a major lawsuit. It is only a matter of time.

#1 Consumer Suggestion

NCO - the NC stands for "not competent"

AUTHOR: Jace - (U.S.A.)

SUBMITTED: Tuesday, February 28, 2006

I am the controller for a branch office of a Fortune 100 company, and I've dealt with NCO on a couple of occasions regarding debts they claim are unpaid. Not only are NCO's collectors rude, they're barely competent. When I told them I had copies of cancelled checks that prove the debts were paid, they became belligerent, accused me of fraud and demanded to speak to my boss to resolve the matter. Finally I faxed them copies of the cancelled checks and called to make sure they got them, only to have them again become belligerent and hang up on me. Must have worked though, since they've never called me back.

You should request a debt validation, and as a last resort, send them a copy of the cancelled check or anything that proves your debt is paid. Don't forget to file complaints with your state AG and FTC as well.

Advertisers above have met our

strict standards for business conduct.